On Monday a group of Senators and Representatives from the Northeast announced their latest proposal to repeal the cap on deductions for state and local taxes (SALT), this time offsetting the costs by restoring the top personal income tax rate to 39.6 percent.

This is an improvement over previous proposals to repeal the cap on SALT deductions without offsetting the costs at all. But the new approach does not improve our tax system overall. Instead, it trades one tax cut for the rich (a lower top income tax rate) for another (repeal of the cap on SALT deductions).

Background of the Cap on SALT Deductions

Debate over this provision has raged since it was enacted as part of the Tax Cuts and Jobs Act (TCJA) at the end of 2017. TCJA capped the amount of state and local taxes (SALT) that taxpayers can deduct on their federal returns at $10,000.

The SALT cap is flawed. The overhaul of the tax code could have been an opportunity to reduce or eliminate special breaks favoring the wealthy in a comprehensive way. Instead, President Trump and his allies in Congress chose mainly to target the one deduction that disproportionately benefits those who live in higher-tax states like New Jersey, New York, and California.

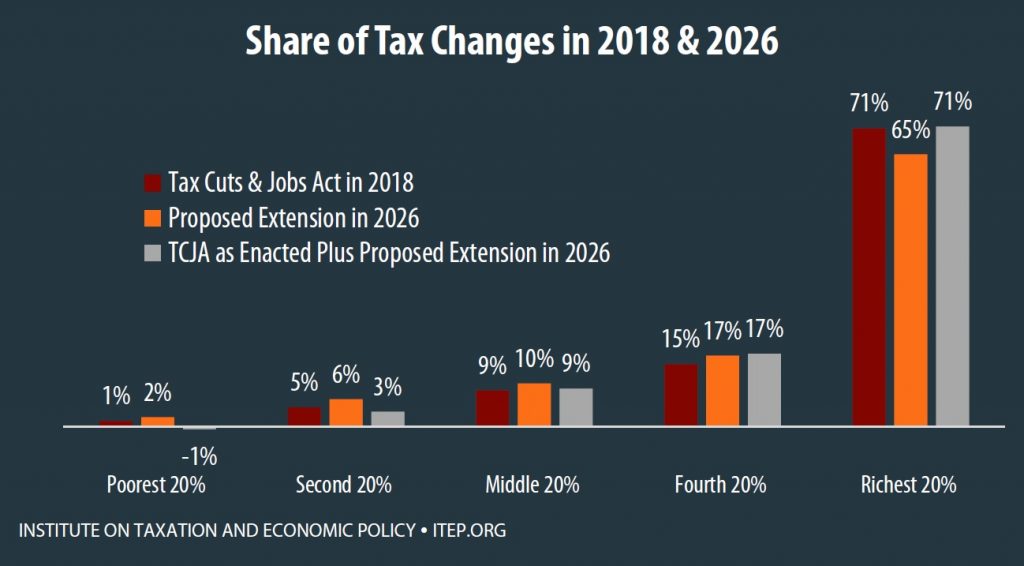

But that does not mean the answer is to repeal the SALT cap, which is the one personal income tax provision that partially controls the costs of TJCA in any serious way. A recent ITEP report finds that 63 percent of the effect of the SALT cap (and thus 63 percent of the benefit if the SALT cap is repealed) falls on the richest 1 percent of taxpayers this year.

Misunderstandings About the Effects of TCJA

TCJA has created many problems, but raising taxes is, for most households, not one of them, at least not initially. The cap on SALT deductions is one of the few personal income tax changes that does raise taxes for some households, but for most families it is offset by TCJA’s tax-cutting provisions.

This is illustrated by ITEP’s state-by-state data on the effects of TCJA. ITEP estimates that New Jersey residents will enjoy a total of $8.1 billion in federal tax cuts for the 2018 tax year as a result of TCJA. (This includes $2.9 billion in corporate tax cuts that will go to New Jersey residents, mostly shareholders, in 2018. Excluding the corporate changes, New Jersey residents will receive more than $5 billion in federal tax cuts for the 2018 tax year.)

The ITEP data show that 82 percent of New Jersey residents will pay less for tax year 2018, and only 10 percent will pay more.

An additional criticism of the SALT cap coming from lawmakers in states such as New York and New Jersey is that high-income taxpayers will uproot their lives and move to states without income taxes because much of their state and local tax liability is not scheduled to be deductible again until 2026 (when much of TCJA expires). These “tax flight” anecdotes have been around for years, but the best available evidence suggests that they are exceedingly rare. In reality, high-income taxpayers tend to move less than the average American because they have already found economic success where they live and family and economic considerations tend to encourage them to remain in place.

Better Alternatives

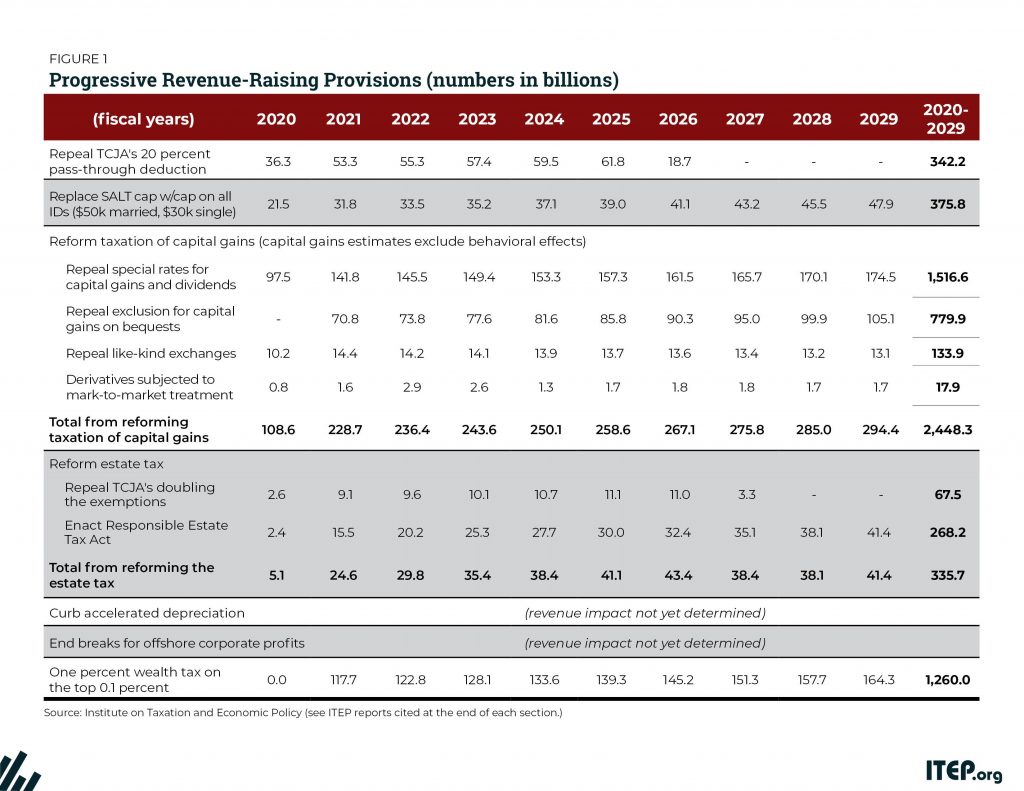

ITEP’s report on the SALT cap describes different approaches that Congress could take to replace the cap with something better. Congress could replace the SALT cap with a broader limit on all itemized deductions. For example, one option described in the ITEP report would limit the total amount of itemized deductions claimed by a taxpayer to $50,000 for married couples and $30,000 for singles. Another would impose a “floor,” only allowing taxpayers to write-off itemized deductions that exceed a certain percentage of their income. Both approaches would raise revenue compared to current law and would improve the progressivity of the federal tax code—two features that should be high priorities for lawmakers in the wake of TCJA.

More Fundamental Reform Needed

Sponsors of the new proposal in Congress, called the Stop the Attack on Local Taxpayers Act (SALT Act), should be given credit for deciding to offset the cost of repealing the SALT cap. They would do this by reversing the TCJA provision that cut the top personal income tax rate from 39.6 percent to 37 percent.

But this does not change any of the fundamental problems with TCJA, including its enormous cost and the fact that it favors the rich. Instead, this proposal merely trades one tax cut for the rich for another. TCJA’s provisions favoring the rich certainly should be reversed, but the revenue raised is needed for other priorities besides new tax cuts for the rich.

A new ITEP report illustrates a way forward for Congress with a package of proposals that would go far beyond replacing the SALT cap with something better. It includes proposals that would address other problems created by TCJA and address those problems that plagued our tax code even before TCJA was enacted. Ultimately, Congress must turn to this more comprehensive type of tax reform rather than just fixing one part of TCJA.