Before the recent tax law passed, multiple economists across the political spectrum warned it was an ill-timed fiscal stimulus that could leave policymakers in a quandary should the country face another economic recession in the near future.

Now, new research from the Federal Reserve Bank of San Francisco finds that the Tax Cuts and Jobs Act may not be so much of a stimulus after all. In other words, lawmakers have left themselves with few options should the country face an economic recession, and the country may not receive a substantive economic benefit in the short term.

The key issue is that Congress historically has passed tax cuts on the scale of the TCJA when the economy was in recession or early in a recovery from recession. Lawmakers passed the TCJA in the eighth year of a recovery when most measures showed the economy already close to full capacity. According to the report, this means that rather than boosting GDP by 1 percent as some economic analysts have estimated, the impact of the TCJA could be “well below that” or even “zero” in 2018.

Federal fiscal policy usually acts as a counter-cyclical force in the economy: when the economy is weak, Congress frequently boosts federal spending or cuts taxes, and deficit reduction through spending cuts or tax hikes typically is done during periods of economic growth. These changes often occur automatically, as spending on programs such as unemployment insurance, SNAP, Medicaid and other programs ramp up during recessions as more people are in need. Similarly, tax revenue tends to go down in a weak economy as incomes decline, even when tax laws remain unchanged.

The TCJA flipped this stabilizing role, cutting taxes and increasing deficits at the height of a strong economy. In fact, the new Federal Reserve study notes that this is the first time since the late 1960’s (in that case driven by spending on the Vietnam War) that the United States has enacted a fiscal policy that is so out of sync with economic trends.

For this reason, the study finds that many economic analyses may be overestimating the impact of the TCJA because their models assume that the impact of the recent tax cuts will mirror the typical impact of past tax cuts that were enacted under weaker economic conditions. The study’s literature review found that the stimulative effects of the new tax cuts could be substantially smaller (in some cases hitting zero) than the effects would have been under a weaker economy.

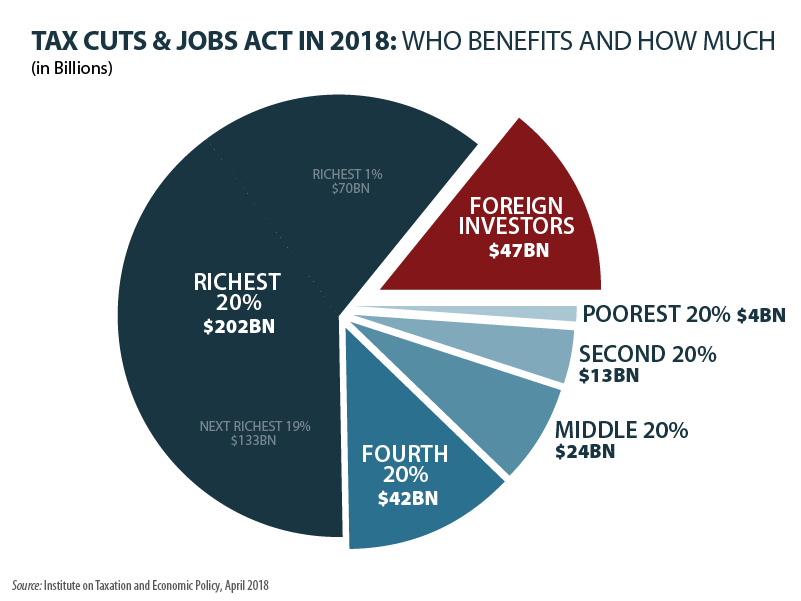

Even if the economic impact is not as low as the Federal Reserve Bank of San Francisco study warns, it is important to note that GDP is an inadequate measure of the tax cuts’ impact on the U.S. economy. The Congressional Budget Office (CBO) found earlier this year that over the next 10 years, 43 percent of the increase in real GDP that it estimates will come from the TCJA will go to foreign investors rather than Americans. In other words, a large portion of TCJA benefits will flow to foreign investors rather than Americans. The reason is that the tax cuts were largely targeted at corporations (35 percent of shareholders of U.S. companies are foreign) and deficit financed (with foreign investors holding a substantial amount of U.S. debt).

Barely six months have gone by since the passage of the TCJA, so it is too soon to tell definitively how the tax cuts will affect the economy. So far the evidence has overwhelmingly indicated that the primary beneficiaries of the TCJA have been corporations and the wealthy, rather than the middle class as President Trump and the GOP claimed. Even in the long run, the best estimates are that the TCJA will have a negligible impact on growth all things considered.