Every state with a personal income tax offers tax subsidies for seniors that are unavailable to younger taxpayers. The best academic research suggests that the median state asks senior citizens to pay about one-third less in personal income tax than younger families with similar incomes. The majority of these subsidies are costly and poorly targeted. In many states, high-income seniors pay less tax than younger families with much lower incomes. And yet too many states have been on a steady march toward enacting and expanding carveouts for seniors.

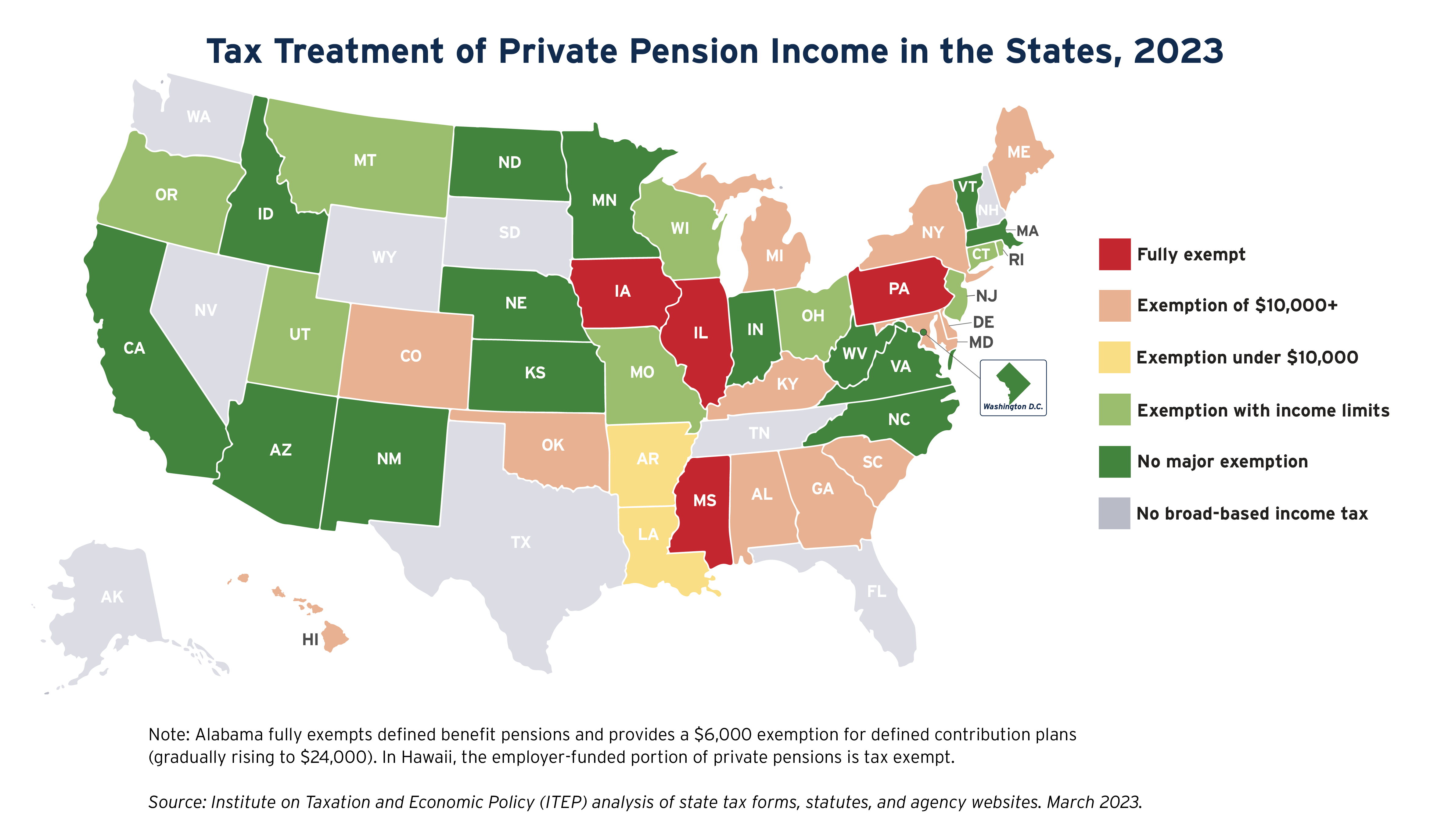

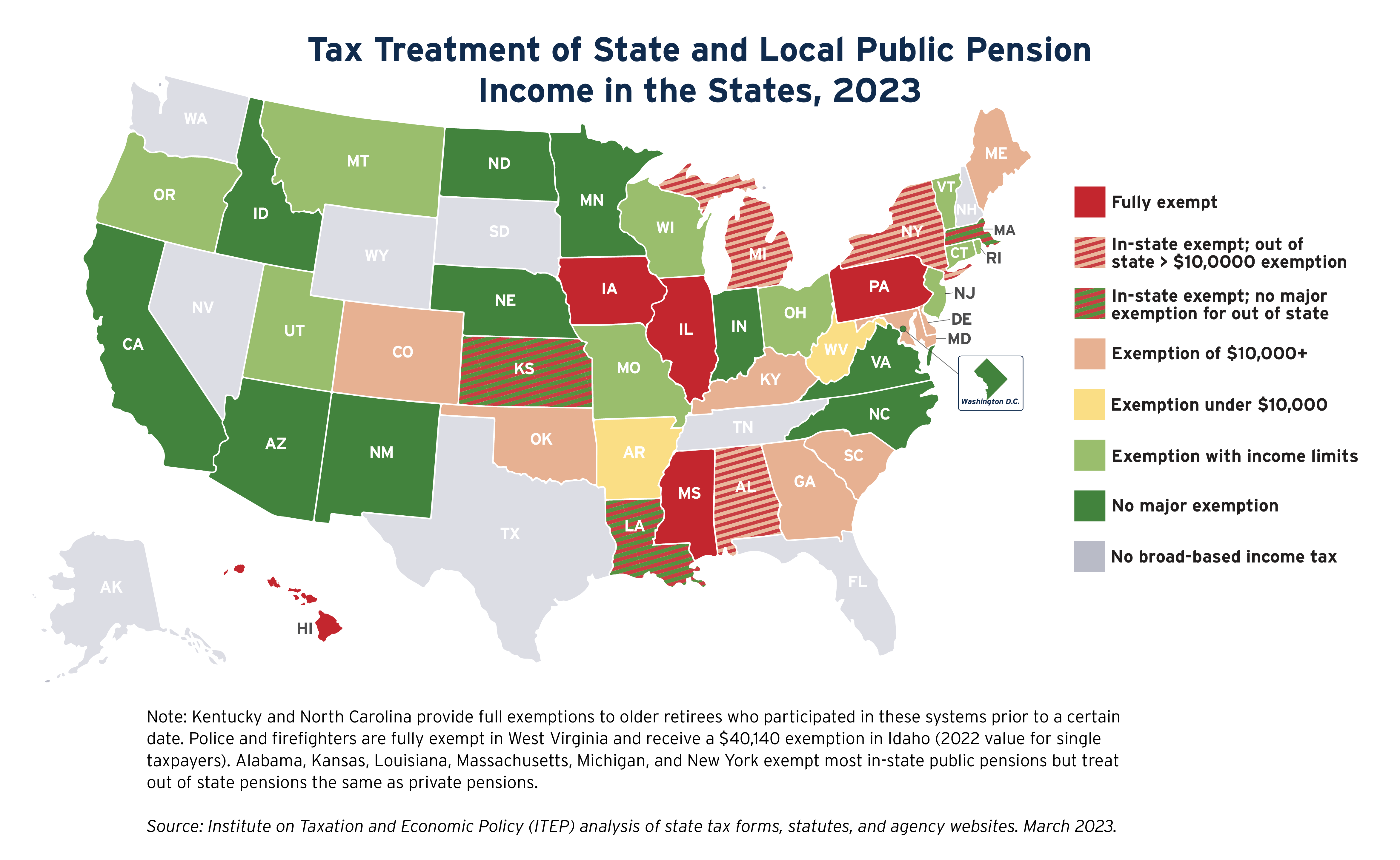

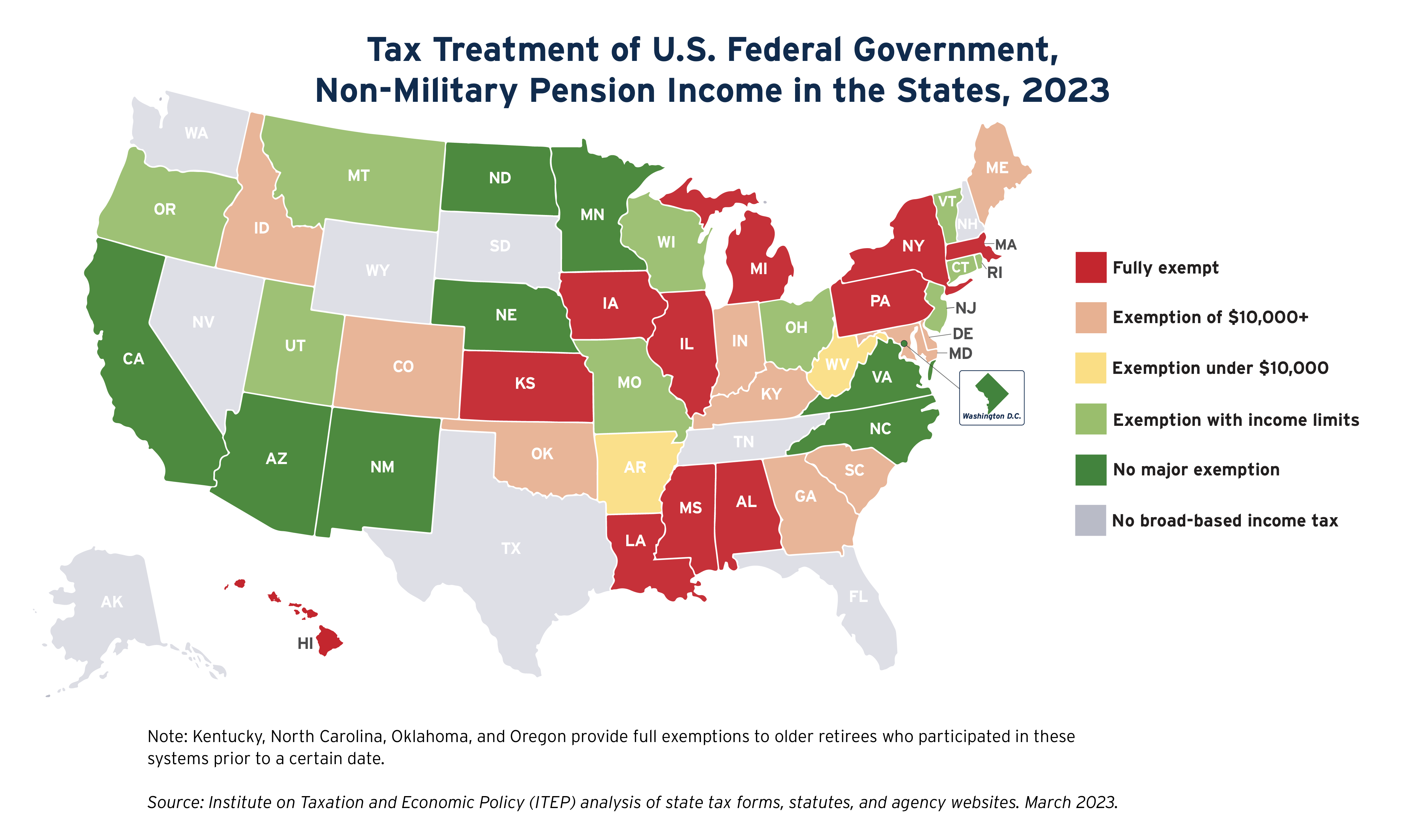

All states provide a substantial income tax exemption for Social Security income, with 32 states choosing to exempt this income entirely, even for very wealthy families. Twenty-seven states offer an exemption or credit for private pension income in 2023, up from 21 states in 1990 and just 11 states in 1977. Other types of tax subsidies targeted exclusively to older adults are common as well.

These subsidies take several different forms, as shown below.