State and local taxes exist primarily to fund schools, roads, health care, and other services needed for communities to thrive.

There are multiple ways to achieve this goal, so it can be helpful to evaluate different options based on a few core principles.

Tax policy involves tradeoffs, and not everyone will agree on how much to weigh each of those principles. That’s one reason people argue so much about it. But experts who study taxes generally agree that the concepts of adequacy, fairness, neutrality, simplicity, and accountability are central to a good tax system.

Adequacy

An adequate tax system raises enough funds to sustain the public services required for any healthy and successful community, like public education, roads and bridges, health care, and public safety. Conversely, an inadequate tax system undermines public services, harming everyone, often with particularly dire consequences for children, seniors, people with disabilities, and other vulnerable populations, and often making it harder for families and businesses to succeed. Since states and localities have laws requiring them to balance their budgets, they need to make sure there’s enough revenue to fund public services in the coming year.

But it’s not enough just to look at present-day needs. States and localities should be aiming for predictable, sustainable revenue so they will have enough funding to support necessary services five and 10 years down the road, in good times and bad, and meet the emerging needs of a thriving community. This requires not just good tax policy but also reliable and accurate revenue estimates to ensure that today’s tax policy changes don’t undermine tomorrow’s services.

One strategy for adequate taxation is to have a broad tax base rather than a narrow one. A broader tax base is more likely to keep pace with trends across the economy, growing along with the entire economy, which can help avoid unexpected revenue shocks that may hit just one sector. For example, in the sales tax, broadening the base could mean applying the tax not just to physical goods but to intangibles such as services and digital purchases. Another strategy is to rely more heavily on taxes with proven long-term sustainability, such as income taxes, than on sales and excise taxes that are often more narrowly based and less sustainable.

Fairness

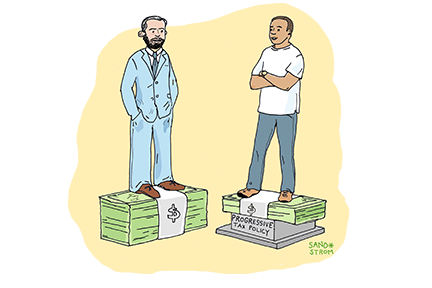

Tax fairness can be looked at in three important ways: vertical equity, horizontal equity, and benefits received.

- Vertical equity – sometimes also known as the ability-to-pay principle – holds that tax rates should be highest for those with the greatest financial capacity. Three terms are used in measuring vertical equity:

- Regressive tax systems take a larger share of income from low- and middle-income families than upper-income families, so they intensify income inequality.

- Proportional tax systems take the same share of income from all families.

- Progressive tax systems require upper-income families to pay a larger share of their incomes in taxes than those with lower incomes.

Vertical equity is a concept that can be applied to individual taxes. Sales taxes, for example, are almost always regressive, and graduated-rate personal income taxes are usually progressive. What’s most important, however, is the impact of the entire tax system. The more a state relies on regressive taxes such as sales and excise taxes, the more unfair it will be to lower-income residents. On the other hand, a highly progressive income tax can serve to balance out a regressive sales tax. Most states today – even many with income taxes – still have tax systems that fail the test of vertical equity.

- Horizontal equity is a measure of whether taxpayers with similar economic means pay similar amounts of tax. It would be hard to defend a tax system that intentionally taxed left-handed people at higher rates than right-handed people. Similarly, if two families of equivalent means living in the same town in equivalently valued houses pay different amounts of property tax that violates horizontal equity. This scenario occurs under California’s Proposition 13 property tax cap, which taxes long-time residents lower than newcomers. Such disparity undermines public support for the tax system and diminishes people’s willingness to file honest tax returns.

Another form of fairness is to tax people or businesses based on benefits received. For example, many states finance highway systems with gasoline taxes and vehicle excise taxes. These aren’t user fees, because drivers aren’t required to pay the taxes to use the road, and the amount they pay is not directly tied to the level of road use. But they do roughly connect tax paid to benefits received. Benefit-based taxation is particularly helpful when the beneficiaries are nonresidents such as out-of-state drivers or tourists who otherwise might not contribute to the cost of services; taxing non-residents is known as “exportability.” A danger is that taxes based on benefits received tend to be regressive for residents, so careful design is essential.

Policymakers should pay special attention to whether racial and ethnic minorities are treated unfairly – as they often are – under any of these standards. See “How Do State and Local Tax Systems Affect Racial Justice,” linked below.

Neutrality and Efficiency

Special tax breaks for sports stadiums, for example, squeeze out other possible investments and thus can slow economic growth.

The principle of neutrality tells us that most of the time, a tax system should stay out of the way of economic decisions. Tax policies that systematically favor one kind of economic activity or another can lead to misallocation of resources, or to schemes whose sole aim is to exploit such preferential tax treatment. If individuals or businesses make their investment or spending decisions based on the tax code rather than on their own judgment and preferences, that’s a violation of the neutrality principle and can lead to negative economic consequences. Special tax breaks for sports stadiums, for example, squeeze out other possible investments and thus can slow economic growth. Policymakers should generally avoid using tax policy to create “winners and losers” by promoting one sector of the economy ahead of another or by favoring one type of income over another, unless there’s an extremely good reason to do so.

The principle of neutrality also argues against trying to use tax policy to influence where businesses or individuals relocate. Policymakers should avoid lavishing unwarranted tax breaks on individual companies, because the consensus of researchers is that such subsidies rarely warrant the cost. Nor should policymakers worry much about concepts like “tax climate” to keep wealthy folks from leaving; again, researchers find that tax-induced relocation is much less significant than is commonly thought. Revenue lost to overly aggressive tax cuts could be better spent on strengthening public services to make places more desirable.

There is an exception to the principle of neutrality. It can sometimes be a good idea to levy particularly high taxes on products like cigarettes or fossil fuels that have large, measurable social costs. Economists describe such taxes as “efficient” because they address a known market failure. Those taxes succeed if they lead people to change their behavior, which (somewhat paradoxically) leads to less revenue. Less revenue may seem like a failure, but if behavior doesn’t change as anticipated – for example, if many taxpayers find ways to avoid paying the tax, or if the tax penalty is not sufficient — we may fail to alleviate those social costs, and we end up only with a tax that violates the principles of both vertical and horizontal equity.

Simplicity

All things being equal, we’d like our tax systems to be as simple as possible. Simpler tax rules make the tax system easier for taxpayers to understand and comply with. Simpler rules are often easier to enforce. And simplicity can make it harder for lawmakers to enact (and conceal) targeted tax breaks benefiting particular groups. A tax system full of complicated loopholes gives those who can afford clever accountants an advantage over those who must wade through the tax code on their own.

Still, we live in a complex world. Many regulations exist to clarify how taxes should be calculated, so just getting rid of regulations and forms doesn’t make the tax system easier to understand and comply with. Nor is a graduated tax system much more complicated than a flat rate. What really makes filing taxes more complicated – and makes the tax forms longer and longer each year – is the proliferation of special tax breaks. The best way to make taxes simpler is to eliminate unwarranted tax loopholes, not to flatten the rates.

Accountability

Just as citizens in a democracy have the right to know how tax dollars are spent, they also have a right to know how they are collected. A transparent and accountable tax system provides individual taxpayers with the information they need to calculate their taxes and gives the public the information it needs to determine whether the tax system is adequate, fair, and neutral. It also holds taxpayers accountable for paying what they owe and tax administrators accountable for making sure those payments are made at all levels of income. Accountability also means that policymakers who want to claim credit for tax cuts should explain how they will be paid for. Federal policymakers should avoid preempting state taxes, and state policymakers should avoid preempting local taxes.

A Final Note

It’s worth underscoring that all these principles are broad, and no one policy can accomplish them all. Just because a particular policy change violates one principle doesn’t mean we shouldn’t consider it. Rather, considering these principles can help us consider all the pros and cons of a specific proposal.

Related Entries

How Do State and Local Tax Systems Affect Racial Justice?

State and local tax codes have the potential to either narrow or widen racial inequality created by historical and current injustices in public policy and in broader society. In general, tax codes that are more progressive across the economic spectrum do more to narrow racial inequality, while regressive tax policies exacerbate it.

Do Tax Cuts Fuel Growth?

Tax policy is an important economic tool, but claims that tax changes will affect a state’s economy are often overstated. Such overstated claims are particularly common in discussions of taxes on wealthy individuals and profitable corporations, so careful assessment of such claims is an important part of shaping adequate and equitable revenue streams.

Learn More

- ITEP. Who Pays? A Distributional Analysis of the Tax Systems in All 50 States, Seventh Edition. 2024.

- National Conference of State Legislators. Tax Policy Handbook for State Legislators, Third Edition. February 2010.