The great majority of property tax revenue is based on the value of land and buildings, but states also apply property taxes to certain business equipment, machinery, and supplies, and sometimes also to automobiles.

Collectively these taxes are known as “personal property taxes.”

In most states, local property taxes apply not just to land and buildings but also to business property such as equipment, supplies, and sometimes even inventory. Some states limit the tax to larger businesses with expensive equipment; others apply it to all businesses, even the smallest. These taxes are an important source of local revenue, helping fund schools, roads, and other public services. But they require filing detailed reports on asset ownership, and they disfavor businesses that invest in equipment compared to those who don’t.

A few states also have property taxes on personal cars and trucks. The tax is typically levied on the vehicle’s blue-book value. Since the state maintains a registry of all vehicles, it’s simpler to tax car value than it would be to tax a household’s other major physical assets. And compared to the flat per-vehicle registration fees that are common in every state, vehicle property taxes are fairer, since higher-income households tend to own more expensive cars. Nonetheless, vehicle property taxes are regressive, because car values and hence car taxes as a share of income are higher for low- and middle-income people than for the wealthy.

Until a few years ago, some states also taxed intangible personal property, like stocks and bonds; the last such tax was repealed by Florida in 2006. State tax systems would be much fairer if these taxes still existed because, while middle-income households tend to hold their wealth in the form of a primary residence, the ownership of intangible wealth is highly concentrated in the hands of a wealthy few. States repealed the tax on the grounds that it was hard to enforce, but it now appears that the movement against the intangibles tax was short-sighted. The rise of the digital age and other advances in technology have greatly improved the potential for states to enforce an intangibles tax.

Any state bold enough to reinstate its intangibles tax or create a new one has a lot to gain, not only in terms of improved tax progressivity, but also in the form of a substantial revenue boost. Before reducing the intangibles tax rate shortly before its repeal, Florida brought in as much as $1 billion annually from the tax – an amount that would surely be far higher if the tax were reinstituted today. Alternatively, if state and local property tax bases included intangible property, property tax rates on homes and land could be greatly reduced.

Related Entries

How Do Real Property Taxes Work?

Property taxes on land and buildings are the oldest and still the largest major revenue source for state and local governments. They fund schools, health care, public safety, and other services. They are collected mostly by cities, counties, school districts, and other types of local government, but states typically make the rules for assessing the value of property and imposing the tax, with major implications for tax fairness and adequacy.

How Do States Tax Investment Income?

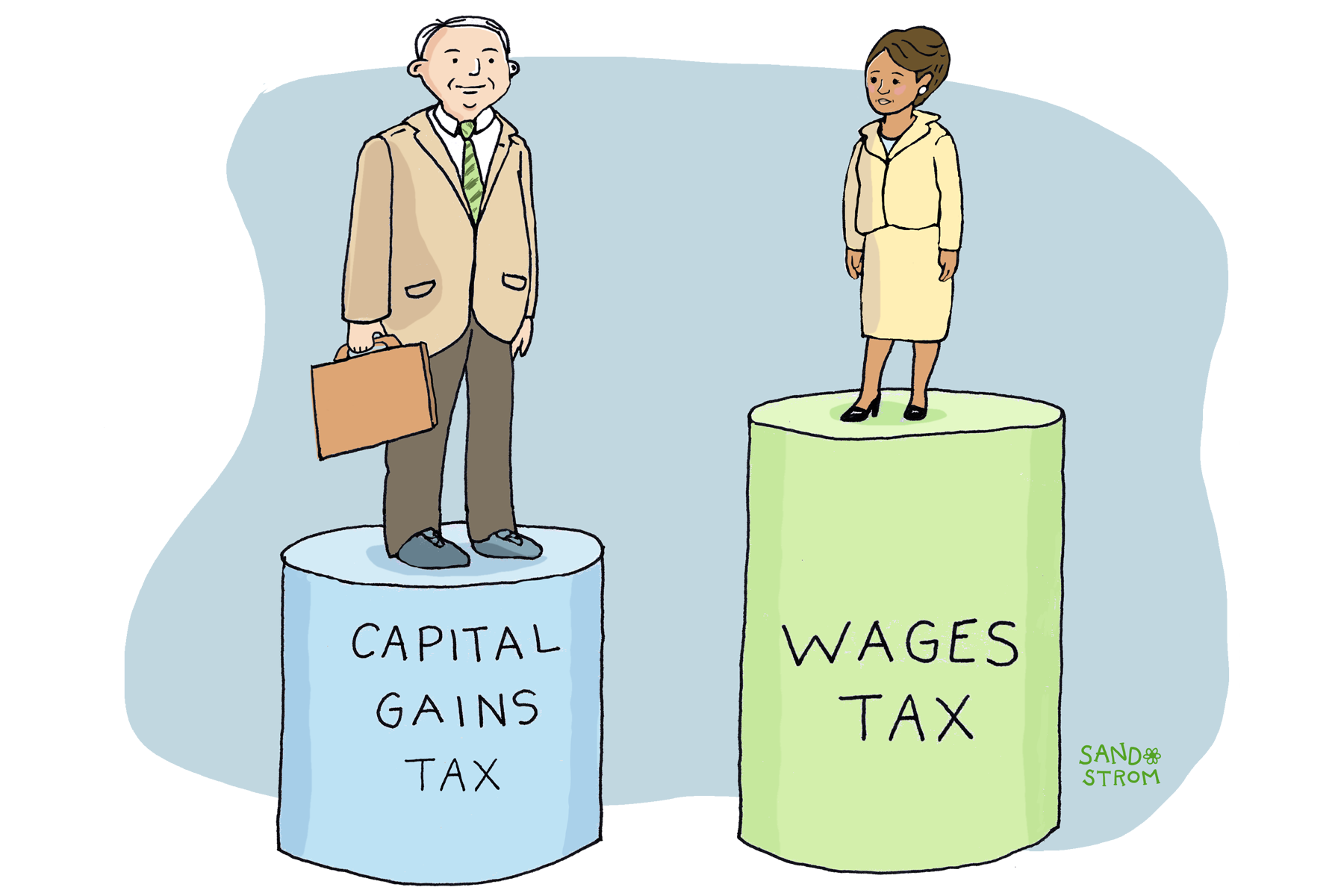

State personal income taxes apply not just to wages and salaries but also earnings on investments, like stocks and bonds. Most investments are held by wealthy people, so when states tax investment income at a lower rate than wages, high-income households pay tax at lower rates than middle-income households. By contrast, states that strengthen taxation of investment income can raise substantial revenue while improving economic and racial equity of their tax code.

Learn More

- Davis, Carl, and Eli Byerly-Duke. “America Used to Have a Wealth Tax: The Forgotten History of the General Property Tax.” ITEP, 2023.

- Lincoln Institute of Land Policy. “Significant Features of the Property Tax.” Database accessed 2025.