State and local sales taxes are typically conceived as broad-based consumption taxes – that is, taxes on most things consumers buy.

In practice, many purchases are exempt from sales taxes.

Some sales tax exemptions can benefit consumers and businesses, but many of them take the sales tax away from its primary purpose of taxing consumption broadly and may lead states to enact higher rates to make up for the lost revenue.

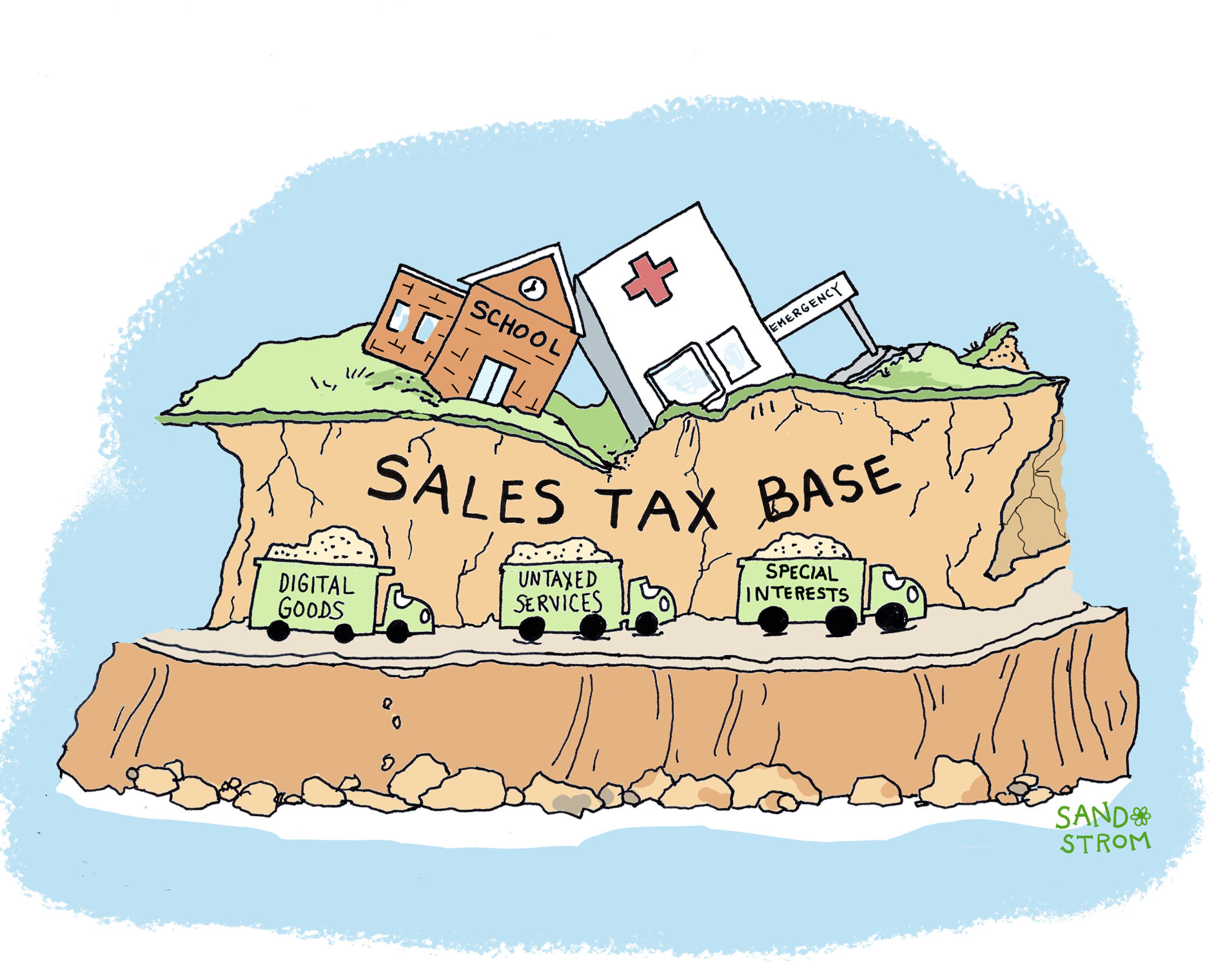

Exemptions for Services and Digital Goods

Most state sales taxes were enacted in the 1930s and 1940s. At that time, people bought mostly tangible goods like food, furniture, clothing, and household equipment, so that was the focus of the tax. Since then, however, American consumer purchases have changed dramatically, shifting toward consumption of services rather than goods – for example, lawn care services instead of lawnmowers. Most states responded by extending their sales tax to include certain services in their standard tax base. Far fewer states have chosen to tax services in a manner that can be described as even remotely comprehensive—just Hawaii, South Dakota, and New Mexico have taxes with relatively comprehensive coverage of services today. Most states still apply their sales tax to less than half of the 168 potentially taxable services that are taxed in at least one state—such as rental services, repairs, installations, cleaning services, and a wide variety of entertainment options. The result is that, in many states, the sales tax applies to a falling share of consumer purchases.

This erosion of state sales tax bases has been exacerbated by consumers’ rising purchases of goods and services that are delivered in digital form. Consumers can buy e-books instead of hardcopies, subscribe to video games rather than buy board games, and stream music rather than buy albums, but states are inconsistent in whether they tax purchases of those digital goods and services. Taxing services helps ensure that the amount of sales tax anyone owes will depend primarily on how much they spend, not what they spend it on. There is nothing inherently better (or worse) for society in spending money on services as opposed to goods. Taxing consumer goods but not consumer services favors consumers who prefer services over those who prefer goods.

Exemptions for Business Inputs

States usually exempt businesses’ purchases of manufacturing inputs, goods for resale, and some other types of business inputs. One reason is that when business-to-business purchases are taxed, the tax is often passed through invisibly to consumers in the form of higher prices, a phenomenon known as pyramiding or cascading. Taxing business purchases penalizes companies that buy goods and services from other companies rather than producing them in-house. For example, taxing accounting services at a 10 percent rate would give a big corporation with its own accountants an advantage of a 10 percent cost savings relative to a smaller company that hires an outside firm. Some tax experts argue that business-to-business purchases should be exempt whenever possible, but categorically exempting such purchases could cost states and localities 30 percent to 50 percent of their sales tax revenue. Sweeping exemptions for business purchases also run the risk of creating administrative headaches and new tax avoidance opportunities, particularly among small business owners.

Exemptions for Necessities

Every sales tax allows targeted exemptions. These exemptions are usually intended to make the sales tax less unfair. Sales taxes can be made somewhat less regressive by taxing more of the things the wealthy consume the most and fewer of the things on which middle- and low-income families spend their money (e.g. taxing restaurant meals, but not groceries). Full or partial grocery exemptions are the most common example of states seeking to remove a necessity of life from the tax base. Taxing food is particularly hard on poor families because such a high portion of their incomes goes to mere sustenance. Hawaiʻi and Idaho tax groceries fully but offset the effect by offering targeted tax credits. Most states exempt rent, payments to health care providers, and prescription drugs. Some also exempt clothing, tampons, diapers, non-prescription drugs, and certain other items. Different households may vary in their definition of what purchases are “necessary,” so exempting some but not others can produce inequity while losing revenue. Exemptions are also costly to administer, and they are a blunt instrument that often saves wealthy families more money than poor families. The better approach is to tax most consumer goods and services and to use a portion of the revenue to fund direct spending programs or targeted tax credits that can help struggling families meet the cost of living.

Sales Tax Holidays

Some states exempt specific goods for just a few days each year. Such sales tax “holidays” provide the greatest benefit to families with the financial flexibility to adjust the timing of their purchases, and they often seem more targeted to narrow interests than to consumers’ needs.

Federal Law

Federal law requires states to exempt certain purchases. Some of these exemptions make sense. A federal statute bars states from taxing grocery purchases made with federal Supplemental Nutrition Assistance Program (SNAP) benefits, which reduces regressivity and ensures federal SNAP dollars go further for families facing food insecurity. Other federally mandated exemptions are harder to justify on policy grounds. Courts have said that the Constitution’s Commerce Clause bars taxes on interstate transportation, so an in-state bus ticket from Atlanta to Savannah, Ga. is taxable but a ticket in the other direction to Birmingham, Ala. is exempt. And the federal Internet Tax Freedom Act says states cannot tax Internet access, a prohibition first enacted in the 1990s when the Internet was considered an “infant industry” in need of protection; that justification seems absurd today, yet the statute remains in place.

Special-Interest Breaks

Finally, many states offer an assortment of poorly conceived sales tax exemptions with no purpose other than to assist favored special interests. While the sales tax is well enough understood that special interest loopholes in the tax law tend to get noticed (especially compared to some of the more complex tax breaks that are sometimes hidden in the income tax), that doesn’t mean that special interests don’t work hard to win preferential sales tax treatment. In some cases, these exemptions cross into the absurd, such as the exemption for products made from trees infested by pine beetles in Colorado, or the Arkansas exemption for vehicles purchased by blind veterans, both of which likely create administrative costs that outweigh the benefit.

Related Entries

How Do State and Local Excise Taxes Work?

Excise taxes are sales taxes that apply to specific products, such as gasoline, tobacco, or alcohol. Sometimes it’s appropriate to ask consumers of a particular item to pay an especially high tax for various reasons. But even in those circumstances, most current excise taxes are highly regressive.

Learn More

- Davis, Carl (2024). “Pyramids, Cascades, and the Taxation of Business Inputs.” Presentation to the New Mexico Revenue Stabilization and Tax Policy Committee.

- Federation of Tax Administrators (2017). “Sales Taxation of Services.”

- Guzman, Marco (2025). “Sales Tax Holidays Miss the Mark When It Comes to Effective Sales Tax Reform.”