For the past 21 years, I’ve lived in Cleveland, on the shores of a beautiful Great Lake. My kids attended excellent public schools and I saw the legacy of a manufacturing economy that had thrived with deep public investments and strong union contracts. I also saw how bad policy decisions and increasing economic divides threatened that economy and left people scrambling for many basics.

Ohioans, like all Americans, know how to adapt—people get more training or add a second job to sustain their families in this changing economy. But increasingly, policies don’t do enough. College costs are high and financial aid is inadequate; quality childcare or pre-K is often unaffordable; and we’re letting our planet burn while not making transit, insulation or green energy available.

So I feel beyond lucky to have been entrusted with a new role, leading a national organization dedicated to tax justice. As the incoming executive director of the Institute on Taxation and Economic Policy and its sister organization Citizens for Tax Justice, I’m joining a phenomenal team that analyzes and makes policy recommendations to improve federal and state tax policy.

Now in its 40th year, ITEP’s work is driven by the belief that tax justice is essential to social and economic justice. ITEP analyses help us understand who pays taxes, and how we can better secure for our communities the resources to educate our kids, protect our lakes and rivers, and keep us safe.

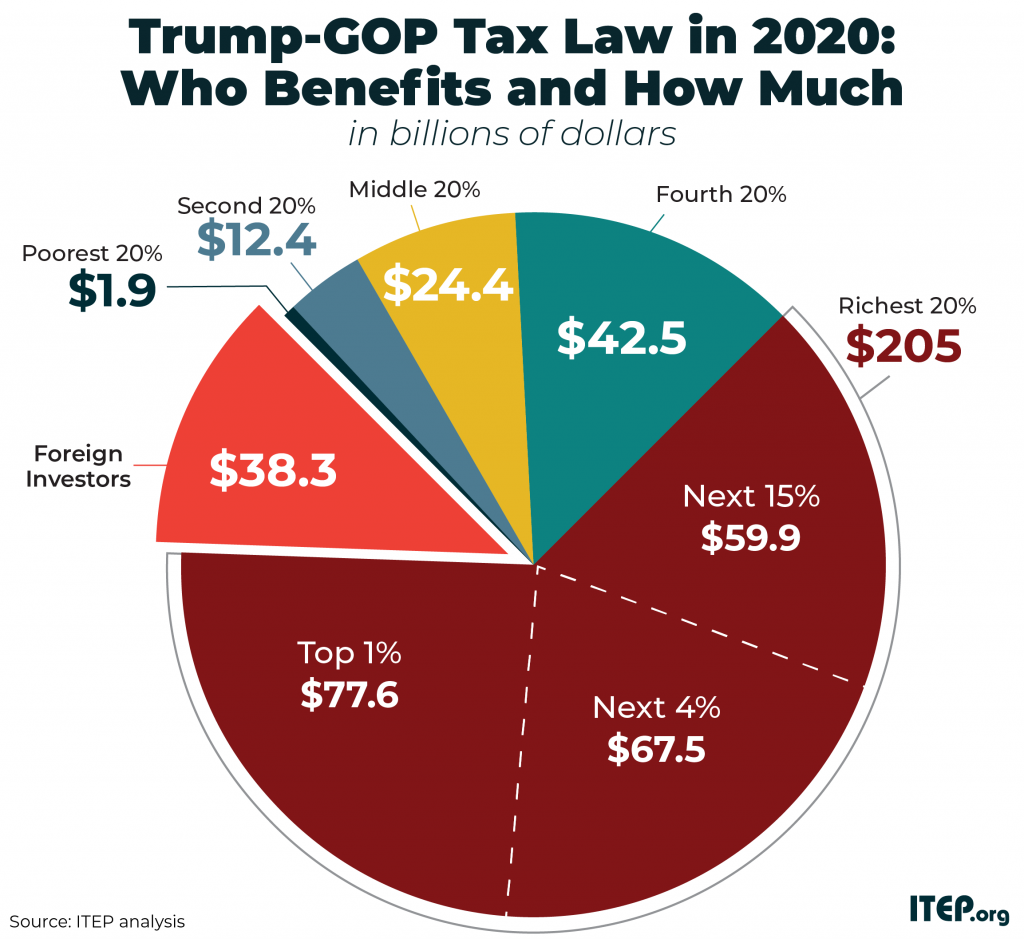

Tax policy has never been perfect, but the 2017 Tax Cuts and Jobs Act took us backward. It reduced what the richest 20 percent pay by more than $200 billion collectively. In 2020 it will boost the income of the top 1 percent—earning an average $1.9 million each year—by nearly $50,000. In addition to increasing economic inequality, these giveaways worsen racial inequality, with white Americans receiving the vast majority (80 percent) of the tax cuts.

The cuts make it harder to do what America desperately needs—pay for things that would improve children’s lives, slow climate change, and put people to work. The plan was supposed to cost a whopping $1.5 trillion over a decade but seems likely to run more like $1.9 trillion—ballooning annual deficits and reducing resources for Social Security, health care, and infrastructure.

We also work on taxes at the local and state levels, where middle-income and low-income families pay a larger share of what they earn in taxes than the wealthiest. Upside-down state tax codes not only worsen income inequality, they make it hard to fund our schools, treat addiction, or get a college degree without deep debt.

After years of watching tax policy increasingly leave communities behind, at ITEP I’ll have the chance to work with local, state and national partners on policy solutions. I’m prepared to push for a tax system that can better deliver economic, climate and racial justice; for a public sector that can prepare our kids and our grid for 2020 and beyond; and for an America that works for all of us, whether we were born in Nebraska or Hawaii, Detroit or Miami.

There are plenty of obvious fixes: We can stop taxing money that goes mostly to the rich, like stock dividend and capital gains, at lower rates than we tax the earned income that most of us work for and live on. We can start taxing the wealth of multi-millionaires at least as much as we already tax the homes that are the main source of wealth for the middle class. And we can restore a reasonable estate tax on the many millions that get passed down from a great, great grandfather to an heir who lives off the inheritance. The smartest states are already moving to make their tax codes more progressive.

Throughout much of the 20th century, despite policies that intentionally perpetuated racial inequity, we had a better tax system that enabled investment and transformation. That’s what helped us turn an agrarian society where barely 10% of adults had a high school degree to one where more than 90% of adults have completed high school and more than a third of young adults have finished college. It allowed us to more than double life expectancy of Black Americans and nearly double the (still longer) life expectancy of white Americans over the century. It built the pipes, power lines and bridges we needed to have the world’s strongest economy.

That’s why I’ve joined the fight for tax justice. In an increasingly unequal America, I’m proud to be on the side of the worker, the planet and the people who know it’s time to push back.