When Congress was considering capping the deduction for state and local tax (SALT) payments last year, numerous lawyers warned that states would likely circumvent the hastily devised cap by helping their residents convert state tax payments into fully deductible charitable gifts.

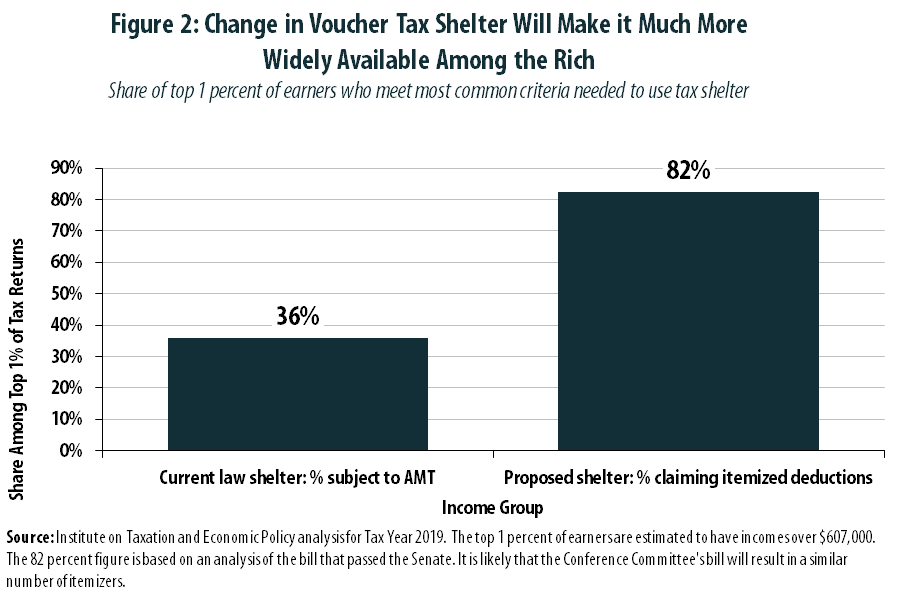

To make this conversion, states would offer “workaround tax credits,” offsetting most or all of the cost of “donating” to support public services (New York, New Jersey, Connecticut, and Oregon have since enacted these credits). Lawyers knew to offer this warning, which Congress ignored, because this abuse of the charitable giving deduction was already taking place in many “red states” with tax credits supporting K-12 private school vouchers.

A new ITEP report explains the close parallels between the new workaround credits and existing state tax credits, including those benefiting private schools. The report comes the same day that the IRS and Treasury Department announced they would seek new regulations related to these tax credits. It notes that the SALT workarounds are emblematic of a broader weakness with the federal charitable deduction. And it cautions regulators to avoid a “narrow fix” that will only address the newest SALT workarounds (which, so far, have only been enacted in blue states) without also addressing other abuses of the deduction, which have long been employed by red states.

The new IRS notice is light on details, suggesting that regulators do not yet know how they will navigate this complex policy area. ITEP’s new report discusses in detail the two main options that the IRS could choose to pursue:

- Broad action that improves the tax code’s measurement of charitable giving, and requires taxpayers to subtract state tax benefits they received when calculating the portion of each gift that was truly “charitable.” For example: if a taxpayer donates $100 and receives a $60 state tax credit in return, only the remaining $40 would be considered a charitable gift for federal tax purposes.

Or

- Narrow action that requires examining every entity (government agencies, public universities, nonprofit organizations, etc.) receiving a donation reimbursed with a tax credit. Based on the outcome of that examination (using criteria that are not yet known), the IRS would either: (a) turn a blind eye and grant a full federal charitable deduction even when the alleged “donation” was reimbursed with a state tax credit, or (b) categorize the reimbursed portion of the donation as a state tax payment subject to the $10,000 SALT cap.

Pursuing the narrow fix would require drawing arbitrary distinctions within the wide range of public entities, quasi-public entities, and heavily-regulated nonprofits currently benefiting from state charitable tax credits. It would also lead to perverse outcomes in which red-state tax shelters would be left intact while the newer, and sometimes less-lucrative, blue-state equivalents would be shut down. As the report explains:

It turns out that high-income taxpayers living in states such as Alabama and Pennsylvania are already enjoying the personal financial benefits of SALT cap workarounds, while those living in California, New York, and elsewhere are still waiting for their lawmakers to finish debating or implementing workaround credits.

Accountants in Alabama and elsewhere are marketing existing state tax credits for private schools using the exact same sales pitch that drew the IRS’s attention to the new credits in New York and other states. For example, an accounting firm’s tax advice that has been promoted by the Medical Association of Alabama explains that making a “donation” to support private school vouchers is “an opportunity to preserve your state tax deduction.” In Pennsylvania, meanwhile, a similar tax credit is being touted as a tool for “bypassing the $10k state and local tax deduction limitation.”

These sales pitches are not merely idle chatter. This year, Alabama’s entire allotment of $30 million in tax credits was snatched up in just two months, and SALT cap avoidance was reportedly on the minds of many claimants.

These private school voucher shelters have been problematic for years, as ITEP and others have explained in a series of reports. Any IRS action targeting the newest “workaround credits” needs to address these longer-running tax shelters as well. Failing to do so would be unfair and arbitrary, and a step backward for federal tax policy.