Many states have tax systems that are regressive: They take a greater share of income from the poor than the rich. And because a disproportionate share of the richest taxpayers are white, these state tax systems also widen racial wealth gaps.

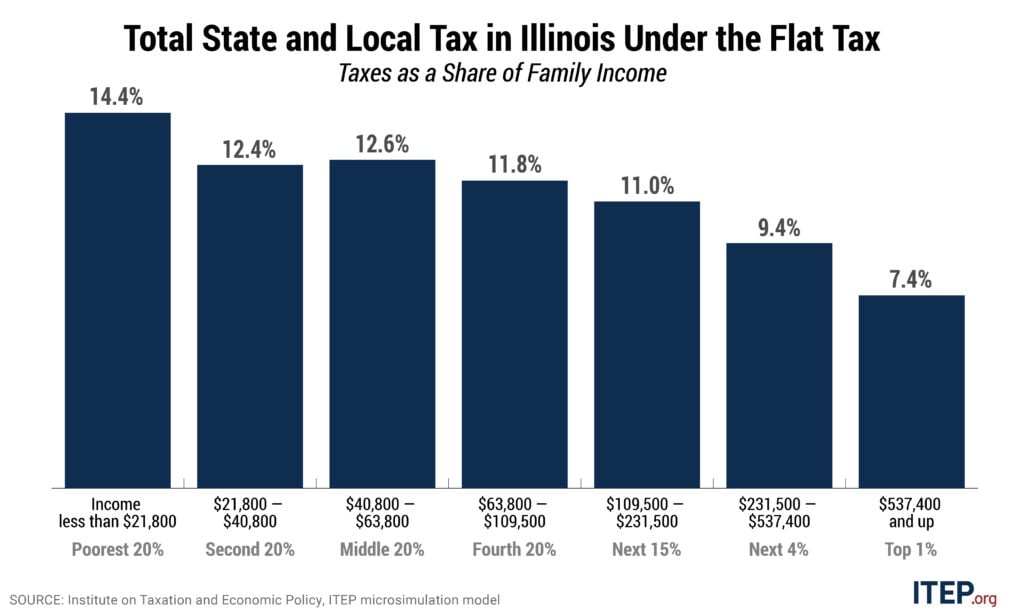

In Illinois, for example, the lowest-earning fifth of the population pays 14.4 percent of its income in state and local taxes, according to a new study by the Institute on Taxation and Economic Policy. The middle-earning fifth pays 12.6. The highest-earning 1 percent of residents pays 7.4 percent. Read more