A House Ways and Means subcommittee hearing on Tuesday will explore a highly controversial provision of the Tax Cuts and Jobs Act (TCJA) that prevents individuals and families from writing off more than $10,000 in state and local tax (SALT) payments on their federal tax forms each year.

To be sure, the SALT cap is a flawed and politically motivated policy that skewed TCJA in favor of red states with lower taxes and fewer public services. But not every criticism of the law is equally valid. There’s good reason for Congress to craft a replacement that preserves revenue raised by the cap (upwards of $88 billion per year) while expanding the availability of the SALT deduction.

The focus of tomorrow’s hearing will be whether the cap negatively affects state and local revenue streams that fund schools, firefighters, and other services. There are at least three ways this could happen though only one of those is plausible, and it’s not the one that the organizers of this hearing likely expected.

The SALT cap, in combination with reductions in the mortgage interest deduction (MID) and increases in the standard deduction (a change that reduces the number of homeowners claiming MID and SALT deductions), has reduced federal tax subsidies flowing to some homeowners. In theory, this should have a downward impact on housing prices, which would impact property tax revenues if localities could not raise property tax rates to make up for the difference.

But predictions of a collapse in housing prices have not been realized. While it may be the case that home values in some areas are lower now than they would have been absent TCJA, this effect would likely be concentrated in higher-cost areas already experiencing housing affordability problems. That is, in areas where a more rapid increase in housing prices would not benefit the community. Moreover, if local governments need more property tax revenue to adequately fund their school districts, they do not have to wait for a booming housing market to trigger those revenue increases; they can choose to vote for higher property tax rates instead.

The second way that the $10,000 SALT deduction cap could impact state and local revenue collections is if high-income taxpayers decide to pack their bags, pull their kids out of school, and move to a state with little or no income tax out of frustration that much of their SALT bill is no longer tax deductible. In this hypothetical scenario, the state from which the wealthy are fleeing would see its tax base shrink.

But the question of whether high-income earners will move across state lines in search of lower taxes has been studied extensively, and the results do not support this narrative. The best study conducted to date was completed in 2016 by researchers at Stanford University and the U.S. Treasury Department. They examined every tax return reporting at least $1 million in earnings between 1999 and 2011 and found that tax flight occurs “only at the margins of statistical and socioeconomic significance.” In other words, anecdotes about certain rich people leaving for lower-tax locales are exactly that. These stories may not be fabricated, but they are not evidence of a broad trend that is dragging down state revenues.

But if the SALT cap hasn’t led to a collapse in the housing market or a mass migration of the nation’s elite, then how could it affect state and local revenues? The third possibility is that complaining about the SALT cap’s impact on state and local revenues is a self-fulfilling prophecy. By talking about how the SALT cap makes it impossible for states and localities to raise taxes, some state lawmakers seem to be accomplishing exactly that.

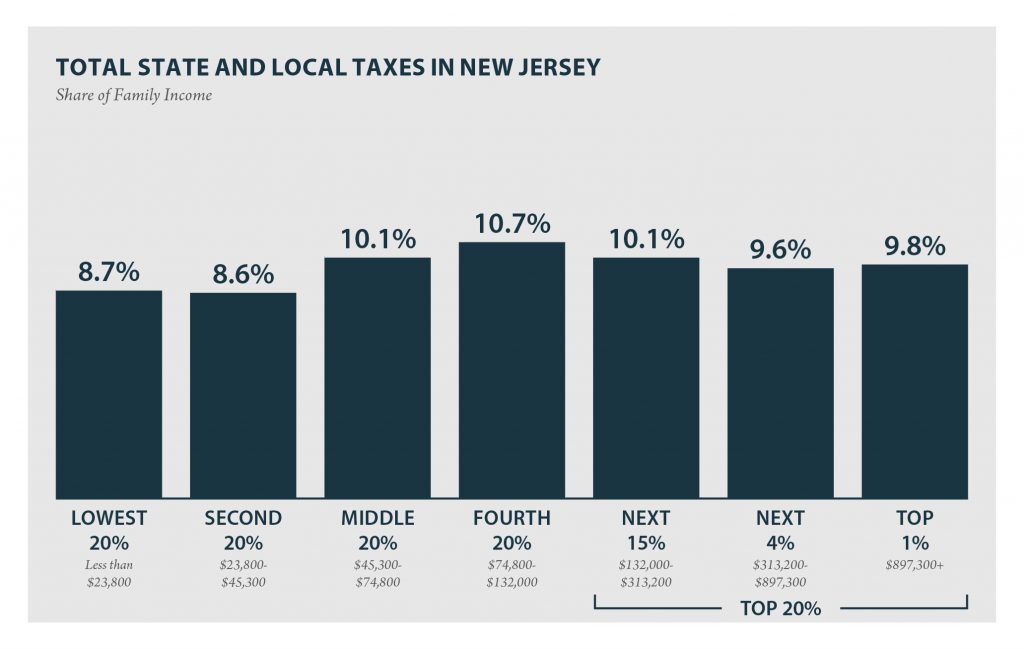

New Jersey is a case in point. For years, legislators overwhelmingly agreed that the state needed to implement a higher tax rate on millionaires to better fund its public services and improve the distribution of its tax system. In fact, they repeatedly passed such a proposal only to see it vetoed by former Gov. Chris Christie each time.

Now, however, legislative leaders have changed their position and are opposing Gov. Phil Murphy’s proposal to implement the higher rate for top earners that they long sought. Their change of heart appears to be partly rooted in misinformation suggesting that TCJA was largely a tax hike for people living in New Jersey (while it’s true that New Jerseyans tended to get smaller tax cuts than most Americans, they did still overwhelmingly see their taxes fall). But the other reason for their reversal is an unsubstantiated fear that New Jersey’s millionaires will leave the state if they are required to pay a higher state tax rate without being allowed to write-off that higher amount on their federal forms. We’re likely to see New Jersey government shut down on July 1 because of this disagreement.

Revisiting the SALT cap is a worthy endeavor. But it’s important not to exaggerate the downsides of this policy. If the cap is having a negative impact on state and local revenues in some areas, it’s not because of an underlying economic reality. It’s because of politics.