This analysis was updated on July 2, 2025.

The House of Representatives is planning to take up the version of President Trump’s “megabill” that was approved by the Senate. Like its House counterpart, the Senate reconciliation bill makes permanent the provisions of the 2017 tax law that will otherwise expire and makes many additional changes beyond that. This analysis examines the tax provisions in the legislation passed out of the Senate and provides numbers generated with the ITEP microsimulation model.

While the Senate version differs from the House bill in some ways, it has essentially the same effects, favoring the richest taxpayers and providing working-class Americans with relatively small tax cuts that would in many cases be more than offset by the import taxes, or tariffs, imposed by President Trump.

The Senate bill would have the following effects on taxpayers, which are all very similar or nearly identical to those of the House bill:

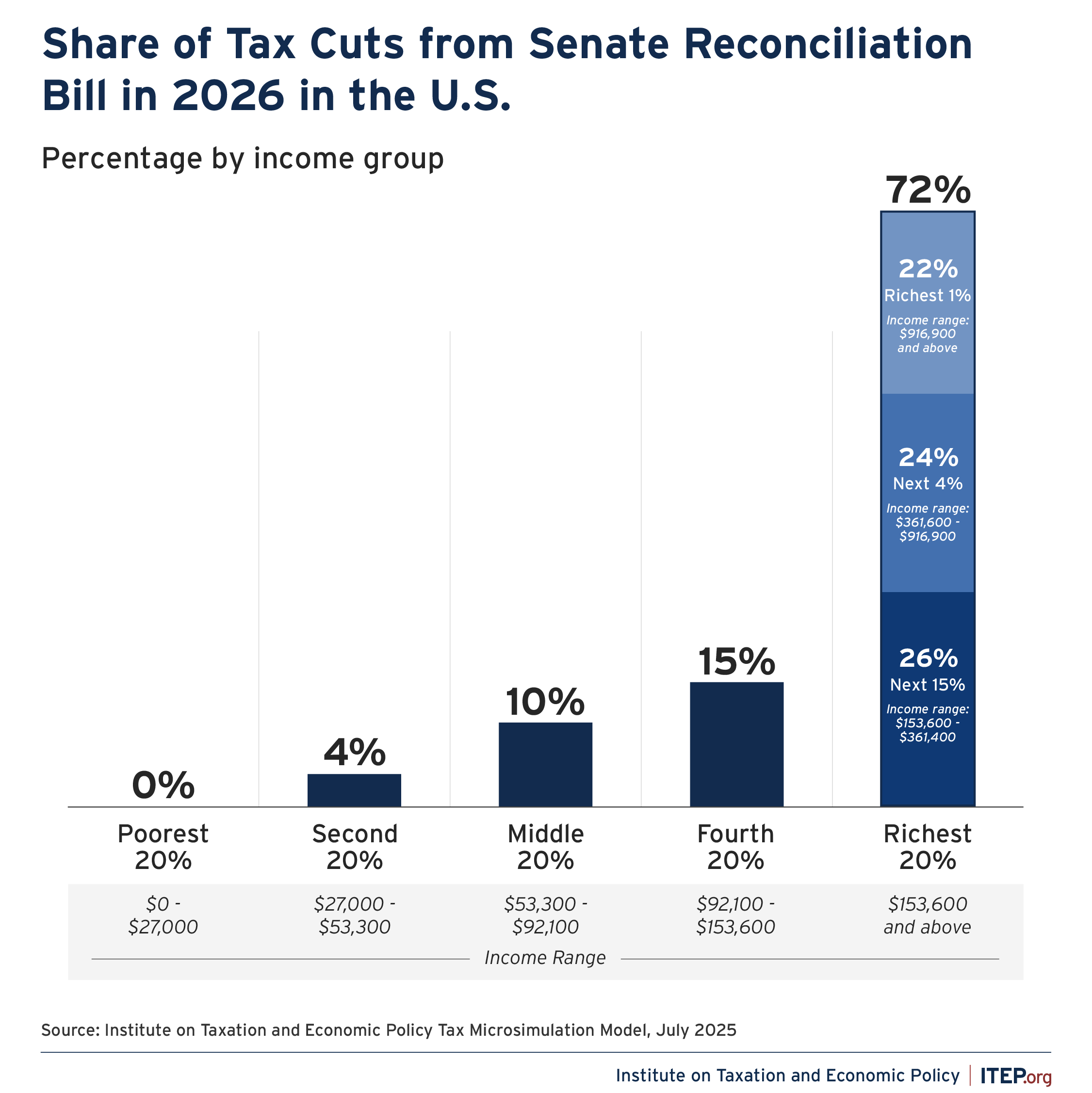

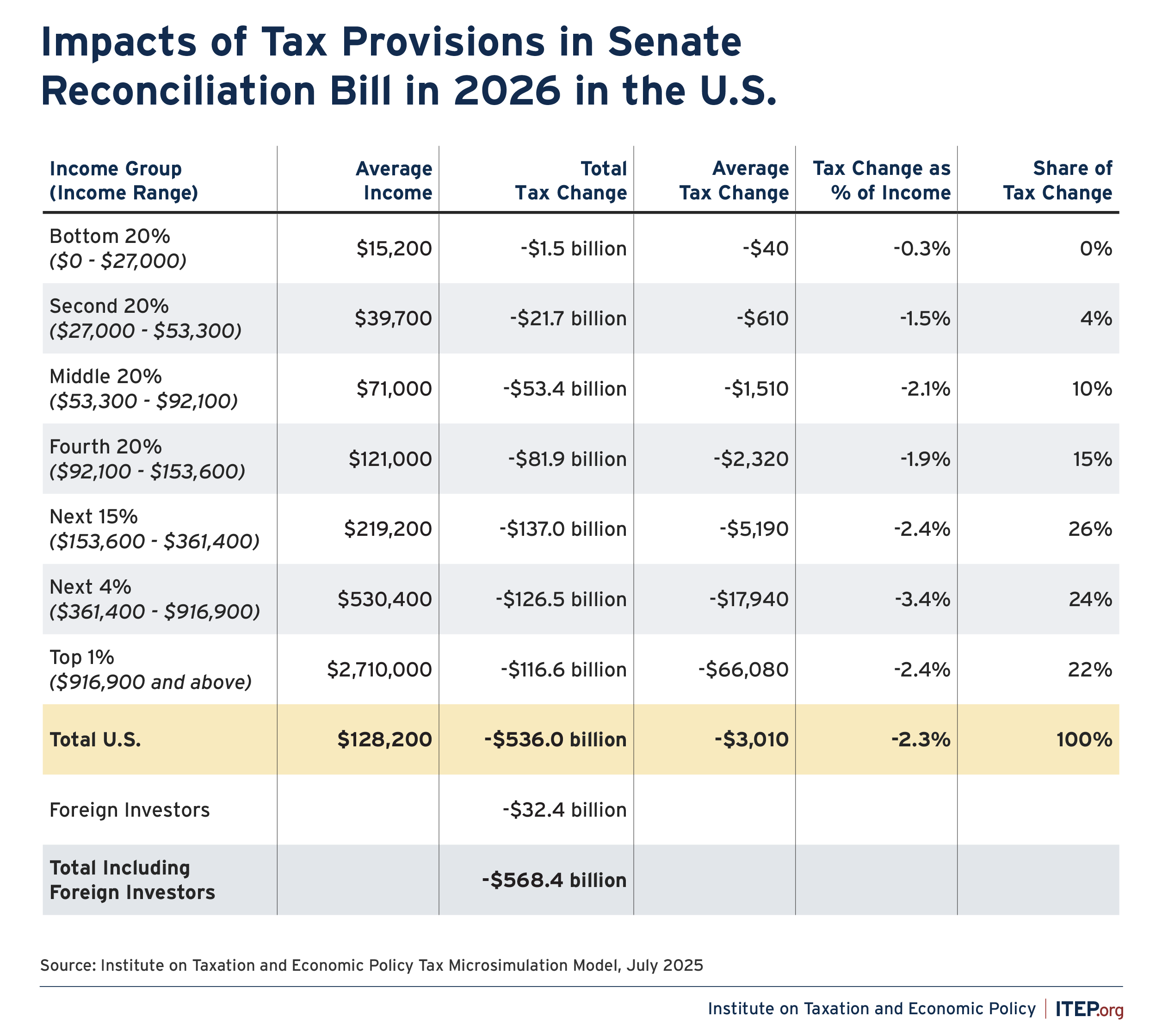

- Under the Senate bill, more than 70 percent of the net tax cuts would go to the richest fifth of Americans in 2026, only 10 percent would go to the middle fifth of Americans, and less than 1 percent would go to the poorest fifth.

- The richest 5 percent alone would receive 45 percent of the net tax cuts next year.

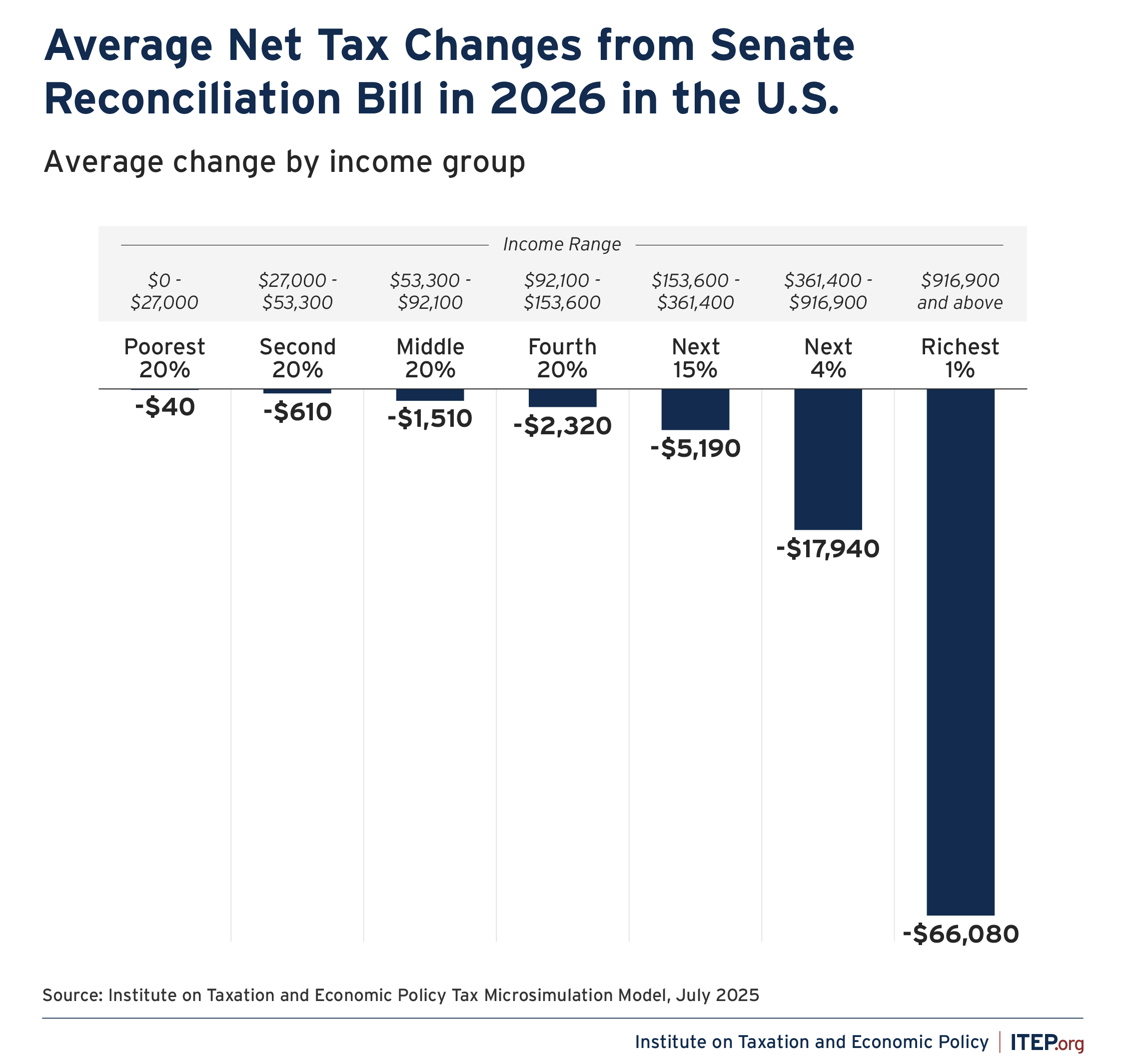

- The richest 1 percent of Americans would receive an average net tax cut of $66,000, many, many times more than the average tax cut received by other income groups.

- The richest 1 percent of Americans would receive a total of $117 billion in net tax cuts in 2026. The middle 20 percent of taxpayers on the income scale, a group that has 20 times the number of taxpayers as the richest 1 percent, would receive less than half that much, $53 billion in net tax cuts that year.

- The $117 billion in net tax cuts going to the richest 1 percent next year would exceed the amount going to the entire bottom 60 percent of taxpayers (about $77 billion).

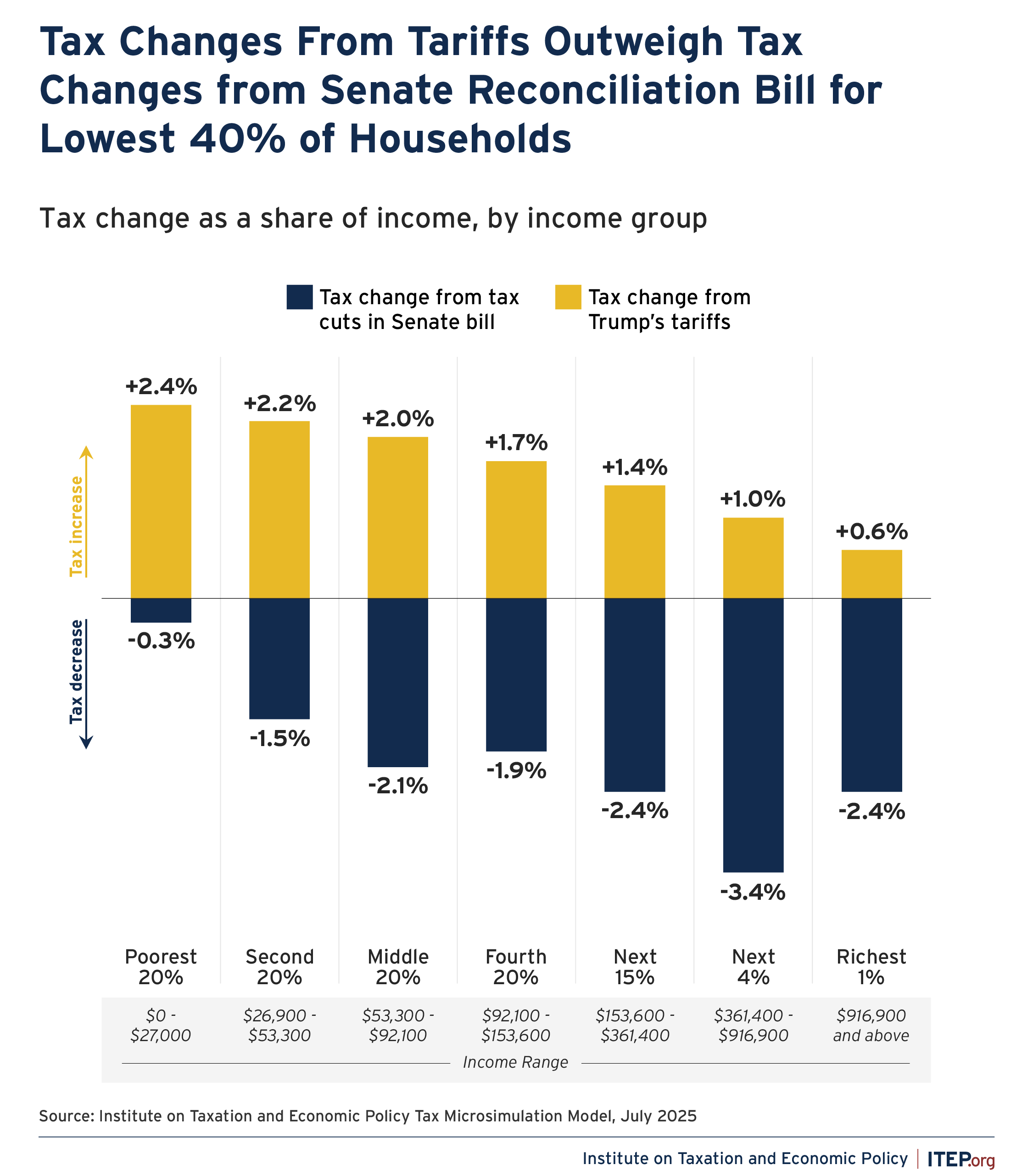

- The effects of President Trump’s tariff policies alone offset most of the tax cuts for the bottom 80 percent of Americans. For the bottom 40 percent of Americans, the tariffs impose a cost that is greater than the tax cuts they would receive under this legislation.

- Even foreign investors who own shares in U.S. companies would benefit more than many Americans. These foreign investors would enjoy $32 billion in tax cuts in 2026 compared to just $1.5 billion for the bottom 20 percent of Americans.

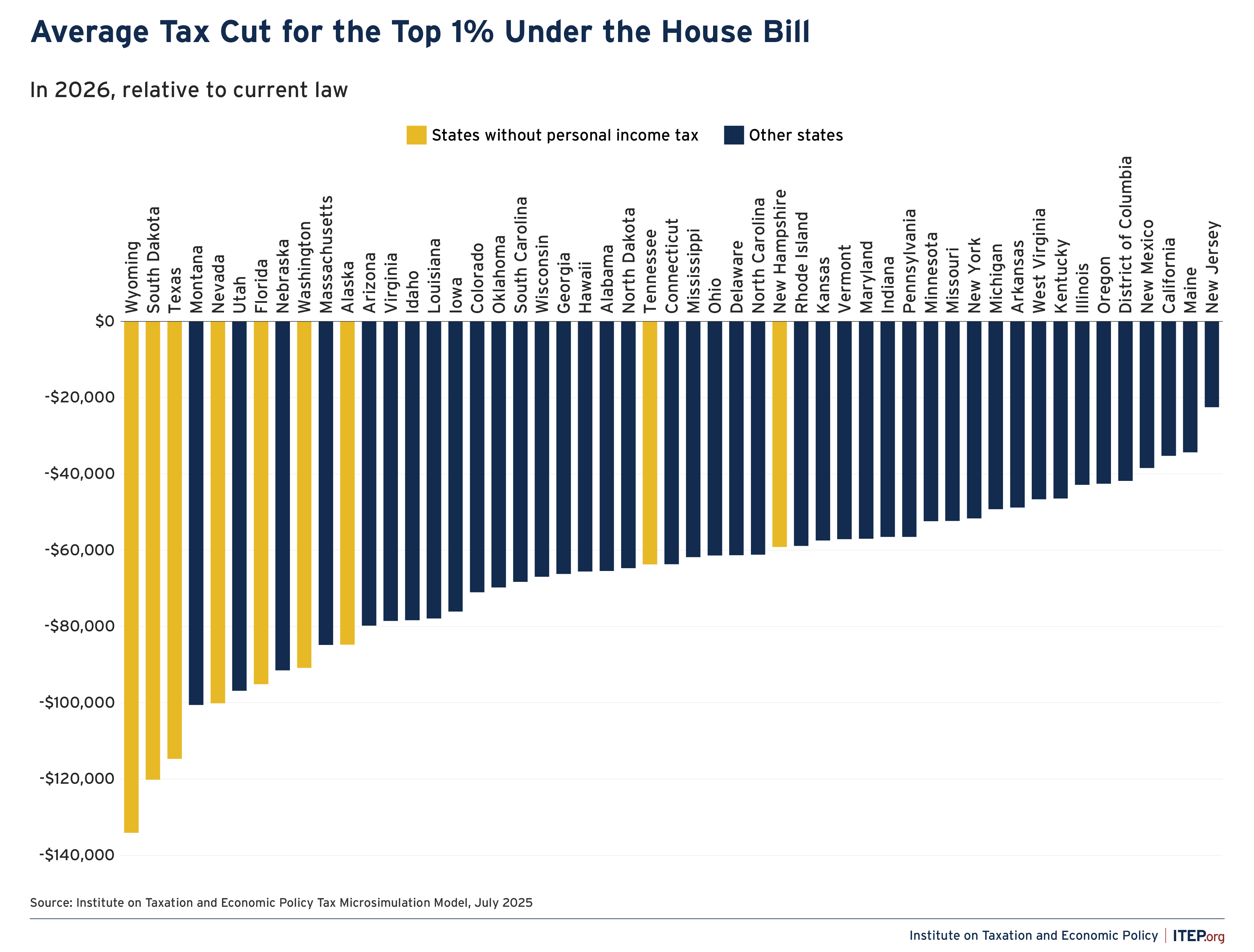

- The legislation provides the greatest rewards to high-income people living in states that have low state and local taxes on the wealthy. In these states, high-income people are not much affected by the cap on deductions for state and local taxes, which the Senate bill would make permanent. As illustrated in Figure 6, the states where the richest 1 percent of residents receive the largest average net tax cuts would mostly be states that have particularly unfair tax systems because they have no personal income tax.

These figures do not include other potential costs to families in the bill, such as deep cuts to Medicaid and food assistance. These cuts would have adverse health and financial implications for families that directly benefit from these programs. The cuts would also harm others in communities that are broadly dependent on these funding streams—such as rural communities, which would see hospital closings.

FIGURE 1

FIGURE 2

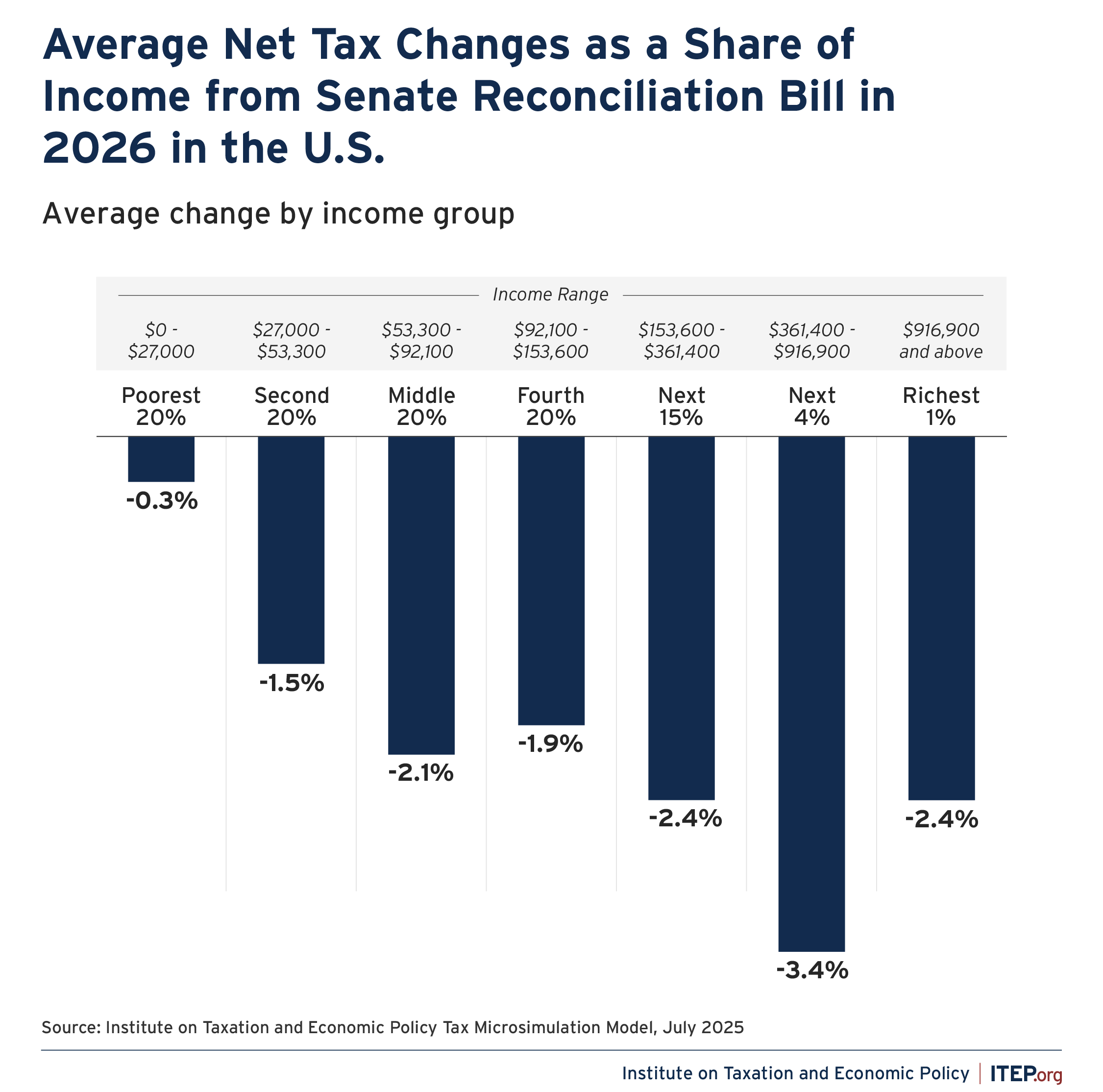

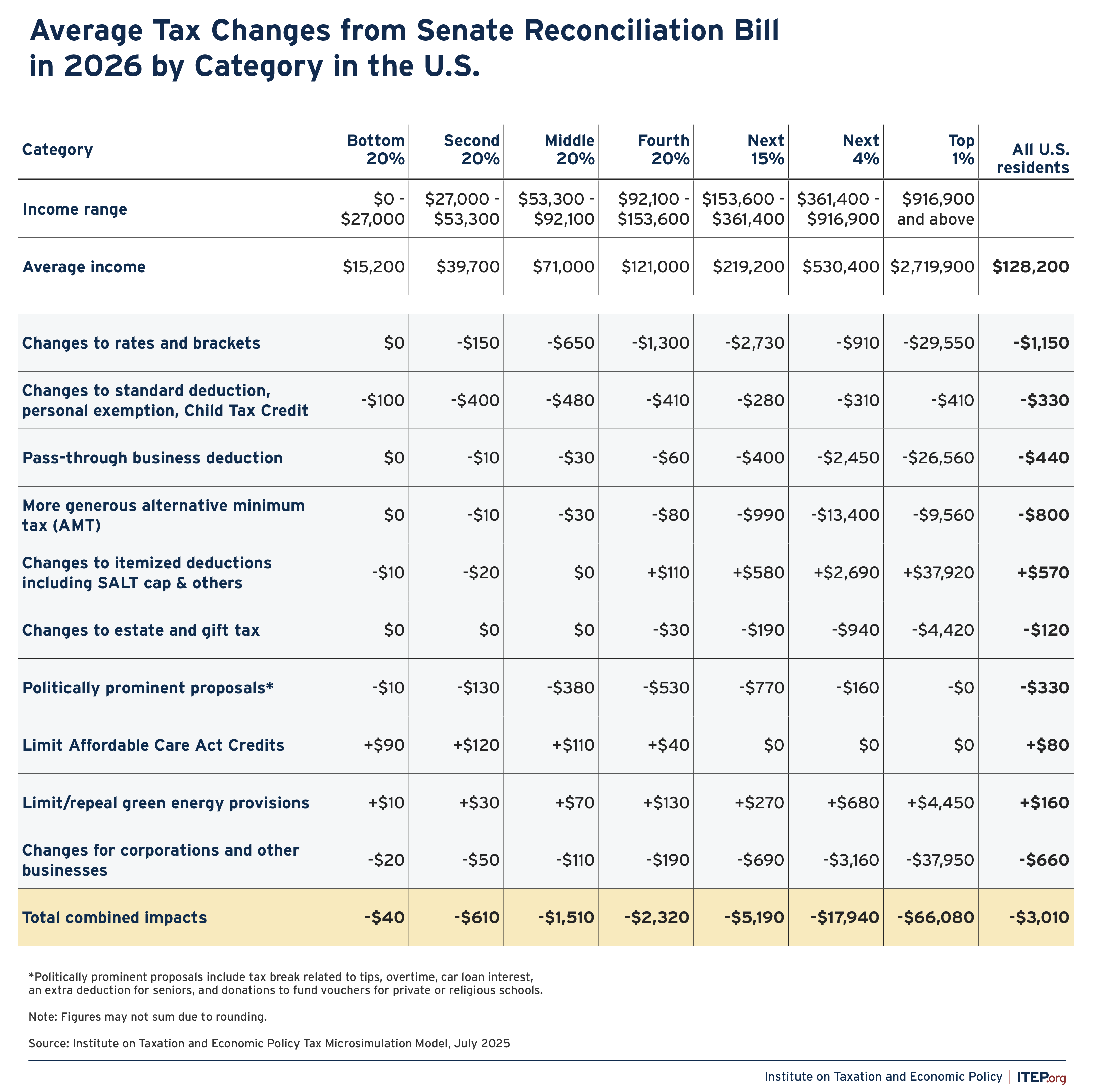

FIGURE 3

FIGURE 4

FIGURE 5

FIGURE 6

Compared to its House counterpart, the Senate bill makes certain provisions more generous, including corporate tax breaks that it makes permanent rather than temporary. Other tax breaks are less generous in the Senate bill to prevent the cost from more dramatically exceeding that of the House bill.

- The Senate legislation includes permanent corporate tax breaks (involving more generous versions of tax rules for bonus depreciation, research, and limits on interest deductions) that lawmakers have attempted to enact in recent years. The House bill provides them temporarily.

- Compared to the House bill the Senate bill provides a less generous extension of the 2017 law’s deduction for pass-through business owners (keeping the deduction at 20 percent vs the 23 percent provided by the House bill).

- The Senate bill also provides a less generous expansion of the Child Tax Credit (increasing the maximum credit to $2,200 vs. $2,500 in the House bill, although the Senate version makes the CTC expansion permanent, unlike the House version). Both are up from the current credit of $2,000, though down from the Biden credit of $3,600 for children under 6 and $3,000 for older children, and both would leave out the millions of children whose parents earn too little to receive the full CTC.

- Both bills extend the 2017 tax law’s $10,000 cap on deductions for state and local taxes (SALT), and both bills initially increase the cap to $40,000 for all but the richest taxpayers. But the House bill makes this provision permanent while the Senate’s provision returns the cap on SALT deductions to $10,000 starting in 2030.

- The Senate legislation would make tax breaks for so-called “Opportunity Zones” permanent while the House bill would extend them temporarily.

The Senate and House bills are, however, identical in most significant features. Just as in the House bill, the Senate bill has three categories of tax provisions providing the biggest tax cuts to the richest 1 percent.

- Changes in tax rates and brackets would cut taxes for the richest 1 percent by an average $30,000 in 2026.

- The extension of the pass-through deduction (section 199A) for business owners would reduce taxes for the top 1 percent by an average $27,000 next year.

- A collection of business tax changes affecting corporations and other businesses would cut taxes by an average $38,000 next year for the top 1 percent.

- The Alternative Minimum Tax (AMT) and estate tax provisions provide more for the rich on top of that.

Provisions changing itemized deductions (most importantly the cap on itemized deductions for state and local taxes, or SALT) claw back an average of $38,000 of the tax cuts for the richest 1 percent. The SALT cap serves as a very partial limit on tax cuts for the richest Americans.

FIGURE 7

FIGURE 8

Revenue Impact of Tax Provisions Included in this Analysis of the Senate Reconciliation Bill in 2026

| Provisions | Revenue Impact |

|---|---|

| Extending and Modifying TCJA Provisions Expiring End of 2025 and Related Changes | |

| Rates and Brackets | —$204 billion |

| Standard Deduction | —$117 billion |

| Personal Exemptions | +$147 billion |

| Child Tax Credit | —$89 billion |

| Pass-Through Deduction | —$79 billion |

| Alternative Minimum Tax | —$142 billion |

| Itemized Deductions | +$103 billion |

| Estate Tax | —$20 billion |

| Total TCJA Provisions Expiring End of 2025 | —$402 billion |

| New Provisions Proposed as Middle-Class Tax Cuts | |

| Deduction for Tips | —$10 billion |

| Deduction for Overtime Pay | —$23 billion |

| Enhanced Deduction for Seniors | —$20 billion |

| Exclusion for Car Loan Interest | —$6 billion |

| Total New Provisions Proposed as Middle-Class Tax Cuts | —$58 billion |

| Business Tax Breaks (excluding pass-through deduction in TCJA) | |

| Reinstate bonus depreciation | —$65 billion |

| Reinstate research expensing | —$20 billion |

| Reinstate more generous limits on deductions for interest | —$6 billion |

| New international corporate rules | —$19 billion |

| Special depreciation allowance for qualified production property | —$34 billion |

| Section 179 small business expensing expanded | —$4 billion |

| Extension and modification of clean fuel production credit | —$2 billion |

| Extend and modify opportunity zones | —$8 billion |

| Expand advanced manufacturing investment credit | —$3 billion |

| Capital gains from farmland | —$3 billion |

| Total Business Tax Breaks | —$165 billion |

| Other Tax Provisions | |

| Repeal and phase out green tax provisions | +$37 billion |

| Limits on ACA credits | +$14 billion |

| Strengthen limit on deductions for high compensation | +$1 billion |

| 1 percent floor on corporate charitable deductions | +$2 billion |

| Treatment of payments from partnerships to partners for property or services | +$2 billion |

| Total Other Tax Provisions | +$56 billion |

| TOTAL | —$568 billion |

|

ITEP.org

|

|