Sens. Kamala Harris, Bernie Sanders and Edward Markey released a proposal to provide a monthly payment of $2,000 for each member of a household (including up to three dependents), with benefits phased out at income levels starting at $200,000 for married couples. The monthly payments would last until three months after the Secretary of Health and Human Services declares that the health emergency has ended.

The proposal is partly a response to concerns that one-time cash payments under the CARES Act, which amount to $1,200 ($2,400 for married couples) and $500 for each child under age 17, are not sufficient to help families make ends meet or boost the economy. Unlike the CARES Act, the Harris-Sanders-Markey proposal (hereinafter the HSM proposal) provides payments for dependents regardless of age and undocumented immigrant adults who file taxes with an Individual Taxpayer Identification Number (ITIN) as well as their children.

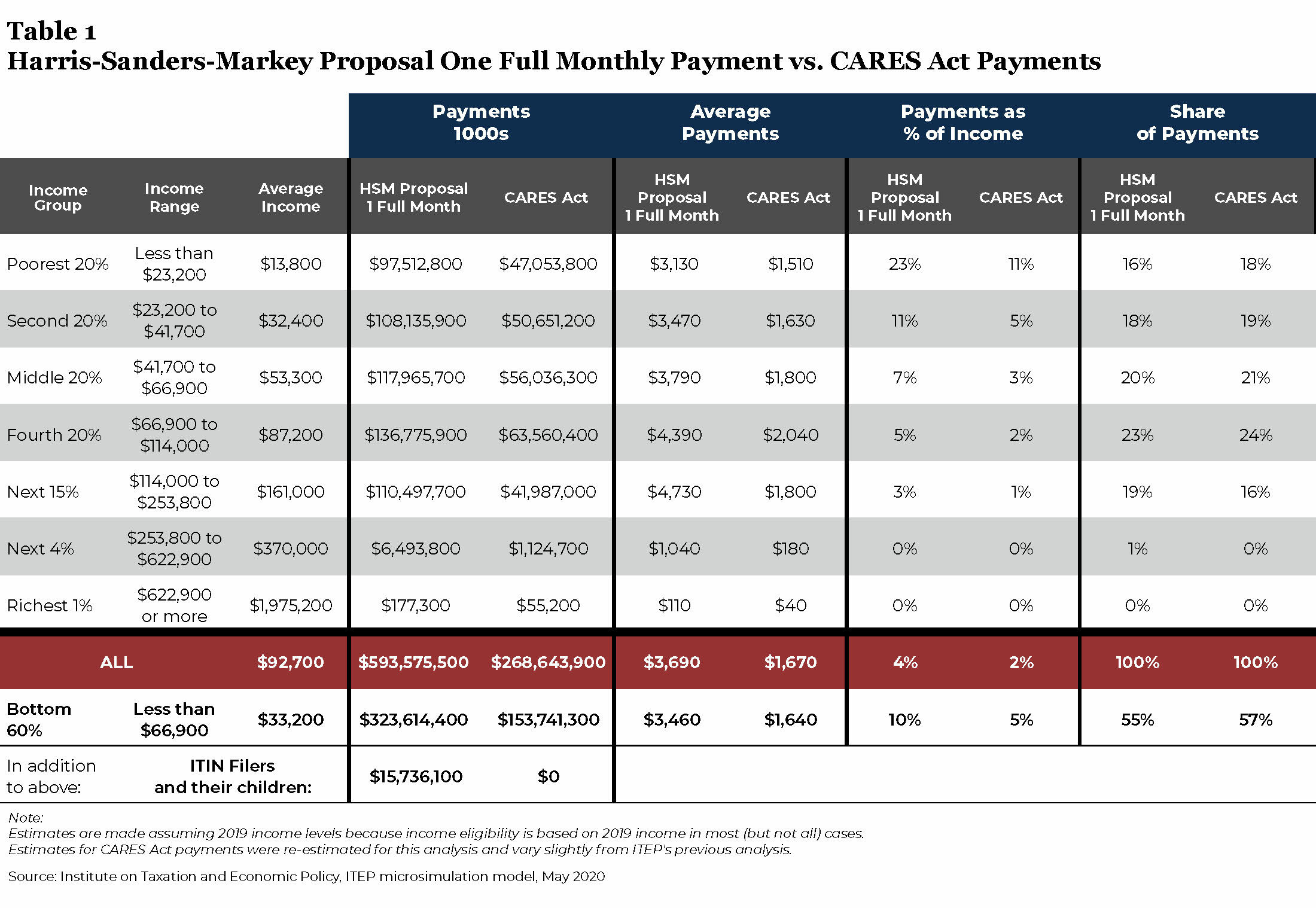

The first month’s payment under the HSM proposal would be a partial payment, as explained further on. Table 1 compares a full monthly payment under the HSM proposal to the one-time payment made under the CARES Act.

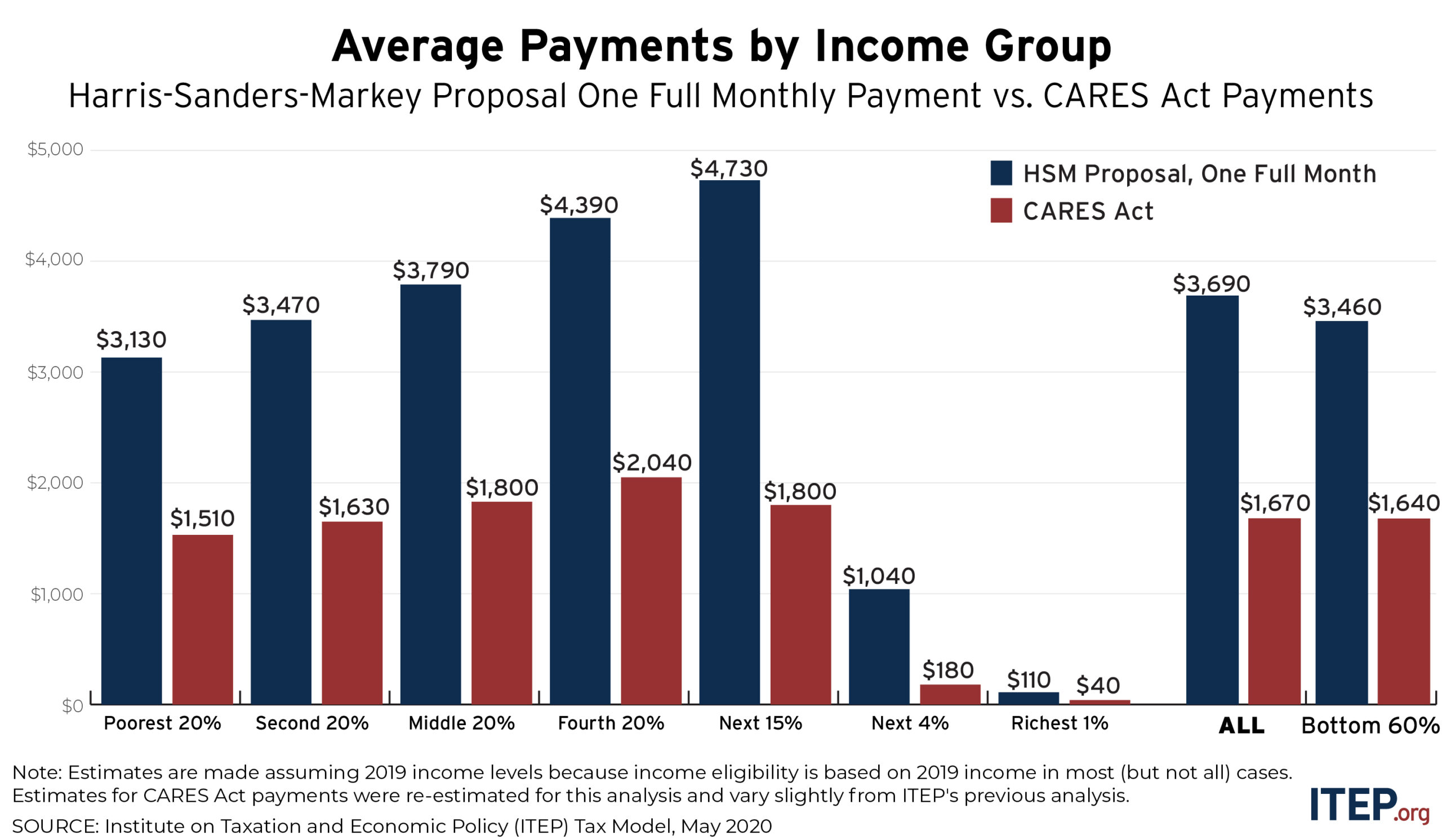

A full month of payments under the HSM proposal would provide nearly $600 billion to households, more than twice as much as the CARES Act. The average full monthly payment under the proposal would be about $3,690, compared to $1,670 under the CARES Act.

Compared to the CARES Act benefit, the payments under the HSM proposal would be larger for each recipient and would be made in equal amounts for dependents of all ages (but for no more than three dependents).

Also illustrated in Table 1, but separate from the main estimates, is $16 billion in payments that would be made to immigrants working in the United States who file taxes using an Individual Taxpayer Identification Number (ITIN). This relatively small amount (compared to the total) of payments would go to at least 7.9 million immigrant workers and their children who were excluded under the CARES Act.

More Details

The HSM proposal would provide $2,000 for each spouse and provide $2,000 each for up to three dependents. This means that a family of five or more could receive up to $10,000 monthly. The benefit would be phased out at a rate of $10 for each $100 of income exceeding $200,000 in the case of married couples, $150,000 in the case of single parents, and $100,000 in the case of singles.

The payments would also be retroactive to March. The March payment under this proposal would be calculated so that it would, when combined with the payment a household already receives under the CARES Act, equal $2,000 per member of the household. The payment provided under the HSM proposal for March would therefore be a partial payment, while each monthly payment afterward would be a full payment.

If enacted in May, the legislation would provide payments for at least six months, March through August. That is because if the Secretary of Health and Human Services declares the health emergency over sometime in May, the payments would continue for another three months under the legislation.

Table 2 compares the impacts of six months of payments under the HSM proposal, the minimum payments under the proposal, to the one-time payment under the CARES Act. For the HSM proposal, the first monthly payment is reduced by what households already receive under the CARES Act. As shown in Table 2, the minimum amount of payments under the HSM proposal would be about $3.3 trillion for the six months.

The bill has no limit on the number of monthly payments. In theory, the Secretary of Health and Human Services could choose not to declare the emergency over this year. Table 3 illustrates the impacts of the proposal if payments are made through the end of the year. In this scenario, the total payments made would be about $5.7 trillion.