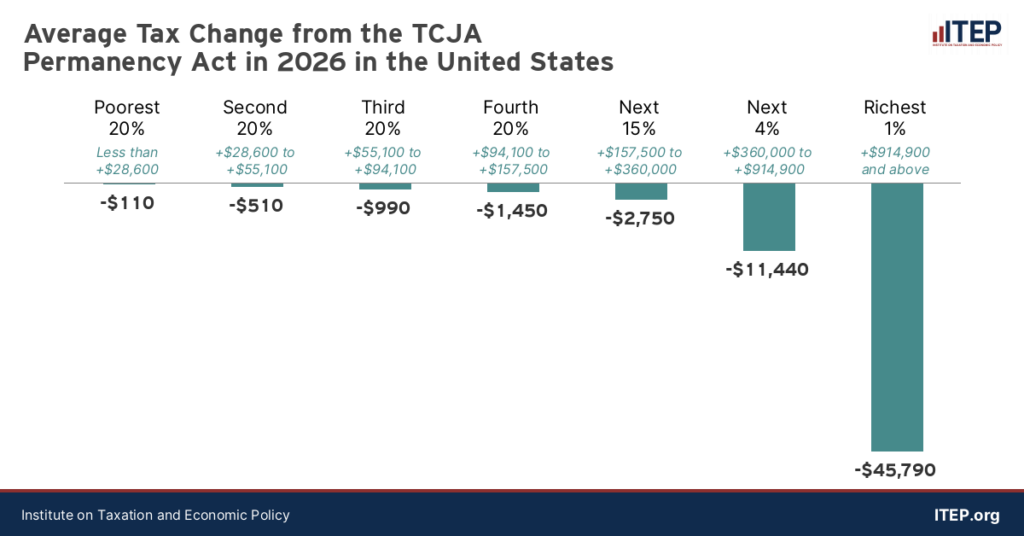

The TCJA Permanency Act would make permanent the provisions of the Tax Cuts and Jobs Act of 2017 that are set to expire at the end of 2025. The legislation would disproportionately benefit the richest Americans.

Below are graphics for each state that show the effects of making TCJA permanent across income groups. See ITEP’s previous report for a detailed explanation as well as a previous version of these estimates.

Download all state-by-state-data here.

Download the State-by-State Graphics

Click below for each state’s estimates. For full U.S. estimates, click here.