States across the nation are debating how best to respond to costly new federal tax cuts – many of which are impacting state tax codes. Delaware officials are estimating a $400 million state revenue shortfall if no action is taken, and lawmakers in Maine and Michigan both decided to maintain their current policies, opting to not incorporate federal changes that mostly benefit large corporations.

Meanwhile, in response to federal tax and spending cuts, and the growing need to address wealth and income inequality, proposals out of California and Connecticut would levy new taxes on the richest in those states. Similar proposals to ask more of the richest in the state are circulating in New Jersey.

Major State Tax Proposals and Developments

- A coalition of labor and health care groups in CALIFORNIA have launched an effort to implement a one-time 5 percent tax on the wealth of the state’s billionaires to cover the cuts to Medicare included in the new federal tax and spending law. The measure would tax those with a net worth above $1 billion and is estimated to raise up to $100 billion over several years. – ELI BYERLY-DUKE

- DELAWARE faces an estimated $400 million state revenue shortfall due to conformity of recent federal tax cuts over this year and the coming two fiscal years. According to the Delaware Economic and Financial Advisory Council, one of the largest drivers of the shortfall is a decrease of $220 million in corporate tax revenue due to automatically connection to the new federal law. – MILES TRINIDAD

- IOWA’s latest revenue forecast is highly troubling. A combination of aggressive state income tax cuts for high-income Iowans, federal tax cuts to which Iowa is heavily exposed, a slowing economy, and tough times for tariff-affected farmers have all contributed to a precipitous $800 million year-over-year decline in revenue, leaving the state $1.3 billion short of funding its $9.4 billion budget for the current year. The state has about $6 billion in reserves to help avoid dismantling public services in the short term, but those looking past the current budget and election cycle are very concerned. – ELI BYERLY-DUKE

- MAINE Gov. Janet Mills adopted conformity recommendations (on a temporary basis) outlined by the financial services commissioner, following their report on the impacts of the new federal law on state revenues. The state will not couple to certain expensing and depreciation provisions, and have committed to not incorporating the “no tax on tips” and “no tax on overtime” language. – MARCO GUZMAN

- MICHIGAN Gov. Gretchen Whitmer signed a bipartisan budget deal that included exempting tip income, overtime, and Social Security from state taxable income, and also included decoupling the state tax code from recent federal changes that would have benefited large corporations, such as depreciation for qualified property, deductions on domestic research and development, and interest on pre-depreciation expenses. The state also recently enacted $1.1 billion in new revenue for its transportation budget. The revenue will primarily come from a 24 percent wholesale tax on marijuana, which is anticipated to generate $420 million, and replacing the state’s 6 percent sales tax applied to gas with an equal increase of the gas tax. – MILES TRINIDAD

State Roundup

- Los Angeles, CALIFORNIA, Mayor Karen Bass has proposed suspending the city’s mansion tax for three years for victims of the January Palisades Fire. In the wake of the fires, anti-tax groups have pounced on Measure ULA trying to get state leaders to overturn the law, including attempting to get a referendum put on the 2026 ballot to kill similar real estate transfer taxes.

- Meanwhile, city leaders in San Diego, CALIFORNIA, are considering adopting a tax on second homes and vacation rentals. The city determined over 10,000 homes are not used as permanent residences, contributing to high home prices and rents. An early projection estimates the tax could collect nearly $135 million a year. The proposal would need be approved by voters in 2026.

- CONNECTICUT lawmakers are considering tax increases on the very wealthy—who will receive a windfall from the new federal tax law—to help fund increased benefits for middle- and low-income households. The plans include a 1.75 percent capital gains surcharge on those whose incomes exceed $1 million ($2 million for couples) and a mansion tax of two mills on properties assessed between $3 million and $5 million. House Republicans, meanwhile, have proposed increasing the state property tax credit from $300 to $1,000.

- A FLORIDA lawmaker has proposed competing property tax cut bills to Gov. Ron DeSantis’ property tax elimination proposal. Sen. Mack Bernard is instead focused on policies like exempting non-school portions of property taxes for seniors with annual incomes under $350,000, freezes for homeowners with 20 years of ownership and Florida residency, and additional homestead exemptions after 30 years. Proposed legislation has yet to be targeted towards renters, who comprise a third of occupied housing in Florida.

- IDAHO is facing a projected budget deficit of almost $57 million for the current fiscal year. Personal and corporate income tax collections came in 15 percent lower than the year prior, and Gov. Brad Little has already called on state agencies to cut their budgets by 3 percent, following a $450 million tax cut signed earlier in the year. Meanwhile, several lawmakers are supporting efforts to collect signatures for an initiative that would allow voters to decide whether to repeal the state’s 6 percent sales tax on groceries.

- Chicago, ILLINOIS, Mayor Brandon Johnson is considering reinstating the city’s corporate head tax amidst a $1.15 billion budget shortfall. Head taxes charge large corporations a flat amount per employee and are used to help support the services and infrastructure needed to support large businesses and corporations.

- MARYLAND will not be able to enforce a provision of its first-of-its-kind digital ad tax that prohibited online companies from alerting consumers to the tax, such as passing on the tax as a surcharge, fee, or line item of a bill, after a U.S. District Court ruled that the provision violated the First Amendment. The overall law continues to face other legal challenges, including in Maryland Tax Court.

- MISSOURI lawmakers are considering separating property into four classes – residential, commercial, agricultural, and personal – to set valuation percentages for each class separately.

- With NEW JERSEY estimated to face a budget shortfall of $1.5 billion next year, a coalition of labor unions and advocacy groups is arguing that the state’s wealthiest residents and big corporations should be contributing more. The coalition’s proposal would raise $1 billion with new and higher tax rates on those earning over $2 million, $5 million, and $10 million, with rates set at 12 percent, 13 percent, and 14 percent, respectively.

- NEW YORK Gov. Kathy Hochul faces a difficult budget situation and her office is already alerting state agencies to prepare for a no-growth budget at best. Federal cuts and other factors are creating a shortfall projected to total up to $34.3 billion over the next four years. And Gov. Hochul’s reluctance to embrace any tax increases means her proposal, due in January, is likely to lean heavily on funding cuts.

- In better news for NEW YORKers, Gov. Kathy Hochul has also been working with lawmakers on a legislative package crafted to improve housing affordability for homeowners and renters. The package expands localities’ ability to grant property tax incentives to developers turning vacant properties into housing, provides a partial property tax exemption to homes transferred from various entities to low-income households, outlaws rent-setting algorithms that inflate prices, and strengthens laws against appraisal discrimination.

- The OHIO Senate Education Committee Chairman is proposing a bill that would replace local school property taxes with a single, statewide 20-mill property tax, increase the state sales tax by 1.75 percentage points to 7.5 percent, and eliminate the EdChoice voucher program and instead use a per-pupil school financing system that would pay public and private schools depending which school a student enrolls in.

- SOUTH DAKOTA’S legislative tax force focused on reducing property taxes advanced 19 proposals in its final meeting, and the proposals could be considered by legislators later this year. The proposals include state spending cuts to fund property tax cuts, creating one-time tax credits, and reserving future state revenue increases to reduce property taxes, and replacing the property tax with a sales tax increase, which is similar to a proposal that could soon start gathering signatures to be placed on a future ballot.

- TEXAS voters will consider 17 constitutional amendments next month. The amendments include expansions to the homestead exemption, as well as amendments prohibiting taxes on various forms of income from wealth, like capital gains, securities, and inheritances.

- Several UTAH lawmakers are eyeing a bill proposal that would look to reduce the state’s motor fuel tax rate and make up some of the lost revenue by eliminating a tax exemption that local refineries get for exporting some of their products out of state.

What We’re Reading

- A recent ITEP report identifies the 5 states that provided the biggest tax cuts to millionaires in 2025. Those cuts – in Kansas, Mississippi, Missouri, Ohio, and Oklahoma – drain a combined $2.2 billion a year from state coffers and were drastically skewed in favor of millionaires over everyone else.

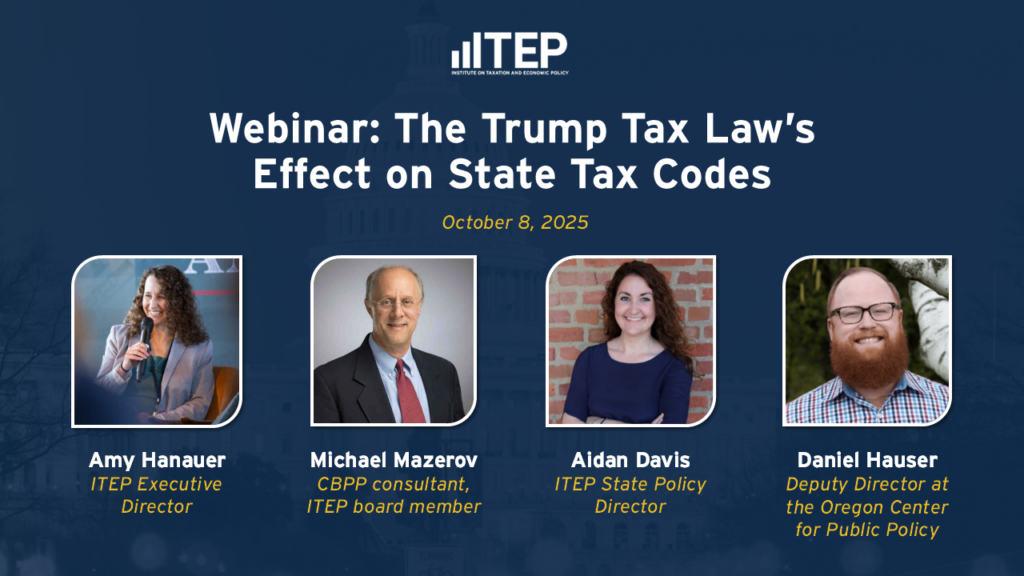

- A new practical guide highlights why states should not go along with OBBBA’s corporate tax breaks. The piece builds on the knowledge shared in a recent ITEP webinar (available here ICYMI).

- The Center on Budget and Policy Priorities released a report pushing states to eliminate the “drop-kick” loophole that allows companies to avoid paying real estate transfer taxes.

If you like what you are seeing in the Rundown (or even if you don’t) please send any feedback or tips for future posts to Aidan Davis at [email protected]. Click here to sign up to receive the Rundown via email.