At a time when states across the country are forecasting deficits or anticipating slowing revenue growth, Mississippi lawmakers are debating deeply regressive and expensive tax cuts that would overwhelmingly benefit their state’s richest residents.

Nearly one in five adults and one in four children live in poverty in Mississippi. Cutting revenues while shifting taxes away from the state’s richest residents to low- and moderate-income families who already struggle to make ends meet is shortsighted. Instead, Mississippi lawmakers should preserve revenues during this time of economic and fiscal uncertainty.

The plans in question raise alarms. The S&P Global already downgraded Mississippi’s credit outlook citing the state’s 2022 tax cut bill as reason to anticipate future budget instability. And the Trump administration’s threats to federal dollars – many of which have just made it through the House -make these potential tax cuts even more dangerous to Mississippians and the state’s economy. Mississippi relies on the federal government for 46 percent of its spending, the second highest share in the nation. While other states are preserving revenues in anticipation of reductions to federal dollars that help deliver programs like SNAP, Medicaid, and education resources, Mississippi lawmakers are instead considering costly and regressive tax cuts.

The Mississippi Senate and Lt. Gov. Hosemann propose reducing the state’s personal income tax rate from 4.4 to 2.99 percent by 2030. Their plan would also reduce sales taxes on groceries – which are currently taxed at the state’s 7 percent general sales tax rate – to 5 percent and increase the state’s gas tax from 18.4 to 27.4 cents per gallon, a 9-cent increase.

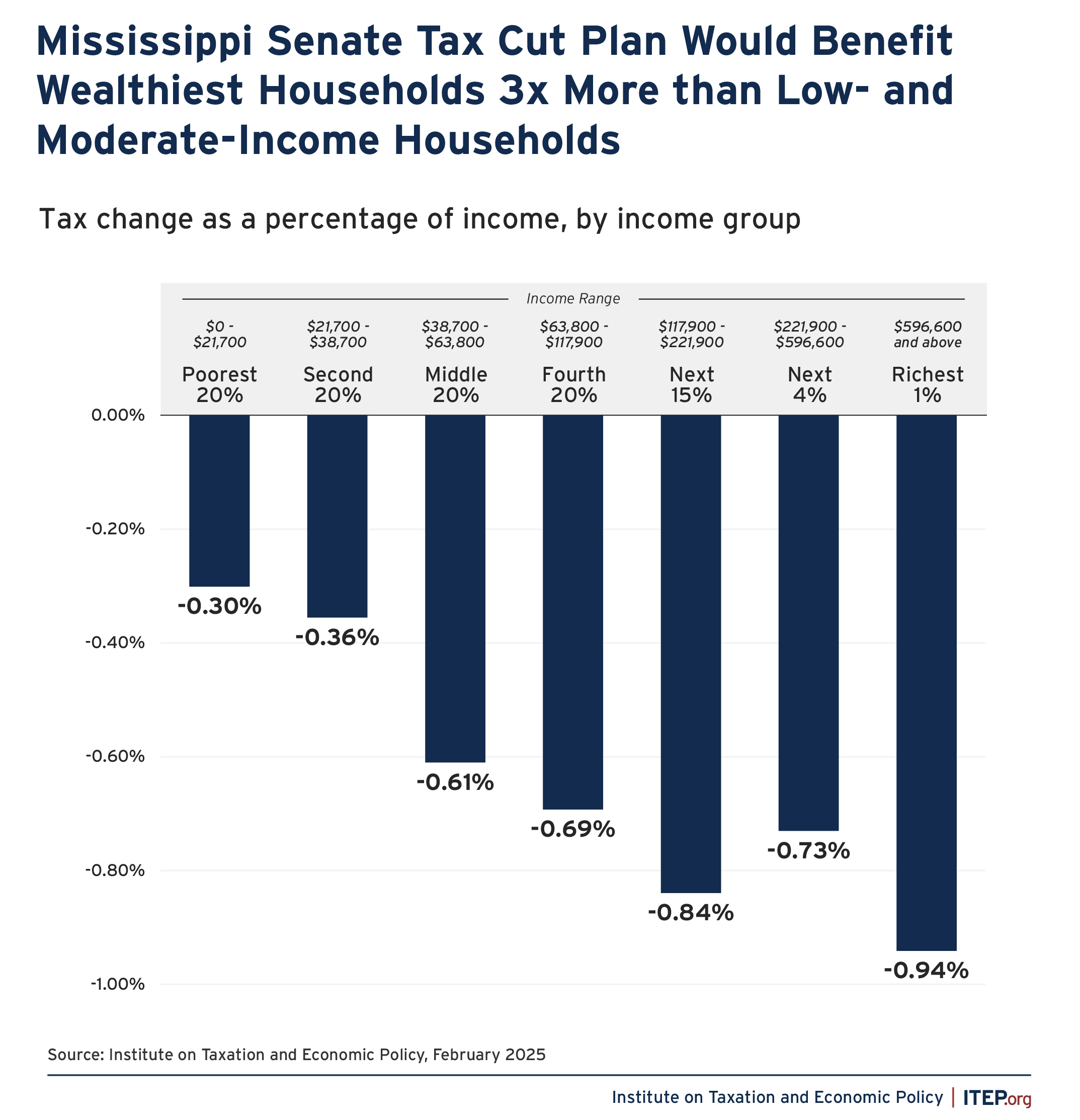

Compared to Mississippi’s current tax system under 2025 law, our modeling estimates these changes will result in $876 million in lost revenue – more than the state spent on higher education last year. The plan is also regressive, with the wealthiest Mississippi households benefiting more than three times as much low- and moderate-income families. Our analysis finds households in the top 1 percent of earners would receive a tax cut of nearly 1 percent of their annual income and low- and moderate-income households would receive a tax cut of around 0.3 percent of their income.

Mississippi House members and Gov. Tate Reeves support a separate tax bill that would eliminate the state’s personal income tax over 10 years. According to our modeling, their plan would reduce state revenues by $2.1 billion compared to taxes today – a 30 percent reduction of the state’s current general fund.

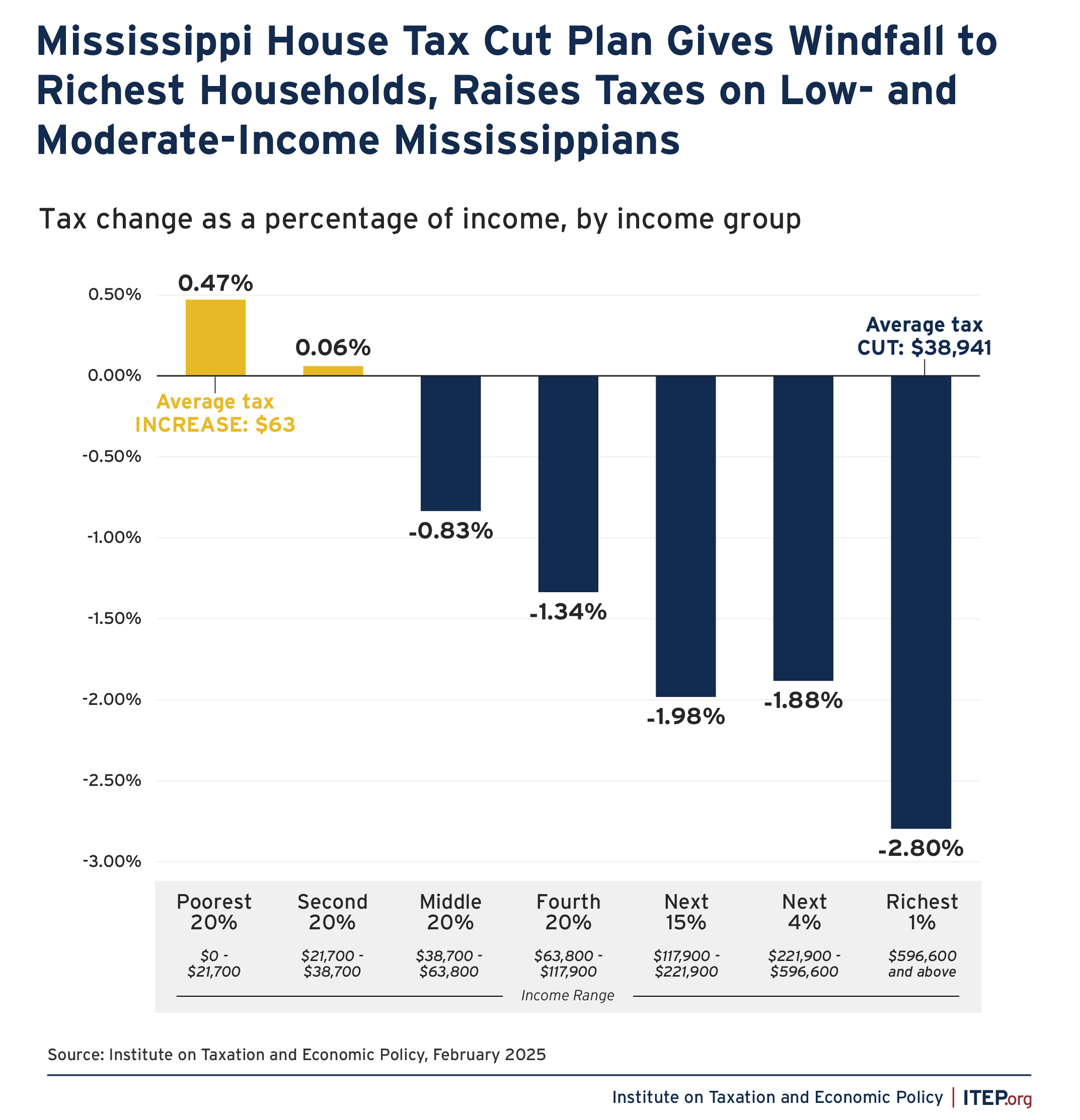

The bill would also decrease sales taxes on groceries while increasing general sales tax rates through new local sales taxes and create a new 5 percent sales tax on gasoline that would be levied in addition to the existing gas tax. These changes would result in a massive windfall to the state’s wealthiest residents while raising taxes on many low- and moderate-income households.

Our analysis shows the average tax cut for the top 1 percent of Mississippians – who have average annual incomes of $1.4 million – would be nearly $40,000. But the bottom 40 percent of households – who make under $39,000 a year – would see their taxes increased. In other words, this proposal would give the richest Mississippians a tax cut that is more than 42 percent of Mississippi households bring home in a year while increasing taxes on working-class families.

In addition to low- and moderate-income households, elderly Mississippians will be disproportionately impacted by this tax shift. Mississippi exempts retirement and Social Security income from state income taxes, so seniors stand to benefit very little, if at all, from reducing or eliminating income taxes. But shifting from income taxes to higher gas taxes, fuel taxes, or even higher general sales taxes overall will ask more of seniors – particularly low-income seniors – on fixed incomes.

Mississippi lawmakers have given few if any details on what programs or services they will cut to afford these tax cuts for the richest in the state. Instead, they fall back on vague, debunked talking points about attracting businesses and growing the economy.

Cutting or eliminating personal income taxes will always make state tax systems more regressive as the wealthiest households receive the largest tax cuts. Swapping income tax revenue for higher consumption taxes turbocharges this inequity by shifting the responsibility of funding government to low- and moderate-income households. And while both tax proposals reduce the state’s regressive grocery tax, they also replace progressive income tax revenue with regressive sales and consumption taxes – all while sacrificing dollars that help pay teachers, fund universities, provide healthcare, and more.

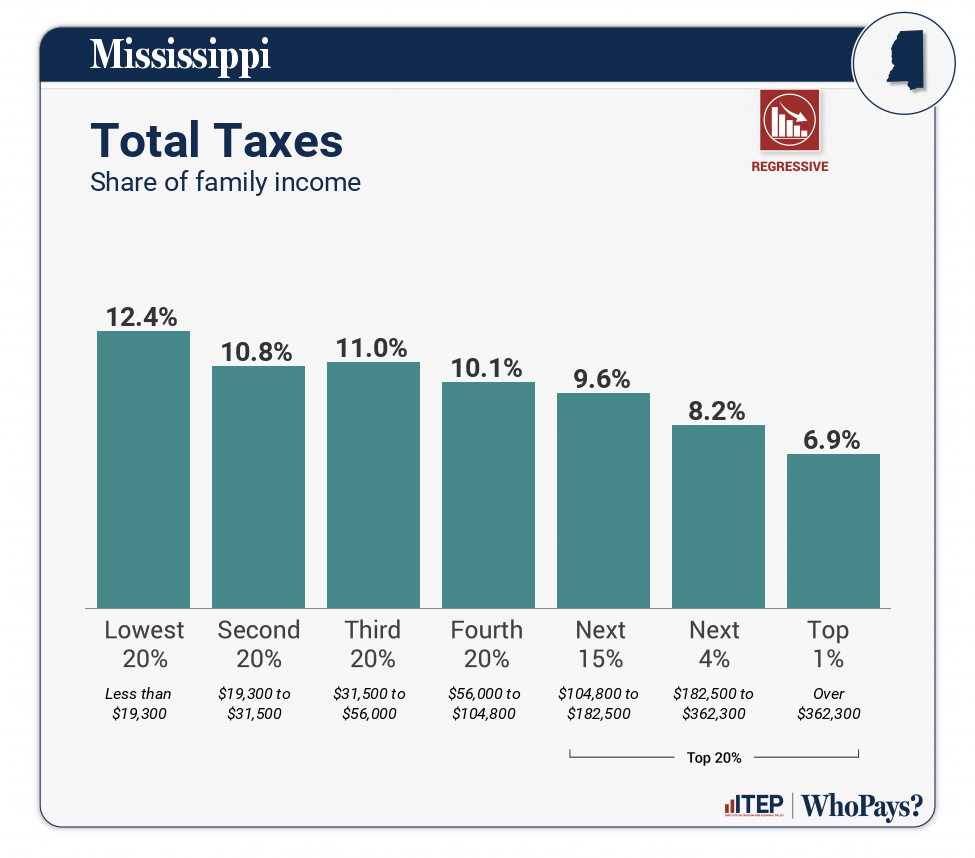

Mississippi already moved from a graduated personal income tax structure to a flat tax in 2023 – a tax change that overwhelmingly benefitted the state’s highest earners and is still phasing in. Now lawmakers want to make Mississippi’s tax system even more regressive. Currently, the top 1 percent in the state pays the lowest tax rate as a share of income when taking all state and local taxes into account.

Mississippi lawmakers should prioritize investments and the preservation of revenue over tax cuts. Cutting income taxes, especially during this period of fiscal uncertainty, will lead to the erosion of public services and make life harder for everyday, hardworking Mississippians.