Online retailer Amazon.com made headlines last year when it began collecting every state-level sales tax on its direct sales.[1] Savvy observers quickly noted that this change did not affect the company’s large and growing “marketplace” business, where it conducts sales in partnership with third-parties and rarely collects tax.[2] But far fewer have noticed that even on its direct sales, Amazon is still not collecting some local-level taxes. This analysis reveals that in seven states (Alabama, Alaska, Idaho, Iowa, Mississippi, New Mexico, and Pennsylvania), Amazon is either not collecting local taxes or is charging a lower tax rate than local retailers. While this collection gap is troubling on its own, it also suggests that many localities are unprepared to reap the benefits of expanded sales tax collection authority that may soon be coming from the U.S. Supreme Court or Congress. Worse, this lack of preparedness extends beyond the seven states identified above and includes states such as Colorado and Illinois where Amazon collects local tax, but where e-retailers without in-state facilities may not be able to do so.

Local Taxes Going Uncollected by Amazon

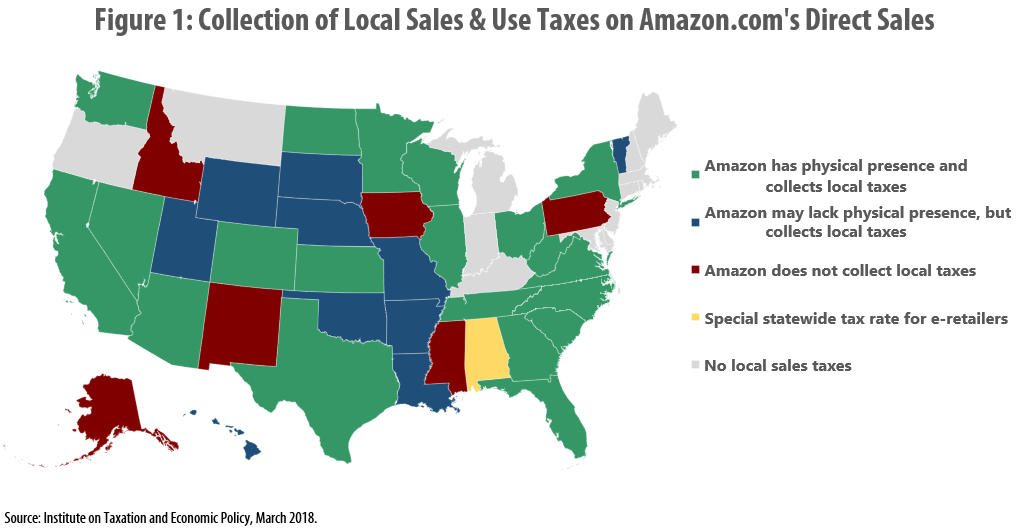

ITEP identified the seven states in which Amazon is not collecting local taxes (or is charging a lower rate) by entering dozens of shipping addresses into the Amazon.com website, observing the sales tax amount charged on a consumer electronics item, and comparing that amount to the combined state and local sales tax rate levied in that jurisdiction.[3] Based on this analysis, the gap between what Amazon collects and what local retailers collect can be as high as 7.5 percent of an item’s pre-tax purchase price (in Homer, Alaska), but it is more commonly in the range of 1 to 3 percentage points.

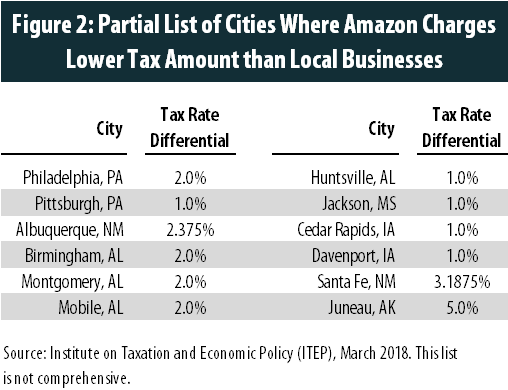

Figure 2 offers a sampling of the largest cities where Amazon charges less tax than local retailers, as well as the size of the tax advantage that the company enjoys over those local businesses.

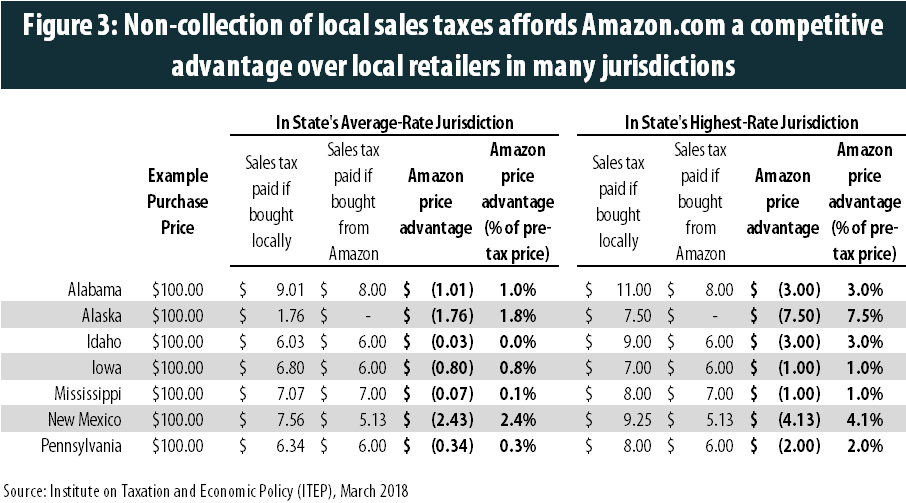

A more detailed analysis is provided in Figure 3 below, which shows Amazon’s average, and maximum, price advantage in each state by using an example of an item purchased for $100.

While the reasons behind Amazon’s ongoing tax advantage vary across states, the basic fairness and economic problems do not. There is little logic in asking consumers who prefer to shop at local businesses to pay more toward funding public services than consumers who shop via their laptops or smartphones. Additionally, local economies are harmed by this arrangement because it incentivizes price-conscious shoppers to buy from out-of-state Internet retailers instead of businesses that hire local residents, pay local property taxes, and otherwise contribute to the local economy. And funding for local services suffers as well, as a large and growing share of retail sales take place over the Internet.

In diagnosing the reasons for Amazon’s non-collection of some local taxes, the seven states discussed in this brief can be sorted into at least four groups. These groupings are discussed in more detail below but in most cases, the gaps in collection result from outdated or otherwise flawed state and local tax laws, rather than a specific tax avoidance strategy used by Amazon.

States without local “use taxes”

In many states, Amazon is not collecting the sales tax, but is instead collecting the backstop “use tax” that applies to interstate sales. Because state-level use taxes are set at the same rate as state-level sales taxes, collecting use tax as opposed to sales tax seldom makes much difference. But localities in Idaho, Iowa, and Mississippi lack their own local use taxes and therefore the company is not collecting any local tax amount.[4] To remedy this problem, theses states should enact legislation authorizing their local governments to levy use taxes and localities should exercise that authority.

“Origin-sourced” states

The current structure of New Mexico and Pennsylvania’s sales tax laws prevents Amazon from collecting local-level taxes on its sales into those states. Both states use “origin-sourcing,” which means that the location of the seller, rather than the buyer, determines the amount of local tax that must be added to a purchase. In New Mexico’s case, Amazon lacks any in-state presence and therefore remits only the state-level (5.125 percent) tax that is owed on any sale originating outside the state. In Pennsylvania, since the company lacks fulfillment centers in the only two jurisdictions with local-level sales taxes (Philadelphia and Allegheny County, which includes Pittsburgh), its sales do not originate from parts of the state with local sales taxes and therefore those taxes go uncollected.[5] Local lawmakers in Philadelphia, Pittsburgh, and throughout the state of New Mexico should be troubled by the fact that Amazon is not permitted to collect local sales taxes on their residents’ purchases. Requiring that these types of sales be “destination-sourced,” where the location of the buyer determines the tax amount collected, would put local retailers on an even footing with out-of-state or out-of-town retailers such as Amazon. Local lawmakers in these two states should pursue destination-sourcing of their local taxes, though state law will likely need to be changed to authorize these taxes.

Localities that lack a state-level advocate

Alaska is the only state that allows local-level general sales taxes without also levying its own statewide sales tax. In contrast to the other 36 states with local sales taxes, Alaska’s state government therefore lacks a vested interest in the outcome of the push for e-retail sales tax collection. As a result, Alaska’s localities have been left without a coordinated effort, or a negotiator, working to see that sales taxes are collected by e-retailers selling into the state. Since Amazon appears to lack a physical presence in Alaska, local governments such as Juneau and Wasilla have limited options for pursuing tax collection on their own. In the absence of new collection authority from the federal government, Alaska localities’ best recourse may be to urge state lawmakers to put pressure on Amazon to begin collecting local sales taxes by enacting a remote sales tax reporting law similar to Colorado’s, or by including local tax collection as a requirement in any future tax incentive offers.[6] In addition, any localities that levy sales taxes but not use taxes should implement use taxes, which already exist in some parts of the state.[7]

State offers preferential rate

In 2015, Alabama lawmakers sought to encourage e-retailers to voluntarily collect the taxes owed on their sales by enacting the Simplified Seller Use Tax Remittance Act.[8] Instead of collecting a combined state and local tax that ranges from 4 to 11 percent in different parts of the state, the Act allows sellers to collect a flat 8 percent tax on every sale made to customers in Alabama. It also allows customers located in areas with tax rates below 8 percent to receive a refund or credit from the state to reimburse them for the amount they were overcharged. While the law did spur companies such as Amazon to begin collecting Alabama taxes, it did not completely level the playing field between e-retailers and Alabama’s own in-state businesses. Three of Alabama’s five largest cities (Birmingham, Montgomery, and Mobile) have combined state and local sales tax rates of 10 percent, while the other two (Huntsville and Tuscaloosa) have rates of 9 percent. As a result, local businesses in the state’s largest commercial centers are at a competitive disadvantage relative to Amazon and other retailers participating in the program because the state offers a preferential tax rate to out-of-state businesses. While such a preferential rate may have made sense as a short-run measure designed to bring out-of-state companies into the state’s tax collection system, in the long-run it is indefensible to offer businesses with no local presence a tax advantage over in-state businesses. State lawmakers should revisit this law with an eye toward creating a more level playing field for Alabama’s retailers and a more adequate revenue stream for local governments.

What Happens if Federal Restrictions on Tax Collection are Eased?

A series of U.S. Supreme Court decisions, most recently Quill Corp. v. North Dakota (1992), have prevented states and localities from requiring out-of-state retailers to collect sales tax. These decisions were rooted largely in the idea that state and local tax systems were too complex for retailers to navigate from afar. But modern tax collection software has rendered this concern largely obsolete and the Court is widely expected to loosen restrictions on state and local tax collection later this year.

If this occurs, most of the localities spotlighted in this brief are unlikely to benefit because state and/or local laws are not written to allow for local tax collection on sales made by out-of-state retailers. Without changes in law, these localities will continue to see their tax bases eroded as consumers increasingly shop online, and local businesses in these communities will continue to face an unlevel playing field as they collect local sales taxes that out-of-state online companies can (or must) forego collecting.

Notably, in the context of e-retailers other than Amazon.com, this problem extends beyond the seven states highlighted in this brief. In Illinois, for example, Amazon has a physical presence and appears to be collecting and remitting local sales tax amounts based on each customer’s shipping address.[9] Retailers located entirely outside of the state, however, are unlikely to collect those same local taxes. The tax filing service TaxJar explains that “Illinois wants sellers who made a sale into Illinois from outside the state [to] charge a flat Illinois ‘use tax’ rate of 6.25% … You are not required to charge any local sales tax rates.”[10]

Similarly, TaxJar states that in Colorado, out-of-state retailers should collect a special “retailer’s use tax” that “does not include any local city or county taxes that may be applicable.”[11] The Colorado Department of Revenue clarifies that those “city and county use taxes are paid directly to those jurisdictions if applicable” and urges sellers to “contact the cities and counties directly for more information on local use taxes.”[12] But since many Colorado cities lack use taxes or levy those taxes at lower rates than their ordinary sales taxes, it appears that out-of-state e-retailers will sometimes find themselves collecting less tax than their locally-based competitors.[13]

A full analysis of how out-of-state retailers are impacted by every localities’ sales and/or use tax laws is beyond the scope of this brief, but local lawmakers around the country should evaluate whether they are positioned to collect local taxes in the event that the federal government eases restrictions on doing so. Generally speaking, localities with destination-sourced sales and use taxes are in the best position to collect tax revenue from online sales.

Conclusion

Many states and localities have begun to collect sales taxes on at least some sales made by out-of-state e-retailers and are eager to expand that collection in the wake of an upcoming Supreme Court ruling that is expected to ease federal restrictions on doing so. Other localities, however, are not collecting tax from out-of-state or even out-of-town businesses because of problematic restrictions in state or local law. Amazon.com, for instance, is not collecting local tax (or is collecting a lower tax amount) in seven of the 37 states with local-level sales taxes. This collection gap is harming local governments’ ability to fund vital programs, and it is contributing to an unlevel playing field for local businesses because millions of shoppers are able to pay less tax if they choose to buy products from out-of-state companies over the Internet rather than at local stores. Reforms such as “destination-sourcing” and the implementation of local “use taxes,” both of which are already common in many states, could help bring these localities’ tax systems into the digital age.

[1] Davis, Carl. “Amazon Will Collect Every State Sales Tax by April 1.” Institute on Taxation and Economic Policy, Just Taxes Blog. Mar. 21, 2017. Available at: https://itep.org/amazon-will-collect-every-state-sales-tax-by-april-1/.

[2] Washington State is a notable exception, as the company recently began collecting and remitting sales taxes on behalf of third-parties. Amazon will do the same in Pennsylvania beginning Apr. 1, 2018. See: Kim, Eugene. “Amazon steps into tax collection with service that could help states collect billions in lost revenue.” CNBC. Nov. 15, 2017. Available at: https://www.cnbc.com/2017/11/15/amazon-marketplace-tax-collection-comes-to-washington-in-2018.html. Levy, Ari. “Amazon will start collecting sales tax for shipments to Pennsylvania as states seek to recoup billions.” CNBC. Mar. 2, 2018. Available at: https://www.cnbc.com/2018/03/02/amazon-to-start-collecting-sales-tax-for-shipments-to-pennsylvania.html.

[3] Findings are summarized in Figure 1. Note that the “physical presence” information in that map is taken from the following two sources: “Economic Impact.” Amazon.com. Accessed Mar. 12, 2018. Available at: https://www.amazon.com/p/feature/nsog9ct4onemec9. “Amazon Fulfillment Center Locations.” Avalara TrustFile. Accessed Mar. 12, 2018. Available at: https://www1.avalara.com/trustfile/en/resources/amazon-warehouse-locations.html.

[4] Local use tax information is available from the Sales Tax Institute at http://www.salestaxinstitute.com/resources/rates, accessed Mar. 12, 2018.

[5] “Amazon Fulfillment Center Locations.” Avalara TrustFile. Accessed Mar. 12, 2018. Available at: https://www1.avalara.com/trustfile/en/resources/amazon-warehouse-locations.html.

[6] Mazerov, Michael. “States Should Adopt a Version of Colorado’s Remote Sales Tax Law.” Center on Budget and Policy Priorities. Aug. 3, 2017. Available at: https://www.cbpp.org/research/state-budget-and-tax/states-should-adopt-a-version-of-colorados-remote-sales-tax-law.

[7] The Sales Tax Institute reports that some Alaska localities levy use taxes while others do not. See http://www.salestaxinstitute.com/resources/rates, accessed Mar. 12, 2018.

[8] A description of the Act, and of amendments made in 2017, is available from the Alabama Department of Revenue at: https://revenue.alabama.gov/sales-use/simplified-sellers-use-tax-ssut/.

[9] ITEP confirmed this by inputting shipping addresses located in Chicago, DeKalb, Galesburg, Peoria, Springfield, and Wheaton into the Amazon.com website and confirming that the sales tax amount charged matched the combined state and local sales tax rate levied within each of those localities.

[10] “Illinois Sales Tax Guide for Businesses.” TaxJar. Accessed Mar. 12, 2018. Available at: https://www.taxjar.com/states/illinois-sales-tax-online/#how-to-collect-sales-tax-in-illinois. For an interesting overview of the history of this issue in Chicago and Cook County, see: Hamer, Brian. “A Fair Revenue Solution for Cook County.” State Tax Notes. Dec. 4, 2017.

[11] “Colorado Sales Tax Guide for Businesses.” TaxJar. Accessed Mar. 12, 2018. Available at: https://www.taxjar.com/states/colorado-sales-tax-online/#how-to-collect-sales-tax-in-colorado.

[12] Colorado Department of Revenue. “Retailer’s Use Tax Return: Instructions.” DR 0173. Jun. 22, 2016. Available at: https://www.colorado.gov/pacific/sites/default/files/DR0173.pdf.

[13] Colorado Department of Revenue. “Colorado Sales/Use Tax Rates.” DR 1002. Dec. 29, 2017. Available at: https://www.colorado.gov/pacific/sites/default/files/DR1002.pdf.