Worldwide combined reporting negates the tax benefits of shifting corporate income offshore

Public polling has consistently shown for decades that most people believe big multinational corporations are paying too little in taxes. Closing the loopholes these corporations use to avoid taxes is one of the most effective – and popular – solutions to this problem. Voters want to see lawmakers crack down on corporate tax avoidance, and state lawmakers have a readymade solution to do just that: worldwide combined reporting.

Worldwide combined reporting eliminates the tax savings from shifting corporate income offshore by treating a corporation, including all its subsidiaries within the U.S. and in foreign countries, as one entity for tax purposes. This policy would raise $18.7 billion a year nationwide if in effect in all states that currently have a corporate income tax, according to a new in-depth analysis by the Institute on Taxation and Economic Policy.

“Worldwide combined reporting would ensure that companies pay tax based on their profits and business fundamentals, not the level of creativity their accountants bring to their tax returns,” said Carl Davis, research director at ITEP and an author of the report. “Any lawmaker who is sick and tired of U.S. companies pretending they earn the bulk of their profits in Ireland and the Cayman Islands should be taking a hard look at worldwide combined reporting right now.”

Key findings:

- In total, universal adoption of mandatory worldwide combined reporting would boost state corporate income tax revenues by roughly 14 percent, or $18.7 billion a year.

- The revenue effects would vary across states, with 38 states and D.C. seeing revenue increases totaling $19.1 billion a year and five states seeing revenue declines totaling $400 million a year.

- The 10 states with the most revenue potential are: California ($3 billion), Florida ($2.4 billion), Pennsylvania ($1.5 billion), Illinois ($1.2 billion), New Jersey ($910 million), Tennessee ($891 million), Virginia ($787 million), New York ($737 million), Georgia ($731 million), and Maryland ($717 million).

In all, 28 states plus D.C. already require combined reporting, but the combined report only includes subsidiaries within the U.S. Extending these laws to include foreign entities is a commonsense way to make a state’s corporate tax code fairer by cracking down on tax avoidance.

That’s one reason worldwide combined reporting has received a growing amount of attention in the states in the past few years. Legislative chambers in Maryland and Minnesota approved the policy in 2024 and 2023, respectively, and bills have been introduced in at least eight states across the country. Lawmakers in eight states have introduced, or plan to introduce, legislation this year as well.

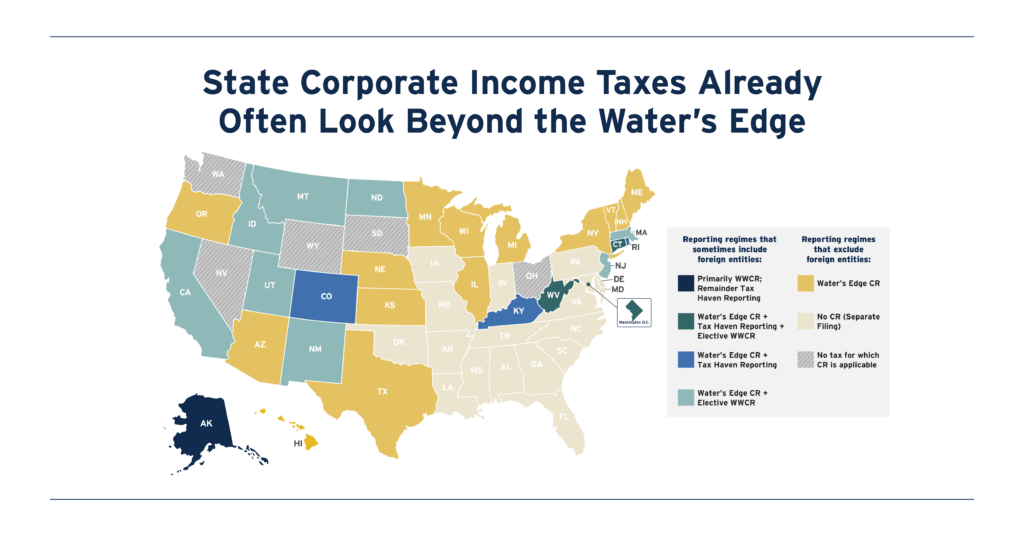

And in fact, as we pointed out in 2023, 14 states and D.C. either allow, or require, companies to file returns that include at least some profits booked in foreign countries, while 10 states and D.C. allow for worldwide combined reporting on an elective basis. In other words, requiring worldwide combined reporting would not be a radical change for multinational corporations that are already having to do this accounting work internally.

While our analysis focuses only on the revenue potential of worldwide combined reporting, there are many other compelling reasons for lawmakers to enact this policy. In addition to raising revenue in most states, worldwide combined reporting would help level the playing field between small in-state businesses and large multinationals and could be enforced far more effectively than the current patchwork of laws and litigation designed to curb aggressive corporate tax avoidance.

Contact: Jon Whiten ([email protected])