Read this Policy Brief in PDF Form

As states continue to grapple with the impact of the most recent economic downturn, the budget revenue outlook for many states remains bleak. In this context, states must find ways to generate additional revenue without increasing the tax load on individuals and families struggling to make ends meet. For six states—Alabama, Iowa, Louisiana, Missouri, Montana, and Oregon—one straightforward approach would be to repeal the deduction for federal income taxes paid. Repealing the deduction would help these states reduce their budgetary gaps and make their tax systems less unfair. This policy brief explains how the deduction for federal income taxes works and assesses its impact on state budgets and tax fairness.

How the deduction for federal income taxes works

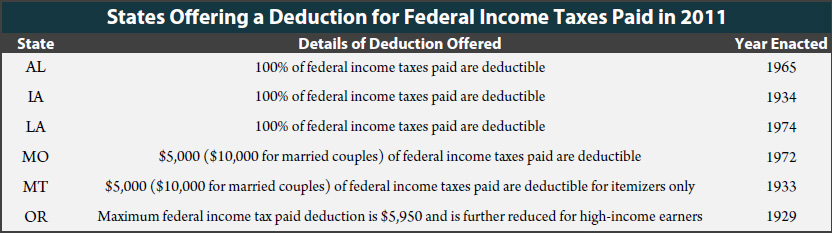

The deduction for federal income taxes paid is an unusual state personal income tax break that allows taxpayers to subtract the value of the federal income taxes they pay in a given year from their state taxable income. Only six states (Alabama, Iowa, Louisiana, Missouri, Montana, and Oregon) allow this deduction. The chart on this page shows how the deduction works in these six states.

Three of these states (Alabama, Iowa and Louisiana) allow a full deduction for all federal income taxes paid. The remaining three states put a cap on the allowable deduction. Missouri and Montana limit the deduction to $5,000 for single taxpayers, and $10,000 for married couples. Oregon’s deduction is capped at $5,950. Montana and Oregon each impose additional limitations: the Montana deduction is only available to Montanans who itemize their state tax return, and the Oregon deduction is gradually phased out for higher income earners (singles earning over $125,000 and married couples earning over $250,000).

Revenue Implications

In tax year 2011, the six states offering a deduction for federal income taxes paid will, collectively, lose just over $2.5 billion because of this feature in their tax system, with losses ranging from $46 million to $643 million per state. Such losses constitute a meaningful share of total income tax revenue.

As costly and unfair as the deduction is right now, it’s very likely that it will become even more so in the next couple of years. States that offer this deduction are especially susceptible to federal tax changes and it seems likely that the federal income taxes paid by the best-off Americans will rise in the future. Since the best-off residents in each state are the primary beneficiaries of the state tax deduction, an increase in their federal taxes will increase the cost of this tax break.

Fairness Impact

Because the deduction for federal income taxes is structured differently from state to state, the impact on tax fairness varies somewhat. But in every one of these states, the deduction offers little or no benefit to most low- and middle-income families. This shouldn’t be surprising. After all, the federal income tax is designed to shelter low income families from tax. The availability of exemptions, deductions and credits means that many families simply do not have any federal income tax to deduct.

The Opportunity: Closing the Deduction Loophole

States that allow a deduction for federal income taxes paid allow their income taxes to be undermined by a costly and regressive loophole. The loophole is a major drain on state income tax revenues and the price tag yields remarkably little benefit to low-and middle-income families. This tax break also leaves state budgets and taxpayers especially vulnerable to changes in the federal income tax. As the recession lingers and states look to enhance their ability to provide for long term fiscal solvency, elected officials have a real opportunity to close fiscal shortfalls in a way that has minimal impact on low-and middle-income families.