This toolkit accompanies ITEP’s report, The Wealth Proceeds Tax: A Simple Way for States to Tax the Wealthy.

It provides ready-to-use social media posts, graphics, and messaging examples to help share ITEP’s findings with your networks.

It also includes an interactive tool to visualize your own Wealth Proceeds Tax that displays how much revenue it would generate for your state.

Key Talking Points

States can start levying their own Wealth Proceeds Taxes on wealthy families based on the federal tax code’s definition of passive proceeds derived from wealth: capital gains, dividends, interest, and certain business profits.

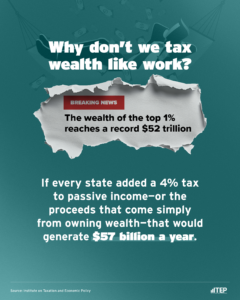

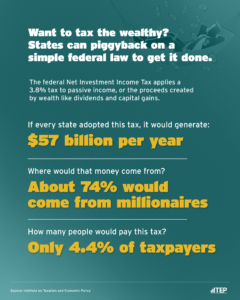

This tax can raise much-needed revenue. A modest 4% Wealth Proceeds Tax could raise more than $45 billion a year; an enhanced version would raise $57 billion a year.

That revenue would mainly come from the wealthiest few. About three-quarters of the revenue would come from households with incomes over $1 million, and roughly 4% of taxpayers would owe any tax.

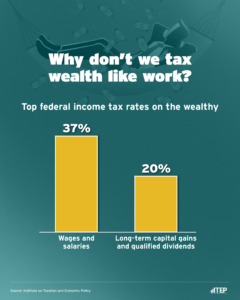

The federal tax code currently gives preferential treatment of wealthy households over working households – an imbalance that this tax would help correct. Most income from wealth faces effective federal tax rates roughly 40% lower than wages and salaries.

States that adopt a Wealth Proceeds Tax can simply piggyback on federal tax filings, minimizing administrative costs for both taxpayers and state revenue agencies.

One state has already broken ground on this tax. Minnesota enacted a 1% Wealth Proceeds Tax in 2023 using a straightforward law just 223 words long.

Graphic Generator

Illustrate the revenue impact of a Wealth Proceeds Tax in four easy steps:

- Find your state.

- Choose a tax rate for a potential Wealth Proceeds Tax.

- Compare with an enhanced version that would approach realized capital gains more comprehensively.

- Download the graphic.