ITEP Executive Director Amy Hanauer gave the prepared testimony below to a Senate Spotlight hearing hosted by Sens. Kaine and Murphy on June 17, 2025.

Thank you for including me today and you can find research that I reference today on the website of the Institute on Taxation and Economic Policy at www.itep.org. The One Big Beautiful Bill Act (OBBBA) would cut services to poor and middle-class families, reduce revenue available for public needs, and provide large tax cuts primarily to the richest Americans, while also providing tax cuts to foreign investors.

These elements mean that the bill would dramatically increase inequality. As a New York Times headline succinctly put it on June 12, 2025, “Trump’s Big Bill Would Be More Regressive Than Any Major Law in Decades.” That story was based on a Congressional Budget Office analysis of both tax and spending provisions, but it is in keeping with our findings at ITEP, which primarily concern the tax components of the bill. We found, when considering just taxes and not spending cuts, that:

- The richest 1 percent of Americans would receive a total of $124 billion in net tax cuts in 2026. The middle 20 percent of taxpayers on the income scale, a group that is 20 times the size of the richest 1 percent, would receive less than half that much ($60 billion).

- The $124 billion in net tax cuts going to the richest 1 percent next year would exceed the amount going to the entire bottom 60 percent of taxpayers (about $90 billion).

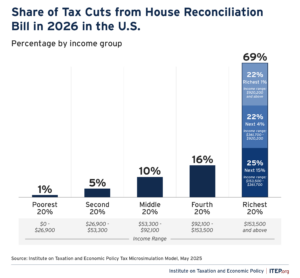

- The poorest fifth of Americans would receive 1 percent of the bill’s net tax cuts in 2026 while the richest fifth would receive 69 percent and the richest 5 percent alone would get nearly half (44 percent) of the net tax cuts that year. And again, this does not account for cuts to healthcare and nutrition that will hit poor and working-class families.

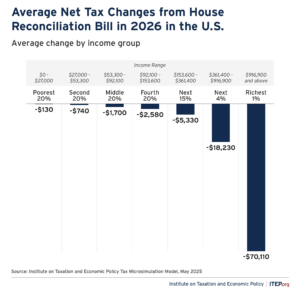

- The richest 1 percent would receive an average net tax cut of about $70,000 next year, many, many times more than any other income group.

- Even foreign investors who own shares in U.S. companies would benefit more than low-income Americans. These foreign investors would get $23 billion in tax cuts in 2026 (compared to just $4 billion for the bottom 20 percent of Americans).

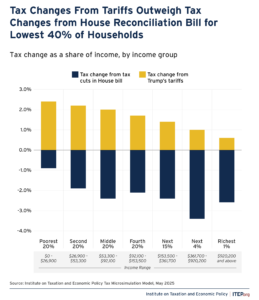

The above numbers consider only the tax components of the bill, without considering the spending cuts and without considering who will bear the cost of tariffs that President Trump has announced by Executive Order. Tariffs are taxes on imported goods and they are paid primarily by the consumers who purchase those goods. These are extremely challenging to analyze because the President frequently changes which countries, which products, and which rates he says will be in effect.

Our most recent analysis, which examines the May 22 version of the Trump tariffs, finds that these tariffs would alone offset most of the tax cuts for about 80 percent of Americans: low-income, middle-income and even upper middle-income families. For the lowest-income 40 percent, the tariffs impose a cost that exceeds any tax cuts they would get – again, before we begin to consider cuts to Medicaid and food assistance.

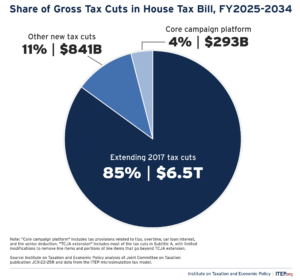

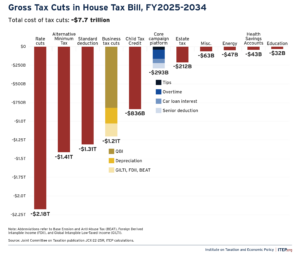

The bill includes some high-profile provisions that get a lot of media attention. Among those are temporary provisions eliminating taxes on some tips, eliminating taxes on some overtime pay, reducing taxation of some income that elderly people get, and eliminating taxes on some car loans. Labor experts agree that there are much better ways to help working people than those so-called “populist” provisions, which I’m happy to get into in the question-and-answer period. But one key point I’d like to make is that – for all the media discussion these provisions have gotten – combined they constitute less than 4 percent of the cost of this bill. In fact, new business tax breaks in this bill cost nearly three times more – and remember, the 2017 Trump tax law already made many business tax breaks permanent. So 96% of the cost of this extremely expensive bill is for tax breaks to businesses and for individual tax cuts that go primarily to the wealthiest. And I have to emphasize that this is paid for by the biggest cuts to healthcare and food assistance in American history.

This bill contains tax cuts that cost $7.7 trillion and I’d like to highlight a few.

- The costliest of these is the individual income tax cuts. They alone cost $2.18 trillion and most flow primarily to high income households. Policymakers could substantially lower the cost of these cuts by limiting them to households earning less than $400,000.

- The bill contains $1.21 trillion in new business tax breaks between 2025 and 2034 according to the Joint Committee on Taxation. It’s important to remember that TCJA already included many permanent business tax breaks, which is one of the reasons that the benefits of TCJA went mostly to wealthy people, corporations and even to foreign investors.

- One of these is the pass-through business deduction, shown in mustard on the chart as QBI (Qualified Business Income). This allows partners in law firms, accounting firms, hedge funds and other businesses to pay a lower tax rate. These are businesses that do not pay the corporate tax but instead choose to pay personal income taxes on the earnings of the companies in which they have an ownership stake. The majority of benefits of this generally go to people with incomes in the top 1%.

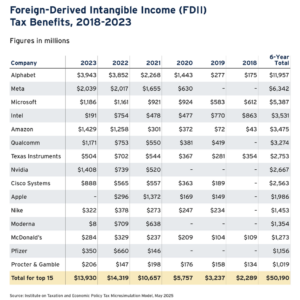

- Masked in a section of the House bill that purports to help Main Street and Rural America, are a number of tax breaks that solely benefit large multinational corporations. Those include a lower tax rate on certain foreign profits (Global Intangible Low Taxed Income, GILTI) and on certain profits earned on exports (Foreign Derived Intangible Income, FDII). The GILTI tax break subsidizes the offshoring of US multinational profits by offering a reduced corporate tax rate on those profits compared to profits earned in the United States. The FDII tax break largely benefits companies that have significant intangible assets, such as patents and trademarks. Our organization found that between 2018 and 2023, just fifteen companies received the majority of the total benefit of this tax break – all large multinationals, and primarily large tech firms. These two costly provisions benefit the largest multinational corporations and may disincentivize investment in the United States.

- The bill continues a decades-long effort to weaken the estate tax. It more than doubles the estate tax exemption so that a couple would be able to leave $29.99 million to their heirs before anyone pays a penny in estate tax. The current exemption levels ($7 million for individuals, $14 million for couples) already means that less than 0.1 percent of people who die leave an estate large enough to incur any tax. This is a huge departure from past practice. As recently as 2001, the exemption was just $675k, which would be about $1.2 million per individual today. Even then, just over 2 percent of estates were subject to the tax.

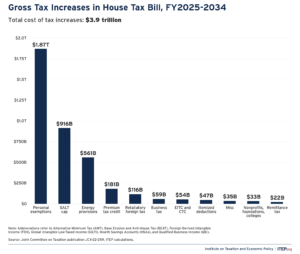

This bill costs about $2.4 trillion including the tax increases. While the bill does not raise nearly what it spends, the revenue raisers chosen are less than ideal to put it mildly. It gets rid of green energy credits that were increasing investments in environmental infrastructure and creating jobs. It fails to extend premium tax credits that help 22 million moderate income people pay for health insurance under the Affordable Care Act. It also creates a retaliatory foreign tax on countries that are implementing the global minimum tax which I’m happy to discuss more in Q and A. Finally, it reduces eligibility for the EITC and CTC for some vulnerable families, which is a problematic choice as part of a bill that sends such enormous tax cuts to the very wealthy.

In short, this bill increases inequality, reduces revenue, and fails to benefit working class Americans. A different approach would make much more sense.

What could a different approach look like? The United States collects much less revenue than other wealthy democracies. We also collect much less than we need to cover our spending, resulting in deficits. So we would ideally want to increase, not decrease revenue, the opposite of what this bill does.

Second, our tax code is only barely progressive at the federal level and that’s if you don’t consider the unrealized income of the very wealthy who benefit most from the society built with Americans’ tax dollars. So an ideal tax code would be more progressive not less progressive, and that would be much more in keeping with how taxes were distributed during the 20th century. Again, this is the opposite of what this bill is doing.

We could instead be pursuing an alternative approach that would cost less, raise more revenue, and make the tax code more progressive. That could include:

- Get rid of tax breaks for capital gains – these are income from wealth and they should be taxed at the same rate as income from work, if not at a higher rate. Currently capital gains are privileged with a lower rate, it is only applied when the gain is “realized”, and there is an exemption for unrealized gains passed to heirs. All of those elements should be reformed.

- Restore more adequate corporate taxation by getting rid of corporate tax breaks and having more adequate rates – most of the benefits of corporate tax cuts either leave the country entirely by going to foreign investors or go to the richest 20% – together those two groups get $90 of every $100 in corporate tax breaks

- TCJA enabled many large profitable corporations to substantially lower their effective tax rates or even to pay zero. Tesla, for example, paid zero taxes last year. Companies like Meta, Disney, FedEx and many others substantially lowered their tax rates and paid well below even the new lower rate. Fed Ex paid 1% effective tax rates between 2018-2021; Disney paid just 8%; Archer Daniels Midland paid just 6% and the list goes on

- Restore a more adequate estate tax.

- Pass a stronger CTC that doesn’t exclude the poorest families.

While we could undoubtedly suggest other positive changes to our tax code, the four simple changes above would raise more revenue, do so in a more progressive manner, and help American families in the process.

Thank you again for including me today and I’m happy to answer any questions.