Click here for a PDF of this page

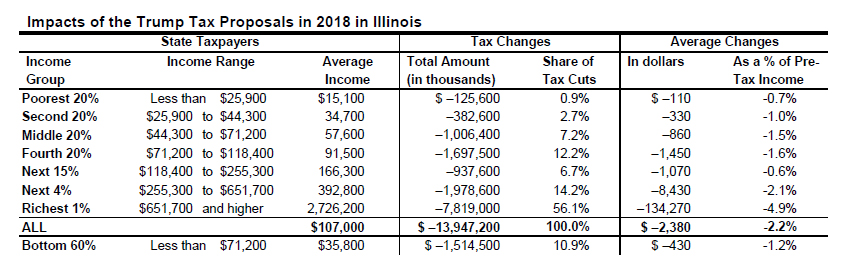

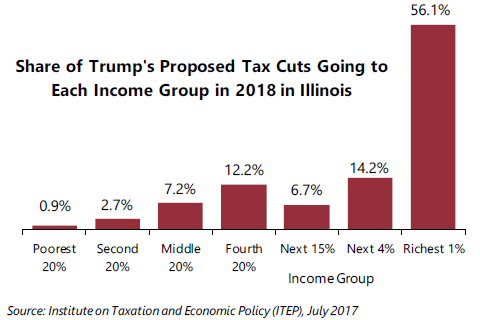

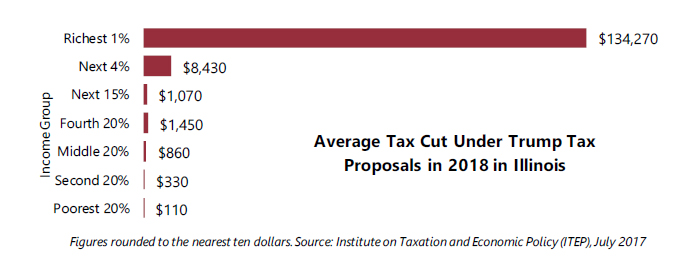

Earlier this year, the Trump administration released some broadly outlined proposals to overhaul the federal tax code. Households in Illinois would not benefit equally from these proposals. The richest one percent of the state’s taxpayers are projected to make an average income of $2,726,200 in 2018. They would receive 56.1 percent of the tax cuts that go to Illinois’s residents and would enjoy an average cut of $134,270 in 2018 alone.

Officials in the Trump administration have said that their tax plan will help the middle-class, but that is not true of the proposals they have put forward so far. For example, in Illinois, the middle fifth of taxpayers in terms of income are projected to make an average income of $57,600 in 2018. This group would receive just 7.2 percent of the tax cuts next year in Illinois compared to the 56.1 percent of the tax cuts received by the richest one percent of the state’s residents.

Bottom 60 Percent of Taxpayers in Illinois Would Receive Just 10.9 Percent of the Tax Cuts in the State

The bottom three-fifths of taxpayers (the lowest-income 60 percent of taxpayers) in Illinois will all make less than $71,200 in 2018. They would gain very little, just 10.9 percent of the tax cuts that go to residents in the state. The average tax cut for this group next year would be $430, which is tiny compared to the average $134,270 going to the richest one percent.

Some middle-income taxpayers would even pay higher taxes under Trump’s proposal. (See ITEP’s longer report for more details.)

Price Tag of Plan Would Mean Cuts in Public Investment that Working People Rely On

Trump’s tax proposals would reduce total federal revenue by at least $4.8 trillion over ten years. In the short-run this might just mean higher government deficits, but eventually Congress and the President would almost surely have to cut major programs like Medicare, Medicaid, food assistance and others to offset the costs. Low- and middle-income families would probably lose far more as a result than they gain from the small tax cuts President Trump would provide them.

Tax Cuts Can Be Measured in Several Ways, But This Plan Favors the Rich Under Any Measure

Politicians who propose tax cuts sometimes argue that no one should be surprised if they mostly benefit the rich. They argue that the rich make most of the income, so of course they receive most of the tax cuts.

But their argument is misleading. The richest one percent receive a larger tax cut than everyone else under Trump’s proposals even when it is measured as a percentage of their income. In Illinois, the richest one percent would receive a tax cut equal to 4.9 percent of their income. The bottom three-fifths of taxpayers in the state would receive a tax cut equal to just 1.2 percent of their income.

The Trump Tax Proposals Included in These Figures

These are described in more detail in ITEP’s longer report on the Trump tax proposals.

- Repeal of the 3.8 percent tax on investment income for the rich.

- Repeal of the Alternative Minimum Tax.

- Repeal of personal exemptions and doubling of the standard deduction.

- Replacement of current income tax brackets with three brackets, 10 percent, 25 percent, and 35 percent.

- Elimination of all itemized deductions except those for charitable giving and home mortgage interest.

- Special tax rate (15 percent) for businesses that do not pay the corporate income tax.

- New deduction and tax credit for child care.

- Repeal of special tax breaks for businesses and reduction in the corporate income tax rate from 35 percent to 15 percent.

- Repeal of the estate tax.