Download national and state-by-state data

The endlessly debated cap on deductions for state and local taxes (SALT) has emerged in the GOP megabill largely unscathed—despite the efforts of Republican lawmakers from “blue” states. Those lawmakers are correct that the cap reduces the bill’s tax cuts for their wealthy constituents more than for those in other states. The megabill, however, is so loaded up with other provisions benefiting the rich that any concern for the well-off is ludicrous. The megabill is, SALT cap or no, a dramatic tax cut for the richest 1 percent in every state—as described in a recent ITEP report.

The debate about the SALT cap goes back to when the big tax bill of the first Trump administration was being created in Congress in 2017. The Republican drafters were looking for a way to trim its costs to mollify members of their party who were antsy about the rising deficit implications of their creation. They latched onto the idea of capping the itemized deductions for state and local taxes.

The cap, set at $10,000, reduced the tax cut they were aiming at the wealthy. This was unfortunate from their perspective but, with the wealthy getting most of the tax cuts, if the cost of the law was going to be reduced that was the only way to do it.

The cap on SALT deductions, however, had, in the eyes of the Republicans, a distinctive virtue over other options. It would raise revenue disproportionately in states that have the highest taxes on the well-off. This meant that (a) they would be discouraging states from taxing the well-off, consistent with their overall objective and (b) the largest tax cuts would be reserved for the more conservative states they largely represent. States which, not coincidentally, tax the wealthy less.

Most GOP members of Congress were on board with the SALT cap, but not all. Particularly in the House, there were objections by Republicans from states such as California, New Jersey, and New York whose well-off constituents were most affected.

Nevertheless, the cap became law—but only temporarily. It expires in 2026 along with other significant parts of the original legislation.

That brings us to the present where the Trump megabill, which includes extensions of the 2017 law, is being advanced. The Republican “SALT caucus” (as the blue state Republicans opposed to the cap became known) has been demanding that the SALT cap not be extended. That effort, however, has not gone well. With the SALT cap set to expire completely, all they have been able to extract in the current version is that it be set at $40,000 instead of $10,000—but only for those with incomes less than $500,000 and only temporarily. The cap reverts to $10,000 permanently, for everyone, in five years. In addition, there are provisions that make the deduction that remains less valuable.

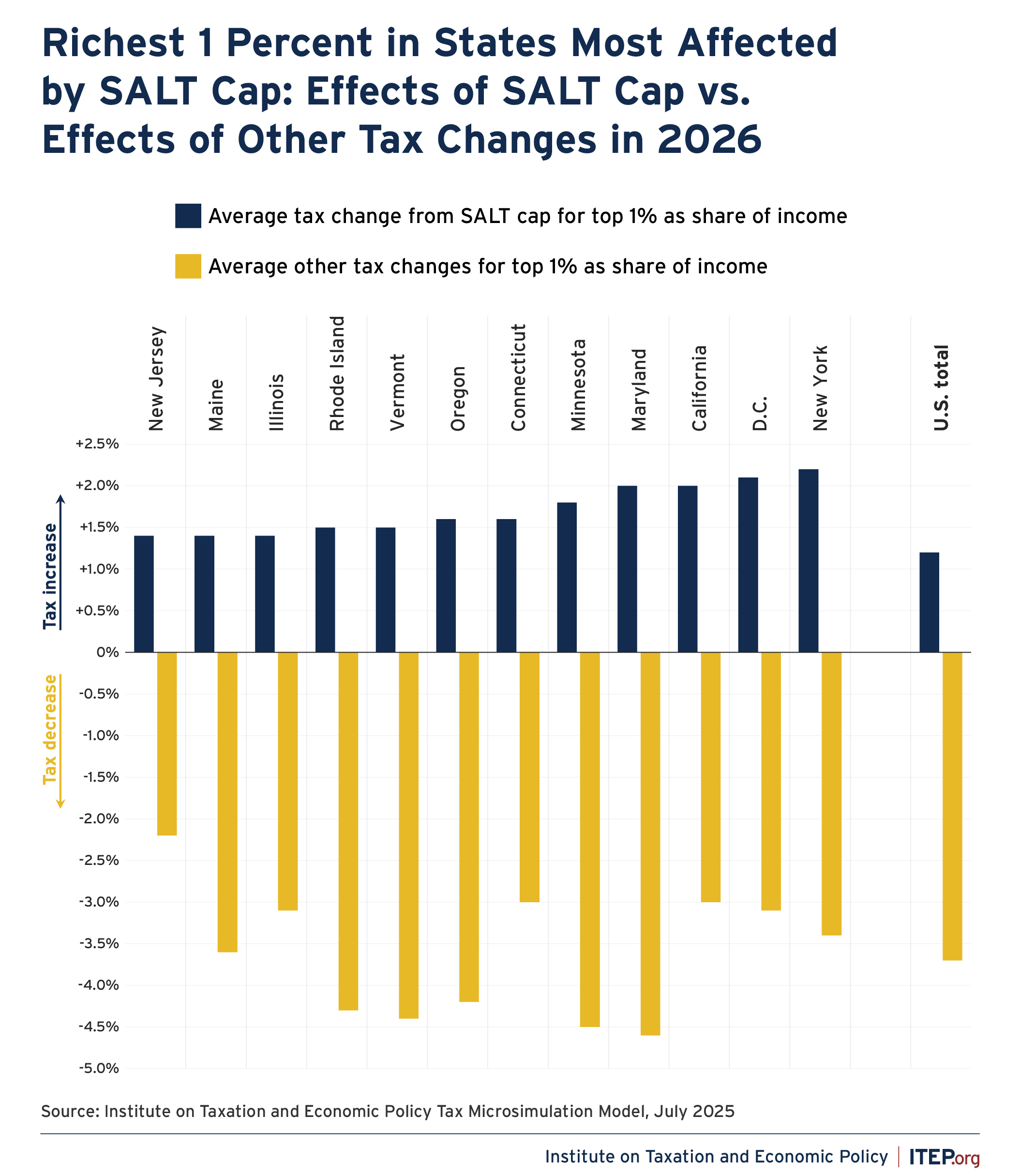

For the richest 1 percent of Americans, the megabill’s version of the SALT cap basically claws back about a third of the tax cuts they would otherwise receive from the legislation. As illustrated in Figure 1, the other tax provisions in the megabill, on average, cut taxes for the top 1 percent by 3.7 percent of their income in 2026, but the SALT cap reverses that tax cut by 1.2 percent of income. Thus, the SALT cap reduces the benefits of the significant tax cuts for the wealthy in the megabill but leaves most of them intact.

The megabill’s version of the cap affects taxpayers (mostly the rich) in every state, but it is most keenly felt in states with more progressive tax systems.

Figure 1 below shows the reduction in the tax cut for the richest 1 percent because of the SALT cap for the dozen most affected states—led by New York with a bevy of other blue states following. The chart also shows how much other provisions in the tax law cut the taxes of the wealthy: significantly more than the SALT cap takes back in every instance.

FIGURE 1

So the Republican SALT caucus failed in its goal of shielding their wealthiest constituents from anything that would restrict the tax breaks they enjoy. Some of the taxpayers in their states may even pay higher personal income taxes under the megabill than they would owe if Congress did nothing. Other provisions in the legislation, however, guarantee that their wealthiest constituents will, overall, still get substantial tax cuts—as other ITEP analysis has shown.