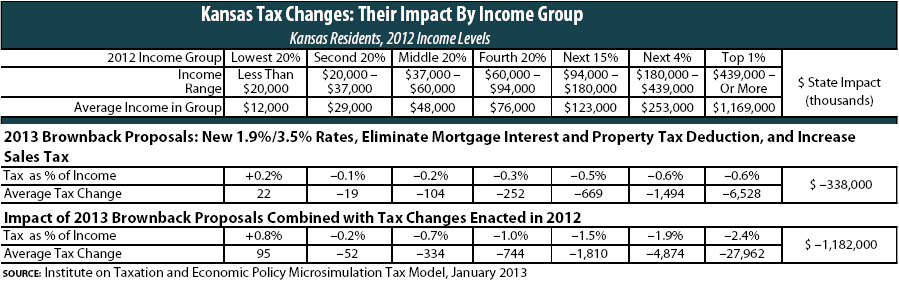

Kansas Governor Sam Brownback proposed, for the second straight year, major tax changes during his State of the State speech. These new changes include lowering the tax rates to 1.9 and 3.5 percent, eliminating itemized deductions for mortgage interest and property taxes paid, and raising the sales tax. If fully implemented in 2012 Brownback’s latest proposal would have reduced state revenues by close to $340 million, while actually increasing the taxes paid by the very poorest Kansans.

Under Governor Brownback’s proposed plan:

• The poorest 20 percent of Kansas taxpayers would pay 0.2 percent more of their income in taxes each year, or an average increase of $22.

• The middle 20 percent of Kansas taxpayers would pay 0.2 percent less of their income in taxes each year, or an average cut of $104.

• Upper-income families, by contrast, reap the greatest benefit with the richest one percent of Kansans, those with an average income of over a million dollars, saving an average of $6,528 a year.

This isn’t Governor Brownback’s first attempt at changing the state’s tax structure. These proposed changes are on top of the $700 million in tax cuts he signed into law last year. The 2012 tax changes include:

• Reducing and compressing tax rates to 3.0 and 4.9 percent

• Exempting all “pass-through” business income from the personal income tax base.

• Eliminating some tax credits including the Food Sales Tax Rebate, the dependent care credit, and Homestead Property Tax Refund for renters.

• Increasing the standard deduction for head of household fi lers and married couples.

Adding the Governor’s new proposal on top of those tax changes he signed into law last year, the total price tag of the Governor’s proposals rises to over $1.1 billion, and the tax hike faced by poor Kansans continues to grow. In particular:

• The poorest 20 percent of Kansas taxpayers would pay 0.8 percent more of their income in taxes each year, or an average increase of $95.

• The middle 20 percent of Kansas taxpayers would pay 0.7 percent less of their income in taxes each year, or an average cut of $334.

• Upper-income families, by contrast, reap the greatest benefit with the richest one percent of Kansans, those with an average income of over a million dollars, saving an average of $27,962 a year.

As lawmakers debate Governor Brownback’s proposal they should be aware of the cost of these new proposals and know how these new changes exacerbate the state’s budget shortfall in the context of tax cuts already signed into law last year.