South Carolina legislators will return next week to try to finalize a few issues before the end of their session and fiscal year on June 30th, including the question of how to respond to the federal Tax Cuts and Jobs Act (TCJA). The state’s income tax code is closely coupled to federal tax law, though not set up to automatically change when federal law changes, so lawmakers can essentially choose to 1) do nothing, leaving their tax code as it is, 2) fully conform to the relevant changes in the TCJA, or 3) conform more selectively to the TCJA, possibly while also considering further changes to their tax code. That’s a short timeframe with some important questions at stake, and some misinformation has been spread, so here’s a quick guide to the facts, issues, and options.

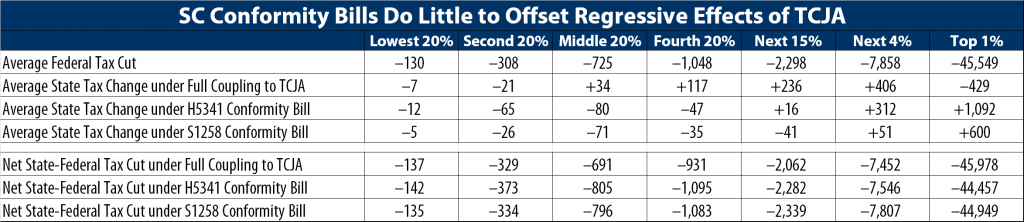

The context of the TCJA and South Carolina’s budget: The first and most important piece of information is that the TCJA greatly reduces federal taxes for South Carolinians (see table below and our state-by-state data on the TCJA here). These cuts are highly skewed toward higher-income people and, for all income levels, dwarf any of the tax changes being considered at the state level. The sheer size of the tax cuts in the TCJA also makes it inevitable that federal funding flowing to South Carolina will be reduced, leaving the state to either pick up a greater share of the tab for public safety, infrastructure, health care, and education — or watch the quality of those services wither. Meanwhile, South Carolina is already struggling to fund K-12 and higher education and to afford raises for teachers and other public employees.

What happens if they do nothing? Taking no action this session would leave the state income tax code as it is, which somewhat lessens the urgency of reaching agreement next week. Some lawmakers argue this would make filing state taxes more complicated, but that’s not the case since most states (including South Carolina) vary from the federal code in numerous ways already. In any event, they will eventually need to update their references to the federal code, so the debate is an important one even if it is not highly urgent.

What would full conformity look like? Because of the state’s close conformity to the federal tax code, remaining coupled to every provision the state currently couples to would be a significant change. The state’s personal exemption would be eliminated, its standard deduction would roughly double, several itemized deductions would be eliminated or changed, and the state would adopt one of the TCJA’s most regressive changes, the new deduction that allows individuals to write off 20 percent of pass-through income. On net, mostly because of the personal exemption elimination, this would raise an estimated $170-$250 million annually while offsetting only around 5 percent of the TCJA federal tax cut on average and no more than about 11 percent for any income group (see nearby table).

What are the options on the table and what are their strengths and weaknesses? In addition to the federal TCJA effects and the prospect of fully conforming to its changes, we have modeled two proposals put forth in South Carolina so far, the House’s H 5341 and a more recent proposal on the Senate side, S 1258. Both bills would couple to most of the TCJA changes but de-couple from the pass-through deduction. H 5341 would then institute a new personal exemption at a lower ($1,525) amount. S 1258 preserve personal exemptions at their current ($4,050) level, break from the federal standard deduction but increase the state deduction about 20 percent, speed up implementation of some changes passed last year, and adjust key parts of the tax code for inflation. These bills have a number of strengths and weaknesses for lawmakers to take into consideration when they return:

- Both bills take the commendable step of de-coupling from the federal pass-through deduction, coupling to which would predominantly benefit a small number of high-income residents while costing the state around $75 million per year.

- With these bills, lawmakers have also resisted the temptation to use this minor revenue bump as an excuse to cut taxes for higher-income families through rate reductions, as was done in several other states such as Georgia, Idaho, Iowa, Missouri, and Utah.

- On the other hand, both bills would miss an opportunity to improve the regressive nature of South Carolina’s tax code by recouping a larger share of the massive federal tax cut going to wealthy South Carolinians and/or finding more targeted means of reducing taxes for low- and middle-income families through a mechanism such as making the state’s new Earned Income Tax Credit refundable.

- Both bills are roughly revenue neutral, which can be seen as both a strength and a weakness. Relative to the reckless decisions made in some other states such as Idaho and Iowa, which both deeply cut their revenues going forward, these bills’ revenue-neutral approach is a notable strength. And distributionally, most of the revenue gain under full conformity would come from eliminating the personal exemption, which is available to all taxpayers, rather than more targeted means that would focus on the high-income beneficiaries of the TCJA. But it should be noted that in the context of impending federal funding cuts and other growing needs, forgoing a chance to raise some needed revenue to put toward those needs can be seen as a weakness.

- Finally, some misinformation has been spread that might be influencing the drafting and interpretation of these bills. For example, one lawmaker publicly made the blatantly misleading claim that “simple conformity, as we routinely do it, will result in South Carolina taxpayers paying more income taxes to the state, eliminating any benefit gained by the federal reductions.” As noted above and shown in the table, even full conformity would only offset about 5 percent of the federal tax cut on average, and for no income group does the state change come close to eliminating those federal cuts. There are negative effects of the TCJA worth trying to mitigate at the state level, most notably its extreme tilt in favor of high-income individuals, but South Carolina lawmakers do not need to worry that any of the options currently being discussed will leave residents paying more in total federal and state taxes than they are paying right now.

All in all, each of these bills is a mixed bag that could be improved but could be much worse. South Carolina legislators still have time to improve on these drafts and improve both the distribution and adequacy of their tax code.