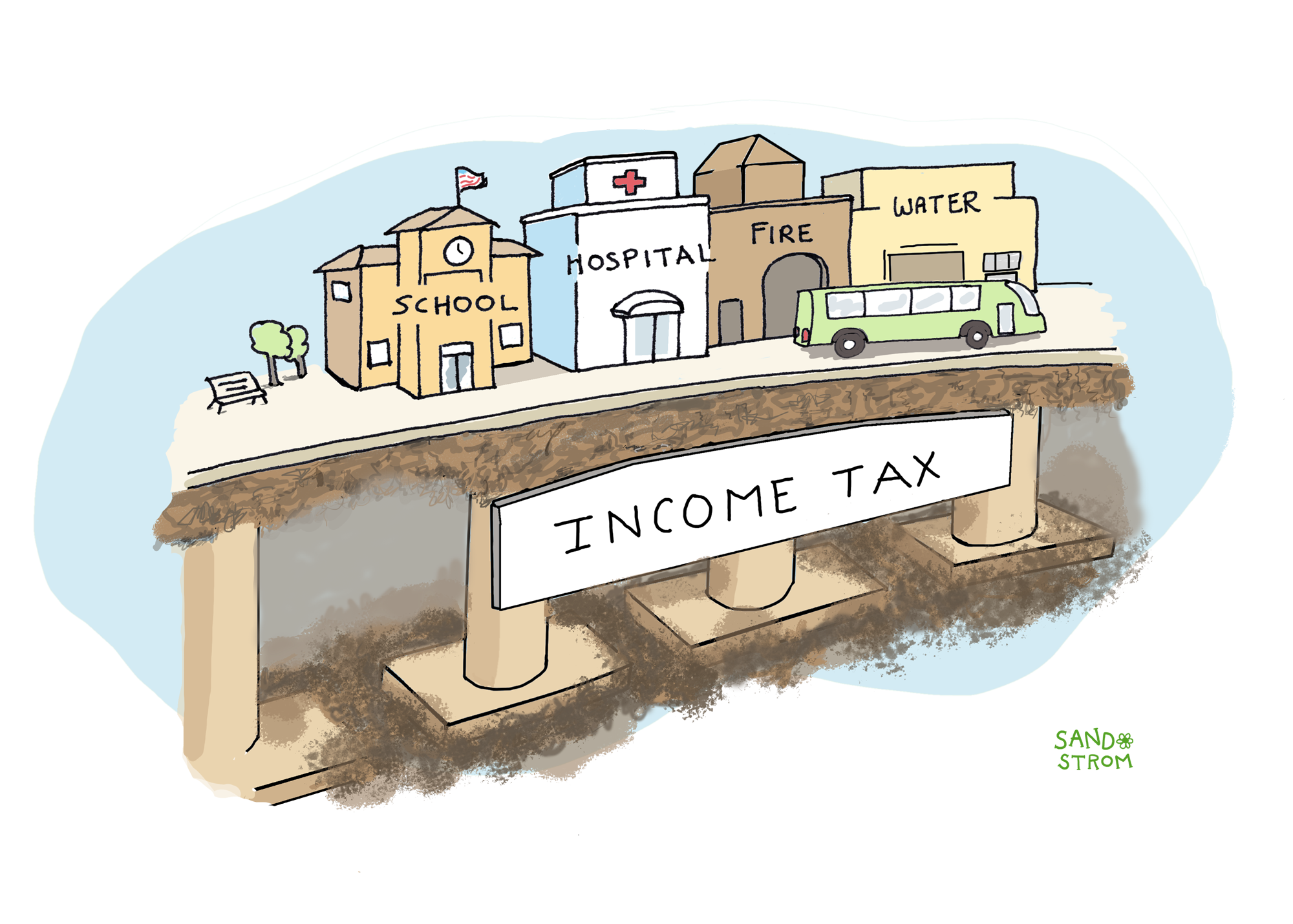

The personal income tax funds public education, health care, public safety, and other public services provided by state and local governments.

If well-designed, it is the fairest major revenue source available to states.

Income taxes levied in 41 states, the District of Columbia, and Puerto Rico are typically quite comprehensive. They touch all parts of the economy and are usually progressive.

If structured properly, the income tax can help balance out other state and local taxes that are higher for poorer and middle-income households than for the wealthy. Sometimes income taxes become so laden with special tax breaks that they aren’t as fair as they should be, but a well-designed income tax is the best starting point for a sound tax system that reflects ability to pay.

What’s more, the revenue collected through a personal income tax tends to keep pace with a state’s economic growth, allowing a state to sustain public services like schools and health care.

Personal income taxes are mostly levied at the federal and state levels, but some counties, cities, and school districts have them too. These are often (but not always) based on the state tax, and they are an important portion of those localities’ tax revenue.

What Kinds of Income Are Taxed

State income taxes cover a wide range of personal income from work, investments, and other sources. Most states use taxpayers’ federal income tax calculations as a starting point, making the tax simpler to administer and comply with. In practice, this means that taxpayers calculate their federal taxes first and then copy their total adjusted gross income (AGI) from the federal tax forms to their state form. A few states do it differently, but the result is similar: most but not all income is taxed.

Because income taxes are levied on most types of income, they reflect most of the economic activity in a state. This breadth makes them a reliable revenue source for the long term. These types of income are typically taxed by states:

- Wages and salaries;

- Business profits from pass-through entities;

- Rental income from real estate;

- Realized capital gains, that is, net profits from the sale of assets such as stocks, bonds, and real estate;

- Interest from bank accounts;

- Dividends from corporate stock; and

- Miscellaneous income, like payments from gig-worker employment.

In addition, some government benefits are typically taxed, such as unemployment compensation; others are not, including nutrition assistance and cash welfare payments through the TANF program. Since nutrition assistance and cash welfare recipients have low incomes, they almost never would owe income tax anyway, although they pay other state and local taxes.

Computing Taxable Income

States allow taxpayers to reduce income subject to tax in several ways.

- First, some states exempt specific types of income. For example, the federal government and some states tax a portion of Social Security benefits received by higher-income retirees, but other states do not. Similarly, the federal government taxes most pension and other retirement income, but states vary in how much retirement income is taxed.

- Second, the federal government allows “adjustments” to gross income, including subtractions for alimony payments, interest paid on student loans, and certain retirement plan contributions. Many states allow these federal adjustments and may allow state-specific adjustments. What remains after accounting for these exemptions and adjustments is called “adjusted gross income.”

- Third, federal taxpayers (and taxpayers in most states) have a choice of subtracting either a standard deduction or specific itemized deductions, whichever is larger. Itemized deductions mostly benefit higher-income people, because they typically are the only ones who have enough deductions to make itemizing worthwhile. Most households are better off with the standard deduction. In states that use the federal standard deduction, which is quite large, only one in ten households itemize.

- The fourth step in arriving at taxable income—the base to which income tax rates are applied—is to subtract personal exemptions. The theory behind exemptions is that at any income level, a taxpayer’s ability to pay declines as family size increases: the more mouths to feed, the less money is left over to pay taxes. Often, like other provisions of the income tax, exemptions are indexed annually for inflation. The federal government stopped allowing personal exemptions in 2017, but some states still provide them.

Tax Rates

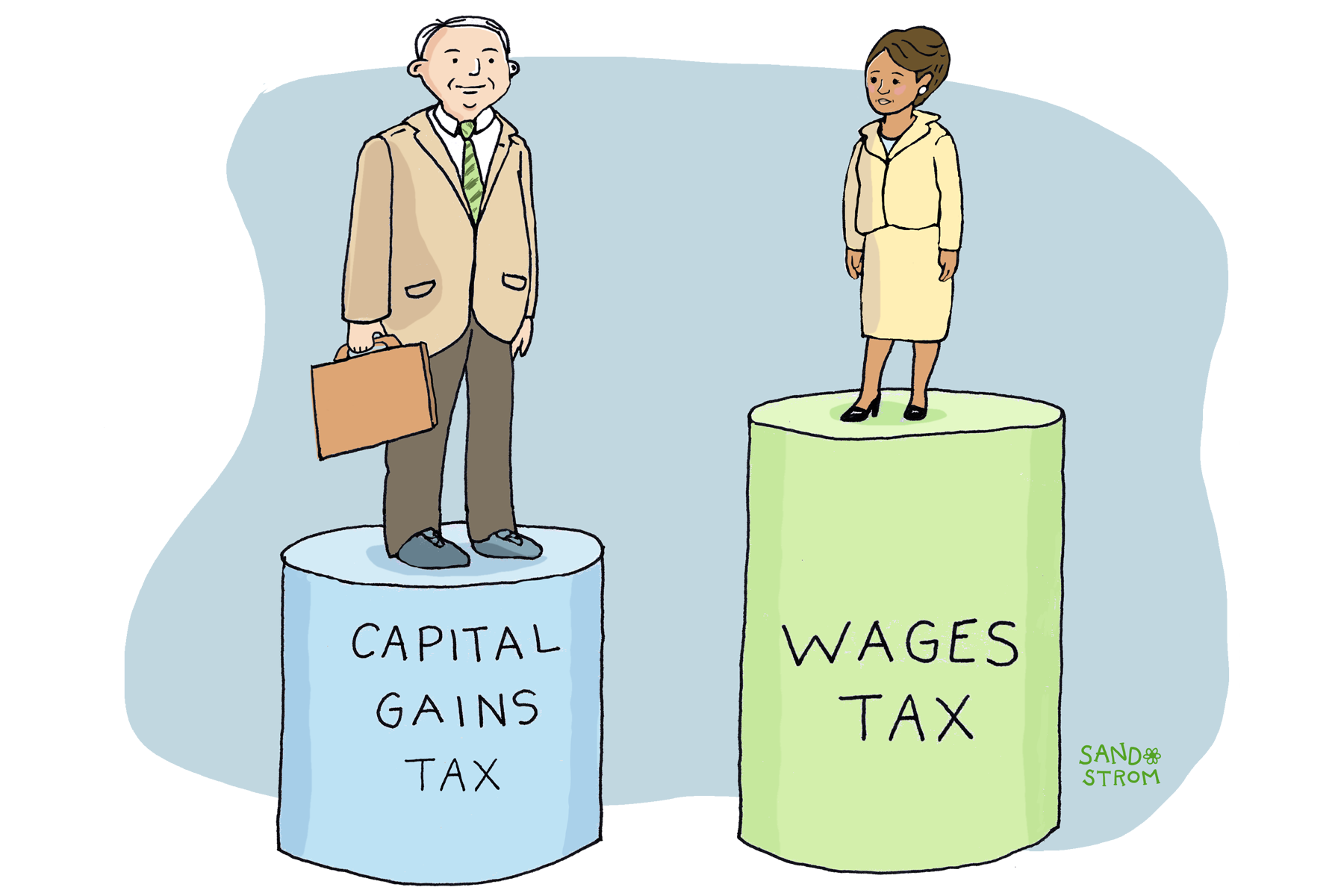

The single most important policy choice in determining the fairness of a state’s income tax is the way its tax rates work. Most states use graduated tax rates to apply higher rates at higher income levels. Other states apply a single, flat rate to all income. A few states apply different rates to different types of income – for example, taxing investment income at a higher rate than wage income.

Graduated rates are the most straightforward way to make an income tax progressive and sustainable . Without such a structure, it is hard for a state to avoid taxing low-income people more than higher-income people. And a graduated rate helps ensure that the high concentration of income among the wealthy adequately contributes state revenue to fund services.

Higher rates on higher incomes allow for lower rates on other income to raise the same revenue.

Credits

After computing the amount of income tax based on the applicable tax rates, credits (if any) are subtracted. Credits are taken directly off the tax amount that would otherwise be owed, as distinguished from deductions, which are subtracted from the amount of income that is subject to tax.

States vary greatly in the number of credits they offer, and the credits vary greatly in whether they are used by large or small numbers of taxpayers and whether they are refundable or non-refundable. Refundability is particularly important for a low-income family that doesn’t have much income tax liability to begin with. Common family tax credits include child tax credits, earned income tax credits, and credits for child and dependent care.

Related Entries

How Does Federal-State Tax Conformity Work?

Most states use the federal tax code as a starting point for their calculations of state personal income taxes, corporate income taxes, and estate taxes. Changes to the federal code and federal tax administration have the potential to affect state tax systems enormously, but to some extent states can pick and choose which of those federal changes to accept.

How Do States Tax Investment Income?

State personal income taxes apply not just to wages and salaries but also earnings on investments, like stocks and bonds. Most investments are held by wealthy people, so when states tax investment income at a lower rate than wages, high-income households pay tax at lower rates than middle-income households.

How Do State Tax Credits for Workers and Families Work?

State-level Earned Income Tax Credits (EITCs) and Child Tax Credits (CTCs) help workers and families make ends meet by reducing their taxes and providing refunds. Research shows these credits are very effective at reducing poverty and creating more equitable tax systems.

Learn More

- Davis, Carl (2020). “State Itemized Deductions: Surveying the Landscape, Exploring Reforms.” ITEP.

- Davis, Carl, and Eli Byerly-Duke (2023). “State Income Tax Subsidies for Seniors.” ITEP.

- Davis, Carl, and Eli Byerly-Duke (2025). “The Pitfalls of Flat Income Taxes.” ITEP.

- ITEP. Who Pays? A Distributional Analysis of the Tax Systems in All 50 States, Seventh Edition. 2024.

- Jefferson, Rita (2025). “The (Mostly Untapped) Power of Local Income Taxes.” ITEP.