In the ongoing debate over major federal tax legislation, there is significant focus on how House and Senate bills would eliminate the deduction for state income tax payments and cap the deduction for property taxes at $10,000 per year. At the same time, tax writers have retained deductions for charitable gifts and mortgage interest with what appear to be comparatively minor changes, at least at first glance.

But a new analysis produced using the ITEP Microsimulation Tax Model reveals that Americans’ use of these three deductions would be dramatically curtailed by the House and Senate tax bills, likely to a far greater extent than most people realize.

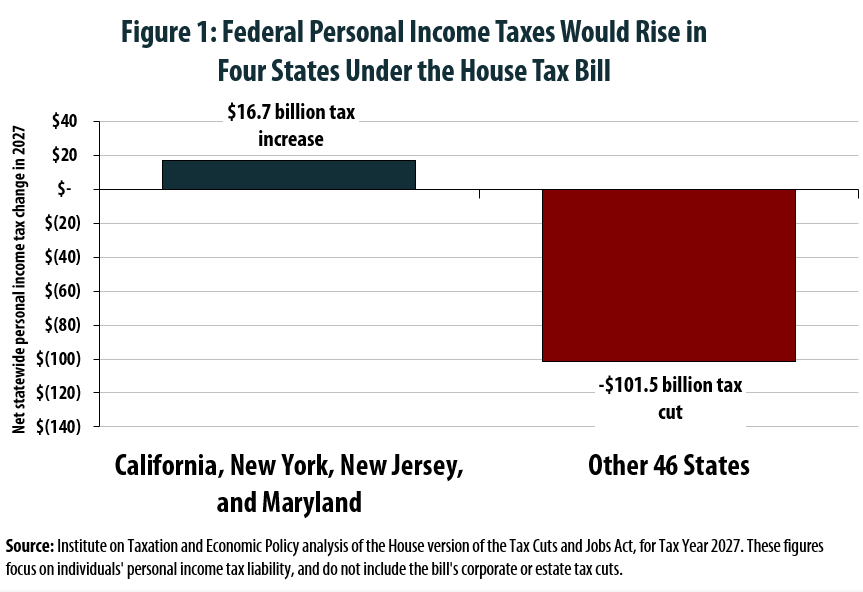

While one of the debate’s dominant narratives—that repeal of the state income tax deduction is being used as a tool to make “blue” states like California and New York pay for tax cuts in other parts of the country—does have merit, it is also incomplete. Congressional Republicans in most states may feel that it is politically “safer” to go after the state income tax deduction directly, but an indirect consequence of this decision is that more broadly popular deductions, such as for donations to churches and local nonprofits and mortgage interest, are being dramatically cut as well.

The analysis includes both national figures and findings for all 50 states. Among its findings:

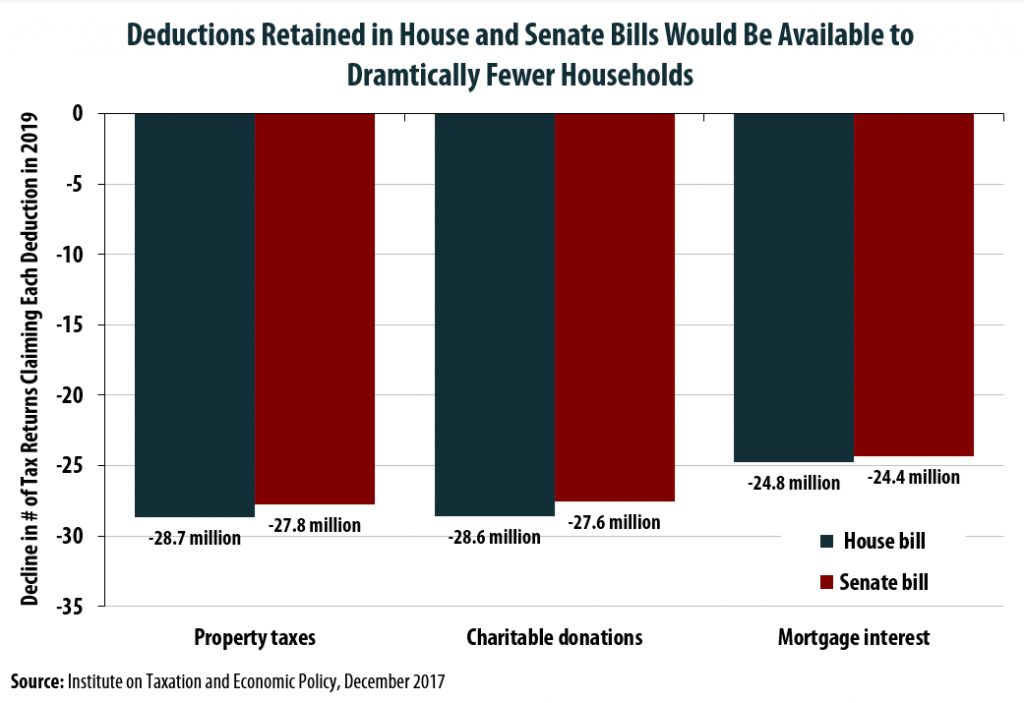

- Under either the House or Senate tax bill, more than two-thirds of American households that currently deduct their property taxes, mortgage interest, or charitable contributions would lose the ability to write-off these expenses. As shown in the nearby chart, between 24 and 29 million households would no longer benefit from these deductions.

- While property taxes are currently deductible for more than one quarter (27 percent) of American households, that figure would fall to just 8 percent under the House plan or 9 percent under the Senate plan. High-income taxpayers are the group most likely to retain at least a portion of their property tax deduction. Three out of every four middle-income families would lose their property tax deductions in 2019, but just one in eight high-income families (defined as the top 1 percent of earners) would stop deducting property taxes entirely.

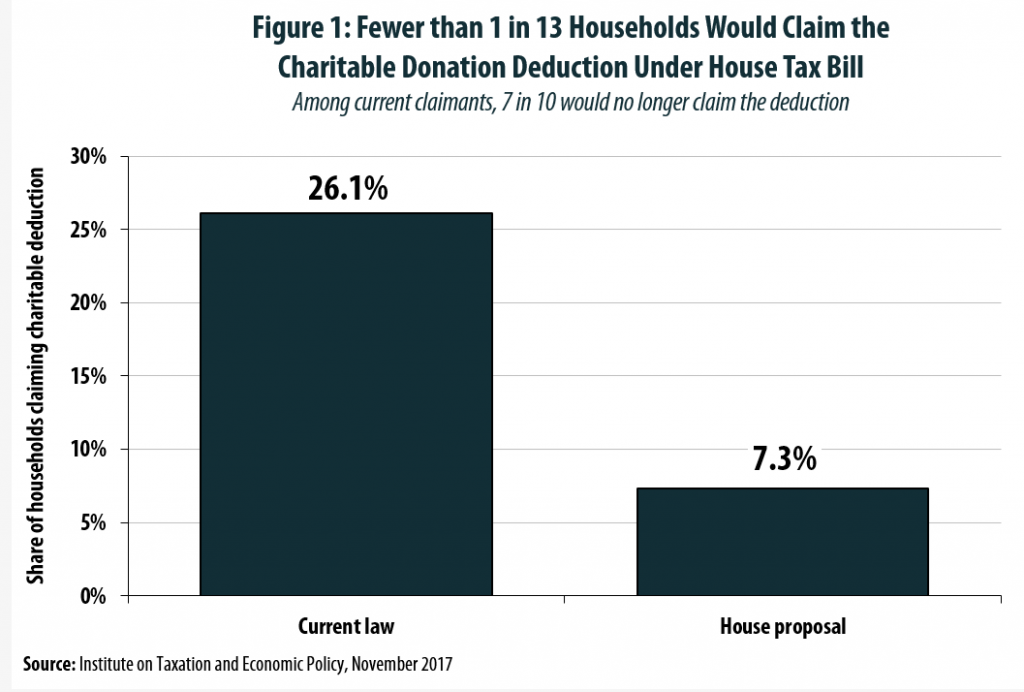

- These plans would have a similar impact on the charitable giving deduction. While 26 percent of households are expected to write-off charitable gifts in 2019, that figure would plummet to just 8 or 9 percent under the House and Senate tax bills. More than four out of every five high-income taxpayers would continue to see their charitable donations rewarded with a federal tax deduction, while just one of every 20 middle-income families would receive such a deduction. In total, the federal government would stop incentivizing charitable giving for roughly 28 million American households who otherwise would have received a charitable tax deduction in 2019.

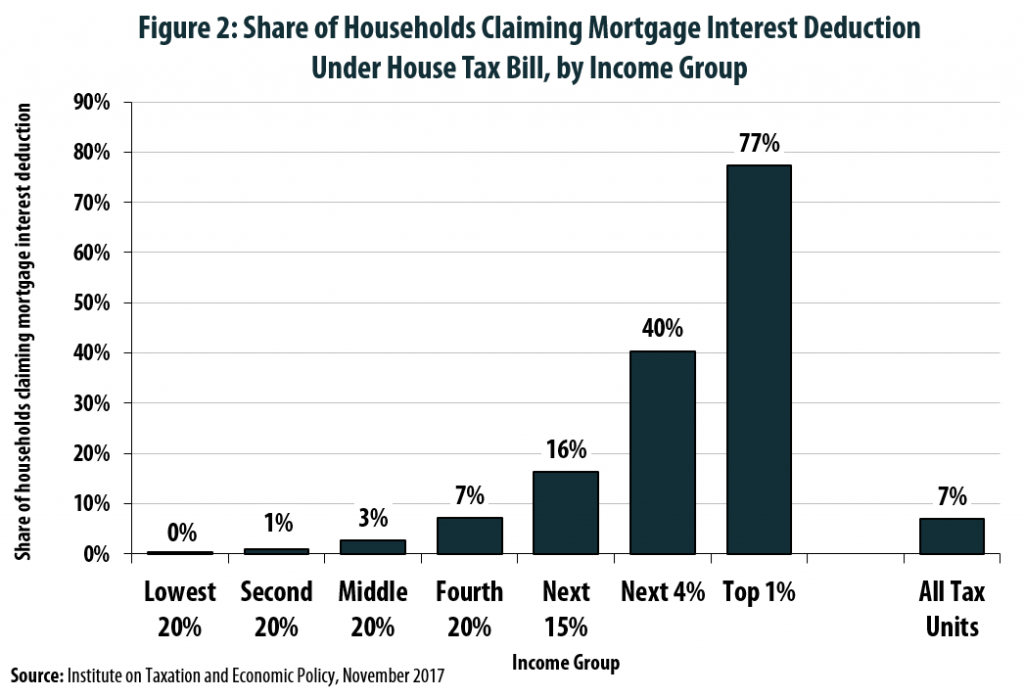

- The mortgage interest deduction would be left in place for precisely the families who are least likely to need to the deduction to become homeowners. More than three-fourths of middle-income families claiming a mortgage interest deduction today would no longer receive that deduction, while just 9 percent of the nation’s top earners would see their mortgage interest deduction taken away entirely. Overall, 78 percent of high-income households would continue to deduct some amount of mortgage interest, while just 4 percent of middle-income households would do so.

The House and Senate’s tax plans would have significant impacts on all of these deductions. But the rushed nature of the debate, combined with the fact that many of those changes would happen indirectly—because of the elimination of the state income tax deduction or increases to the standard deduction, for instance—means that many of those impacts are not well understood by ordinary Americans or perhaps even their representatives in Congress.

As ITEP has argued before, there are good reasons to consider reforming itemized deductions to improve their effectiveness or fairness. But the House and Senate’s approach to that task leave much to be desired.

View 50-state data in Excel or PDF for all three deductions.

Or view data for a specific deduction: