Even as the haze from western wildfires reduced visibility across the nation this week, voters got more clarity on what to expect to see on their ballots this fall, particularly in California (commercial property taxes and corporate surcharges), Colorado (income taxes for education), Missouri (gas tax update), and North Dakota (recreational cannabis). Meanwhile, although Virginia lawmakers won’t return until 2019, they got a preview of a clear-headed federal conformity plan they should strongly consider. And look to our “What We’re Reading“ section for further enlightenment from researchers on the [in]effectiveness of charitable contribution credits, the [lack of] wage growth for America’s workers, and what [a few] states are doing to prepare for the inevitable next recession.

— MEG WIEHE, ITEP Deputy Director, @megwiehe

Major State Tax Proposals/Developments:

- Voters in COLORADO will decide whether to raise an additional $1.6 billion for education this November. Initiative 93 is the third attempt in seven years to allocate more public funding in support of education. If approved, the corporate income tax rate and personal income tax rates on those with more than $150,000 in taxable income would increase, generating monies to help fund full-day kindergarten, expand preschool opportunities, and boost special services for those with different abilities and English as Second Language Learners. — LISA CHRISTENSEN GEE

- In CALIFORNIA, supporters of an initiative that would change how commercial properties are assessed report they have collected enough signatures to appear on the 2020 ballot. If passed, this measure would close the commercial property assessment loophole that was put in place 40 years ago by Proposition 13. — LISA CHRISTENSEN GEE

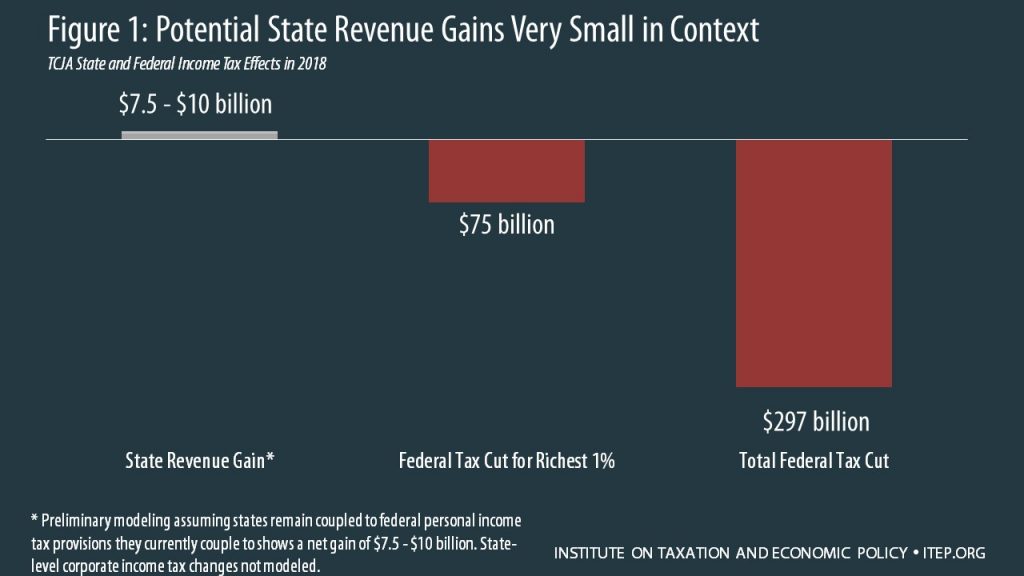

- VIRGINIA lawmakers opted to wait until 2019 to decide how to respond to the federal tax cut bill that will slash taxes for wealthy individuals and corporations and, due to an unusual relationship between the Virginia and federal tax codes, raise around $500 million in state revenue. Ralph Northam has an idea for them that echoes some of our advice to states from earlier this year: use about half of the revenue gain to make the state’s Earned Income Tax Credit (EITC) fully refundable, delivering significant benefits to the low- and middle-income working families who could most use the help and were mostly ignored in the federal bill. — DYLAN GRUNDMAN

On the Ballot:

- A court in MISSOURI has dismissed a lawsuit that would have stopped a gas tax update from the ballot, so voters will be able to weigh in on the question in November after all.

- NORTH DAKOTA voters will have a chance this year to create an additional revenue source by legalizing recreational cannabis

- Voters in Boulder, COLORADO will decide this November if the city can keep extra tax revenues raised by the soda tax or if the revenues will have to be returned to distributors per TABOR. The soda tax passed via ballot in 2016 and raised closer to $5.2 million than the originally projected $3.8 million.

- In Mountain View, CALIFORNIA, voters will determine whether they think large business (like Google) should pay more via employee surcharges (similar to the “head tax” proposed and killed by Amazon in Seattle earlier this year). Voters in San Francisco and East Palo Alto will also have the chance to vote on measures that will tax large companies to help address the housing affordability crisis brought on in part by the presence of these large, successful companies.

State Roundup:

- Two corporate giants in CALIFORNIA—Apple and Genetech—are engaged in ridiculously high-volume, year-long disputes with local assessors as to the appropriate valuations of their equipment and other properties. Apple argues that a collection of new buildings at its headquarters is only worth $200. Genetech has more than 653 unresolved appeals, clogging up the county tax appeals board process and tying up monies that would otherwise be invested into public services. Challenges to assessments are legal, but these tactics reek of poor corporate citizenship.

- A NEW JERSEY lawmaker has released the recommendations of his Economic and Fiscal Policy Review Committee, which include consolidating school districts, reducing public employee health and pension benefits, and reviewing tax exemptions. The committee also proposes transferring ownership of major state assets such as the New Jersey Turnpike to the pension fund as a way of improving its finances.

- OREGON’s Supreme Court recently held that businesses must pay corporate income taxes on income earned in the state even if they don’t have a physical presence.

- Counties in MISSISSIPPI are looking at raising property taxes and going into debt to re-open at least a few of the 500 county-owned bridges that are currently shut down due to safety concerns and state lawmakers’ unwillingness to raise the necessary revenue at the state level.

What We’re Reading…

- The TaxProf Blog calls out new research showing that state tax credits meant to incentivize charitable giving have no effect.

- Route Fifty warns that many states are underprepared for the inevitable next recession, and also highlights a few states that have done well to gird against it with reserve funds and other measures.

- From The Washington Post’s Wonkblog, inflation is wiping out meager wage growth in the US, a sign that an expanded economy is not bringing greater prosperity to middle- and working-class Americans.

- The Congressional Budget Office’s latest forecast predicts economic growth will rise towards the end of 2018 but slow in 2019.

- USA Today and the New York Times both feature the public policy disappointment that is the sales tax holiday.

If you like what you are seeing in the Rundown (or even if you don’t) please send any feedback or tips for future posts to Meg Wiehe at [email protected]. Click here to sign up to receive the Rundown via email.