For Tax Day, ITEP has released several new reports that tell a broad story about our nation’s federal, state and local tax systems, providing important details about taxes we all pay and research on the tax-paying habits of Fortune 500 corporations. And of course, we have a trove of other tax policy resources.

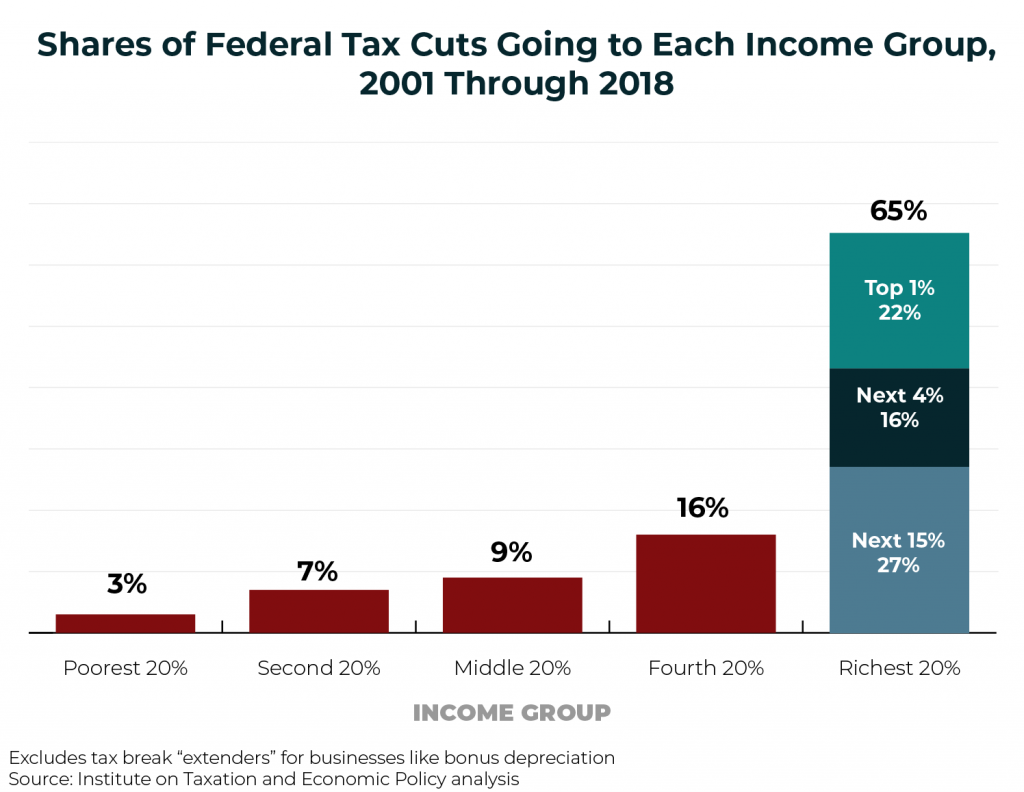

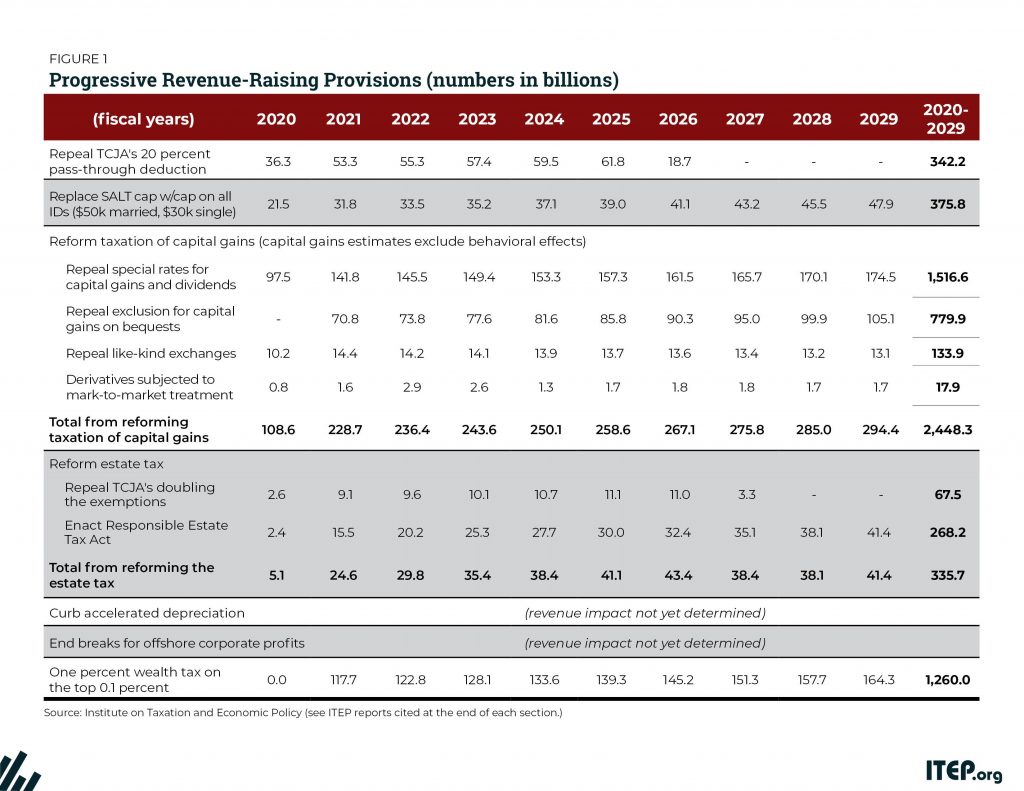

- In the wake of the 2017 tax law and its substantial cuts that mostly benefited corporations and the wealthy (and will pile trillions onto the national debt), public discourse is shifting toward whether the rich should pay more in taxes. In a new chart book, The Case for Progressive Revenue Policies, ITEP explains why Congress should increase taxes on the rich. An ITEP report released in February, Progressive Revenue-Raising Options, describes proposals that would achieve that goal.

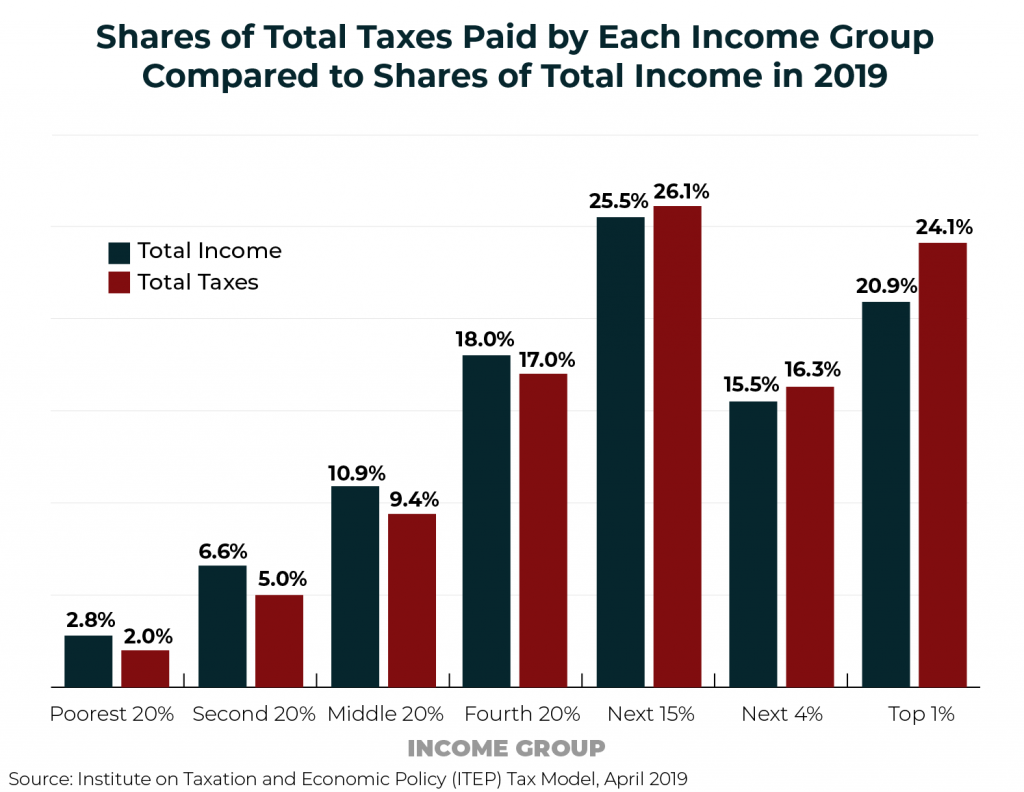

- Every year, ITEP analysts release Who Pays Taxes in America?, a comprehensive distributional analysis of the combined federal, state, and local tax rates paid by people across the income spectrum. This report provides important context for conversations about federal and state tax policies. It demonstrates that our overall tax system is barely progressive and dispels myths about the wealthy paying all the taxes.

- An ITEP report released last week, Corporate Tax Avoidance Remains Rampant under New Tax Law, provides an initial look at the tax-paying habits of corporations under the Tax Cuts and Jobs Act, which cut the federal corporate tax rate to 21 percent. Our analysts examined 2018 corporate financial filings released to date and found 60 Fortune 500 corporations that were profitable but nonetheless avoided federal income taxes. The corporations represent a range of industries and used a variety of breaks to zero out their tax bills. This comes after earlier ITEP reports revealed tech giants Amazon and Netflix both avoided all federal income taxes. ITEP also last month published a blog based on Treasury data that revealed corporate tax collections declined by 31 percent from in FY2018 over the previous year.

A few ITEP state resources that may interest you this Tax Day:

- Forty-five out of 50 states tax the lowest-income 20 percent at higher rates than the top 1 percent. Released last October, ITEP’s flagship report, Who Pays? Sixth Edition, provides a comprehensive analysis of tax systems in all 50 states and the District of Columbia. It also includes ITEP’s Inequality Index, a 50-state ranking that shows how states compare when it comes to their tax systems’ effect on income inequality.

- A companion piece to Who Pays?, Fairness Matters: A Chart Book on Who Pays State and Local Taxes, further distills the study’s findings. It includes detailed charts that define how state tax systems widen the income gap between the rich and poor families. For example, take a look at this chart, which shows how, after taxes, share of total income for the rich increases while declining for lower-income households.

- Another report dispels the myth that states without income taxes are “low tax.” Low-Tax States Are Often High-Tax for the Poor takes a look at the 10 states with the highest tax rates on the lowest-income 20 percent.

- Taxing Cannabis examines how much revenue states are raising from legalized recreational cannabis and outlines best practices for structuring cannabis taxes.

- If you’re interested in undocumented immigrants’ tax contributions, take a look at Undocumented Immigrants State and Local Tax Contributions. Information on the taxes that undocumented young immigrants pay is here: State and Local Tax Contributions of Young, Undocumented Immigrants.