Income inequality continues to be an undercurrent in public discourse about our economy and how working families are faring. It drove the national debate over the 2017 Tax Cuts and Jobs Act, which, mounds of data reveal has exacerbated the problem.

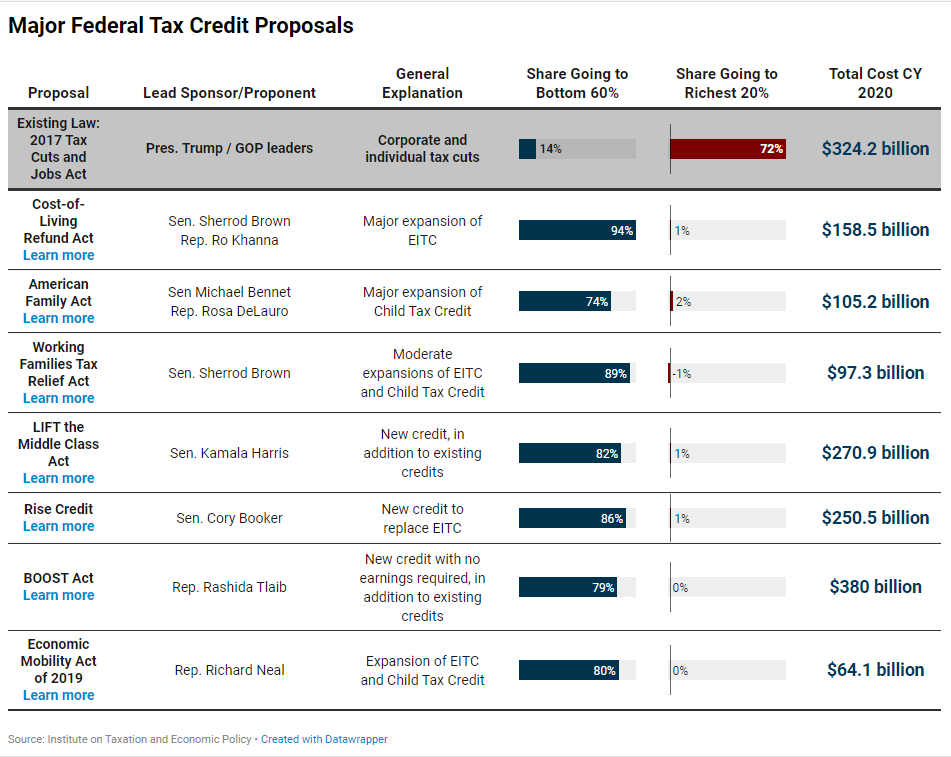

Some elected federal officials have responded to this step backward with calls for higher taxes on the wealthy. Others have proposed bold tax plans that are the precise inverse of the tax law, bestowing their greatest benefit on the lowest-income taxpayers and providing nothing or nominal benefit to higher-income households. A recent ITEP report outlines how these proposals could reduce inequality by providing meaningful benefits to low- and middle-income households.

The idea of using tax policy to improve family economic wellbeing is on the top of mind for many state-level lawmakers as well—a conversation that is long overdue. Nearly every state and local tax system takes a much greater share of income from low-income families, which further widens the income gap and pushes low-income income families further into poverty.

The silver lining? State lawmakers are increasingly taking action where their federal counterparts have failed: enacting meaningful enhancements to refundable tax credits that offer low- and middle-income households a leg up in an economy that is too often stacked against them.

Here are the steps state lawmakers have been taking to improve tax credits in their states this year.

Notable Improvements Enacted

Minnesota, New Mexico and Ohio improved their Earned Income Tax Credits (EITC) this year.

In Minnesota, the state’s omnibus tax bill included a $30 million EITC expansion. Much of the benefit will go to families with three or more children, as well as workers without children in the home (in the form of both a larger credit and a higher income ceiling), although families with one or two children will also see increases.

As part of a major tax reform bill, New Mexico lawmakers increased the state’s Working Families Tax Credit from 10 to 17 percent of the federal credit.

Ohio increased the nonrefundable Earned Income Tax Credit from 10 to 30 percent of the federal credit and removed the cap for taxpayers with incomes above $20,000. Lawmakers enacted these changes to offset the impact of a gas tax increase, however many low-income families were left out since the credit remains unavailable to those without positive income tax liability.

Looking beyond this year’s legislative victories, New Jersey’s EITC increase continues to phase-in under previously passed law. The credit increased from 35 to 37 percent of the federal credit in tax year 2018 and to 39 percent of the federal credit in tax year 2019. Starting next year, the credit will equal 40 percent of the federal EITC.

Maryland lawmakers expanded the state’s EITC last year to include more working adults without children in the home, and enacted another tax credit expansion this year by extending the state’s Child and Dependent Care Expenses Credit to more families, increasing the income cap from $50,000 to $143,000. The expansion will send $11 to 12 million per year to these families and will vary from about $350 to $800 per family. In Illinois, lawmakers passed an increase to the state’s property tax credit and a $100 nonrefundable Child Tax Credit that phases out for married filers making over $100,000, and $80,000 on all other returns.

Lawmakers Continue to Push for Tax Credit Enhancements This Year

Several other proposals are still being negotiated that, if passed, would advance economic opportunity for low-income workers across the country.

- In California, a Senate panel approved a budget that includes expanding the state’s EITC to residents with Individual Taxpayer Identification Numbers (ITINs) – a change particularly beneficial to immigrants. Notably, Gov. Gavin Newsom also has released a revised budget that recommends a significant expansion of the state’s EITC including a marked boost for families with children under the age of 6.

- Maine’s Legislative Taxation Committee endorsed, with unanimous and bipartisan support, an expansion of the state’s EITClate last month. The plan would increase the credit for families with and without children, increase income eligibility for adults without children in the home, make childless adults eligible for the credit beginning at 18 years of age, and increase the phase-in rate. It would also include caregivers and students for the first time, making them eligible to receive one half of the maximum credit. This enhancement, however, does not appear in the latest version of the state budget. In addition, lawmakers are considering an expansion of the state’s property tax fairness credit.

- In her budget, Michigan’s Gov. Gretchen Whitmer included plans to double the state’s EITC to 12 percent. A handful of other proposals would do even more, by expanding the credit to 20 or 30 percent of the amount claimed on taxpayers’ federal forms.

- Tony Ever’s budget proposal in Wisconsin included several different provisions around refundable tax credits, including increasing the EITC for families with one or two children and improving the homestead credit (circuit breaker) by increasing the income eligibility threshold. The state legislature has yet to incorporate these promising improvements into its budget negotiations.

Missed Opportunities

But 2019 also brought some notable missed opportunities. As part of the state’s tax reform bill, New Mexico lawmakers opted to create a dependent deduction rather than a more progressive, refundable Child Tax Credit (lawmakers sought to replace the state’s dependent exemption, which the 2017 federal tax cut law indirectly appealed).

Ohio lawmakers missed an opportunity to benefit those most in need by opting to not make the state’s EITC refundable. With the goal of offsetting the impact of the gas tax on families least able to afford higher gas prices, lawmakers missed their mark by not instating full refundability.

Oregon also missed a major opportunity during its debate over a modified gross receipt tax (GRT) at the center of a package raising $1 billion per year for K-12 education. As part of that debate, advocates concerned with the likely regressive effects of the tax pushed for a refundable credit to offset the impacts on low- and middle-income families. The credits explored would have done more for the families most impacted by the GRT than the income tax rate cuts the legislature ultimately enacted. This year, an EITC expansion that would have increased the percentage of the state’s credit from 8 to 20 percent of federal (11 to 25 percent for families with children under 3 years of age) was proposed but appears unlikely to gain enactment.

In Virginia, where the state’s session recently closed, some lawmakers saw an opportunity for the state’s 20 percent nonrefundable credit to be made fully or partially refundable. Gov. Ralph Northam and many legislators were on record in support of such action. One of the key bills proposed along these lines would have made the credit half refundable (10 percent) and then phase in full refundability over the course of 10 years, at one percentage point per year. Instead, lawmakers opted to provide a one-time tax rebate that is not targeted to those most in need and that actually missed many of those who need it most given its lack of refundability.