Sales taxes are the second-largest source of revenue for state and local governments.

In nearly every state they are an important way we pay for public education, health care, public safety, and other services. But they are also typically the costliest tax for low-income families.

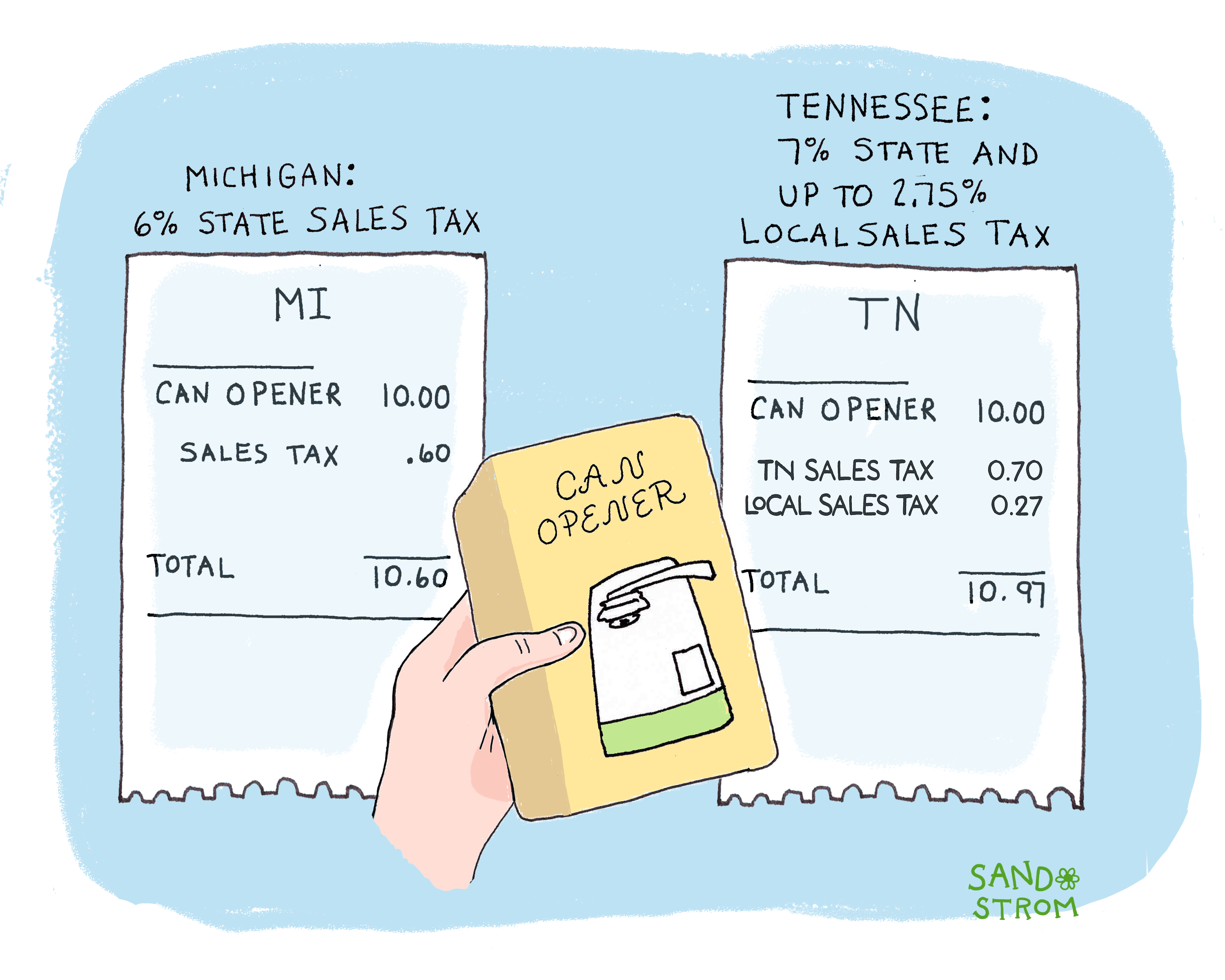

General sales taxes are levied in 45 states plus the District of Columbia and Puerto Rico. They apply to items we purchase every day. That includes goods like furniture and automobiles and often also services such as car repairs and dry cleaning. To compute the sales tax, the price of a taxable item is multiplied by the tax rate. For example, in Michigan, where the state sales tax rate is 6 percent, the sales tax on a $10 can opener is 60 cents, so the cost of the can opener to the consumer after tax is $10.60. Many states also have local sales taxes. For example, in Tennessee, where the state sales tax is 7 percent, local governments can add a tax of up to 2.75 percent, for a maximum combined sales tax of 9.75 percent. So, the $10 can opener that costs $10.60 in Michigan could cost up to $10.97 in Tennessee.

Local taxes usually apply to the same items as the state sales tax, but a few states give municipalities flexibility on what items to tax. Sales tax rates are usually the same for all items, but higher rates or additional taxes often apply to goods and services consumed primarily by tourists, such as hotels or rental cars, with the goal of “exporting” part of the sales tax to residents of other states. Separately, states also have excise taxes, such as taxes on cigarettes, alcohol, and utilities. Excise tax is often applied on a per-unit basis instead of as a percentage of the purchase price. For instance, cigarette excise taxes are calculated in cents per pack. And most gasoline excise taxes are imposed in cents per gallon.

Who Pays Sales Tax

Sales taxes are unavoidable in the states that have them. While rent and groceries are usually exempt, most other tangible goods are taxed: clothing, household items, school supplies, furniture, electronics, and so on. Many business purchases are subject to sales tax, too. The fact that everyone pays the tax sometimes makes it seem “fair.” And families may not realize the total amount they spend over the course of a year, because it’s spread out over many individual purchases. A look at actual spending patterns, however, reveals large imbalances in who pays sales tax.

Poor and middle-income families spend all or most of their incomes to meet basic expenses. Even in states where some necessities are exempt from tax, a large share of these families’ purchases are taxed. By contrast, while higher-income families spend more than poor families, they have the luxury of setting aside a portion of their income for savings. Also, their purchases of items like luxury services or financial services are often exempt. So, high-income people spend a smaller share of their income on items subject to sales tax. The results are striking: a typical state collects five to seven times as much sales and excise tax from poor and middle-income families, relative to their incomes, as from the richest families.

In other words, even though a rich family consumes more and thus pays more sales tax in dollars, the sales tax is lower relative to income and thus is much easier to bear than for middle- and low-income families. There’s a racial equity consequence as well: Since wealthy families are disproportionately white, white families are more likely than Black and Hispanic families to benefit when states and localities rely heavily on sales taxes. And sales taxes make hard times harder, because they’re based on spending, not income. So, when someone loses a job and must dip into savings, sales taxes make it even harder to make ends meet.

Revenues

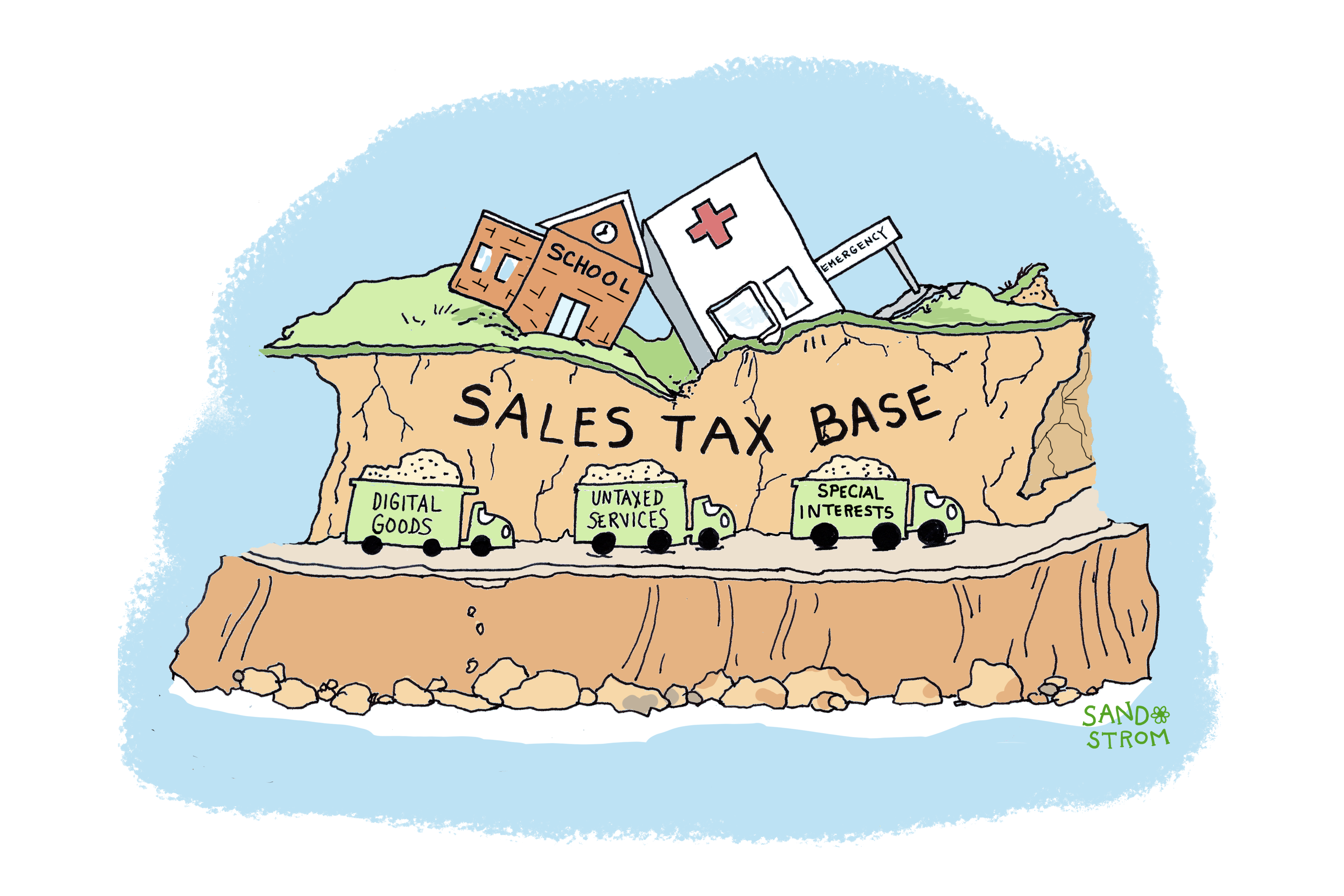

Despite their regressivity, sales taxes are mainstays of state budgets in almost every state, and of local budgets in many places too. But important as they are, we can’t always count on those revenues when we need them. In a recession, for example, families and businesses may delay purchases, putting a damper on sales tax revenues. And over time, a smaller and smaller share of the economy has become subject to sales tax, partly due to new exemptions, and partly because the economy is increasingly dominated by consumption of untaxed services and digital goods rather than just tangible goods. As a result, states and localities find themselves having to periodically raise rates just to keep pace with economic growth.

Mitigating Regressivity

Exempting groceries is the most common step states have taken to reduce the regressivity of sales taxes. A few states also have enacted tax credits, often administered through the income tax and targeted particularly to lower-income families, to offset sales taxes. Perhaps most importantly, some states have worked to ensure that the rest of their tax code includes progressive elements, like graduated income taxes and refundable credits for working families, so it doesn’t over-rely on sales taxes.

Related Entries

What’s Exempt from State and Local Sales Taxes?

State and local sales taxes are typically conceived as broad-based consumption taxes – that is, taxes on everything consumers buy. In practice, many purchases are exempt from sales taxes.

How Do State and Local Excise Taxes Work?

Excise taxes are sales taxes that apply to specific products, such as gasoline, tobacco, or alcohol. Sometimes it’s appropriate to ask consumers of a particular item to pay an especially high tax for various reasons. But even in those circumstances, most current excise taxes are highly regressive.

Learn More

- ITEP. Who Pays? A Distributional Analysis of the Tax Systems in All 50 States, Seventh Edition. 2024.

- Jefferson, Rita, and Galen Hendricks (2024). “How Local Governments Raise Revenue — and What It Means for Tax Equity.” ITEP.