Key Findings

- Eighteen states had sales tax holidays on the books in 2025; however, Louisiana’s seven-year suspension of previous sales tax holidays has expired, which would allow the state to reinstate its previous sales tax holidays.

- These holidays combined will cost states and localities nearly $1.3 billion in lost revenue this year.

- Sales tax holidays are poorly targeted and too temporary to meaningfully change the regressive nature of a state’s tax system.

- Overall, the benefits of sales tax holidays are minimal while their downsides are significant.

Sales taxes are an important revenue source, making up close to half of all state tax revenues.1 But sales taxes also are inherently regressive because low-income families spend a greater share of their income on goods and services subject to the tax.

Lawmakers in many states have enacted “sales tax holidays” to temporarily suspend the tax on purchases of clothing, school supplies, and other items. While lawmakers often tout sales tax holidays as a way to benefit everyday households, this approach falls short of alleviating the regressive nature of sales taxes on low- and middle-income households while simultaneously reducing state revenues and creating administrative burdens – particularly as lawmakers have sought to apply the concept as a substitute for more meaningful, permanent reform or to arbitrarily reward people with specific hobbies or in certain professions.

Eighteen states have sales tax holidays on the books in 2025, just shy of the 19 that existed in 2024. The combined annual cost to state and local budgets this year is estimated to be around $1.3 billion.2 Nationwide, we saw one state allow a firearm sales tax holiday to expire while regaining its ability to reinstate previously suspended holidays, a reckless expansion in one state, and other states holding steady with existing tax holidays.

Figure 1

Louisiana’s legislators did not renew its sales tax holiday for firearms, ammunition, and hunting supplies this year as it was scheduled to expire on June 30. However, on July 1, the state regained its ability to reimpose its sales tax holidays for disaster preparedness and school supplies after it was suspended for seven years starting in 2018 during a special session to balance the state budget. While the legislature’s action in 2018 was a rare example of policymakers deciding that lost revenue wasn’t sustainable, it isn’t clear yet if these sales tax holidays will return.

Another state made a significant expansion to one of its sales tax holidays. Florida legislators made the state’s back-to-school sales tax holiday permanent and extended it for the entire month of August. The expanded approach is expected to cost about $167.7 million, an increase from last year’s cost of $97.2 million for the two-week holiday. Florida also created a new sales tax holiday for hunting and fishing items.

To offset the cost of the expanded tax holiday, the state did not renew its separate sales tax holiday for recreational activities, and instead of renewing the tax holiday for disaster preparedness items, the state created a permanent sales tax exemption for some of them. Sales tax revenue is vital for a state like Florida, as it is one of nine states lacking a broad-based personal income tax. Florida heavily relies on regressive sales and excise taxes, which account for 80 percent of its total state tax revenue.3

How Sales Tax Holidays Work

Sales tax holidays are temporary sales tax exemptions, usually applying to a small number of taxable items for a very limited period. They are typically timed to take place in August during the traditional back-to-school shopping season and usually offer breaks on school-related items such as clothing, school supplies, and computers. A few states exempt all taxable goods during the suspension. Most sales tax holidays last only two or three days, and almost all apply only to items below some specified price (for example, clothing items over $100 are generally not included).

In addition to traditional back-to-school weekend holidays, some states now have longer, broader exemptions with varying themes. Holidays for energy-efficient appliances and storm preparation materials are becoming increasingly common, for example. In 2025, there are also holidays being held for hunting and fishing activities in Florida and for National Guard members and their families in Nevada.

History of Sales Tax Holidays

The notion of such a holiday was first introduced in 1980 when Ohio and Michigan opted to not tax the sale of automobiles for a period of time.4 New York experimented with the current concept of sales tax holidays in 1996 but has since reversed the policy. More than 20 states have enacted legislation at some point to temporarily suspend sales taxes, and proposals to extend the concept to more states and more types of purchases appear every year.

Many states have repealed or temporarily ended sales tax holidays when facing significant revenue gaps. For example, lawmakers in Florida, Georgia, Maryland, Massachusetts, and the District of Columbia all canceled holidays during the height of the Great Recession. Although most of these reinstituted them afterward, Georgia and D.C.’s holidays have not been revived. Louisiana, which once held three separate exemptions for back-to-school shopping, hunting season, and hurricane preparedness, started paring them back due to revenue shortfalls in 2016 and only recently revived its holiday for hunting season. Holidays in Illinois, New York, North Carolina, Vermont, and Wisconsin were also either short-lived or repealed.

Problems with Sales Tax Holidays

Sales taxes are inherently regressive. Policymakers tout sales tax holidays as a way for families to save money while shopping for “essential” goods. On the surface, this sounds reasonable. However, a two- to three-day sales-tax-free shopping spree for selected items does nothing to reduce taxes for low- and moderate-income taxpayers during the other 362 days of the year. In the long run, sales tax holidays leave a regressive tax system unchanged, and the benefits of these holidays for working families are minimal. These temporary exemptions also fall short because they are poorly targeted, reduce revenue, can easily be exploited, and create administrative difficulties.

Sales Tax Holidays Are Poorly Targeted

Since wealthier taxpayers also benefit from sales tax holidays, they offer less “bang for the buck” from a fairness perspective than more targeted tax breaks such as low-income sales tax credits,5 state earned income tax credits,6 or child tax credits.7

Wealthier taxpayers are often best positioned to benefit from a temporary exemption since they have more flexibility to shift the timing of their purchases to take advantage of the tax break—an option that isn’t available to families living paycheck to paycheck. Many low-income taxpayers spend most or all their income just getting by, which means that they have less disposable income than wealthier taxpayers to spend when a tax-free period arrives. One study found households that earn more than $30,000 were likely to shift the timing of clothing purchases to coincide with a sales tax suspension, but households earning less than $30,000 were not.8 This is more pronounced during recessions and economic downturns because low-income families or those who lose jobs see a much bigger hit to their incomes and generally recover more slowly. For families whose incomes are reduced or volatile for several years coming out of a recession, a temporary sales tax suspension doesn’t relieve the monthly challenges associated with a regressive tax system that depends on a sales tax.

Sales tax holidays are also not limited to state residents but instead extend to anybody who happens to be within the state’s borders at the time of the tax suspension, including tourists and people who live close to the border.

Finally, though the holidays are often marketed as boons to local businesses, nearly all (New Mexico’s “Small Business Saturday” is an exception) apply to online purchases—even those shipped from other states—giving no advantage to locally owned businesses.

Sales Tax Holidays Reduce Revenue

In 2025, sales tax holidays will cost states and localities about $1.3 billion in lost revenue, similar to the amount of lost revenue in 2024.9 This will ultimately have to be made up elsewhere, either through painful spending cuts or increasing other taxes. Cities and counties—which often have few revenue options and must rely on sales taxes to fund important priorities like roads, parks, police and fire protection10— rarely have a choice in the matter of sales tax holidays. Only Alabama, Mississippi, and Missouri allow localities to opt out of them.

Moreover, now that most online sales are subject to state and local sales taxes, the cost of these temporary suspensions has grown. Online purchases, which are tax exempt under all but one of these holidays, are a large and growing share of retail sales, and consumers can more easily time online purchases than brick-and-mortar purchases to coincide with a tax-free period.

Lawmakers’ recent experiments with longer and broader tax suspensions have added to this growing price tag, heightening the need to better understand why sales tax holidays are ineffective and how states can do more with less through more targeted policies.

Right now these reductions in revenue will be particularly painful, with states facing the fallout of the recently passed federal tax and spending package11 that will shift many costs to states, economic uncertainty from the Trump administration‘s unpredictable tariffs and trade wars, and more.12

Some Retailers Exploit Sales Tax Holidays

Retailers can also take advantage of the shift in the timing of consumer purchases by increasing their prices or watering down their sales promotions during the tax holiday. The influx of shoppers gives them economic incentive to do so, and the evidence suggests that they often do. One study of retailers’ behavior in Florida, for example, found that up to 20 percent of the price cut consumers thought they were receiving from the state’s sales tax holiday was reclaimed by retailers.13

Sales Tax Holidays Create Administrative Difficulties

Sales tax holidays create administrative difficulties for state and local governments and for retailers who must collect the tax. For example, exempting groceries requires a collection of well-defined government regulations to police the border between non-taxable groceries and taxable snack food – and only for a certain defined period of time. A temporary exemption for clothing (or for any other back-to-school item) requires retailers and tax administrators to wade through a similar number of complex administrative changes for an exemption that lasts only a few days. Further complexity can arise in states with local sales taxes when some localities opt not to participate in the holiday and consumers unexpectedly end up paying local sales taxes on their purchases.

Conclusion

Sales tax holidays are poorly targeted and too temporary to meaningfully change the regressive nature of a state’s tax system. Lawmakers must understand that they cannot resolve the unfairness of sales taxes simply by offering a short break from paying them. If the long-term consequence of sales tax holidays is a higher sales tax rate, low-income taxpayers may ultimately be worse off because of these policies. Policymakers seeking greater tax fairness would do better to provide a permanent refundable low-income sales tax credit or prioritize state-level child tax credits or earned income tax credits which would do more to help families make ends meet and to offset the impact of the sales tax on low- and moderate-income taxpayers.

2025 Sales Tax Holidays

| State | Back to School | Energy and Water Efficiency | Severe Weather Preparedness | Other |

|---|---|---|---|---|

| Alabama | July 18-20

|

February 21-23

|

||

| Arkansas | August 2-3

|

|||

| Connecticut | August 17-23

|

|||

| Florida | August 1-31

|

|||

| Iowa | August 1-2

|

|||

| Maryland | August 10-16

|

February 15-17

|

||

| Massachusetts | August 9-10

|

|||

| Mississippi | July 11-13

|

Hunting Season August 29-31

|

||

| Missouri | August 1-3

|

April 19-25

|

||

| Nevada | October 31 – November 2

|

|||

| New Mexico | July 25-27

|

|||

| Ohio | Expanded Sales Tax Holiday August 1-8

|

|||

| Oklahoma | August 1-3

|

|||

| South Carolina | August 1-3

|

|||

| Tennessee |

|

|||

| Texas |

|

May 24-26

|

April 26-28

|

|

| Virginia | August 1-3

|

August 1-3

|

August 1-3

|

|

| West Virginia | August 1-4

|

|||

| *A conventional back-to-school sales tax holiday, as outlined in continuing law, will be held in years where surplus revenue does not reach at least $60 million and trigger an expanded tax holiday. | ||||

|

ITEP.org

|

||||

Endnotes

- 1. U.S. Census Bureau, 2024 Annual Survey of State Government Tax Collections.

- 2. ITEP survey of cost estimates from state tax expenditure reports, fiscal notes, revenue departments, and academic studies.

- 3. U.S. Census Bureau, 2024 Annual Survey of State Government Tax Collections.

- 4. Janssen, C. B. (2012), (Un) Happy Holidays: The True Meaning of Sales Tax “Holiday” Policy, Loyola Consumer Law Review. 24: 411–440.

- 5. Davis, Aidan (2019), Options for a Less Regressive Sales Tax in 2019. Institute on Taxation and Economic Policy. https://itep.org/options-for-a-less-regressive-sales-tax-2019/

- 6. Butkus, Neva (2024), State Earned Income Tax Credits Support Families and Workers in 2024. Institute on Taxation and Economic Policy. https://itep.org/state-earned-income-tax-credits-2024/

- 7. Butkus, Neva (2024), State Child Tax Credits Boosted Financial Security for Families and Children in 2024. Institute on Taxation and Economic Policy. https://itep.org/state-child-tax-credits-2024/

- 8. Marwell, Nathan and Leslie McGranahan (2010), The Effect of Sales Tax Holidays on Household Consumption Patterns. Federal Reserve Bank of Chicago.

- 9. ITEP survey of cost estimates from state tax expenditure reports, fiscal notes, revenue departments, and academic studies.

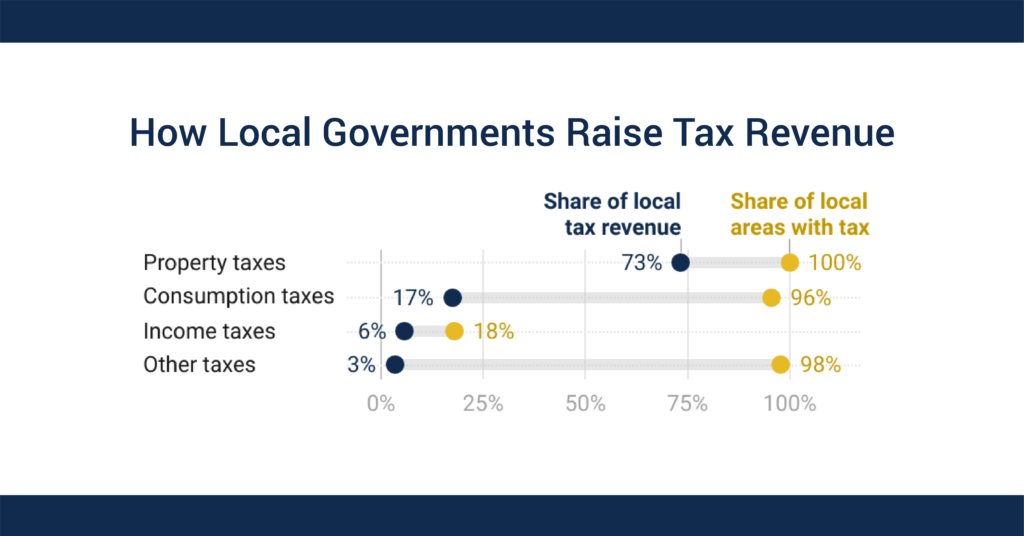

- 10. Boardman, Andrew and Hendricks, Galen (2023), How Local Governments Raise Revenue—and What it Means for Tax Equity. Institute on Taxation and Economic Policy. https://itep.org/how-local-governments-raise-revenue-effects-on-tax-equity/

- 11. Wamhoff, S., and Davis, C., Hughes, J., and Velas, J. (2025) Analysis of Tax Provisions in the Trump Megabill as Signed into Law: National and State Level Estimates. Institute on Taxation and Economic Policy. https://itep.org/tax-provisions-in-trump-megabill-national-and-state-level-estimates/

- 12. Davis, Carl (2025). Sharp Turn in Federal Policy Brings Significant Risks for State Tax Revenues. Institute on Taxation and Economic Policy. https://itep.org/sharp-turn-in-federal-policy-brings-significant-risks-for-state-tax-revenues/

- 13. Harper, R. K., Hawkins, R. R., Martin, G. S. and Sjolander, R. (2003), Price Effects around a Sales Tax Holiday: An Exploratory Study. Public Budgeting & Finance, 23: 108–113.