Proposed tax changes would give richest 5% a tax cut, raise taxes on all other groups

Contact: Jon Whiten ([email protected])

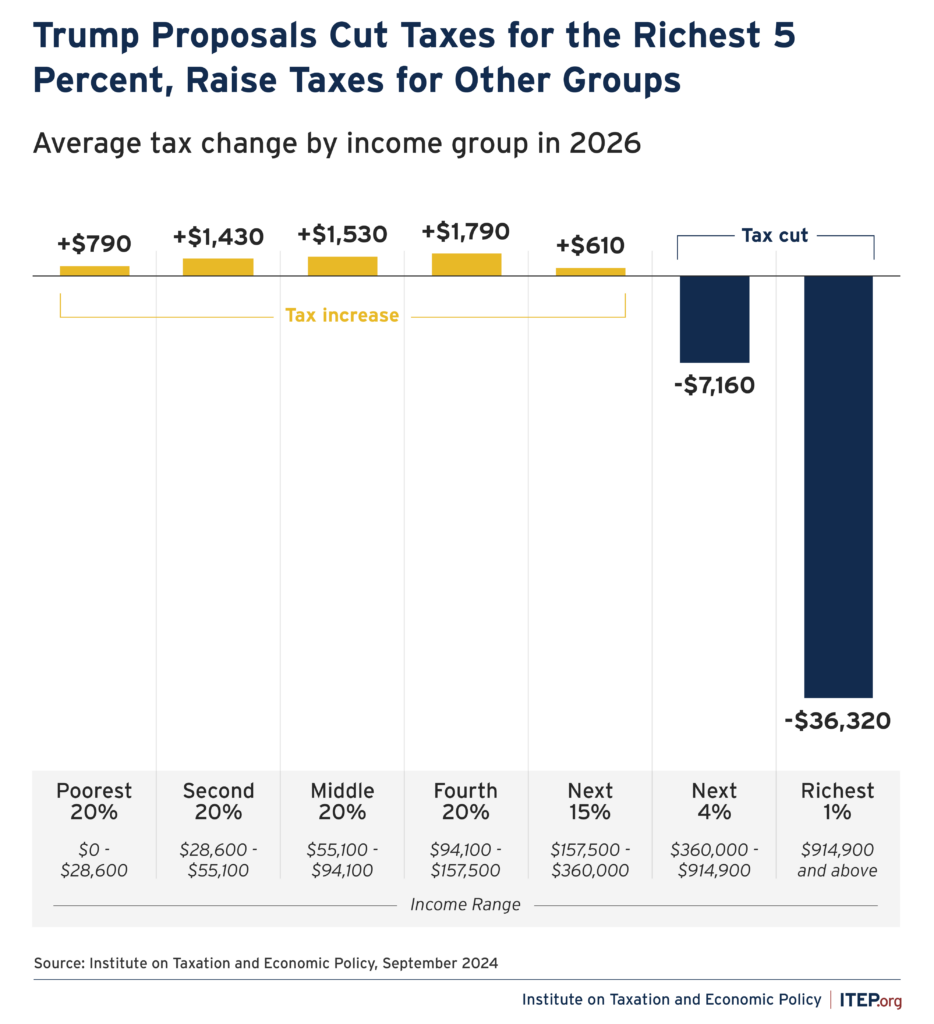

The tax proposals announced by former President Trump would, on average, lead to a tax cut for the richest 5 percent of Americans and a tax increase for all other income groups, according to a new in-depth analysis by the Institute on Taxation and Economic Policy (ITEP).

While many of the former President’s proposals have been analyzed in isolation, the ITEP report is the first comprehensive analysis of how enacting these proposals in their entirety would affect American families at different points in the income distribution.

“This is the most comprehensive analysis that anyone has done, and the findings are crystal clear,” said Amy Hanauer, ITEP’s Executive Director. “Trump’s tax proposals would substantially raise taxes on regular Americans while delivering more tax cuts to corporations and the wealthy.”

If the proposals were in effect in 2026, the richest 1 percent – with incomes of $914,900 and above – would receive an average tax cut of about $36,300 and the next richest 4 percent – with incomes between $360,000 and $914,900 – would receive an average tax cut of about $7,200.

Americans in all other income groups would see, on average, a tax increase. For example, the middle 20 percent – with incomes between $55,100 and $94,100 – would face an average tax increase of more than $1,500 and the poorest 20 percent of Americans – with incomes less than $28,600 – would face an average tax increase of about $800.

Measured as a share of income, the tax increases faced by most Americans would fall hardest on working class families and would increase as a family’s income decreases. The middle 20 percent of Americans would face an average tax increase equal to 2.1 percent of their income, while the poorest 20 percent of Americans would face an average tax increase of 4.8 percent of their income.

“Many of Trump’s proposals disproportionately benefit the well-off, like extending the 2017 tax changes and further cutting corporate taxes. Meanwhile his proposal for new broad-based tariffs would effectively raise taxes on everyone, with the greatest impact on working-class households,” said Steve Wamhoff, Federal Policy Director for ITEP. “The net result of these proposals would allow the richest 5 percent of Americans to shift some of their taxes to everyone else.”

The ITEP analysis includes all of Trump’s major tax proposals, including:

- Extending the temporary provisions in Trump’s 2017 tax law that will otherwise expire at the end of 2025 (except for the $10,000 cap on State and Local Tax (SALT) deductions, which he recently stated he would not extend)

- Exempting certain types of income from taxes (overtime pay, tips and Social Security benefits)

- Reducing the corporate tax rate from 21 percent to 20 percent and then further reducing it to 15 percent for “companies that make their product in America”

- Repealing tax credits enacted as part of President Biden’s Inflation Reduction Act that provide incentives for the production and use of green energy

- Imposing a new 20 percent tariff on imported goods, with a higher rate of 60 percent for goods from China