In most states, the gasoline tax is set at a fixed number of cents per gallon of gas. South Carolina drivers, for example, have been paying 16 cents per gallon in state tax for more than a quarter century.[1] But while this type of fixed-rate gas tax may appear to be flat over time, its lack of change in the face of inflation means that its “real” value, or purchasing power, is steadily declining. In ten states, this decline has brought the state’s inflation-adjusted gas tax rate to its lowest level in the state’s history.

In most states, the gasoline tax is set at a fixed number of cents per gallon of gas. South Carolina drivers, for example, have been paying 16 cents per gallon in state tax for more than a quarter century.[1] But while this type of fixed-rate gas tax may appear to be flat over time, its lack of change in the face of inflation means that its “real” value, or purchasing power, is steadily declining. In ten states, this decline has brought the state’s inflation-adjusted gas tax rate to its lowest level in the state’s history.

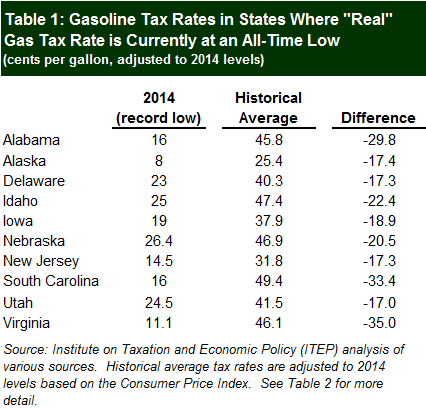

The ten states where gas tax rates are currently at an all-time low are Alabama, Alaska, Delaware, Idaho, Iowa, Nebraska, New Jersey, South Carolina, Utah, and Virginia.[2] Table 1 shows these states’ current gasoline tax rates and compares them to the average gas tax rate (adjusted for inflation) levied in each state since the tax was first created. This inflation adjustment is needed for a meaningful comparison of tax rates over time. For example, while the 2 cent gas tax that Delaware levied in 1924 may sound extremely low to today’s drivers, in the context of the 1924 economy it was actually higher than the tax rate Delaware levies today. As shown in Table 2, a 2 cent tax in 1924 was roughly equivalent to a 27.8 cent tax today.

Each of the states examined in Table 1 is levying its gas tax at a rate significantly lower than its historical average. Utah’s current gas tax rate is 17 cents below its historical average, while Virginia’s current rate is 35 cents below its average. The other eight states fall between these two extremes.

|

| Click Table or Here for High Quality Version Download Excel Table of Data (Right-Click and Save-as) |

Perhaps unsurprisingly, lawmakers in many of these states have given serious consideration to gas tax increases or reforms in recent months. Delaware Governor Jack Markell has proposed increasing his state’s gas tax by 10 cents per gallon and linking it to inflation, while Iowa Governor Terry Branstad said that he thinks allowing the gas tax to gradually rise alongside gas prices is a good idea. Utah’s Senate passed gas tax reform in 2014, though it was not acted on by the House. And New Jersey’s Assembly speaker and the chair of South Carolina’s Senate Finance Committee support gas tax increases as well.

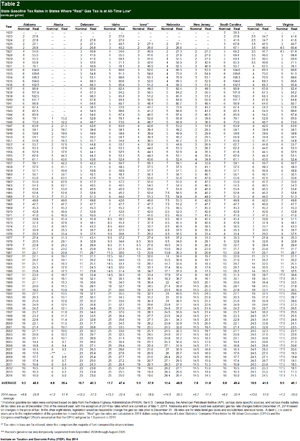

Raising the gas tax in these states could reverse the long-running decline in their value brought about by inflation. In many cases, however, the tax rate has been allowed to stagnate for so long that a significant increase is needed just to restore the tax to its previous value. Even if South Carolina tripled its 16 cent gas tax, for example, the tax rate would still fall below its 93-year average of 49.4 cents per gallon. Failing to raise the gas tax in these states guarantees that the unprecedented decline in the tax’s purchasing power will continue. Unless lawmakers act, this decline is likely to be a major barrier to adequately funding infrastructure in the years ahead. Table 2 analyzes the full history of all ten states’ gas tax rates, showing both the nominal rate paid by drivers in each year, as well as the “real” (inflation-adjusted) value of that tax rate in 2014.

Graphs for all ten states are available at the following links:

Alabama | Alaska | Delaware | Idaho | Iowa | Nebraska | New Jersey | South Carolina | Utah | Virginia

1 Institute on Taxation and Economic Policy, “How Long Has it Been Since Your State Raised Its Gas Tax?” April 2014. Available at: https://itep.org/itep_reports/2014/04/most-americans-live-in-states-with-variable-rate-gas-taxes.php/.

2 These ten states were identified after examining comprehensive historical gas tax data in thirty-four states and partial historical data in the remaining sixteen states. In those states lacking comprehensive data, the partial data available were sufficient to determine that the current gas tax rate is not the state’s all-time low.