Connecticut

High-Rent, Low-Wealth: Addressing the Racial Wealth Gap through a Federal Renter Credit

March 3, 2025 • By Brakeyshia Samms, Emma Sifre, Joe Hughes

While the federal tax code has some policies focused on raising income of low earners, it contains fewer provisions designed specifically to address wealth inequality. A renter tax credit offers a simple, administratively practical means of reaching low-wealth populations through the federal tax code without requiring a comprehensive measurement of every household’s wealth.

Below is a list of tax expenditure reports published in the states.

In the face of immense uncertainty around looming federal tax and budget decisions, many of which could threaten state budgets, state lawmakers have an opportunity to show up for their constituents by raising and protecting the revenue needed to fund shared priorities. Lawmakers have a choice: advance tax policies that improve equity and help communities thrive, or push tax policies that disproportionately benefit the wealthy, drain funding for critical public services, and make it harder for most families to get ahead.

A Revenue Analysis of Worldwide Combined Reporting in the States

February 20, 2025 • By Carl Davis, Matthew Gardner, Michael Mazerov

Universal adoption of mandatory worldwide combined reporting would boost state corporate income tax revenues by roughly 14 percent. Thirty-eight states and the District of Columbia would experience revenue increases totaling $19.1 billion.

State Rundown 2/12: State Tax Policy Heats Up as Winter Storms Sweep Much of the Country

February 12, 2025 • By ITEP Staff

Tax policy proposals are a hot topic of conversation across the country. Both North and South Dakota are considering property taxes cuts, while proposed cuts in Florida, Mississippi, and Texas are percolating. Meanwhile, fiscal conditions are tight in states like Alaska, Tennessee, Oklahoma, and West Virginia. None are on the cusp of passing new revenue, but years of recent tax cuts and inflation have caught up to states and many lawmakers have revenue gaps to close.

Turning IRS Agents to Deportation Will Reduce Public Revenues

February 11, 2025 • By Carl Davis, Jon Whiten

The Trump Administration’s plan to turn IRS agents into deportation agents will result in lower tax collections in addition to the harm done to the families and communities directly affected by deportations.

Tax changes have been proposed or are nearing the finish line in many states. Kentucky is poised to enact an income tax cut as a bill heads to the governor’s desk. In Pennsylvania, Gov. Josh Shapiro’s budget proposal called to accelerate existing corporate tax cuts while closing corporate tax loopholes by enacting combined reporting. Ohio Gov. Mike DeWine proposed a new credit for children of working parents. And Virginia Democrats countered Gov. Glenn Youngkin’s proposed tax cuts with a plan of their own that includes an increase to the state’s Earned Income Tax Credit (EITC) and a one-time, nonrefundable tax…

State Rundown 1/15: Tax Debates Heat Up Despite Winter Weather

January 15, 2025 • By ITEP Staff

While frigid temperatures expected across a large swath of the country, major tax proposals are heating up in the states. Governors are giving their State of the State addresses and state lawmakers have begun to convene for 2025. New York Gov. Kathy Hochul announced plans to expand the state’s Child Tax Credit earlier this year and has since announced nearly $1 billion in income tax cuts. Maryland Gov. Wes Moore unveiled a new tax proposal aimed at helping close the state’s looming revenue shortfall. The plan would increase taxes on the wealthy and cut taxes for many low- and middle-income…

Trump’s Plan to Extend His 2017 Tax Provisions: Updated National and State-by-State Estimates

January 8, 2025 • By Steve Wamhoff

Trump’s plan to make most of the temporary provisions of his 2017 tax law permanent would disproportionately benefit the richest Americans. This includes all major provisions except the $10,000 cap on deductions for state and local taxes (SALT) paid.

Extending Temporary Provisions of the 2017 Trump Tax Law: Updated National and State-by-State Estimates

September 13, 2024 • By Steve Wamhoff

The TCJA Permanency Act would make permanent the provisions of the Tax Cuts and Jobs Act of 2017 that are set to expire at the end of 2025. The legislation would disproportionately benefit the richest Americans. Below are graphics for each state that show the effects of making TCJA permanent across income groups. See ITEP’s […]

Audio: ITEP’s Marco Guzman Talks About the Tax Payments of Connecticut’s Undocumented Immigrants

August 1, 2024

CT’s undocumented immigrants pay over $400 million in taxes annually, study finds. Read more or listen here.

Undocumented immigrants paid $96.7 billion in federal, state, and local taxes in 2022. Providing access to work authorization for undocumented immigrants would increase their tax contributions both because their wages would rise and because their rates of tax compliance would increase.

Improving Refundable Tax Credits by Making Them Immigrant-Inclusive

July 17, 2024 • By Emma Sifre, Marco Guzman

Undocumented immigrants who work and pay taxes but don't have a valid Social Security number for either themselves or their children are excluded from federal EITC and CTC benefits. Fortunately, several states have stepped in to ensure undocumented immigrants are not left behind by the gaps in the federal EITC and CTC. State lawmakers should continue to ensure that immigrants who are otherwise eligible for these tax credits receive them.

Connecticut Mirror: Could CT Fight Homelessness With a ‘Mansion Tax’? Yes, Report Says

July 3, 2024

State government could raise as much as $180 million annually to combat homelessness or address other social needs by boosting its tax on the sale of high-value houses, according to a recent report from two Washington fiscal think tanks.

State Rundown 6/26: Summer Special Sessions Are In, Anti-tax Ballot Initiatives Out

June 26, 2024 • By ITEP Staff

Many families are heading out on summer vacations, but legislators across the country are heading back to statehouses for special sessions...

States Should Enact, Expand Mansion Taxes to Advance Fairness and Shared Prosperity

June 26, 2024 • By Carl Davis, Erika Frankel

The report was produced in partnership with the Center on Budget and Policy Priorities and co-authored by CBPP’s Deputy Director of State Policy Research Samantha Waxman.[1] Click here to use our State Mansion Tax Estimator A historically large share of the nation’s wealth is concentrated in the hands of a few, a reality glaring in […]

This week, it was the best of times or, in some cases, the worst of times for tax policy in two different states...

Every child deserves the opportunity to succeed in society – and tax policy has a huge role to play in making that happen. Better tax policy can help prepare our young children with skills to become successful and thriving adults.

ITEP’s Marco Guzman Testifies in Favor of Tax Fairness Bills in Connecticut

March 11, 2024

Good afternoon, Senator Fonfara, Representative Horn, and members of the Committee, and thank you for this opportunity to testify. My name is Marco Guzman and I'm a senior policy analyst with the Institute on Taxation and Economic Policy, or ITEP, and we’re a nonprofit research organization that focuses on state, local, and federal tax policy issues.

Anti-tax interests finally found the end of the tax cutting appetite in a few states this week...

State Tax Watch 2024

January 23, 2024 • By ITEP Staff

Updated July 15, 2024 In 2024, state lawmakers have a choice: advance tax policy that improves equity and helps communities thrive, or push tax policies that disproportionately benefit the wealthy, drain funding for critical public services, and make it harder for low-income and working families to get ahead. Despite worsening state fiscal conditions, we expect […]

Connecticut: Who Pays? 7th Edition

January 9, 2024 • By ITEP Staff

Connecticut Download PDF All figures and charts show 2024 tax law in Connecticut, presented at 2023 income levels. Senior taxpayers are excluded for reasons detailed in the methodology. Our analysis includes nearly 100 percent of state and local tax revenue collected in Connecticut. State and local tax shares of family income Top 20% Income Group […]

Hidden in Plain Sight: Race and Tax Policy in 2023 State Legislative Sessions

November 21, 2023 • By Brakeyshia Samms

Race was front and center in a lot of state policy debates this year, from battles over what’s being taught in schools to disagreements over new voting laws. Less visible, but also extremely important, were the racial implications of tax policy changes. What states accomplished this year – both good and bad – will acutely affect people and families of color.

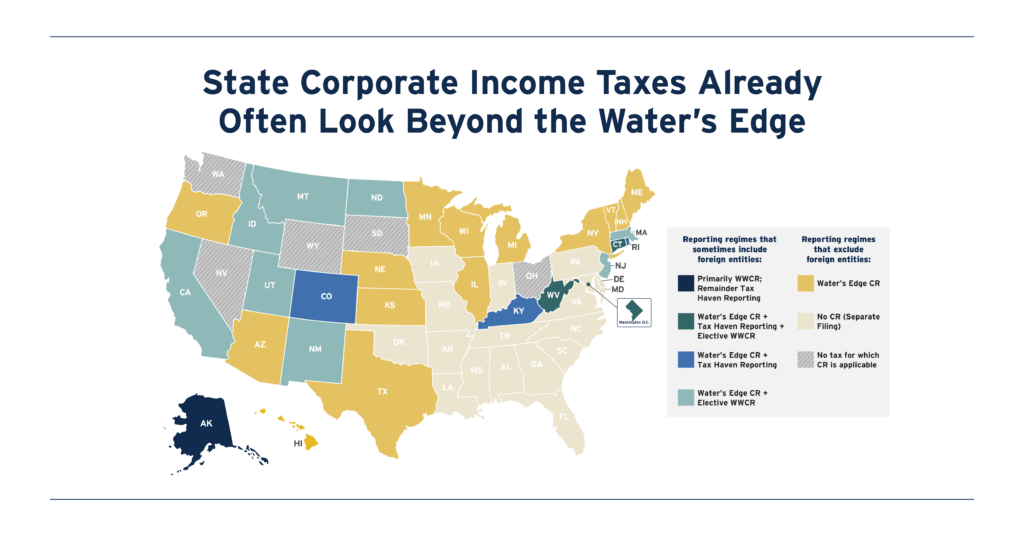

Far From Radical: State Corporate Income Taxes Already Often Look Beyond the Water’s Edge

November 7, 2023 • By Carl Davis, Matthew Gardner

State lawmakers are increasingly interested in reforming their corporate tax bases to start from a comprehensive measure of worldwide profit. This provides a more accurate, and less gameable, starting point for calculating profits subject to state corporate tax. Mandating this kind of filing system, known as worldwide combined reporting (WWCR), would be transformative, as it would all but eliminate state corporate tax avoidance done through the artificial shifting of profits into low-tax countries.

State Rundown 10/26: Off-Year Ballot Measures and State & Local Tax Policy

October 26, 2023 • By ITEP Staff

November elections are creeping closer and closer and while that typically means a new batch of lawmakers are elected, it also means voters have another chance to help shape state and local tax policy...