Note: This blog was updated in January 2026 to reflect credit changes passed in Pennsylvania and the District of Columbia in late 2025.

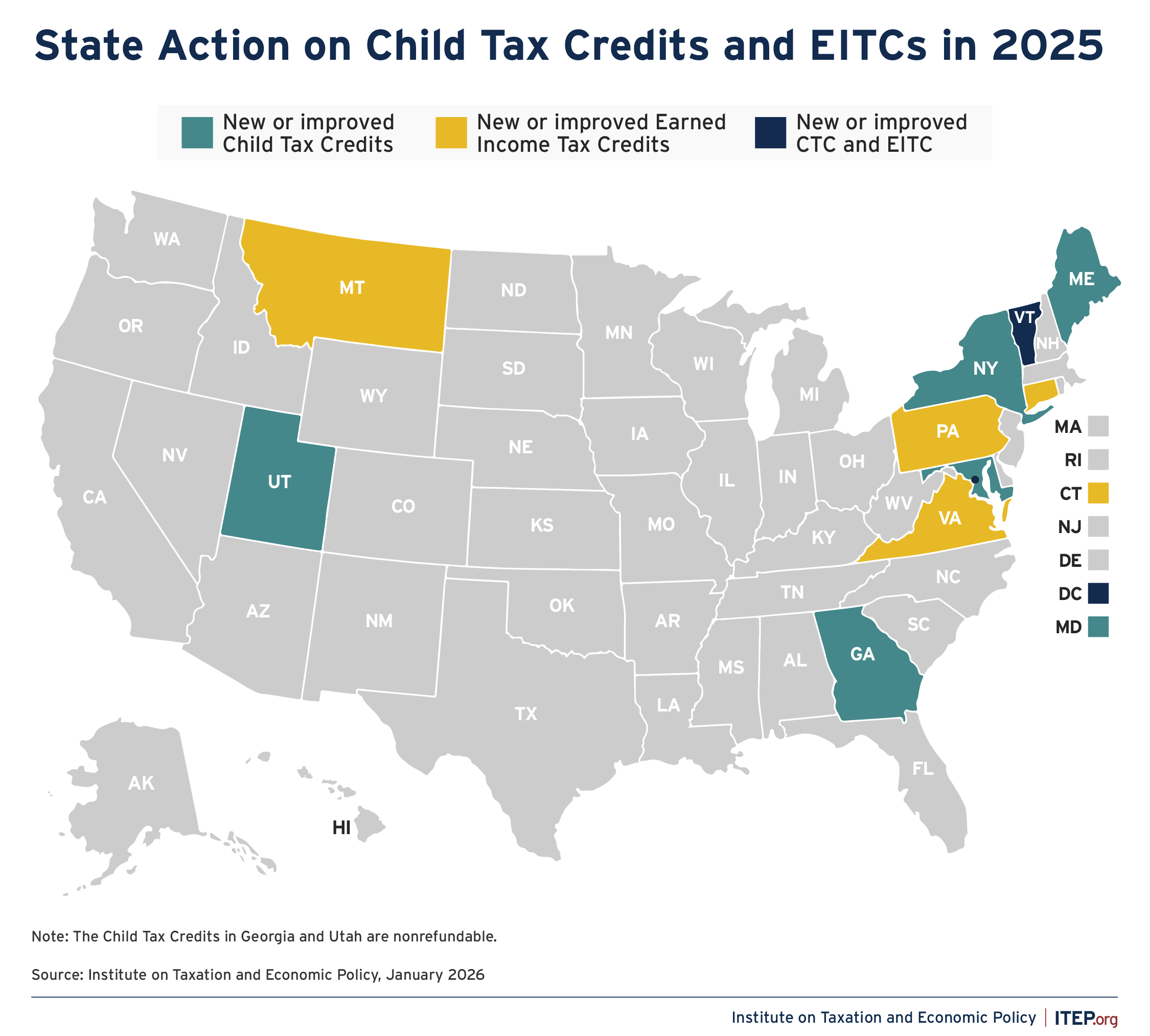

Refundable tax credits were a big part of state tax policy conversations this year, as lawmakers sought to boost incomes, make their tax systems less regressive, and improve economic stability for working families and families with children. In 2025, nine states improved or created Child Tax Credits (CTC) or Earned Income Tax Credits (EITC).

Momentum around these credits has been steady since the American Rescue Plan Act temporarily expanded the federal Child Tax Credit and Earned Income Tax Credit in 2021, spurring a 50% reduction in child poverty. This year, state lawmakers passed more modest improvements than in other recent years due to shrinking revenues and uncertainty around the federal tax and spending bill. The federal bill will also alter state CTCs in Oklahoma and Utah that couple to the federal credit.

Successful efforts to enhance state tax credits spanned the country.

Child Tax Credits

- The District of Columbia restored and expanded funding for its Child Tax Credit which will provide a refundable $1,000 per dependent child under the age of 18.

- New York expanded and improved its Empire State Child Credit, building on recent improvements. Lawmakers increased the maximum available credit from $330 to $500 per child, with a boost for children under four of up to $1,000 per child. The changes decouple the credit from an older version of federal legislation, eliminating the prior phase-in for low-income families and extending the credit to families with no earnings. The expanded credit sunsets after 2028 and will then need to be renewed.

- Maryland eliminated the harsh cliff for its modest state Child Tax Credit, which left families ineligible after $15,000 of annual income. Families will now be eligible for part of the CTC if they earn between $15,000 and $24,000 a year.

- Maine boosted the Dependent Exemption Tax Credit, its state CTC, by $300 for young children under the age of six.

- Vermont expanded its state Child Tax Credit, increasing the maximum qualifying age from 5 to 6 years.

- Georgia created a new nonrefundable Child Tax Credit of $250 per child, and Utah expanded its nonrefundable CTC’s maximum qualifying age from 4 to 5 years old.

Earned Income Tax Credits

- The District of Columbia increased its EITC to 100 percent of the federal credit for all qualifying filers.

- Connecticut boosted its EITC by providing each qualifying family with an additional $250 credit.

- Montana doubled its EITC from 10 to 20 percent of the federal credit.

- Pennsylvania passed its first refundable EITC, which will match 10 percent of the federal credit.

- Vermont raised its credit for workers without children in the home to match 100 percent of the federal credit.

- Virginia will now allow all EITC-qualifying households to receive a fully refundable 20 percent match of the federal credit. Previously, families had to choose between 15 percent refundability or 20 percent nonrefundability. (This improvement will sunset in 2027 unless extended.)

Figure 1

Unfortunately, not all lawmakers are moving toward stronger and more inclusive state tax credits. In Idaho, lawmakers do not appear likely to extend the state’s soon-to-expire nonrefundable Child Tax Credit, which has been in place since 2018.

State Child Tax Credits are also going back to their roots, once again becoming increasingly bipartisan. The lieutenant governor championed Georgia’s new nonrefundable credit. Utah continues expanding its state Child Tax Credit. A newborn credit in Indiana received overwhelming bipartisan support. And in Ohio, Republican Gov. Mike DeWine proposed a refundable state CTC of $1,000 per child under 6 years old.

Other trends

There was a strong focus this year on young children, and credits for newborns specifically. In addition to the expanded credits for younger children in Maine, New York, Utah, and Vermont, other states considered credits for the first year of a child’s life. In Indiana, legislation to create a $500 refundable newborn credit passed the Senate unanimously. Minnesota lawmakers considered boosting the existing Child Tax Credit by an additional $100 during a child’s first year.

While conversations around property tax affordability have dominated statehouses across the country this year, many proposed solutions such as assessment caps or large homestead exemptions fall short of making property taxes more affordable for low- and moderate-income families who own or rent.

Lawmakers and advocates in Illinois, Indiana, Kansas, and elsewhere worked to pivot the conversation toward property tax circuit breaker credits, which are well-targeted toward workers and families most at risk of losing their homes. Unfortunately, many of these discussions stalled as lawmakers pushed for more expensive and regressive policies that, in many cases, drive steep reductions in property tax revenue while doing little for families struggling the most to afford their property taxes.

Targeted tax credits, especially when made refundable, make state tax systems fairer by balancing the inevitably regressive taxes that states depend on like sales, excise, and property taxes. As states consider expanding or creating tax credits in future years, they should prioritize best practices like full refundability, boosts for children and childless workers, and paying for credits by making sure the wealthy and corporations are paying their fair share.