Following is a statement by Alan Essig, executive director of the Institute on Taxation and Economic Policy, regarding rumors that GOP leaders are considering keeping a top tax rate of 39.6 percent in the pending tax proposal.

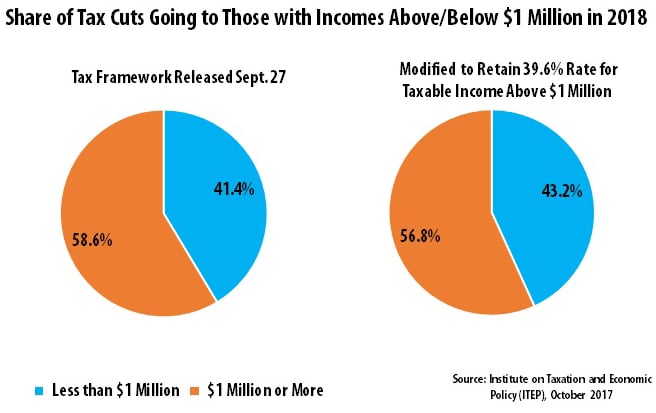

“Keeping the top tax rate at 39.6 percent for millionaires is a cosmetic change meant to make this tax plan more palatable. Unless tax writers take out other provisions that almost exclusively benefit the highest-income households, millionaires will still benefit most. The framework calls for eliminating the estate tax, a tax that only the richest 0.2 percent of taxpayers pay. It would lower the corporate tax, which primarily benefits wealthy investors. And it would lower the tax rate for pass-through business income, creating a gaping tax loophole that will incentivize the wealthy to claim ordinary income as business income to pay a lower tax rate.

“Poll after poll shows this tax overhaul is wildly unpopular. The public didn’t buy false rhetoric that deemed this giveaway to the wealthy and corporations a “middle-class” tax break. Nor will they buy the notion that a minor change will suddenly make this tax plan anything other than a misuse of our tax code to redistribute wealth to the already wealthy.”

Take a look at this ITEP analysis, which shows how millionaires benefit most whether the top rate is 35 percent or 39.6 percent.