Scaled-back deduction would be indefensible as a tool for promoting homeownership

Throughout the ongoing federal tax debate, President Trump and Congressional leadership have insisted that while many tax deductions and credits would be wiped out, the mortgage interest deduction would be spared from the chopping block. But while the proposal recently unveiled by House leaders retains the mortgage interest deduction on paper, the actual substance of this policy would be nearly unrecognizable to today’s homeowners.

So far, most attention has been focused on the plan’s proposal that new homeowners (though not existing ones) would only be allowed to deduct interest on the first $500,000 in mortgage debt, rather than the first $1 million as under current law. In addition, the plan would limit the deduction to a person’s principal residence, meaning that vacation homes would no longer qualify.

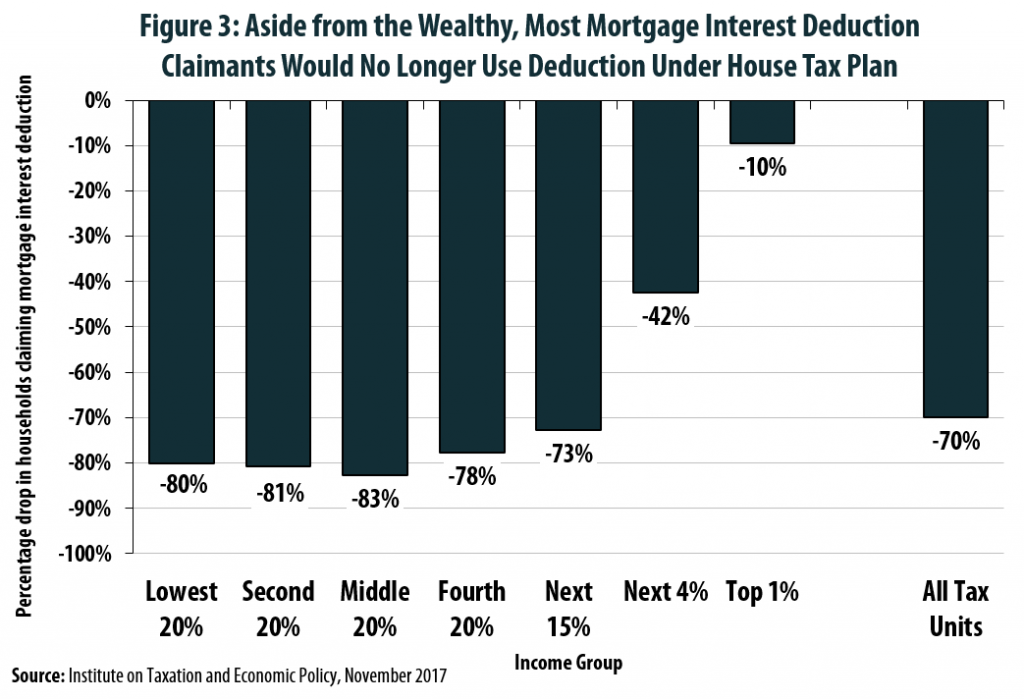

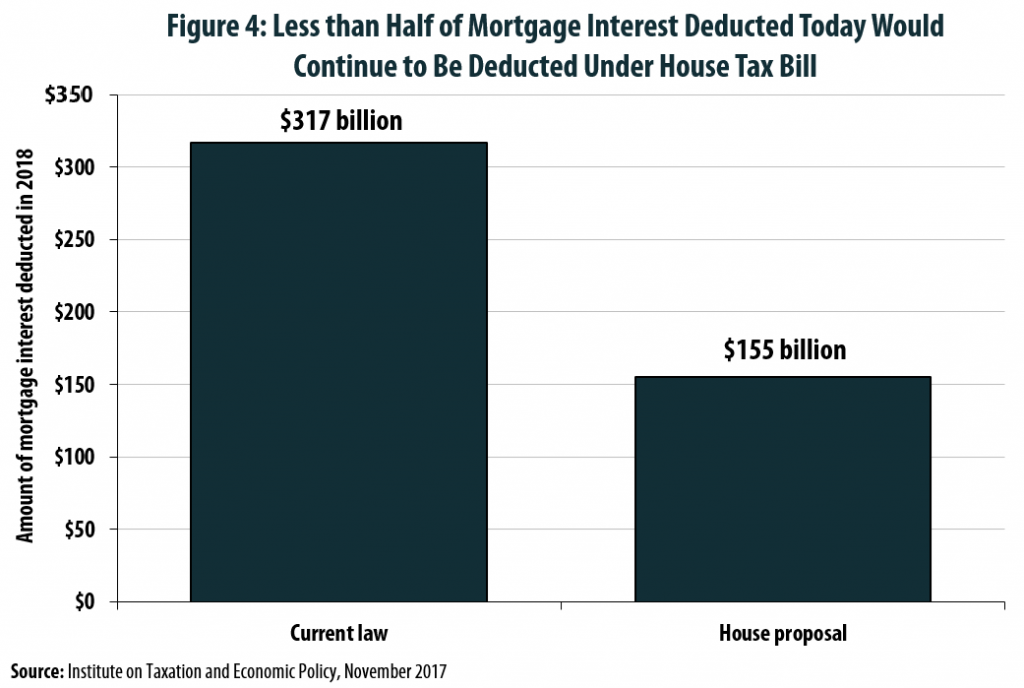

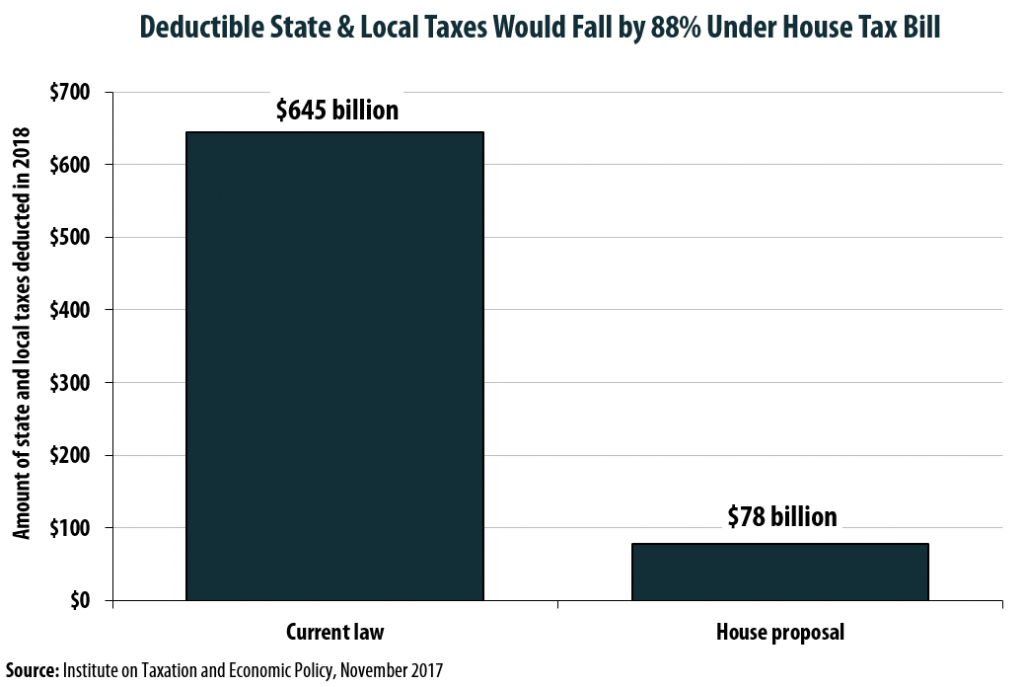

But the more transformative change is one that is actually not spelled out explicitly in the House bill. In short, by expanding the standard deduction and dramatically scaling back the deduction for state and local taxes paid, far fewer households would find itemizing and claiming the mortgage interest deduction to be worthwhile. Because of this, the House plan would effectively eliminate the mortgage interest deduction for 7 in 10 homeowners currently benefiting, making it a non-factor for 24.9 million current claimants. Instead, the deduction would be reserved just a small subset of the wealthiest Americans who are least likely to need a financial incentive to purchase a home, although the value of the deduction would be scaled-back for these households as well. In total, the amount of mortgage interest deducted in 2018 would fall by more than 51 percent, from $317 billion to $155 billion.

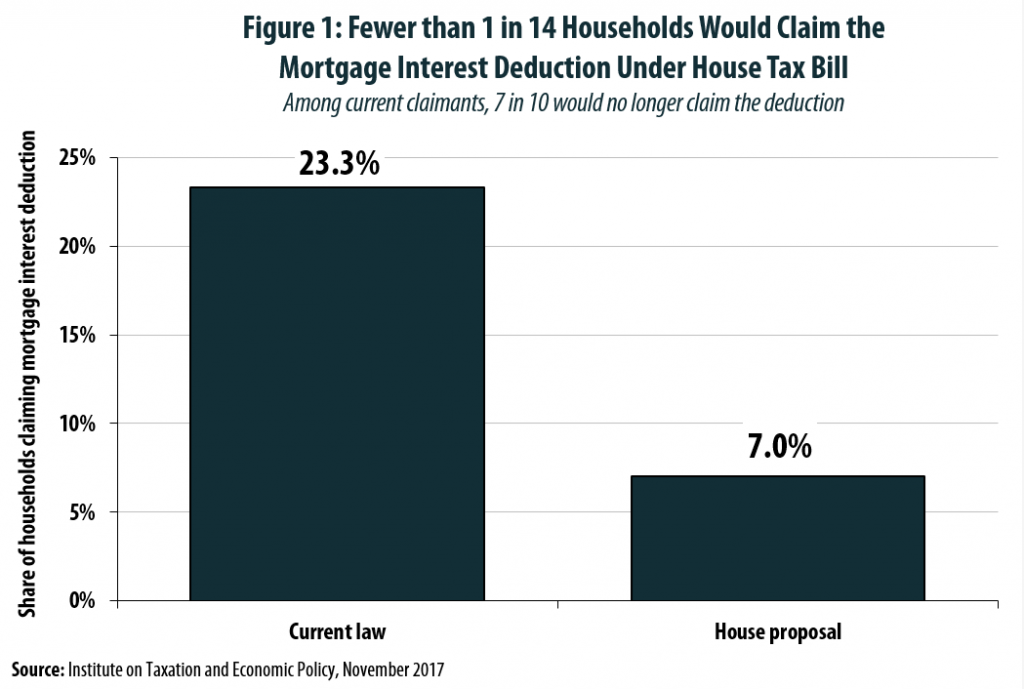

Under the House tax plan, only 7 percent of households would receive any benefit at all from the deduction, compared to more than 23 percent of households today (see Figure 1). This relatively small group would be comprised entirely of households with combined itemized deductions for mortgage interest, property taxes, and/or charitable contributions in excess of $24,400 (or $12,200 for single taxpayers). But for the deduction to have any meaningful incentive effect, taxpayers would need to have combined deductions far above these amounts. A married couple paying $26,000 per year in mortgage interest and property taxes, for instance, would only save about $50 per month by claiming these deductions in lieu of the $24,400 standard deduction. This watered-down incentive stands in stark contrast to the House’s lofty language of “maintaining this tax benefit [to] help more Americans, especially middle-class Americans, achieve the dream of homeownership” as well as earlier promises that the deduction would be left in place to “strengthen civil society.”

To be sure, there are legitimate questions to be raised about whether the current mortgage interest deduction is reliably encouraging people to buy homes. But rather than addressing those questions honestly and crafting a more effective policy, House leadership has largely attempted to shirk this discussion while drastically reducing and transforming the deduction in ways that make it indefensible as a tool for promoting homeownership.

Simply put, it is absurd on its face for House leaders to assert that a deduction reserved for just 7 percent of mostly high-income Americans will be an effective tool for putting the “dream of homeownership” within reach for the American people. If the House tax bill is ultimately enacted in its current form, academic economists are unlikely to even bother to take the time to study whether the mortgage interest deduction left on the books is boosting the overall homeownership rate. The answer would be self-evident.

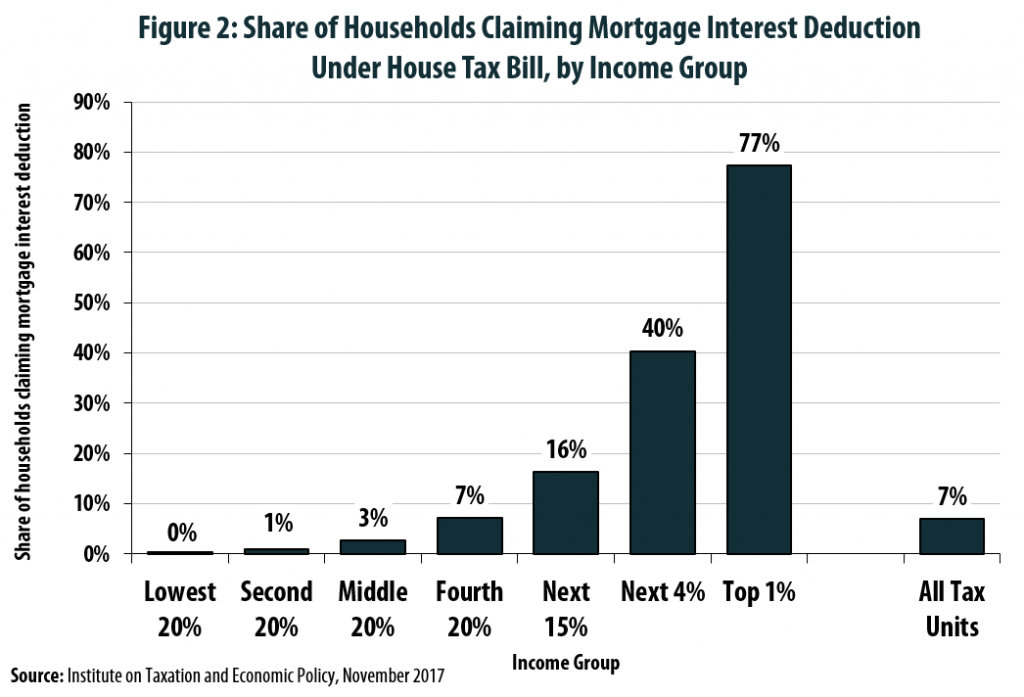

As seen in Figures 2 and 3, the top 1 percent of households are the group least likely to lose their mortgage interest deduction under the House tax plan. Just 1 in 10 households in this group would see the tax benefits associated with deducting mortgage interest wiped out under the plan. Among middle-income families (defined as the middle 60 percent of earners), that figure rises to 8 in 10 households losing the deduction.

Keeping the mortgage interest deduction in the form proposed by House leadership is a shrewd political choice, not a principled policy decision. If House tax-writers seriously believed the deduction is an effective incentive, they would not be proposing a tax restructuring in which 7 out of every 10 current claimants would no longer receive it.

In this light, the only possible interpretation of the House proposal is that its authors believe the mortgage interest deduction to be without merit, but that they do not want to incur the political consequences associated with repealing or dramatically reforming the deduction in a more transparent fashion. The result is a nonsensical and intentionally opaque proposal in which a policy ostensibly aimed at promoting homeownership is being left in place only for the upper-income people least likely to need the deduction to become homeowners.