Some tax cut proposals are bad ideas disguised as ways to help the economy for everyone, while others make no pretense of doing anything other than enriching the already well-off. The temporary “capital gains holiday” from taxes recently suggested by White House economic adviser Kevin Hassett falls into the latter category. Proponents of capital gains tax breaks have always offered a weak argument that they encourage investment and thereby grow the economy. But the Trump administration is now floating a temporary capital gains tax break, which is supported by no argument at all. It would only reward investments made in the past while doing nothing to encourage new investment.

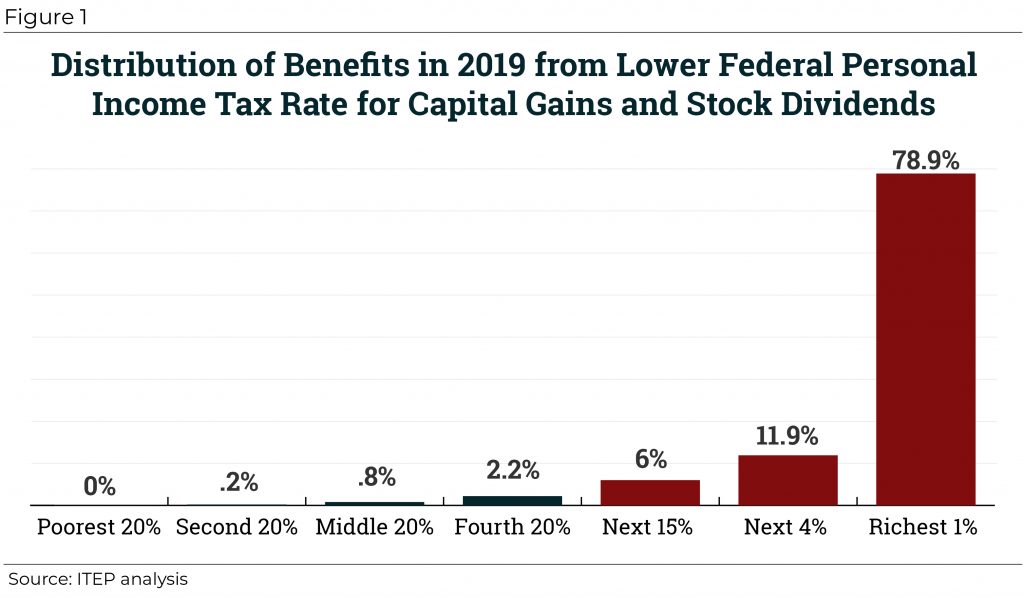

Capital gains, the profits from selling assets, are already taxed at much lower rates than other types of income, and more than three-fourths of the benefits of this break flow to the richest 1 percent. And that is just one of several tax breaks for capital gains.

Proponents of capital gains tax breaks claim they encourage people with resources to invest their money rather than spend it on cruises and skyboxes and whatever else rich people do to have fun, and that these increased investments grow the economy and create jobs. This idea rests on a theory that commerce depends on the supply of capital (the supply of money invested mainly by rich people) but there is no historical evidence to support it. Lower tax rates on capital gains have not resulted in more investment or helped the economy.

If the case for permanent tax breaks for capital gains is flimsy, there is no logic at all to support the temporary tax break floated by the Trump administration. A tax “holiday” is, by definition, a temporary and presumably one-time tax break. Others have already pointed out that this would reward investment made in the past, eliminating taxes for investors who sell their assets now, but would not encourage new investment because it would not change how gains from selling assets in the future are taxed.

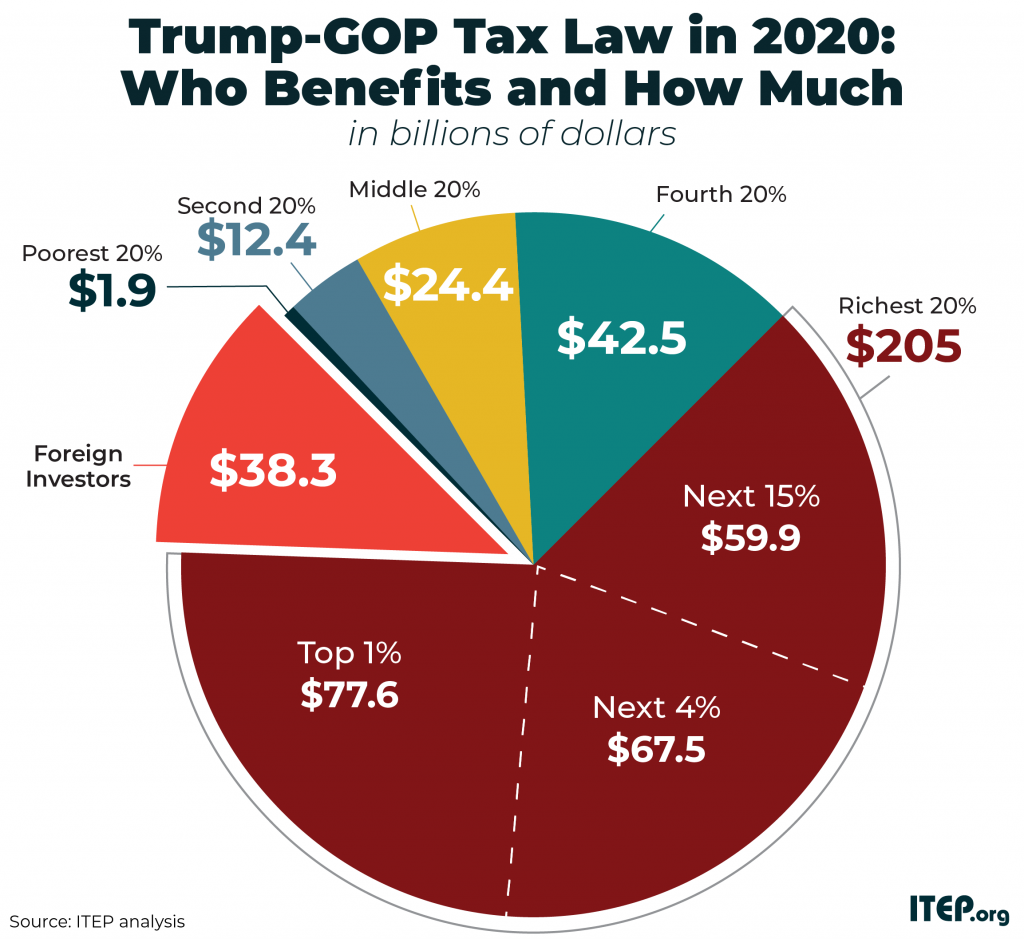

Ever since the Trump-GOP tax law was enacted at the end of 2017, the White House has talked vaguely but consistently about following it up with more tax breaks. Not content with the 2017 law providing half of its benefits to the richest 5 percent and a quarter to the richest one percent (and this is aside from the benefits flowing to foreign investors), the president and his advisers are apparently searching for a policy that will almost solely help the richest 1 percent. The capital gains tax holiday is that proposal.