Trump-GOP Tax Law

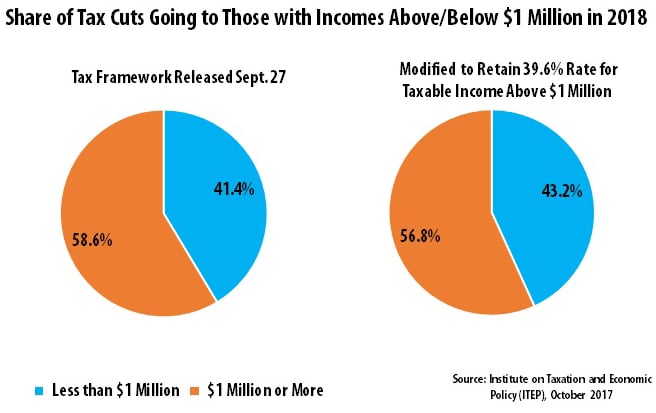

GOP Tax Plan Will Mainly Benefit Millionaires Even If Top Rate Remains 39.6 Percent

October 24, 2017 • By Steve Wamhoff

The Trump-GOP taxframework would reduce the top personal income tax rate from 39.6 percent to 35 percent, but now lawmakers are discussing keeping the top personal income tax rate at 39.6 percent for those with taxable income of more than $1 million. This modification would barely change the proposal’s overall impact.

Middle-Income More Likely Than the Rich to Pay More Under Trump-GOP Tax Plan

October 11, 2017 • By Jenice Robinson

The Trump Administration and GOP leaders continue to wrap their multi-trillion tax cut gift to the wealthy in easily refutable rhetoric about boosting the nation’s middle class. Later today, trucks and truck drivers will serve as a backdrop for a Pennsylvania speech in which Trump is anticipated to talk about how proposed tax changes that […]

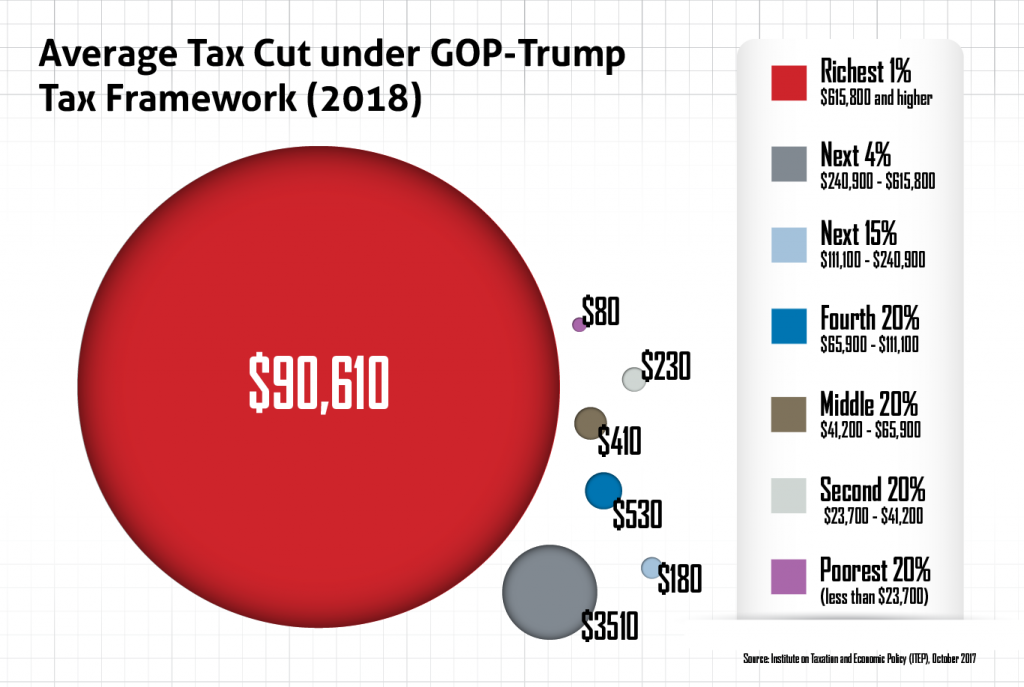

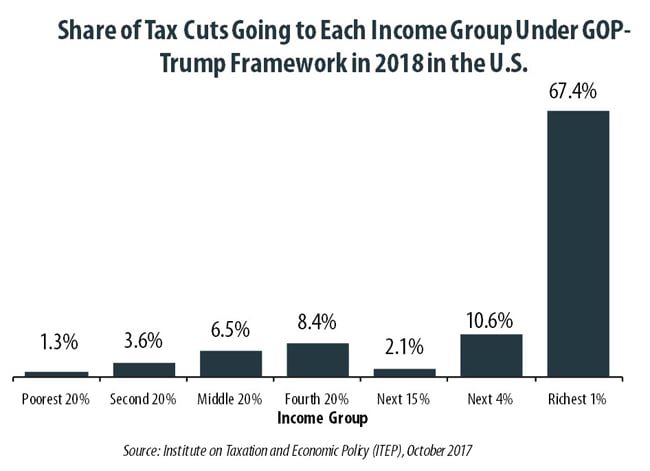

The Trump-GOP tax plan is touted as plan for the middle-class but delivers a boon to the wealthy, throws a comparative pittance to everyone else and even includes a dose of tax increases for some middle- and upper-middle-income taxpayers. The data belie the rhetoric.

Benefits of GOP-Trump Framework Tilted Toward the Richest Taxpayers in Each State

October 4, 2017 • By Steve Wamhoff

The “tax reform framework” released by the Trump administration and Congressional Republican leaders on September 27 would affect states differently, but every state would see its richest residents grow richer if it is enacted. In all but a handful of states, at least half of the tax cuts would flow to the richest one percent of residents if the framework took effect.

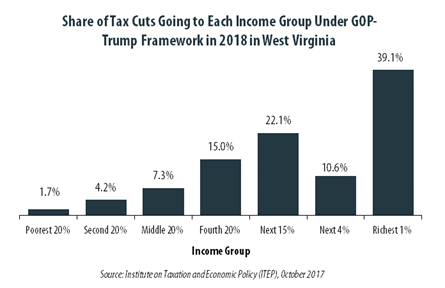

GOP-Trump Tax Framework Would Provide Richest One Percent in West Virginia with 39.1 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in West Virginia equally. The richest one percent of West Virginia residents would receive 39.1 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $358,800 next year. The framework would provide them an average tax cut of $27,800 in 2018, which would increase their income by an average of 3.5 percent.

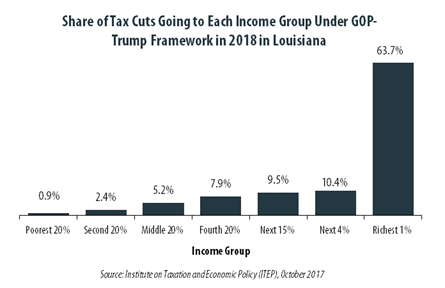

GOP-Trump Tax Framework Would Provide Richest One Percent in Louisiana with 63.7 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Louisiana equally. The richest one percent of Louisiana residents would receive 63.7 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $568,200 next year. The framework would provide them an average tax cut of $97,200 in 2018, which would increase their income by an average of 6.4 percent.

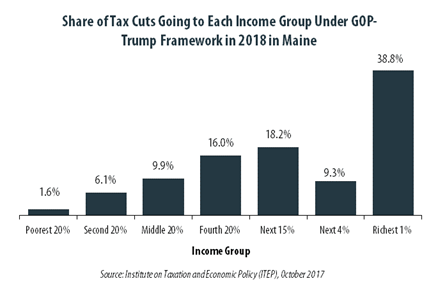

GOP-Trump Tax Framework Would Provide Richest One Percent in Maine with 38.8 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Maine equally. The richest one percent of Maine residents would receive 38.8 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $473,000 next year. The framework would provide them an average tax cut of $30,390 in 2018, which would increase their income by an average of 2.5 percent.

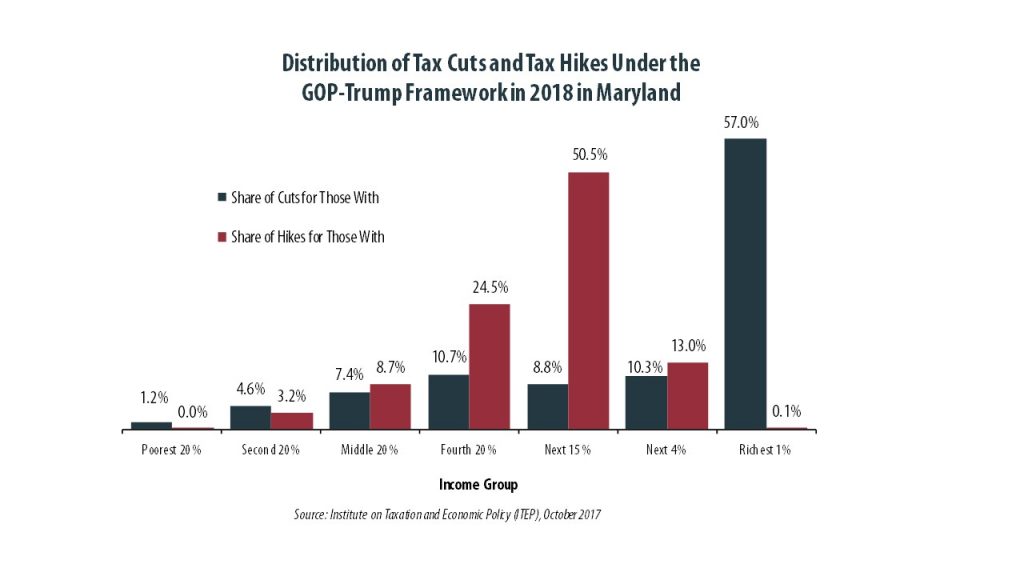

30% of Marylanders Would Pay More Under GOP-Trump Tax Framework, But the State’s Richest 1% Would Pay Less

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Maryland equally. More than 30 percent of Maryland households would have higher tax bills, but nearly everyone among the richest one percent of the state’s residents would receive a tax cut.

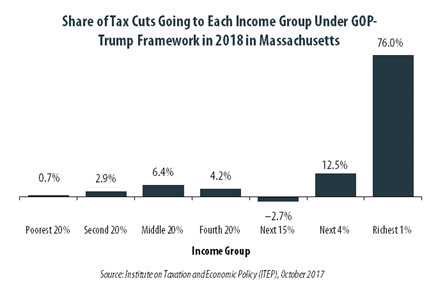

GOP-Trump Tax Framework Would Provide Richest One Percent in Massachusetts with 76.0 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Massachusetts equally. The richest one percent of Massachusetts residents would receive 76.0 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $771,800 next year. The framework would provide them an average tax cut of $136,960 in 2018, which would increase their income by an average of 4.5 percent.

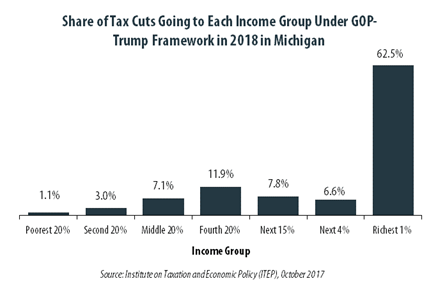

GOP-Trump Tax Framework Would Provide Richest One Percent in Michigan with 62.5 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Michigan equally. The richest one percent of Michigan residents would receive 62.5 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $502,500 next year. The framework would provide them an average tax cut of $76,560 in 2018, which would increase their income by an average of 4.7 percent.

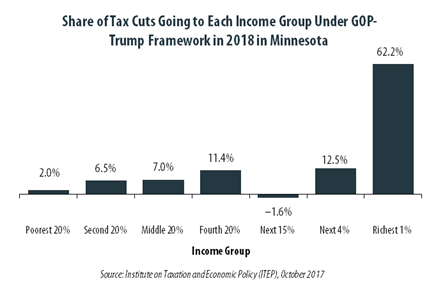

GOP-Trump Tax Framework Would Provide Richest One Percent in Minnesota with 62.2 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Minnesota equally. The richest one percent of Minnesota residents would receive 62.2 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $632,000 next year. The framework would provide them an average tax cut of $65,780 in 2018, which would increase their income by an average of 2.5 percent.

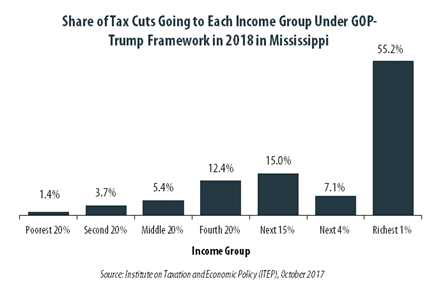

GOP-Trump Tax Framework Would Provide Richest One Percent in Mississippi with 55.2 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Mississippi equally. The richest one percent of Mississippi residents would receive 55.2 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $404,300 next year. The framework would provide them an average tax cut of $42,060 in 2018, which would increase their income by an average of 3.6 percent.

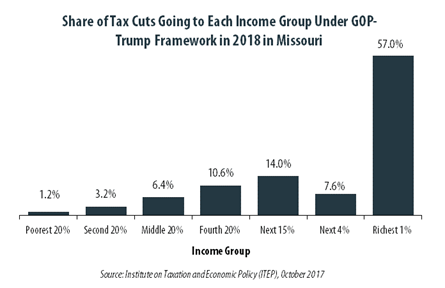

GOP-Trump Tax Framework Would Provide Richest One Percent in Missouri with 57.0 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Missouri equally. The richest one percent of Missouri residents would receive 57.0 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $480,200 next year. The framework would provide them an average tax cut of $62,970 in 2018, which would increase their income by an average of 4.0 percent.

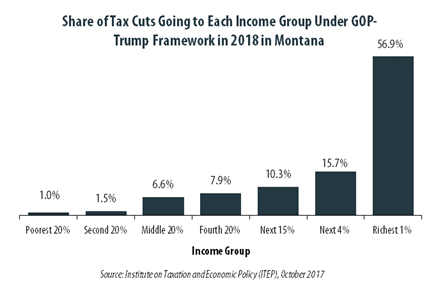

GOP-Trump Tax Framework Would Provide Richest One Percent in Montana with 56.9 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Montana equally. The richest one percent of Montana residents would receive 56.9 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $535,400 next year. The framework would provide them an average tax cut of $68,950 in 2018, which would increase their income by an average of 3.8 percent.

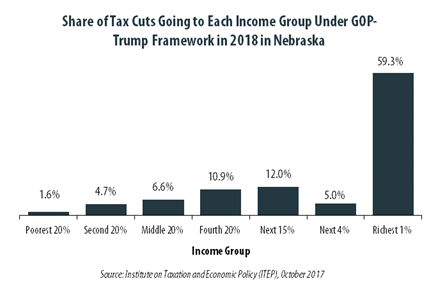

GOP-Trump Tax Framework Would Provide Richest One Percent in Nebraska with 59.3 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Nebraska equally. The richest one percent of Nebraska residents would receive 59.3 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $521,300 next year. The framework would provide them an average tax cut of $80,910 in 2018, which would increase their income by an average of 5.1 percent.

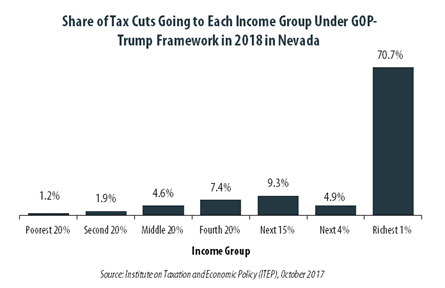

GOP-Trump Tax Framework Would Provide Richest One Percent in Nevada with 70.7 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Nevada equally. The richest one percent of Nevada residents would receive 70.7 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $538,200 next year. The framework would provide them an average tax cut of $113,840 in 2018, which would increase their income by an average of 4.5 percent.

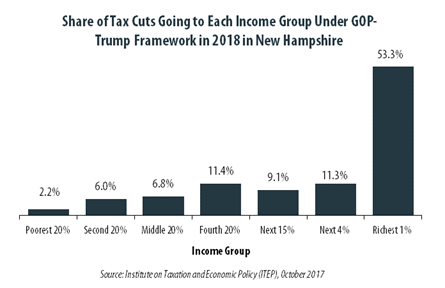

GOP-Trump Tax Framework Would Provide Richest One Percent in New Hampshire with 53.3 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in New Hampshire equally. The richest one percent of New Hampshire residents would receive 53.3 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $545,600 next year. The framework would provide them an average tax cut of $69,390 in 2018, which would increase their income by an average of 4.2 percent.

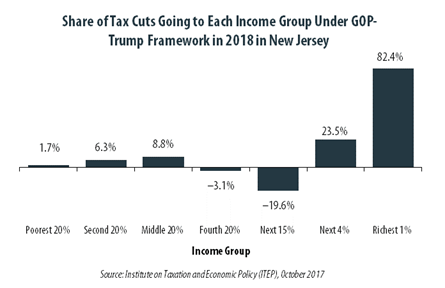

GOP-Trump Tax Framework Would Provide Richest One Percent in New Jersey with 82.4 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in New Jersey equally. The richest one percent of New Jersey residents would receive 82.4 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $1,105,200 next year. The framework would provide them an average tax cut of $73,950 in 2018, which would increase their income by an average of 2.3 percent.

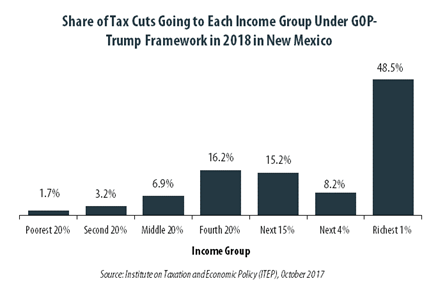

GOP-Trump Tax Framework Would Provide Richest One Percent in New Mexico with 48.5 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in New Mexico equally. The richest one percent of New Mexico residents would receive 48.5 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $443,700 next year. The framework would provide them an average tax cut of $45,910 in 2018, which would increase their income by an average of 3.6 percent.

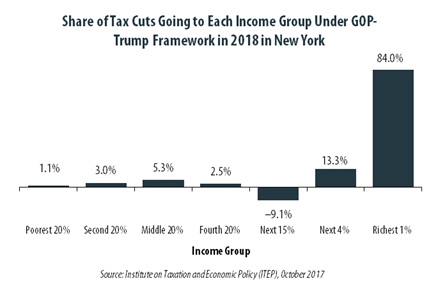

GOP-Trump Tax Framework Would Provide Richest One Percent in New York with 84.0 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in New York equally. The richest one percent of New York residents would receive 84.0 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $872,200 next year. The framework would provide them an average tax cut of $103,660 in 2018, which would increase their income by an average of 3.2 percent.

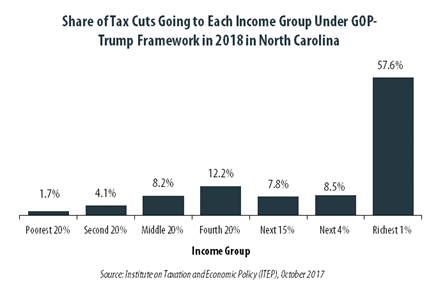

GOP-Trump Tax Framework Would Provide Richest One Percent in North Carolina with 57.6 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in North Carolina equally. The richest one percent of North Carolina residents would receive 57.6 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $512,000 next year. The framework would provide them an average tax cut of $50,440 in 2018, which would increase their income by an average of 3.2 percent.

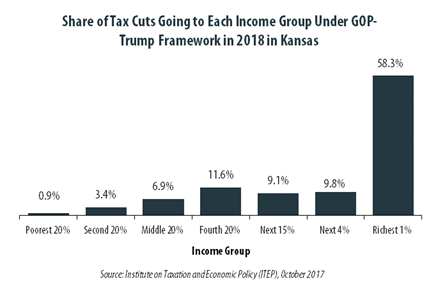

GOP-Trump Tax Framework Would Provide Richest One Percent in Kansas with 58.3 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Kansas equally. The richest one percent of Kansas residents would receive 58.3 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $535,600 next year. The framework would provide them an average tax cut of $84,190 in 2018, which would increase their income by an average of 4.6 percent.

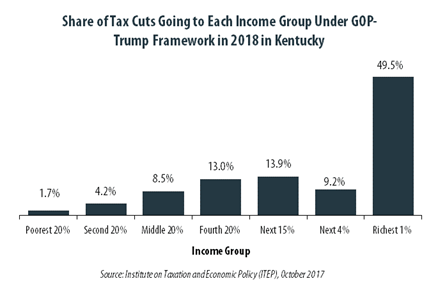

GOP-Trump Tax Framework Would Provide Richest One Percent in Kentucky with 49.5 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Kentucky equally. The richest one percent of Kentucky residents would receive 49.5 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $460,800 next year. The framework would provide them an average tax cut of $42,480 in 2018, which would increase their income by an average of 3.2 percent.

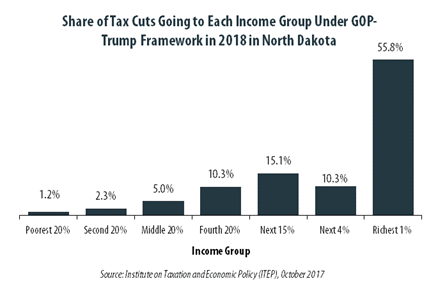

GOP-Trump Tax Framework Would Provide Richest One Percent in North Dakota with 55.8 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in North Dakota equally. The richest one percent of North Dakota residents would receive 55.8 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $693,800 next year. The framework would provide them an average tax cut of $111,620 in 2018, which would increase their income by an average of 6.5 percent.

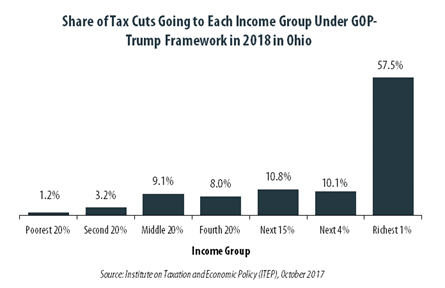

GOP-Trump Tax Framework Would Provide Richest One Percent in Ohio with 57.5 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Ohio equally. The richest one percent of Ohio residents would receive 57.5 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $483,100 next year. The framework would provide them an average tax cut of $56,280 in 2018, which would increase their income by an average of 3.7 percent.