Table of Contents: Why the United States Needs a Federal Wealth Tax | How a Federal Wealth Tax Would Be Administered | A Federal Wealth Tax Would Be Constitutional | Methodology | Acknowledgments

A federal wealth tax on the richest 0.1 percent of Americans is a viable approach for Congress to raise revenue and is one of the few approaches that could truly address rising inequality. As this report explains, an annual federal tax of only 1 percent on the portion of any taxpayer’s net worth exceeding the threshold for belonging to the wealthiest 0.1 percent (likely to be about $32.2 million in 2020) could raise $1.3 trillion over a decade.

Many working families know that a large part of their wealth is their home, which is subject to an annual property tax at rates that, in some states, approach or even exceed one percent. The homes of the very rich typically make up a much smaller share of their overall wealth, meaning state and local property taxes have little effect on them.[1] A federal wealth tax could ensure that the net worth of the very rich is treated more like the wealth held by the middle-class.

This report also addresses the two most commonly raised objections to proposals for a federal wealth tax, which are related to administrability and constitutionality. The challenges in administrating such a tax are real but can be overcome. The objection that the tax would violate the Constitution is based on vague constitutional provisions that were part of the compromise allowing slavery in the United States and that should be interpreted narrowly given how much the nation has changed since its founding.

Why the United States Needs a Federal Wealth Tax

The goals of raising revenue and addressing inequality will be difficult to achieve if federal tax policy continues to focus on taxing income almost exclusively.

One reason is that wealth inequality is much greater than income inequality. The 1 percent of Americans with the highest incomes receive about a fifth of the total income in the United States.[2] In contrast, the top 1 percent of wealth holders in the nation own 42 percent of the nation’s wealth according to estimates from Emmanuel Saez and Gabriel Zucman.[3]

Likewise, the racial wealth gap is far greater than the racial income gap in the United States. According to Census data, median income in 2017 was about $68,000 for white households compared to $50,000 for Latinx households and about $40,000 for black households.[4] The racial wealth gap is far more dramatic because it is a result of generations of compounded inequality. A recent report from Prosperity Now finds that in 2016 median wealth in the nation was $140,500 for white households but just $3,400 for black households and $6,300 for Latinx households.[5]

Wealth inequality has grown dramatically in the past several decades. Saez and Zucman found that the share of wealth held by the very wealthiest 0.1 percent—a group of just 160,700 families who all had net worth exceeding $20 million in 2012—tripled from 7 percent in 1978 to 22 percent in 2012.[6] By 2012, the wealthiest 0.1 percent held nearly as much wealth as the bottom 90 percent, who owned 22.8 percent of the total.

Wealth fluctuates considerably from year to year, but the trend over the past several decades has been for it to grow much more rapidly for those at the top. The data from Saez and Zucman show that the wealth of the top 0.1 percent grew by an average of 9.5 percent annually from 1986 through 2012 whereas wealth of the bottom 90 percent grew by an average 4.3 percent during that period.

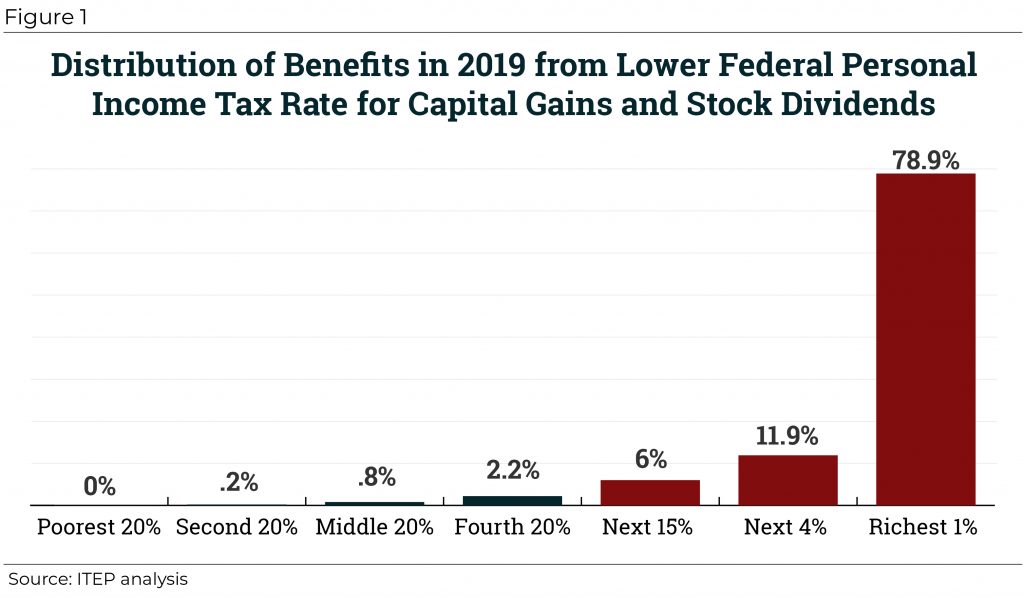

Another, closely related problem with relying on income taxes is that much of the income received by the richest Americans is “unrealized capital gains” which are not taxed. When the value of an asset rises, for all practical purposes that increase in value is income for the owner of the asset, but our current laws do not tax this income until the asset is sold. (In other words, capital gains on an asset are not “realized” until the asset is sold.)

This means that wealthy individuals who own a disproportionate share of all assets can defer paying tax on much of their income for years, allowing their wealth to grow much more rapidly. Meanwhile, most income of working Americans (income like wages or interest on a savings account) is taxed annually.[7]

While this may seem like an arcane matter, it allows the net worth of the wealthiest to build up much more rapidly and substantially. For example, one tax expert estimated in 2015 that Warren Buffett, whose net worth was then nearly $70 billion, would have been worth $9.5 billion if his capital gains had been taxed each year regardless of whether assets were sold.[8]

This means that much of the economic income flowing to the very wealthy each year is entirely exempt from the personal income tax.[9] The very thing that is driving inequality—the rapid appreciation of assets held by the wealthy—is itself nearly untouched by federal taxes.[10]

One solution is for the federal government to tax that wealth directly. The following explains how a mere 1 percent annual federal tax on the wealth of the top 0.1 percent of households would work assuming it takes effect in 2020.

In 2020, a family would likely need to have net worth exceeding $32.2 million to be part of the wealthiest 0.1 percent of Americans. (Estimates are explained in the methodology section at the end this report.) The tax would be imposed on net worth exceeding $32.2 million in 2020 and the threshold would be adjusted each year. This means that, for example, in 2020 a taxpayer with a net worth of $32.4 million would pay 1 percent of $200,000, which comes to $2,000.

Jump to: Why the United States Needs a Federal Wealth Tax | How a Federal Wealth Tax Would Be Administered | A Federal Wealth Tax Would Be Constitutional | Methodology | Acknowledgments

How a Federal Wealth Tax Would Be Administered

One common objection to imposing a tax on a family’s total wealth is that wealth is difficult to measure precisely, making such a tax difficult to administer. Some assets owned by the wealthy are relatively easy to appraise, particularly publicly traded stocks and other securities that have a readily ascertained market value. Anyone can look to a stock exchange to see what a particular stock is worth on a given day.

Other assets could be more difficult to appraise. An ownership stake in a closely held business, for example, does not sell on a public exchange and its market value is therefore not immediately obvious.

But the I.R.S. already does, in theory, assess the net worth of the very wealthy, including all types of assets they own, in order to impose the federal estate tax. The only fundamental difference is that an estate tax is imposed on a person’s net worth just once, at the end of her life, whereas a wealth tax would be imposed annually on net worth.

Estimating the value of a family’s net worth annually poses some additional challenges. It can sometimes take several years for the I.R.S. to assess the estate of a very wealthy decedent. The process would need to be significantly streamlined to make an annual wealth tax workable.

Non-Publicly Traded Business Assets

Legislation creating a federal wealth tax could facilitate the appraisal of taxpayers’ interests in businesses that are not publicly traded and therefore do not have value that is easily determined. The I.R.S. might value such a business with a formula that considers its profits and some of its more easily appraised assets. Another alternative would be to have the business valued periodically, perhaps every five years. The I.R.S. could assume that it would appreciate according to some measure of average growth in the years in between. (A new valuation could be done sooner at the option of the taxpayer.)

Real Estate

Assessments of real estate are currently carried out by local governments to collect property tax but are not done in a consistent way that could be helpful to the I.R.S. in enforcing a federal wealth tax. Local governments also lack the resources to counter the very aggressive tactics that wealthy individuals and their companies use to challenge assessments of commercial and residential real estate.[11] To help address this problem, legislation creating the federal wealth tax could instruct that whenever a taxpayer challenges an assessment of real estate by the I.R.S., the Treasury Department would provide the taxpayers’ own appraisal of their real estate to any state or local government that is considering acquiring the property through eminent domain.[12] State and local governments that obtain property this way are required, under the Fifth Amendment of the U.S. Constitution, to provide “just compensation” to the property owner. The state or local government could very plausibly argue that just compensation can be based on what the property-owner told the I.R.S. his property was worth. The possibility of this would discourage wealthy owners of real estate from understating the value of their properties to the I.R.S. for the purposes of the federal wealth tax.[13]

Trusts

Assets held in trust are for some purposes treated as if they are not actually owned by any person. A wealthy person might place assets in a trust to benefit his child, who cannot access those assets or the income from those assets except as stipulated by the trust document. This fact, and the various inconsistent rules regarding how such assets and income should be treated, allow some people to use trusts to avoid the federal estate and gift tax. Under a federal wealth tax, assets placed in a trust should be treated as owned by the grantor of the trust (by the person giving assets to the trust) until that person’s death, at which point the beneficiaries of the trust should be treated as owning its assets.

Resources for Enforcing the Wealth Tax

A federal wealth tax could raise so much revenue that the I.R.S. would be justified in devoting significant resources to its enforcement. Consider an extreme scenario in which Congress must increase the I.R.S.’s budget by 30 percent to implement a wealth tax. The entire budget for the I.R.S. in 2010, just before Congress started to cut it, was about $14 billion in 2018 dollars.[14] If Congress spent $5 billion of the wealth tax revenue on increasing the I.R.S.’s budget for enforcement, that would amount to a tiny fraction of the overall revenue collected from the tax. The methodology section uses reasonable assumptions to project that the wealth tax would raise more than $100 billion each year it is in effect.

It is also important to keep in mind that rather than collecting from the entire population of the United States, I.R.S. personnel enforcing the wealth tax would be focusing on just the wealthiest 0.1 percent of Americans. As explained in the methodology section, this would likely be about 175,200 families in 2020.

Offshore Assets

Like the federal estate tax, the federal wealth tax would have a worldwide reach. An individual cannot shield assets from the estate tax by holding them offshore, and the same would be true of the wealth tax. Taxpayers with significant assets offshore are already required to report them to the federal government. The United States requires taxpayers with more than $10,000 in offshore financial accounts to file a Foreign Bank Account Report, or FBAR, with the Treasury Department to prevent financial crimes. In 2010 Congress enacted the Foreign Account Tax Compliance Act (FATCA), which requires taxpayers living in the country to file information about offshore assets with their federal income tax returns if those assets exceed $50,000 in the case of singles or $100,000 in the case of married couples. (The thresholds are much higher for Americans living abroad.) While enforcing a federal wealth tax may require some finetuning of the I.R.S.’s ability to calculate the value of assets held offshore, the basic infrastructure to do this is already in place.

Jump to: Why the United States Needs a Federal Wealth Tax | How a Federal Wealth Tax Would Be Administered | A Federal Wealth Tax Would Be Constitutional | Methodology | Acknowledgments

A Federal Wealth Tax Would Be Constitutional

While the arguments in favor of it are many and compelling, conversations about a federal wealth tax are sometimes met with an objection that it is unconstitutional. In fact, the Supreme Court opinions that are often claimed to bar any such tax are themselves aberrations in the Court’s long history of giving deference to Congress’s power to impose taxes, and if followed today they would bar some tax provisions that have been in effect for years.

Whether a federal wealth tax would be consistent with the U.S. Constitution hinges on the question of what is a “direct” tax. Two different parts of the Constitution describe how Congress can impose a direct tax without defining what a direct tax is. One explains that direct taxes must be apportioned among the states based on population (meaning the total amount paid by each state would be the same per capita), but with each enslaved person counting as three-fifths of one person. The other states that if such a tax is imposed it must be in proportion to population as determined by a census or “enumeration.”

“Representatives and direct Taxes shall be apportioned among the several States which may be included within this Union, according to their respective Numbers, which shall be determined by adding to the whole Number of free Persons, including those bound to Service for a Term of Years, and excluding Indians not taxed, three fifths of all other Persons.”

“No capitation, or other direct, Tax shall be laid, unless in Proportion to the Census or Enumeration herein before directed to be taken.”

It is clear that a capitation (a head tax) and a tax specifically on real estate were both thought to be direct taxes at the time the Constitution was drafted. Southern states, with large populations of slaves and abundant land, believed that they could be disproportionately harmed by such taxes and negotiated these provisions of the Constitution to limit the federal government’s ability to impose such taxes. What other types of taxes are direct taxes?

As explained in a 1999 article by Bruce Ackerman and a more recent article by Dawn Johnsen and Walter Dellinger, the drafters themselves seemed unclear about what taxes might be described as “direct” but included the language as part of the compromise that would bring slave states and free states together as one nation—a nation where human beings were held as property.[15]

Johnsen and Dellinger argue that the “Framers’ lack of clarity about the constitutional meaning of ‘direct’ taxes actually may have served the goal of compromise on the issue that threatened the defeat the new Constitution and the new nation: the ambiguity could be read as best suited the reader.”[16]

Starting with the 1796 case Hylton v. United States, the Supreme Court dealt with this uncertainty by ruling that a direct tax was any tax that could reasonably and sensibly be apportioned by population. In this reading, the point of these constitutional provisions was simply to specify how such a tax should be apportioned, according to a Census and counting each enslaved person as three-fifths of a person.

The direct tax clauses of the Constitution are part of the infamous Three-Fifths Compromise. Delegates to the Constitutional Convention from southern states wanted slaves counted as part of their populations for determining the number of Representatives elected to the House from each state. At the same time, the southern delegates did not want slaves counted as part of the population for the purpose of any federal tax that was apportioned by population. The men who spoke on behalf of southern states at the Convention wanted to maximize their clout in Congress while minimizing the federal taxes paid by their states. The “compromise” that southern and northern delegates settled upon was to count each enslaved person as three-fifths of a person for both purposes. The direct tax clauses are part of that compromise.

Johnsen and Dellinger explain that “constitutional text may not be ignored simply because it was the product of compromise rather than thoughtful policy—even compromise inextricably infected by the evils of slavery. At the same time, in construing this unclear, undefined eighteenth-century text, we must keep in mind the inherent ambiguity given that compromise, and more generally, the great differences in the economic circumstances and understandings of that time.”[17]

Ackerman goes even further and refers to Three-Fifths Compromise as the “tainted origins” of these clauses. The Thirteenth Amendment abolished slavery and made the Three-Fifths Compromise irrelevant, and, he argues, the rest of the language referring to direct taxes is also mostly irrelevant for all practical purposes today.

The language makes clear that a “capitation” tax or a head tax, imposed in equal amount per individual, would be a direct tax.[18] It was also commonly believed that a tax on real property (land and buildings on it) would also constitute a direct tax. At the time the Constitution was drafted, some held the view that all income was derived from land so a tax on land itself was a direct tax.[19] (Note that even though a wealth tax would be imposed on net worth, which can include real estate, it is fundamentally different from a tax on land or real estate alone.[20]) Many people at the time also apparently believed that slaves were a type of real estate.

Most types of taxes that we are familiar with today would be unworkable if they were to be apportioned. Imagine there are two states, Poorland and Richland, that have the exact same population. If a tax is apportioned by population, the total amount of that tax paid by these states would be the same. Imagine that Richland had twice as much wealth as Poorland. If a wealth tax was subject to the apportionment requirement, then the residents of Poorland would have to pay the wealth tax at a rate that is exactly twice the rate paid by those of Richland. That is the only way that residents of both states would pay the same amount of tax per capita, as required under an apportionment rule.

In the 1796 case Hylton v. United States, the Supreme Court saw that this would be absurd and held that a federal tax on carriages was not a “direct” tax. Because carriages were owned mainly by the wealthy, one might think of this as something like a tax on yachts or luxury cars today. The Justices who ruled on the case had been involved in drafting and ratification of the Constitution. They found that the apportionment requirement applied “in such cases where it can reasonably apply,” as one of them put it. Another of the Justices noted that southern states “possessed a large number of slaves” and “extensive tracts of territory, thinly settled, and not very productive,” and could therefore be burdened by either a per-head tax or a per-acre tax imposed by the federal government and thus these were the taxes that the Framers most clearly meant to limit. The Supreme Court applied this reasoning for a century, upholding unapportioned federal taxes on income, financial transactions and inheritances.

Those who argue that a federal wealth tax is unconstitutional point to the Supreme Court’s sharp turn away from this reasoning in 1895 in Pollock v. Farmers’ Loan & Trust Company, when the closely divided court decided that the term “direct tax” included any tax on real or personal property, and any tax on the income earned from such property. The income tax that Congress had enacted the year before was thus struck down.

The court’s decision was widely criticized by legal scholars and was, according to Johnsen and Dellinger, “contrary to all authority when a bare majority announced it.”[21]

The Pollock decision so outraged the public that Americans took the extraordinary step of amending the Constitution to reverse Pollock’s holding and allow a federal income tax. The Supreme Court never entirely reversed Pollock—it never needed to because the 16th Amendment, ratified in 1913, allowed Congress to impose a federal income tax. But what is left of Pollock’s reasoning regarding other types of federal taxes?

Ackerman, Johnson and Dellinger explain that the Supreme Court quickly backed away from its reasoning in Pollock in many ways, largely returning to the logic of Hylton, so that Pollock stands out as an aberration in the Court’s history of addressing the issue.

For example, in 1900, just five years after Pollock, the Supreme Court upheld a federal tax on inheritances as a tax on the transfer of wealth. (An inheritance tax is like an estate tax but is technically paid by the recipient of the inheritance rather than by the estate itself.) As already explained, a federal wealth tax in principle is very similar to a federal inheritance or estate tax except that it is imposed each year rather than just once, upon an individual’s death. It is difficult to believe that a wealth tax violates the Constitution while an inheritance or estate tax does not.[22]

The only case in which the Court again applied the type of reasoning found in Pollock was Eisner v. Macomber in 1920. In that case, the Court struck down a federal tax on stock dividends on the theory that the tax was partly being imposed on unrealized capital gains.

While never expressly overturned, this opinion has been limited to the point of irrelevance by subsequent court opinions. If the logic of Macomber was truly in force today, several tax provisions that have been on the books for years would actually be unconstitutional.[23] For example unrealized capital gains are already to some degree subject to federal income tax under section 1256 of the code, which subjects certain derivatives to mark-to-market taxation, and section 475, which subjects securities held by dealers to mark-to-market taxation. No one has ever suggested that these parts of the tax code must be struck down.

Those who believe a wealth tax to be unconstitutional might point to a more recent opinion, National Federation of Independent Businesses v. Sebelius, the 2012 case that upheld the Affordable Care Act. Chief Justice John Roberts, writing for the majority, admits that “Even when the Direct Tax Clause was written it was unclear what else, other than a capitation… might be a direct tax.”

But then he goes on to write,

That narrow view of what a direct tax might be persisted for a century. In 1880, for example, we explained that “direct taxes, within the meaning of the Constitution, are only capitation taxes, as expressed in that instrument, and taxes on real estate.” In 1895, we expanded our interpretation to include taxes on personal property and income from personal property, in the course of striking down aspects of the federal income tax. Pollock v. Farmers’ Loan & Trust Co. (1895). That result was overturned by the Sixteenth Amendment, although we continued to consider taxes on personal property to be direct taxes. See Eisner v. Macomber, (1920).

But it is difficult to imagine that citing Pollock and Macomber in this way indicates that a majority of the justices believe those precedents to be binding today. Both opinions are exceptions in the Court’s long history of construing the term “direct tax” very narrowly as the Hylton court did. As already explained, if Macomber is still on solid legal ground, that would mean that several tax provisions that have been in force for years are unconstitutional.

Johnsen and Dellinger note the “terrible irony that would result if Pollock’s misreading of the ‘direct’ tax apportionment limitation—the product of the Constitution’s ‘original sin’ in accepting slavery—were to hinder Congress in addressing a wealth disparity that overwhelmingly disadvantages African Americans.”

As mentioned earlier, a recent report finds that in 2016, median wealth in the United States was $140,500 for white households but just $3,400 for black households and $6,300 for Latinx households.[24]

Jump to: Why the United States Needs a Federal Wealth Tax | How a Federal Wealth Tax Would Be Administered | A Federal Wealth Tax Would Be Constitutional | Methodology | Acknowledgments

Methodology for Estimating the Revenue Impact of a Federal Wealth Tax

Saez and Zucman project that in 2020, the wealthiest 0.1 percent of households will each have a net worth exceeding $32.2 million. If a federal wealth tax on the wealthiest 0.1 percent goes into effect in 2020, it would apply to net worth in excess of $32.2 million that year.

Their most recent data show that the top 0.1 percent owned 19.6 percent of U.S. wealth in 2016. They project that total wealth in the country in 2020 will reach $98.9 trillion, and assuming the top 0.1 percent would continue to own 19.6 percent of that, the total amount of wealth held by this group would come to $19.4 trillion in 2020.[25]

The amount of taxable wealth under this proposal would equal that $19.4 trillion minus whatever amount is exempt because of the $32.2 million exemption. The total exempt amount in 2020 would equal $32.2 million times the number of households belonging to the top 0.1 percent that year, likely to be about 175,200, which comes to $5.6 trillion. Taxable wealth would therefore equal $19.4 trillion minus $5.6 trillion, which comes to $13.8 trillion.

The wealth tax would be imposed at a rate of 1 percent on this amount. But some non-compliance and challenges in enforcement would inevitably mean less is collected. While it is very difficult to predict the degree of this problem, one might analogize to the federal estate tax, which is the existing federal tax most similar to a wealth tax. Based on the IRS’s estimates of the “tax gap” (the amount of taxes that are owed but not paid), it appears that only about 86 percent of the estate tax is paid when it is due.[26] (Most of the rest is collected later through enforcement and late payments, but in the interest of being cautious in our estimation we assume that such efforts would either be unsuccessful or would have results outside the usual ten-year budget window that is of most interest to lawmakers.)

Assuming the same level of non-compliance would apply to a federal wealth tax, the effective tax rate imposed would be 0.86 percent rather than 1 percent.[27] In 2020, the effective tax of 0.86 percent on the $13.8 trillion in taxable wealth would raise about $118 billion.

The most recent 20 years of data compiled by Saez and Zucman (1997 through 2016) show that total wealth in the United States grew by an average rate of 5.9 percent. Total wealth of the top 0.1 percent alone grew at an average rate of 8.3 percent. This analysis makes a conservative assumption that the wealth of the top 0.1 percent will grow at the historical average rate for all wealth, 5.9 percent. If the top 0.1 percent see their net worth grow at a greater pace, then the wealth tax would raise more revenue than estimated here.

| TABLE 1: Revenue Impacts of a 1% Annual Tax on Wealth Exceeding Threshold to Belong to the Top 0.1 Percent (billions) | ||||||||||

| 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2020-2029 |

| – | 117.7 | 122.8 | 128.1 | 133.6 | 139.3 | 145.2 | 151.3 | 157.7 | 164.3 | 1,260.0 |

| Source: Calculations by the Institute on Taxation and Economic Policy based on data from Emmanuel Saez and Gabriel Zucman. | ||||||||||

In years after 2020, the wealth held by the top 0.1 percent is calculated as the wealth held the previous year, minus the wealth tax paid for the previous year, increased by the 5.9 percent average growth rate. The exempt amount, which is adjusted annually, is subtracted to calculate taxable wealth. It is assumed that the tax collected would equal 0.86 percent of taxable wealth each year.

Of course, the revenue impact can vary because the growth of the wealth held by the top 0.1 percent can vary dramatically. From 1997 through 2016 the growth rate for the wealth held by this group ranged from a high of 22 percent to a low of negative 8 percent.

Operationally, payment of the wealth tax would probably occur in the year following the year it is assessed. (The tax on one’s net worth in 2020 would be paid largely or entirely in 2021.) That means that only nine years of wealth tax revenue would be collected in the first decade it is in effect.

Based on all the assumptions described here, the total revenue collected from 2020 through 2029 would come to nearly $1.3 trillion.

It is unlikely that the wealth tax would change the behavior of wealthy people in any consequential way. In theory, a tax on wealth could influence a taxpayer’s decisions about how much income to save or consume. Such a tax might reduce the benefit of saving and therefore increase consumption, or it might increase saving if the taxpayer needs to save more to achieve a set target for savings. However, this particular proposal is unlikely to have any significant effects either way because most of the taxpayers affected have so much wealth that there are few practical ways to consume it to avoid paying the tax.[28]

Even assuming that the wealth tax does not change taxpayer behavior, it could affect the revenue collected by other types of taxes. But this analysis does not speculate on such effects because they would be very difficult to determine and not necessarily significant.

For example, if most of these taxpayers pay the wealth tax out of income that otherwise would have been invested in income-generating assets, then the affected taxpayers would have less dividends, capital gains, interest and other capital income in the future and thus pay less in income taxes. On the other hand, the money collected by the federal government through a wealth tax would be spent by the government somehow, which means it would become income to other people who would pay taxes on it. Also, in the case of a taxpayer whose net worth is great enough to be subject to the wealth tax but whose income in a particular year is low or negative, assets might be liquidated in order to pay the wealth tax (for example, corporate stocks might be sold) which would generate capital gains that would be taxed. In other words, a federal wealth tax could have both negative and positive effects on other types of federal taxes, so it is not clear what the net impact would be. It seems reasonable to assume that effects on other types of federal taxes will not significantly reduce the overall revenue yield of the wealth tax described in this analysis.

Jump to: Why the United States Needs a Federal Wealth Tax | How a Federal Wealth Tax Would Be Administered | A Federal Wealth Tax Would Be Constitutional | Methodology | Acknowledgments

Acknowledgments

I would like to thank Emmanuel Saez and Gabriel Zucman for their inspiration and technical assistance, and Dawn Johnsen for her insights into the Constitution. I am also grateful to Bruce Ackerman for helping me as I started to think about this concept several years ago. Any errors are solely my own.

[1] Data from Emmanuel Saez and Gabriel Zucman suggest that in 2012, housing made up a quarter of the wealth of the bottom 90 percent of Americans, but made up just 4 percent of the wealth of the top 0.1 percent of Americans. See the data accompanying their paper, “’Wealth Inequality in the United States since 1913: Evidence from Capitalized Income Tax Data,” 2016. http://gabriel-zucman.eu/uswealth/

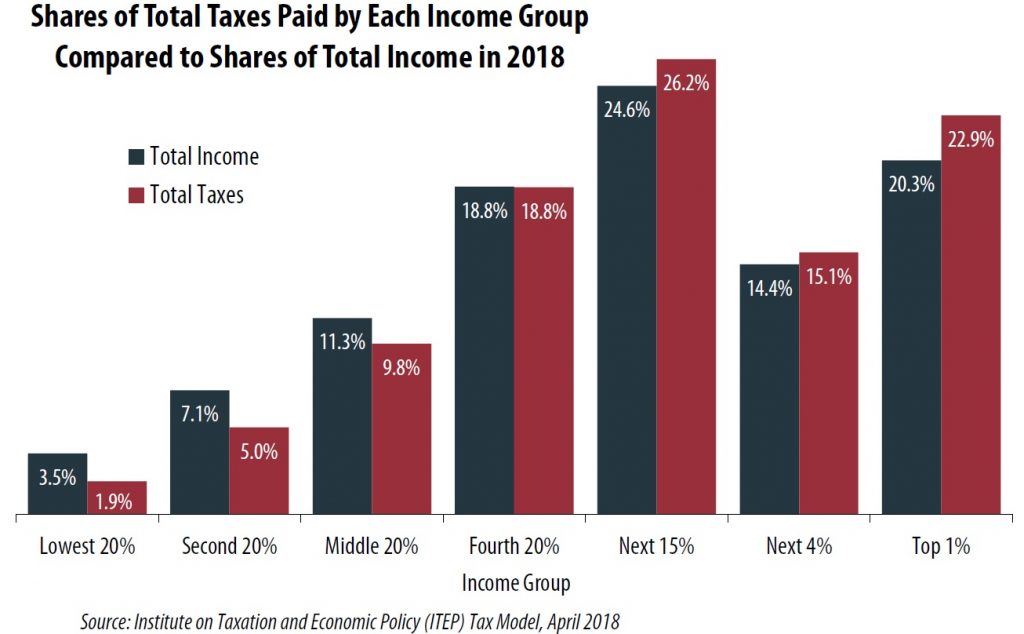

[2] ITEP projects that the richest 1 percent will receive 20.3 percent of total U.S. income in 2018. Steve Wamhoff,

“Who Pays Taxes in America in 2018?” April 11, 2018. https://itep.org/who-pays-taxes-in-america-in-2018/ The most recent data from the Congressional Budget Office show the richest 1 percent receiving 18.4 percent of U.S. income in 2015. The CBO figure is lower partly because CBO assumes that, while corporate income taxes are paid by people, corporate profits are not income to people except for the taxes paid on them and to the extent that they are paid out as stock dividends or realized as capital gains on stock sales. Congressional Budget Office, “The Distribution of Household Income, 2015,” November 8, 2018. https://www.cbo.gov/publication/54646

[3] Saez and Zucman.

[4] Kayla Fontenot, Jessica Semega, and Melissa Kollar, “Income and Poverty in the United States: 2017,” September 2018, U.S. Census Bureau, Figure 1. https://www.census.gov/content/dam/Census/library/publications/2018/demo/p60-263.pdf

[5] Emanuel Nieves and Dedrick Asante-Muhammad, “Running in Place: Why the Racial Wealth Divide Keeps Black and Latino Families from Achieving Economic Security,” Prosperity Now, March 2018. https://prosperitynow.org/resources/running-in-place

[6] Saez and Zucman.

[7] A recent ITEP report provides an example of the benefits of deferral of income tax on unrealized capital gains. If $5 million was invested in an asset that appreciated 17.5 percent each year (the type of very high-yield investments that extremely wealthy individuals sometimes have access to) the asset would be worth a little more than $25 million after a decade and, if then sold and subject to ordinary income tax rates, would leave about $16.9 million to the investor. But if the gains on the asset were subject to income tax each year the way wages and interest are taxed the investor would be left with just $13.4 million at the end of the decade. The investor therefore enjoys a tax break of $3.5 million because taxes on unrealized capital gains are deferred until the asset is sold and the gains are realized. See Steve Wamhoff, “Congress Should Reduce, Not Expand, Tax Breaks for Capital Gains,” Institute on Taxation and Economic Policy, August 1, 2018. https://itep.org/congress-should-reduce-not-expand-tax-breaks-for-capital-gains/

[8] This even assumes that Buffett would be subject to the preferential income tax rates for capital gains. David S. Miller, “How Mark-to-Market Taxation Can Lower the Corporate Tax Rate and Reduce Income Inequality,” October 2015. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2544048&download=yes

[9] It would be possible for Congress to change this and apply the personal income tax to these gains. Subjecting gains to income tax annually regardless of whether an asset is sold is called “mark-to-market” taxation and it already applies in some very limited situations. If applied to all types of assets, this system could be extremely complicated, but arguably it could be viable if imposed only on the very richest taxpayers, who are equipped to deal with complex tax rules and accounting. The ITEP report on capital gains explains one proposal to subject the richest 0.1 percent of Americans to mark-to-market taxation. While this proposal can be difficult to explain to the public, it is an alternative to a federal wealth tax.

[10] One exception is the federal estate tax, which is like a wealth tax except that it only taxes an individual’s net worth once, at the end of her life. Because a wealth tax would be imposed each year, it could more easily address the problem of wealthy people building up their wealth more rapidly by deferring tax on unrealized capital gains. An estate tax can, in theory, solve the same problem by being imposed once, at the end of an individual’s life, but at a much higher rate. If the estate tax was to be used to solve this problem, lawmakers would also have to close its many loopholes and reverse recent legislative changes that have gutted the estate tax.

[11] For example, see Katherine Sullivan, “Trump’s Company Is Suing Towns Across the Country to Get Breaks on Taxes,” April 11, 2018. https://www.propublica.org/article/trump-inc-podcast-trump-organization-suing-towns-property-tax-breaks

[12] In fact, the Treasury Department could make property tax assessments used for the purposes of the wealth tax available generally to help local governments collect their own property taxes. Some local governments could find it easier to adopt the assessments made by the IRS.

[13] Some scholars have proposed such a scheme to prevent property owners from undervaluing their real estate for the purposes of local property taxes. For example, see Abraham Bell & Gideon Parchomovsky, “Taking Compensation Private,” Standford Law Review, 2007. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=806164

[14] Paul Kiel and Jesse Eisinger, “How the I.R.S. Was Gutted,” ProPublica, December 11, 2018. https://www.propublica.org/article/how-the-irs-was-gutted

[15] Bruce Ackerman, “Taxation and the Constitution,” Columbia Law Review, 1999. https://digitalcommons.law.yale.edu/fss_papers/127/; Dawn Johnsen and Walter Dellinger, “The Constitutionality of a National Wealth Tax,” Indiana Law Journal, Winter 2018. https://www.repository.law.indiana.edu/ilj/vol93/iss1/8/

[16] Johnsen and Dellinger, pages 118-119.

[17] Johnsen and Dellinger, page 120.

[18] Ackerman explains that the words “or other direct tax” were added during the Constitution’s drafting at the last minute by a delegate from Delaware who was concerned that the federal government would try to collect on past due “requisitions” owed by the states under the Articles of Confederation. Delaware was one of the states that had failed to pay such requisitions, which were the main way the federal government could collect revenue under the Articles. The weakness of this system was one of the reasons the Constitution was drafted and adopted.

[19] Ackerman, page 16.

[20] Ackerman makes this point at the end of his article. Imagine that a taxpayer must pay a local property tax on her home. The tax is based on the value of the real estate, of the land and the building, and typically does not take into account any other aspect of the taxpayer. Now assume that she also pays a tax on her net worth. Her real estate may be quite valuable but her net worth, even though it includes the real estate, might be negative if she is heavily indebted. In fact, a mortgage on the real estate itself could be the reason her net worth is negative. As a result, she would owe no wealth tax even though she pays the tax that is imposed specifically on real estate.

[21] Johnsen and Dellinger, page 114.

[22] The court ruled that an inheritance tax was not a direct tax on property “solely by reason of its ownership.” But, as Ackerman points out, the inheritance tax would seem to be much more of a direct tax on property than the income tax that was struck down in Pollock.

[23] Ackerman, page 52, note 211.

[24] Emanuel Nieves and Dedrick Asante-Muhammad.

[25] Emmanuel Saez and Gabriel Zucman, unpublished updated data.

[26] The I.R.S. estimated that each year from 2008 through 2010, estate tax noncompliance contributed $4 billion to the gross tax gap (the taxes owed and not paid when due, before enforcement and late payments close some of that gap). Internal Revenue Service, “Federal Tax Compliance Research: Tax Gap Estimates for Tax Years 2008–2010,” May 2016. https://www.irs.gov/pub/irs-soi/p1415.pdf The average revenue collected by the estate tax in those years was $23.7 billion. This implies that noncompliance reduced estate tax revenue by 14 percent.

[27] In this context we use the term “effective rate” to describe the rate effectively imposed on taxable wealth, which is a taxpayer’s total wealth minus the exempt amount. The true effective tax rate on a taxpayer’s total wealth would therefore be a smaller percentage.

[28] The macroeconomic response to a tax increase depends critically on what economists refer to as the “marginal propensity to consume” (MPC), a concept that translates changes in after-tax income or wealth into changes in consumption expenditures (and associated changes in saving). While empirical estimates of such MPCs depend critically on the type of behavioral model posited, the nature of the expenditure/income data used (i.e., cross-sectional, time series or panel data) and the nature of the tax change (e.g., permanent or transitory), voluminous research findings over the years have yielded some robust qualitative conclusions regarding MPCs. Most relevant to the wealth tax are: (1) the MPC out of wealth tends to be much smaller than the MPC out of income, on average over all income/wealth cohorts; and, (2) the MPC out of wealth tends to be much smaller for the wealthiest households than that for the least wealthy households (see, for example, C. Carroll, et.al., [2017] “The distribution of wealth and the marginal propensity to consume,” Quantitative Economics, vol. 8, 977-1020). These robust empirical results mean that a tax on a portion of the net worth of the wealthiest households would likely have only a small impact, if any, on their behavior.