ITEP Senior Fellow Matt Gardner submitted the written testimony below to Maryland’s House Ways & Means Committee on February 20, 2025. Video of his oral testimony is at the bottom of this post.

Thank you for the opportunity to submit written testimony. My name is Matthew Gardner. I am a senior fellow at the Institute on Taxation and Economic Policy (ITEP), a nonprofit research group based in Washington, DC. ITEP’s research focuses on state and federal tax policy issues, with an emphasis on fairness and sustainability.

My testimony today focuses on the personal income tax reforms included in House Bill 1014. The testimony analyzes the effects, on Marylanders at different income levels and on the state’s budget, of four major provisions in the bill. These include two substantial revenue raising provisions (a restructuring of the state’s income tax brackets for high-income earners and a surtax on the “net investment income” of upper-income Marylanders), and two targeted tax cuts (an expansion of the Earned Income Tax Credit and an expansion of the Child Tax Credit).

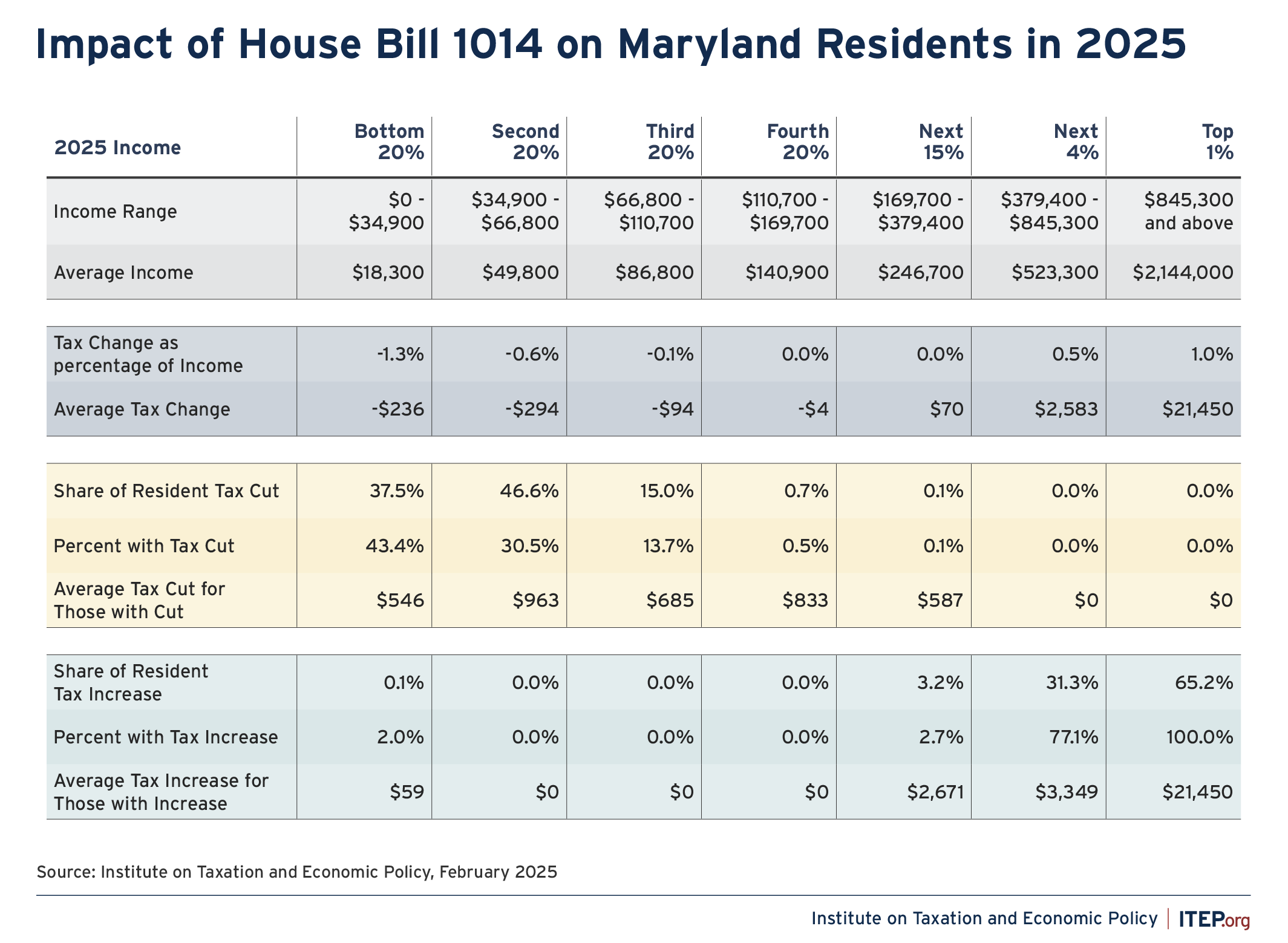

The table below shows the impact of the provisions described above if implemented in 2025.

Our analysis shows that:

- The poorest 60 percent of Marylanders would, on average, see a state tax cut from these provisions of House Bill 1014.

- Almost three-quarters of the tax cuts would go to the poorest 40 percent of Marylanders, those earning less than $66,000 in 2025.

- The best-off 40 percent of Maryland residents would, on average, see a tax increase from these provisions taken as a whole.

- Almost all of the tax increases for those Marylanders seeing a net tax hike (96 percent of the total) would be paid by the top 5 percent of Maryland residents, those earning over $379,000 in 2025.

- Virtually all middle-income Marylanders, the 40 percent of residents earnings between $66,000 and $169,000 in 2025, would either be unaffected by these tax changes or would see a small tax cut.

HB 1014 also includes a number of provisions that are not analyzed here. These include the bill’s “combined reporting” provision for corporate income taxes, a modification of the state’s estate tax, and a tax on certain pass-through entities. These provisions are excluded either because their ultimate incidence on individual taxpayers is difficult to determine, or because of data limitations due to the small number of taxpayers likely affected.

HB 1014 would restructure Maryland’s personal income tax brackets by eliminating the current top tax rate of 5.75 percent and creating three new flat tax rates, applicable to the entirety of taxable income. For married couples these three new rates would be 6 percent for taxpayers with taxable income between $300,000 and $600,000, 6.5 percent for those with taxable income between $600,000 and $1 million, and 7 percent for those with taxable income over $1.2 million. For single taxpayers and unmarried heads of households, these tax rates would apply at slightly lower amounts ($250,000, $500,000 and $1 million respectively).

The bill would also create a “net investment income tax” mirroring a feature of the federal income tax law and would expand the state’s Earned Income Tax Credit and Child Tax Credit.

We estimate that the overall impact of these four provisions on Maryland state revenues would be about $650 million if fully implemented in 2025. This includes a net tax increase of about $1.05 billion from the bracket changes and net investment income tax, and roughly $400 million in tax cuts from the EITC and CTC provisions. These estimates could be subject to revision in the near future given the current uncertainty regarding the employment status of Maryland residents who work for the federal government.

Overall, the provisions of HB 1014 analyzed here would make Maryland’s tax system substantially less regressive. The revenue raising provisions of HB 1014 would fall almost entirely on the very best-off Marylanders, and the Earned Income Tax Credit and Child Credit modifications proposed by the bill would provide meaningful tax relief to middle- and lower-income families. HB 1014 represents an important step toward a fairer, more sustainable Maryland tax system.

Thank you for the opportunity to submit this testimony.