Key findings

• Lawmakers in several states are discussing enacting or expanding school voucher tax credits, which reimburse individuals and businesses for “donations” they make to organizations that give out vouchers for free or reduced tuition at private K-12 schools. In effect, these credits allow contributing families to opt out of paying for public education and other public services.

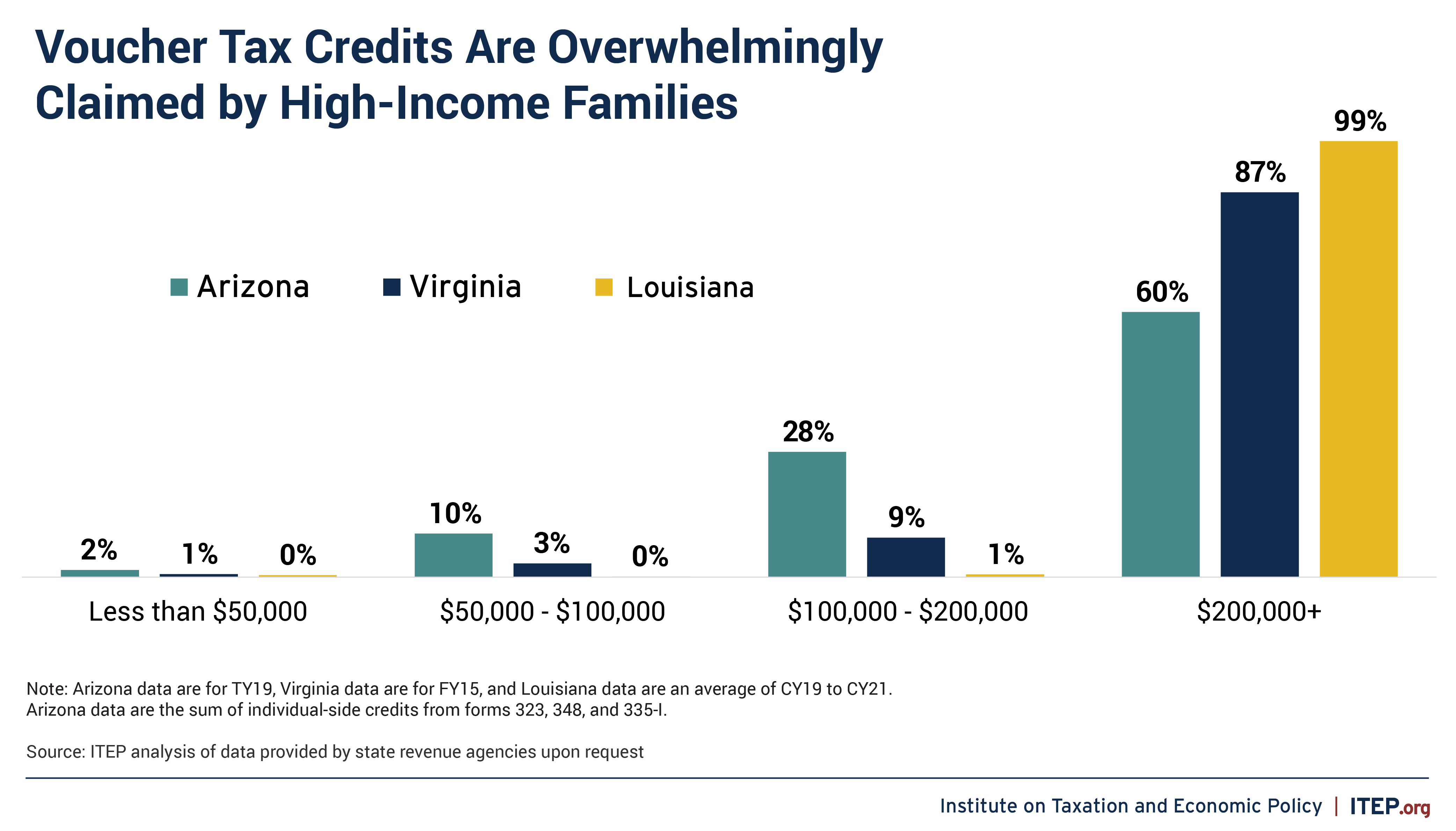

• New data—published here for the first time—reveal that wealthy families are overwhelmingly the ones using these credits to opt out of paying tax to public coffers. In all three states providing data, most of the credits are being claimed by families with incomes over $200,000.

• Wealthy families’ interest in these programs is being driven partly by a pair of tax shelters that can make “donating” profitable. These shelters hinge on stacking state and federal tax cuts and are being advertised in the states as a way to get a “double tax benefit” and “make money” in the process. This kind of language is a far cry from most nonprofit fundraising pitches and gives some sense of the supersized nature of the tax benefits being offered for private and religious K-12 schooling.

• Voucher tax credits are without merit and should be repealed. Short of that, states can end their use as profitable tax shelters with straightforward reforms. A national solution to this problem, however, will require action by the IRS.

One of the most disturbing recent shifts in U.S. public policy has been the renewed push to privatize the nation’s K-12 education system.[1] Originally born out of a desire to preserve school segregation and racial inequality more broadly, the so-called “school choice” movement is enjoying a resurgence as many state lawmakers look for ways to move more kids into private and religious schools.[2] That end is being hastened through the tax code in major ways. In short, school privatization proponents have managed to set up state policies that harness deficiencies in federal tax law and the self-interest of wealthy families to gin up enthusiasm for privatizing the U.S. public education system.

Voucher Tax Credits

State voucher tax credits are among the most significant tools eroding the public education system and propping up private schools. These policies are on the books in 21 states and proposals to create or expand them are being discussed this year in places like Alabama, Georgia, Kansas, Montana, Nebraska, South Carolina, and Texas.[3]

Voucher tax credits reimburse individuals and businesses for “donations” they make to organizations that give out vouchers for free or reduced tuition at private K-12 schools—the overwhelming majority of which are religious in nature.[4]

Unlike charitable gifts to other causes where taxpayers save less than 10 cents in state taxes for every dollar donated, these supersized incentives often give private school “donors” their full donation back. This unusual payoff scheme necessitated a whole new set of regulations from the IRS to enforce the commonsense notion that families being reimbursed for their “gifts” have not done anything genuinely charitable and should not receive federal charitable deductions.[5] Before those regulations took effect, it was common for private schools to tell wealthy families that pairing voucher credits with the federal charitable deduction was a great way to “make money.”[6]

While the IRS has taken steps to prevent taxpayers from misusing the charitable deduction in combination with these state tax credits, significant tax avoidance is still occurring through less-scrutinized channels. The fact that these programs continue to allow many high-income taxpayers to turn a profit for themselves is helping accelerate the diversion of public funding into private schools. States have the power to prevent aggressive tax avoidance through their voucher tax credits, as explained below, but many have turned a blind eye in the interest of maximizing growth in these programs.

A Subsidy for the Wealthy

Despite voucher tax credits’ charitable facade, the reality is they allow wealthy families to opt out of paying for public education and other public services, and to redirect their tax dollars to private and religious instruction instead. If a taxpayer sends $1,000 to a private school organization and receives a $1,000 state tax credit in return, the plain result of that is that the tax dollars have been rerouted away from public coffers and to private organizations instead.

We now know that wealthy families are overwhelmingly the ones using these credits to opt out of paying tax to public coffers because new data—published here for the first time—that we’ve obtained from tax agencies in three states show exactly that.

In all three states providing data—Arizona, Louisiana, and Virginia—more than half of all voucher tax credits are flowing to families with annual incomes over $200,000. Virginia and Louisiana’s credits are especially skewed toward these high-income families because of very high caps on the maximum amount of credit that can be claimed per taxpayer.

So why are wealthy taxpayers so enthusiastic about these credits? Some of them, no doubt, are true believers in the “school choice” cause. But others are being drawn to these programs by tax shelters that make them particularly lucrative to high-income business owners and wealthy people.

The Business Expense Tax Dodge

The original voucher tax shelter addressed through the IRS regulations mentioned above was complicated in the details but very simple in the broad strokes:

State tax credit + federal charitable deduction = profit

With the IRS having shut down this scheme, however, private schools and financial advisors have shifted toward marketing a new variant specifically geared toward business owners:

State tax credit + federal business expense deduction = profit

The box below provides an overview of the ways this tax shelter is being pitched to prospective donors. One voucher-bundling organization in Alabama notes the potential for “a combined federal and state tax benefit greater than the total dollar amount of the donation.” Another organization in the state explains more colorfully that “business owners may make money from a contribution.” This kind of language is a far cry from most nonprofit fundraising pitches and gives some sense of the supersized nature of the tax benefits being offered for private and religious K-12 schooling.

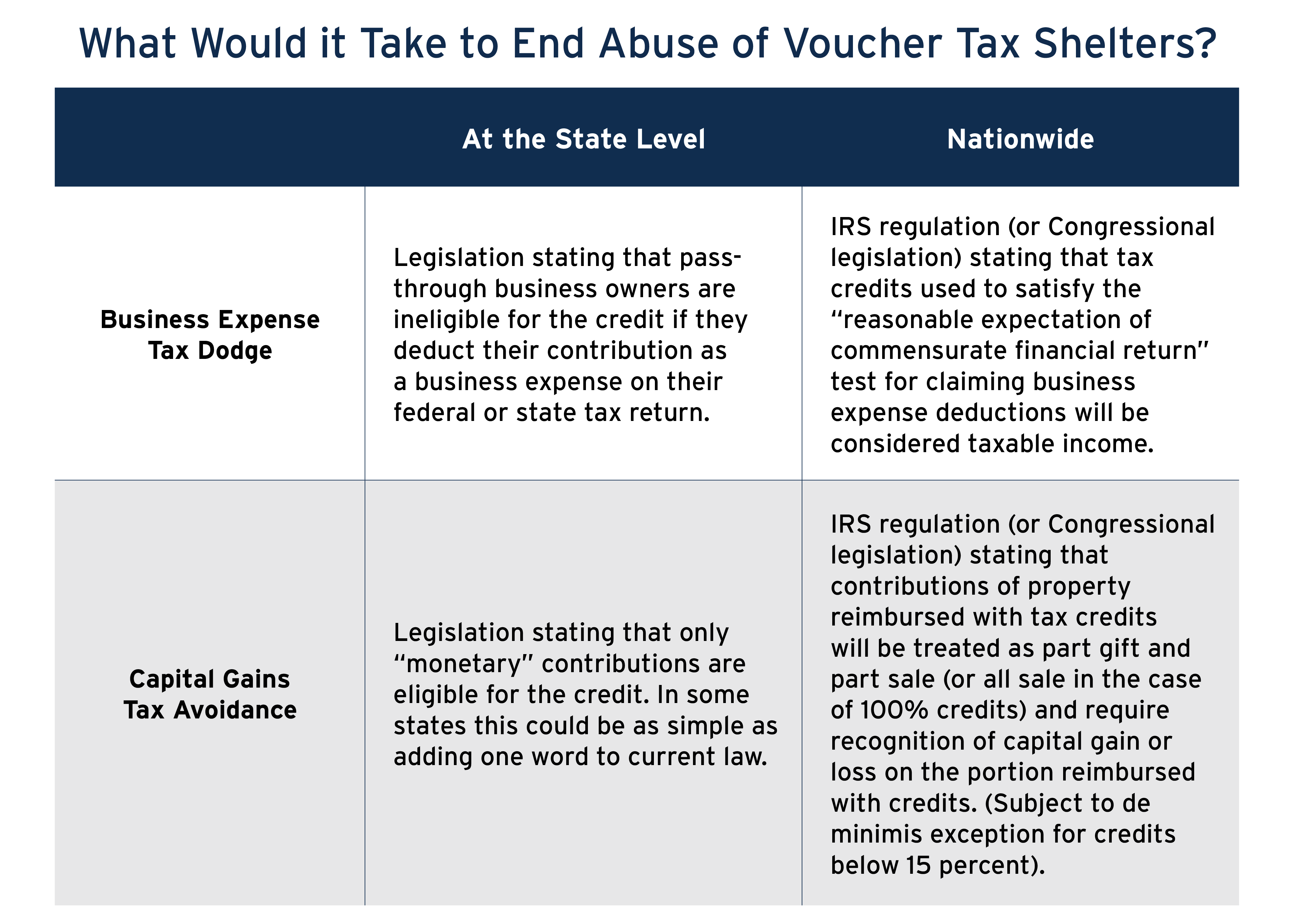

A comprehensive solution to this tax avoidance problem will require IRS action similar to what’s been recommended by Larry Zelenak at Duke University, who has suggested that such credits should be considered income under certain circumstances.[7]

State lawmakers, however, also have the power to shut down this tax dodge within their own borders by barring credit claimants from also making use of the federal business expense deduction. A voucher tax credit law on the books in Illinois, which bars claimants from using federal tax deductions, offers a template for this reform.[8]

Private Schools, Voucher-Bundling Organizations and Accountants are Promoting Tax Shelters Facilitated by Voucher Tax Credits

• The Alabama Policy Institute published a brief pointing out that: “A contribution made from a business owner may receive both the standard dollar-for-dollar tax credit as well as a deductible business expense on the federal side. Essentially, business owners may make money from a contribution.”[9]

• Scholarships for Kids, a voucher-bundling organization in Alabama, notes to prospective donors that: “The net effect is potentially a combined federal and state tax benefit greater than the total dollar amount of the donation.”[10]

• Decatur Heritage, a Christian school in Alabama, has a video on its website where the narrator gags after saying the word “tax” and urges businesses to “double dip” with state credits and federal deductions. Its website also describes the maneuver as a way to “make money by giving.”[11]

• Dent Moses, an accounting firm in Alabama, describes on its website how “in some circumstances, the [business] may also deduct the donation as an ordinary and necessary business expense. These circumstances result in a major win for [business] owners.”[12]

• The Alyn Scholarship Fund in Georgia explains how stacking federal business expense deductions on top of state tax credits “can result in a huge savings” because “the IRS regulations are pretty generous in this regard and it’s not a high bar to meet.”[13]

• The Georgia GOAL Scholarship Program touts the “double tax benefit” that results from claiming state credits and federal deductions, made possible by the fact that “the IRS regs are generous.” GOAL says the shelter is “too good to pass up!” and presents an example calculation where a business owner receives a tax cut of more than $33,000 in return for a $25,000 contribution, yielding a net profit of $8,393.[14]

• The Opportunity Scholarship Fund in Oklahoma advertises “BIG tax credits and deductions!” in return for contributing and presents a relatively conservative example where the taxpayer can walk away with $400 more than they initially donated.[15]

• Fenwick High School in Illinois points out that “The stock market is still trading near all-time highs! Take advantage of double tax savings by contributing long-term appreciated stock to an SGO (thus avoiding capital gains tax).”[16]

Capital Gains Tax Avoidance

Another brand of voucher tax shelter hinges on donating corporate stock or other property that has appreciated in value. This tax dodge isn’t occurring everywhere, as some states have wisely decided to pay out their tax credits only in return for donations made in cash. But states like Illinois, Iowa, Kansas, Oklahoma, South Carolina, and Virginia offer large credits based on the current value of marketable securities or other assets handed over to fund private K-12 school vouchers.

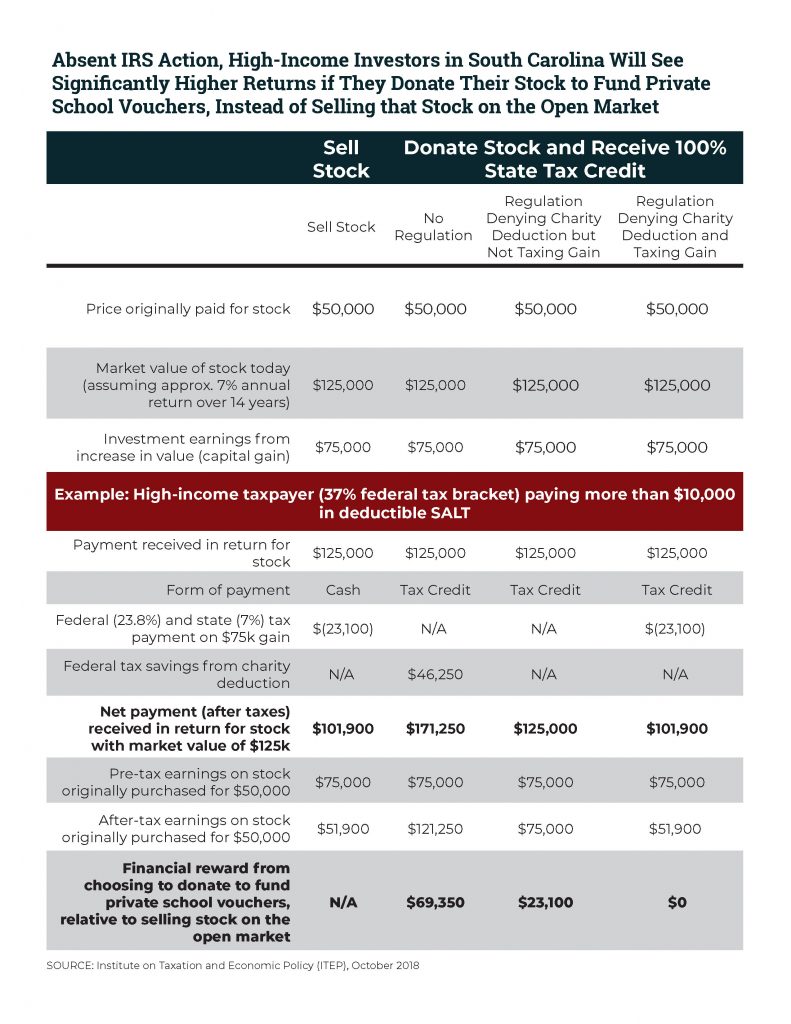

In short, this shelter allows wealthy families to offload their stock to voucher-bundling organizations and get paid most or all its market value with state tax credits. The federal tax treatment of this kind of transaction is murky. One interpretation of recent IRS guidance is that very large state tax credits represent a financial return that constitutes a realization of capital gains. But in the absence of specific IRS guidance saying as much (which ITEP has requested) many taxpayers in this situation are surely failing to treat the transaction as giving rise to taxable capital gains.[17] In fact, organizations in Illinois, Oklahoma, and Virginia have recently touted tax-credit-reimbursed stock donations as a way to avoid income tax on capital gains.[18]

The upshot is that many wealthy taxpayers are in a situation where it is in their financial best interest to hand their stock holdings over to voucher-bundling organizations in exchange for large tax credits rather than sell them on the open market in exchange for cash. This perverse incentive is hastening the privatization of the U.S. educational system.

Putting the Brakes on School Privatization Through the Tax Code

The best voucher tax credit reform is a simple one: repeal these credits outright and make voucher-bundling organizations use the same kinds of charitable giving incentives as other nonprofits. Short of that, there are other steps states can take to curb tax avoidance via these programs, such as only paying out the credits on donations made with cash and denying the credits on payments deducted as businesses expenses on one’s federal tax return.

The IRS also has an important role to play here. The federal tax treatment of these transactions is deeply problematic, and the stakes of getting this right are high. Public education is foundational to our democracy.[19] While tax reforms won’t be enough on their own to stop the seemingly relentless campaign to privatize the U.S. public education system, addressing shortcomings in federal tax law that are hastening privatization is as good a place as any to start.

Endnotes

[1] Valerie Strauss, “Privatization of public education gaining ground, report says,” The Washington Post, August 2022. https://www.washingtonpost.com/education/2022/04/18/privatization-of-public-education-gaining-ground/.

[2] Nancy MacLean, “’School choice’ developed as a way to protect segregation and abolish public schools,” The Washington Post, September 2021. https://www.washingtonpost.com/outlook/2021/09/27/school-choice-developed-way-protect-segregation-abolish-public-schools/.

[3] Deidra Brisco, “School choice expansion options to be reviewed in 2023 legislative session,” WHNT, February 2023. https://whnt.com/news/alabama-news/school-choice-expansion-options-to-be-reviewed-in-2023-legislative-session/. Dave Williams, “Republicans introduce increase in tax credits for private school scholarships into General Assembly,” Georgia Public Broadcasting, January 2023, https://www.gpb.org/news/2023/01/25/republicans-introduce-increase-in-tax-credits-for-private-school-scholarships. Rafael Garcia, “With tax credit scholarship program, Republicans aims to expand Kansas school choice,” The Topeka Capital-Journal, January 2023, https://www.cjonline.com/story/news/education/2023/01/27/kansas-school-choice-tax-credit-program-could-be-expanded-with-bill/69840775007/. Holly Michels, “Bill would again boost caps on scholarship program,” Independent Record, February 2023. https://helenair.com/news/state-and-regional/govt-and-politics/bill-would-again-boost-caps-on-scholarship-program/article_aa48e4d4-ee15-5168-b6c6-13c227541f05.html. Andrew Ozaki, “Nebraska’s private school tax credit bill draws packed legislative hearing,” KETV, February 2023. https://www.ketv.com/article/lincoln-nebraska-private-school-tax-credit-bill-draws-packed-legislative-hearing/42762468. Seanna Adcox, “Bill helping parents pay for private tuition through tax credits advances in SC Senate,” The Post and Courier, February 2023. https://www.postandcourier.com/politics/bill-helping-parents-pay-for-private-tuition-through-tax-credits-advances-in-sc-senate/article_1f4aca50-b22f-11ed-a3c2-1b2a40e154ef.html. Pooja Salhotra, “Texas’ private and rural schools again brace for a showdown on school choice,” The Texas Tribune, January 2023. https://www.texastribune.org/2023/01/31/texas-legislature-school-choice-vouchers-rural-schools-education/.

[4] Stephen P. Broughman, Brian Kincel, Jennifer Willinger, and Jennifer Peterson, “Characteristics of Private Schools in the United States: Results From the 2019-20 Private School Universe Study,” Institute of Education Sciences, NCES 2021-061, September 2021. https://nces.ed.gov/pubs2021/2021061.pdf.

[5] Carl Davis, “New SALT Workaround Regulations Narrow a Tax Shelter, but Work Remains to Close it Entirely,” Institute on Taxation and Economic Policy, June 2019. https://itep.org/new-salt-workaround-regulations-narrow-a-tax-shelter-but-work-remains-to-close-it-entirely/.

[6] Erica L. Green, “In Some States, Donating to Private Schools Can Earn You’re a Profit,” The New York Times, May 2017. https://www.nytimes.com/2017/05/17/us/politics/in-some-states-donating-to-private-schools-can-earn-you-a-profit.html.

[7] Carl Davis, “IRS Rule Leaves the Door Open for Private/Religious School Voucher Donation Schemes, Broader SALT Cap Workarounds,” Institute on Taxation and Economic Policy, August 2020. https://itep.org/irs-rule-leaves-the-door-open-for-private-religious-school-voucher-donation-schemes-broader-salt-cap-workarounds/.

[8] 35 ILCS 40/10.

[9] Alabama Policy Institute, “How Businesses Can Dual Benefit From Donating to a Scholarship Granting Organization,” The Goal Hill Intelligencer, November 2020. https://alabamapolicy.org/wp-content/uploads/2020/11/2020-Accountability-Act-Business-Benefits-GTI.pdf.

[10] Scholarships for Kids, “Alabama Business Owners,” website accessed March 1, 2023. https://www.scholarshipsforkids.org/donors/page/alabama-business-owners.

[11] Decatur Heritage, “Your State Taxes Can Fund Scholarships,” website accessed March 1, 2023. https://www.dhca.org/your-state-taxes-can-fund-scholarsh.

[12] Dent Moses, “Alabama Amends Alabama Accountability Act – Increased Alabama Income Tax Credit Available,” Dent Moses Blog, July 2022. https://dentmoses.com/2022/07/20/alabama-amends-alabama-accountability-act-increased-alabama-income-tax-credit-available/.

[13] Alyn Scholarship Fund, “FAQ for Pass-Through Entities,” website accessed March 1, 2023. https://www.alynfund.org/faq-for-pass-through-businesses.html.

[14] Georgia GOAL Scholarship Program, “For Business Owners & Tax Advisors: GOAL for pass-throughs: too good to pass up!,” website accessed March 1, 2023. https://www.goalscholarship.org/for_donors/page/for-business-owners-tax-advisors.

[15] Opportunity Scholarship Fund, “Receive Big Tax Credits and Deductions For Your Business,” https://osfkids.org/wp-content/uploads/2022/12/OSF-2022-SmallBusinessBrochure-Web-4.pdf.

[16] Fenwick High School, “Reduce Your Illinois Income Taxes and Help Fenwick Students!,” website accessed March 1, 2023. https://www.fenwickfriars.com/giving/illinois-tax-scholarship-program.

[17] Carl Davis, “ITEP Comments and Recommendations on Proposed Section 170 Regulation (REG-112176-18),” Institute on Taxation and Economic Policy, October 2018. https://itep.org/itep-comments-reg-112176-18/.

[18] Agudath Israel of Illinois, “Scholarship Tax Credit: How It Works,” website accessed March 1, 2023. https://agudahstc.org/how-it-works/. Opportunity Scholarship Fund, “Oklahoma Equal Opportunity Scholarship Act & Contributions to State Tax Credit Programs,” August 2019. https://tcoscpa.org/images/downloads/2019_Presentations/august_15__2019___12pm_ok_equal_opportunity_scholarhship_act_state_tax_credit.pdf. The Hague School, “Virginia Department of Education, Education Improvement Scholarship Tax Credits,” website accessed March 1, 2023. https://www.thehagueschool.org/support/scholarship-tax-credits/.

[19] Megan Day, “To Protect Democracy, Defend Public Education: An Interview with Derek W. Black,” Jacobin, August 2021. https://jacobin.com/2021/08/democracy-public-education-history-reform-privatization.