Some problems can only be solved when public officials have the resources to act. Today’s public health crisis is that kind of problem. Unfortunately, the Trump administration’s deep tax cuts leave our health infrastructure knee-capped, just when we need it most. This means more Americans will get sick, the economy will suffer more harm, and more people could die.

Assertive, smart policy changes can protect us from the worst consequences. Changes to the tax code need to be among them. Here are five policies Congress and the Trump administration should enact to address coronavirus (also called COVID-19) and prepare us for future crises.

- Spend now on smart health policy: At the Institute on Taxation and Economic Policy, we study and make recommendations on tax and economic policy. Other policy experts propose spending to ensure American well-being—including expanding health coverage and investing in public health infrastructure. We should listen to those experts now. Nearly 30 million Americans lack insurance—in part because their states have rejected federal Medicaid dollars. On an emergency basis, states should be required to expand Medicaid until the coronavirus threat is eliminated. A bipartisan November report outlined seven ways federal policy should prepare for pandemics, including replacing global health roles that President Trump eliminated and increasing global health investments. President Trump’s 2021 budget called for a 16 percent cut to the Centers for Disease Control and a 40 percent reduction in the U.S. contribution to the World Health Organization, amid other cuts. Instead, we should boost investment in domestic and global public health and expand health insurance coverage.

- Provide fast, well-targeted economic relief: Canceled events, supply chain disruptions to an already-declining manufacturing sector, and closed schools and offices are causing layoffs, furloughs, and spending reductions. Intervention can halt a downward spiral and relieve need by targeting help toward those most harmed, particularly those laid off or paid less during a downturn. Large corporations and wealthy individuals already gaming the tax code should not get more giveaways. We should expand unemployment insurance, eliminate work requirements and ease access to basic safety net programs, and require employers to offer paid sick days with the federal government picking up part of the cost, versions of which are being considered on a bipartisan basis now. Providing rebate checks to all adults and children would be better targeted and more equitable than the payroll tax cut that the Trump administration is pushing. A payroll tax cut delivers fewer benefits to poorer families, is less targeted to those who lack paid time off and can leave out people who lose their job because of the downturn. This makes it both less fair and less helpful to the economy.

The reforms above are needed immediately. Three more should be part of our long-term, permanent policy to address ongoing underinvestment:

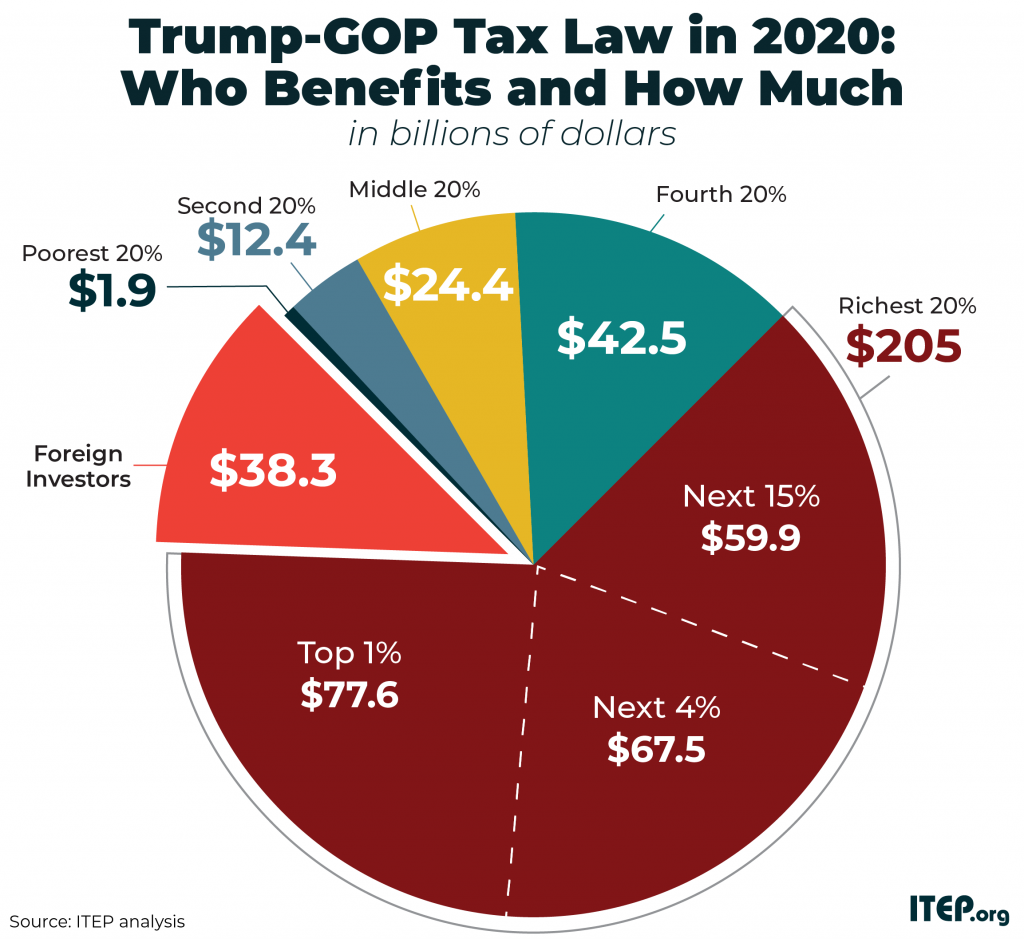

- Reverse the Trump tax cuts: Because of the Trump tax cuts, America will have $324.2 billion less in revenue this year. That could pay for a lot of test kits, vaccine research, and basic health care. The Trump administration directed 72 percent of its tax cuts to the wealthiest 20 percent of households. The average top one-percenter, earning over half a million a year, will get nearly a $50,000 windfall. Repealing the Trump tax cuts would increase tax collections in future years, help pay for recent appropriations to address the virus, and better prepare us for future health and climate catastrophes.

- Enforce corporate taxes: Corporate lobbyists have run circles around the Trump administration, paying a fraction of what the administration predicted when they slashed corporate tax rates. Ninety-one profitable Fortune 500 companies paid not a penny in federal income taxes in 2018 under Trump’s tax law. Most Fortune 500 companies pay less than half the 21 percent rate they’re supposed to pay under statutory law. JetBlue and Delta airlines paid no 2018 taxes—both might now wish the public sector had more resources to address a crisis that could wipe out $113 billion in airline revenues.

- Impose a wealth tax and reform capital gains taxation, directing some of the proceeds to health and climate: A 1 percent tax on wealth above about 32 million would raise about $1.3 trillion over the next decade. Similarly, we tax work more than earnings from capital gains, which go almost entirely to the wealthiest. Instead, the same rules should apply to both. A large share of the proceeds from wealth and capital gains taxes should go to climate and health infrastructure, so we can be better prepared for the next flood, hurricane, or pandemic.

Crises are inevitable but we have power over our response. The Trump administration’s weak response is making our people and likely our economy sicker. There are consequences to destroying our shared capacity to confront problems. We’re about to learn how deep.

The current disaster threatens our health and our economy. Ongoing crises stem from fast-accelerating climate change, skyrocketing inequality, and inadequate federal response to both. We as a country have the resources to address collective problems. But solving them requires that we pull together, raise taxes on those most able to pay, and fund public servants to act in our collective interest. Our future depends on it.