States face shifting landscapes as they attempt to deal with both emergent and longstanding issues in their tax codes and budget structures. This is particularly evident in Oklahoma, where lawmakers must adjust to a U.S. Supreme Court decision that literally redraws state boundaries by recognizing the rights of indigenous communities, but is true in every state, and lawmakers in many of them are rising to the challenge. Read below and see our blog posted today for more on bold proposals that increase tax fairness and solidify bottom lines with needed revenue in states including Connecticut, Minnesota, New York, Pennsylvania, Vermont, and Washington.

Governors’ Annual Addresses and State of State Speeches

- MARYLAND Gov. Larry Hogan used part of his speech to argue for tax cuts and spread myths about “tax flight,” but also encouraged lawmakers to enact his $1 billion Covid-19 recovery plan that includes helpful boosts to workers who qualify for the EITC.

- OKLAHOMA Gov. Kevin Stitt noted in his 2021 State of the State address that the most pressing issue is how the state will handle the U.S. Supreme Court’s decision in McGirt v. Oklahoma that changes how the state will apply tax to tribal areas. The state stands to potentially lose $200 million a year as a result of these changes; the governor explained that he has invited sovereign tribes to work with the state.

- Other recent speeches with less tax content included those by ALABAMA Gov. Kay Ivey, ALASKA Gov. Mike Dunleavy, MICHIGAN Gov. Gretchen Whitmer, MONTANA Gov. Greg Gianforte, RHODE ISLAND Gov. Gina Raimondo, and TEXAS Gov. Greg Abbott.

- A full list of scheduled addresses is available here, including those to come soon in TENNESSEE and WEST VIRGINIA.

Other Major State Tax Proposals and Developments

- Lawmakers in CONNECTICUT are debating and advancing a number of progressive tax bills, many of which closely reflect the recommendations of state experts published in December. In addition to mansion tax and capital gains proposals mentioned here last week, legislators are considering bills to raise income taxes on high-income households, strengthen the estate tax, create a child tax credit that would reach the vast majority of families with children, and boost other supports such as the EITC and property tax credit. – DYLAN GRUNDMAN O’NEILL

- DISTRICT OF COLUMBIA legislation will now be routinely assessed for impact on racial equity, which will be important in many policy areas and should help dispel the illusion of race-neutral tax policy and point lawmakers to ways the tax code can advance racial justice. – DYLAN GRUNDMAN O’NEILL

- Gov. Tom Wolf of PENNSYLVANIA proposed a bold plan to raise much needed revenue and to address inequities within the state’s tax system. The proposal includes an increase to the state’s flat personal income tax rate (from 3.07 percent to 4.49 percent), coupled with an expansion of the Keystone State’s tax forgiveness credit. In effect, the tax increase is designed to ensure that only the top third of wage-earners pay more. – AIDAN DAVIS

State Roundup

- ARIZONA Republicans are looking to advance a bill that would cut property taxes for businesses, in a way that does not lead to increases for homeowners, by having the state make up the difference.

- ARIZONA Republican lawmakers are also hoping to expand the state’s school voucher program by giving qualifying students $4,300 a year to attend private or parochial school, or parents can use the money for home schooling or forming a group with neighbors to teach their kids.

- DELAWARE legislators have waived income tax on unemployment benefits received during 2020.

- Lawmakers in HAWAII are considering a range of legislation, including a tourist surcharge on gas-powered vehicles and an increase to the state’s liquor tax.

- INDIANA lawmakers are considering increasing the cigarette tax and imposing the tax on e-cigarettes and e-liquids.

- IOWA Gov. Kim Reynolds’s proposal to hand out voucher-like subsidies for private schools would drain more than $20 million in funding from the state’s public schools, the state’s own analysts say.

- Republican lawmakers in KANSAS narrowed a tax cut plan that would have initially cut revenues by $329 million a year to $170 million, to help it clear a committee vote.

- MARYLAND lawmakers are considering both alcohol and tobacco tax increases this session.

- NEBRASKA lawmakers are holding hearings on many tax bills. School proponents and local officials came out in strong opposition to Gov. Pete Ricketts’s new unfunded cap on property taxes. Lawmakers also discussed a new tax credit for companies that help employees pay down student loans, how the state might tax recently legalized casino gambling, and a proposal to greatly expand the sales tax base while lowering the rate.

- Despite revenues that were already inadequate and were also among the hardest-hit by the pandemic’s effect on tourism, NEVADA lawmakers are unlikely to entertain a major tax overhaul this session, but will be looking at adding a floor to one of their property tax ceilings and raising mining taxes.

- NEW YORK lawmakers fed up with the preferential tax treatment of income derived from existing wealth over income derived from work have introduced legislation that would add state-level capital gains taxes to make up for the lower rate applied to that type of income at the federal level, one component of the plan recently released by a coalition called Invest in Our New York.

- A NORTH DAKOTA bill that increases the state’s gas tax from 23 cents to 29 cents is heading to the House floor after gaining approval from the House Finance and Taxation Committee by a 9-5 vote.

- OHIO’s Gov. Mike DeWine released his biennial executive budget this week. The proposal includes no major tax changes and does not tap the state’s $2.7 billion rainy-day fund.

- OREGON’s revenue shortfall estimate is up to $1.6 billion over two years due to the combination of the Covid-19 pandemic and devastating wildfires.

- A key legislative commission recommended that VERMONT replace its state homestead education property tax with an income tax, stating that income—not house value—is a better representation of one’s wealth. Lawmakers in the state are considering this, along with other potential changes to the state’s tax structure.

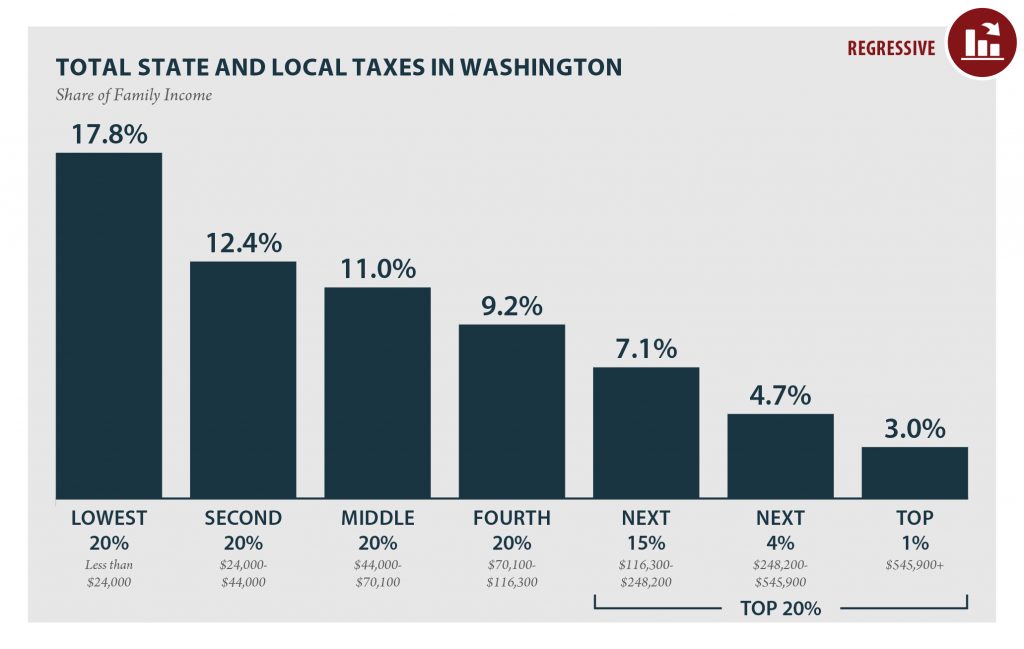

- WASHINGTON lawmakers looking for ways to improve on the most regressive tax code in the nation are embracing proposals to improve—and finally fund—a Working Families Credit based on the federal EITC, and also held a hearing on a proposed wealth tax on the state’s billionaires.

- In an informal poll to Republican colleagues, House leadership in WEST VIRGINIA explored which tax increases and budget cuts could be used to fund personal income tax elimination. On the table are the elimination of state funding to West Virginia and Marshall universities, the Promise Scholarship, increasing and expanding the sales tax, reinstating the food tax, and the legalization and taxation of cannabis.

- WYOMING lawmakers have introduced a bill to levy a $1 tax on each megawatt hour of electricity produced from large solar facilities.

What We’re Reading

- Governing brings to life what the pandemic budget squeeze means for local services and communities.

- Route Fifty explores ways state and local leaders can pursue economic development post-pandemic by centering resilience and inclusivity rather than tried-and-failed business tax subsidies and tax competition.

- Route Fifty also discusses the prospect of bringing back General Revenue Sharing, a Nixon-era federal-state program that helped alleviate pressure on state and local budgets.

- Pew’s podcast checks in on the state of state and local pension funds.

If you like what you are seeing in the Rundown (or even if you don’t) please send any feedback or tips for future posts to Meg Wiehe at [email protected]. Click here to sign up to receive the Rundown via email.