It’s back-to-school shopping season, so…everyone who buys a cell phone in Arkansas this weekend will do so sales-tax-free. For this whole week in Connecticut, and for the entire spring in New Mexico, the corporate owners of highly profitable multinational restaurant chains had the option to pocket their customers’ taxes rather than remit them to the state to fund vital public services, pass along those savings to their customers, or give a much-needed boost to their employees. And all told, about $550 million of state and local revenue will be forgone in 17 states this year through wasteful and poorly targeted sales tax holidays.

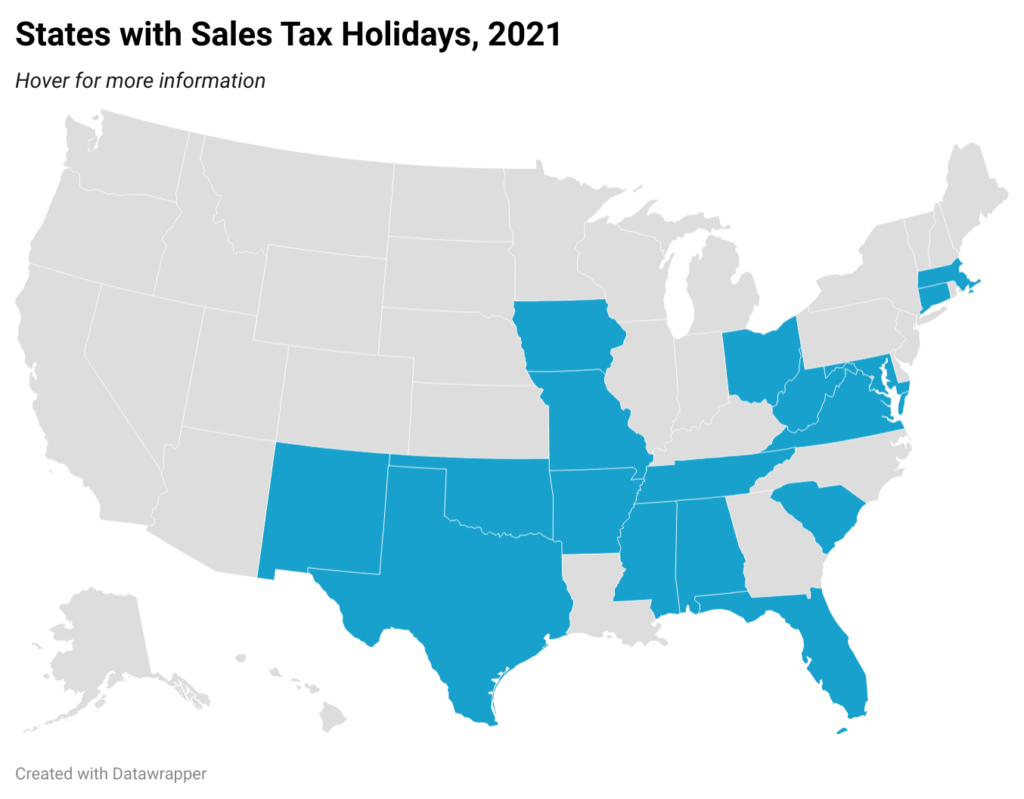

We at ITEP, along with other tax experts and advocates for sound public policy, have been calling attention for years to the fact that sales tax holidays are ineffective, poorly targeted policies, and are vastly inferior to some of the other tools states can use to help families and businesses make ends meet. But year after year the tax holiday idea persists, largely because even though it’s not good policy, it’s not usually greatly harmful either. At a cost in most years totaling about $200-300 million spread across 15-20 states, sales tax holidays don’t deliver their purported benefits to struggling families and state economies, but they do provide a highly publicized illusion of such benefits at a cost that lawmakers have deemed acceptable.

Our updated brief on sales tax holidays chronicles how state lawmakers are increasingly applying the flawed tax holiday concept to new categories of purchases or expanding their scope or duration to previously unheard-of extents, leading to a rising price tag and nonsensical examples like those above. These developments are raising the stakes of sales tax holidays, perhaps enough to draw greater attention to the many flaws of the tax holiday approach, which include:

- Sales tax holidays are poorly targeted, an incredibly blunt instrument that benefits upper-income households as much or more than struggling families and businesses.

- Tax holidays reduce state and local revenue, worsening the quality of public services and exacerbating already difficult budget decisions.

- Some retailers, many of them large out-of-state corporations, are able to exploit sales tax holidays.

- The holidays create administrative confusion as consumers, businesses, and administrators must sometimes wade through pages of rules and guidance to ensure they are in compliance.