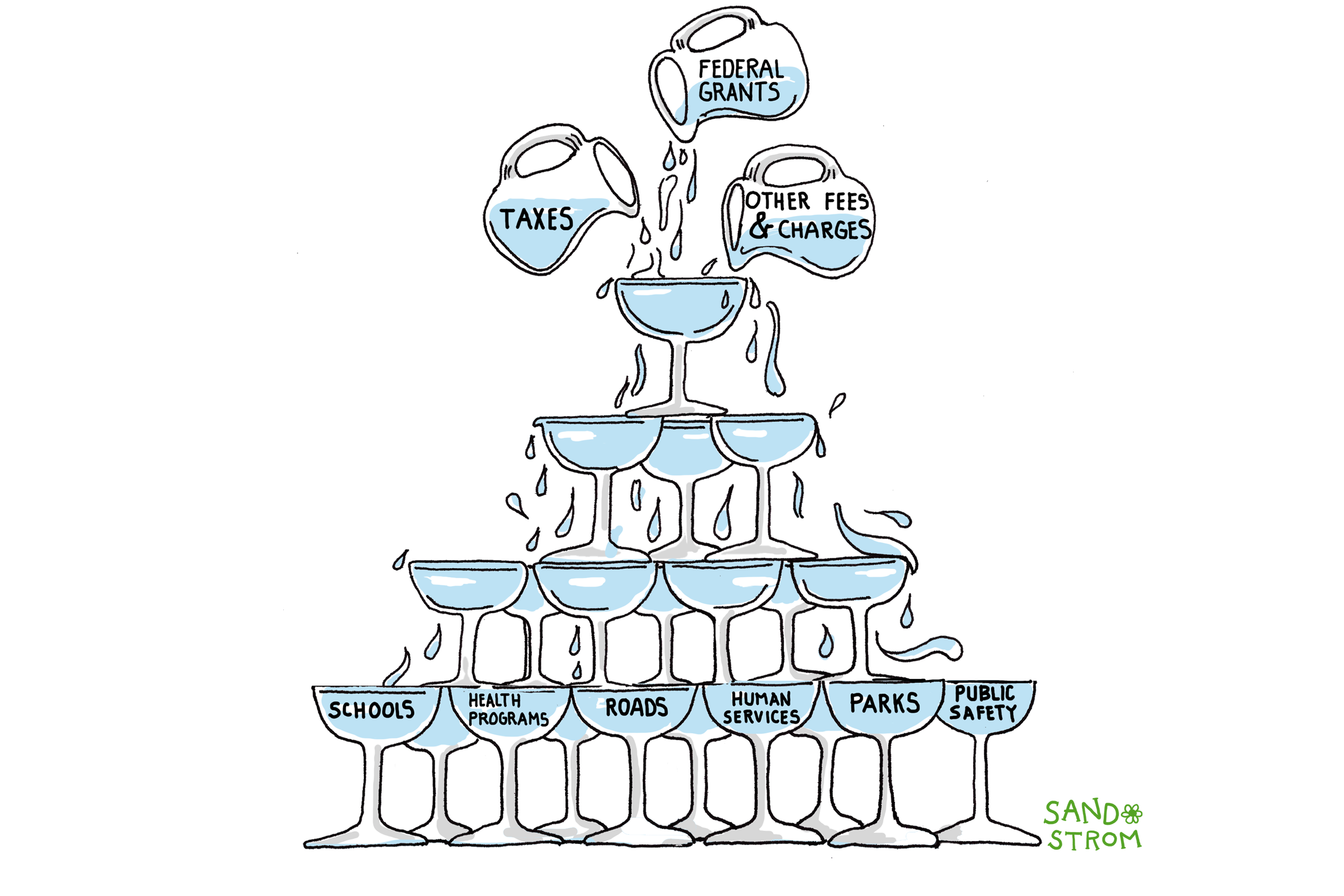

State and local governments play important roles in helping communities thrive. They fund and run schools, roads, parks, health programs, human services, public safety agencies, and other key services.

To pay for these services, states and local areas receive money from multiple sources. The main source is taxes, but funds from the federal government and fees people pay to use services are also important contributors.

The Three Main Revenue Sources

Taxes are the biggest source of money that governments raise themselves. Taken together, state and local taxes average roughly half (51 percent in 2023) of the revenues that states and localities use to fund services. In most communities, property taxes, sales taxes, and income taxes are the three major revenue sources for states and localities. The mix of taxes varies from state to state, but in general, states rely on income and sales taxes the most, and local governments rely on property taxes the most.

Money from the federal government is also an important revenue source. On average, federal grants represent roughly one-quarter (27 percent) of state and local revenue. About half of that is funds for health care through the Medicaid program; the rest is aid for schools, public safety, transportation, and much more. Most of these funds are earmarked for specific purposes, but sometimes – like during major recessions – the federal government provides general-purpose aid as well.

For local governments, aid from the state is another key source of funds. For example, most public schools are operated at the local level, but states provide much of the funding (the proportion varies greatly by state). An important function of state aid is to equalize revenues between poorer localities that have smaller tax bases and wealthier localities that have larger tax bases. But not all states do a very good job of this, so education and other locally funded services are often skewed to benefit wealthy communities.

The final major source of state and local government revenue is user fees and other types of charges and miscellaneous revenues (22 percent). This includes tuition to public universities, public hospital charges from patients and insurance companies, highway tolls, public transit fares, lottery revenues, and payments to publicly owned utility companies. It also includes fees and fines collected through the criminal justice system.

The percentages above come from the U.S. Census Bureau, which each year collects detailed data on revenues and spending by each state and by a sampling of local governments. It’s an invaluable source of information on state and local finances.

Why Different Places Use Different Approaches

Every state, city, county, and school district is a little bit different in its revenue streams. Here are some of the reasons why.

State laws and constitutions set the rules. Each state constitution prescribes what kinds of taxes states and cities can collect. For example, a few states have constitutional bars on local income taxes, so they lean harder on sales and property taxes.

And states and localities divvy up their responsibilities differently from place to place. In some states, school districts are independent entities, while in others they are run by city or county governments. Public assistance programs are a state responsibility in some places and a local responsibility in others. Some states have large public hospital systems while others rely more on private hospitals. These differences greatly affect the flow of resources.

Local economies shape local revenues. States with oil, gas, or coal deposits can collect big money from special taxes on these resources, so they don’t need to rely as much on other tax sources. Places with a lot of tourism often get more revenue from taxes on hotel stays and other purchases. The distribution of income, property values, the location of retail shops – all can affect a state or locality’s revenues.

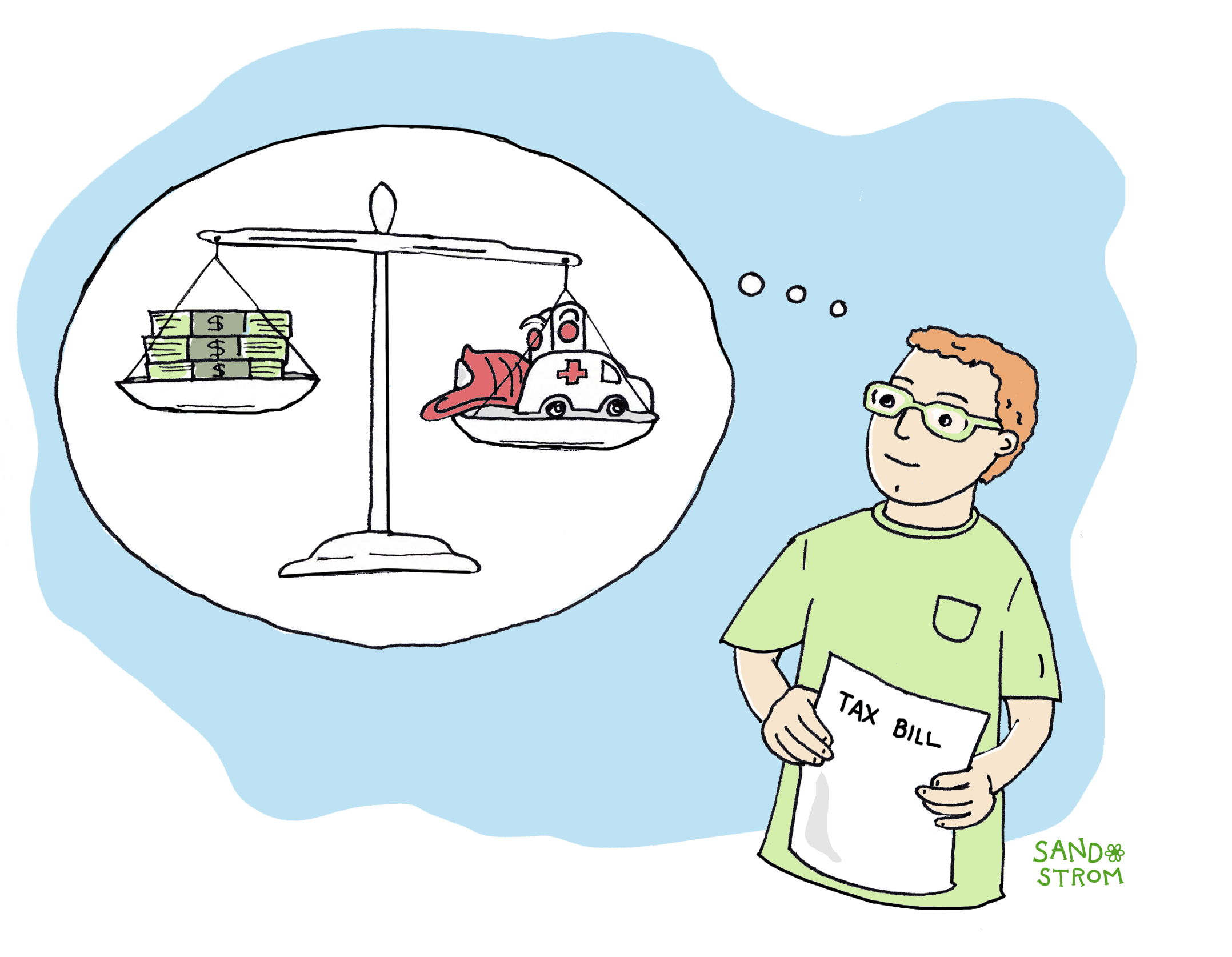

Policy choices shape the mix. Every state or local government enacts an annual or biannual budget. Budgets document priorities and determine how much money the government will take in and how those funds will be spent. Since states and localities are usually required by law to have balanced budgets, their revenue and spending decisions are intertwined. A decision to lower taxes, for example, will typically result in fewer or lower quality public services than would otherwise be available.

Looking Ahead

State and local governments face new challenges today. They’re dealing with housing shortages, health gaps between different racial and income groups, reduced federal aid, narrowing tax bases, and the need for climate-ready infrastructure. To tackle these problems, they’ll need to keep finding new ways to bring in money.

Related Entries

What Principles Should Guide State and Local Tax Policy?

State and local taxes exist primarily to fund schools, roads, health care, and other services needed for communities to thrive. There are multiple ways to achieve this goal, so it can be helpful to evaluate different options based on a few core principles.

How Do State Tax and Expenditure Limits Work?

A Tax and Expenditure Limit (TEL) is a formula written into state law or into a state constitution that constrains government revenue and spending. These measures can undermine governmental accountability, degrade essential public services like health care and education, and create inequitable tax burdens.

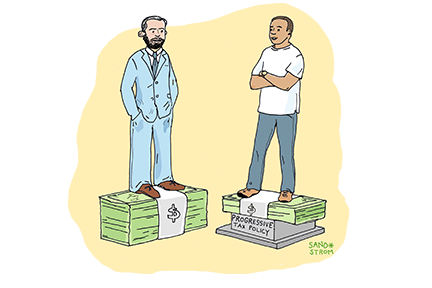

How Do State and Local Tax Systems Affect Racial Justice?

State and local tax codes have the potential to either narrow or widen racial inequality created by historical and current injustices in public policy and in broader society.

In general, tax codes that are more progressive across the economic spectrum do more to narrow racial inequality, while regressive tax policies exacerbate it.

Learn More

- Government Finance Officers Association (accessed 2025). “Local Government Revenue Sources-Cities” and “Local Government Revenue Sources-Counties.”

- ITEP (2024). Who Pays? A Distributional Analysis of the Tax Systems in All 50 States, Seventh Edition.

- Jefferson, Rita, and Galen Hendricks (2024). “How Local Governments Raise Revenue — and What it Means for Tax Equity.” ITEP.

- Jefferson, Rita (2025). “The (Mostly Untapped) Power of Local Income Taxes.” ITEP.

- U.S. Census Bureau (2025). Annual Survey of State and Local Government Finances, 2023 Data Release.