GILTI

House Bill’s $164 Billion Giveaway to Multinational Corporations Puts America Last

May 27, 2025 • By Sarah Austin

The House of Representatives’ recently passed tax bill changes course on taxing multinational corporations engaged in shifting U.S. profits overseas, offering massive tax giveaways that weaken American revenues and risk sending more American corporate investment offshore.

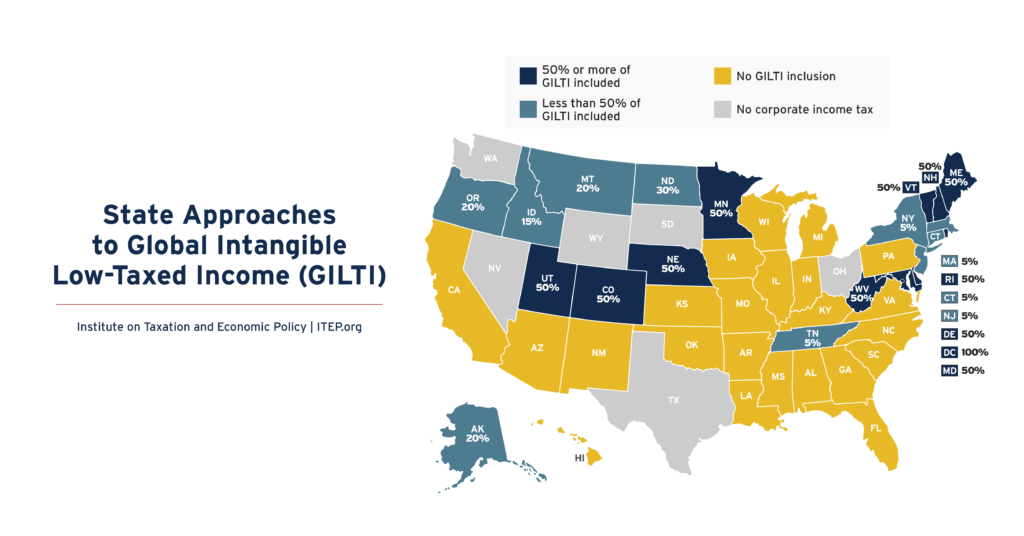

Many states with corporate income taxes include some amount of federally defined Global Intangible Low-Taxed Income (GILTI) in their tax bases. Twenty-one states plus D.C. include some amount of GILTI in their tax calculations in 2025.

Minnesota’s Tax Battle of 2023 Signals a Turning of the Tide Against Corporate Tax Avoidance

July 7, 2023 • By Matthew Gardner

The qualified success of Minnesota’s GILTI conformity—to say nothing of the state’s serious dalliance with the game-changing worldwide combined reporting--sends a clear signal that the days may be coming to an end when big multinationals can scare state lawmakers into allowing them to game the tax system.