Overview

The Earned Income Tax Credit (EITC) is a policy designed to bolster the incomes of low-wage workers and offset some of the taxes they pay, providing the opportunity for families struggling to afford the high cost of living to step up and out of poverty toward meaningful economic security. The federal EITC has kept millions of Americans out of poverty since its enactment in the mid-1970s. Over the past several decades, the effectiveness of the EITC has been amplified as many states have enacted and expanded their own credits.

The EITC is a vital source of income for low-wage workers. In the face of the COVID-19 pandemic and accompanying recession, families across the nation are struggling to meet their basic needs. High unemployment, a struggle to put enough food on the table, and an inability to pay rent or mortgage are widespread.[1] As a result, proven and effective poverty reducers—like the EITC—are more important than ever.

And yet, even during periods of economic growth, too many workers were facing low and slow-growing wages, while simultaneously feeling the squeeze of the growing costs of food, housing, childcare, and other basic household expenses. To make matters worse, in 46 states low-income households pay a higher share of their incomes in state and local taxes than the richest households.[2] This leaves working families with even fewer resources to make ends meet and contributes to ever growing income inequality.

The effectiveness of the federal EITC as an anti-poverty policy can be increased by expanding the credit at both the federal and state levels. To this end, this policy brief provides an overview of the federal and state EITCs and highlights recent trends to strengthen these credits.

The Federal Earned Income Tax Credit

The federal EITC has been supplementing and boosting the income of low-wage workers since it was introduced in 1975. Since that time, the EITC has been improved to lift, and keep, more working families out of poverty. The most recent improvements enhanced the credit for families with three or more children and for married couples. First enacted temporarily as part of the American Recovery and Reinvestment Act (ARRA) in 2009, these changes were made permanent in late 2015.

The federal EITC delivered nearly $63 billion to 25 million working families and individuals in 2018.[3] And its impact will undoubtedly grow in 2020. Used mostly as a source of temporary support, the EITC helps millions of families each year–including veterans making their way back into the civilian workforce–cope with job loss, reduced hours, or reduced pay. Recognized widely as an effective anti-poverty tool, the federal EITC, together with the federal Child Tax Credit (CTC), lifted an estimated 7.5 million people out of poverty in 2019, according to data from the Census Bureau.

The EITC is based on earned income, such as salaries and wages. For example, for each dollar earned up to $14,800 in 2020, families with three or more children will receive a tax credit equal to 45 percent of those earnings, up to a maximum credit of $6,660. Because the credit is designed to boost incomes for low- and moderate-income workers, there are income limits that restrict eligibility for the credit. Families continue to be eligible for the maximum credit until income reaches $19,330 for single heads of household. Above this income level, the value of the credit is gradually reduced to zero and is unavailable when family income exceeds the maximum eligibility level. The credit is entirely unavailable to families with three or more children earning more than $50,954 for single parents and $56,844 if married. For taxpayers without children, the credit is much less generous: the maximum credit is $538 and single filers earning more than $15,820 (or $21,710 for married couples without children) are ineligible.

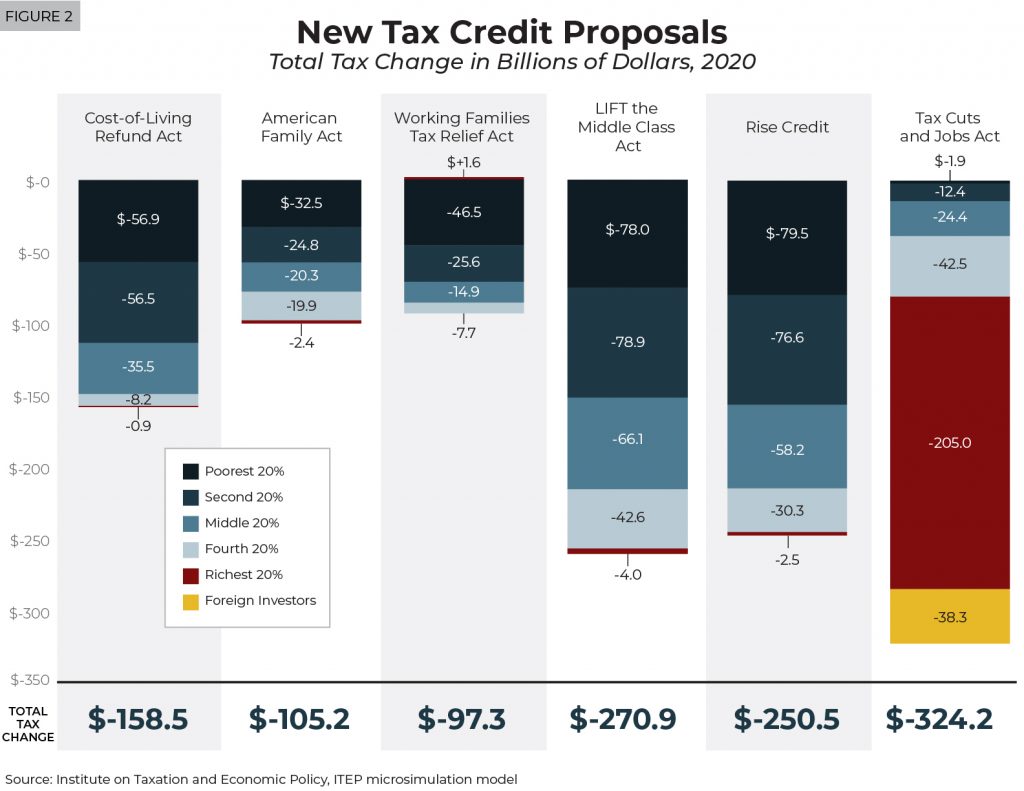

A range of recent federal proposals aim to increase or improve upon the federal EITC and CTC.[4] Notably, the most significant changes under these proposals would be for individuals or families without children in the home.

State Earned Income Tax Credits

In addition to helping working families afford childcare, health care, housing, food and other basic necessities, EITCs at the state level play an important function in improving the equity of upside-down state and local tax systems. Unlike federal taxes, state and local taxes are regressive, requiring low- and moderate-income families to pay more of their income in taxes than wealthier taxpayers. According to ITEP’s 2018 Who Pays? report, the poorest 20 percent of Americans pay 11.4 percent of their incomes in state and local taxes. By contrast, middle-income taxpayers pay 9.9 percent and the wealthiest 1 percent of taxpayers pay just 7.4 percent of their incomes in state and local taxes. Heavy use of regressive sales and property taxes (all of which working families pay) drive the high state and local tax rates faced by the poorest households. A refundable state EITC is among the most effective and targeted tax reduction strategies to help offset these regressive taxes.

Refundability is key to the EITC’s success, especially at the state level. If a credit is refundable, taxpayers receive a refund for the portion of the credit that exceeds their income tax bill. Refundable credits can therefore be used to help offset all taxes paid, not just income taxes, thereby offsetting some of the regressive effects of state and local sales, excise, and property taxes.

To date, nearly two-thirds of the states (29 states plus D.C.) offer state EITCs based on the federal credit (see Appendix). All of the states except Minnesota allow taxpayers to calculate their EITC as a percentage of the federal credit (Minnesota’s credit is structured as a percentage of income rather than a percent of the federal credit). This approach of linking state credits to the federal makes it easy for states taxpayers to claim the credit (since they have already calculated the amount of their federal credit) and straightforward for state tax administrators. However, states vary dramatically in the generosity of their credits. The EITC provided by the District of Columbia, for example, amounts to 40 percent of the federal credit (100 percent for workers without dependents in the home), while five states have credits that are worth less than 10 percent of the federal credit. Six states (Delaware, Hawaii, Ohio, Oklahoma, South Carolina, and Virginia) allow only a non-refundable credit, limiting the ability of the credit to offset regressive state and local taxes.

New Trends and Forward Momentum

Expanding Eligibility to Immigrant Workers

There have been a number of advancements in EITC policy at the state and federal level in recent years. This year alone, Colorado set into motion an increase of its existing credit. The state’s credit will rise from 10 to 15 percent of the federal credit in tax year 2022. And both Colorado and California have taken important steps to expand eligibility to include immigrant workers who file taxes using Individual Taxpayer Identification Numbers (ITINs).

Individual Taxpayers Identification Numbers (ITINs) are tax processing numbers made available to certain immigrants, their spouses, and their dependents who do not have Social Security Numbers. ITIN filers were largely left out of the 2020 Coronavirus Aide, Relief and Economic Security (CARES) Act response. The federal legislation excluded households that had even one filer using an ITIN, barring them from receiving the COVID-19 stimulus checks. In response to this inequity, Colorado and California lawmakers have taken steps to ensure that their state EITCs benefit one of the most vulnerable and hardest hit populations. In 2022, Colorado’s EITC eligibility will be expanded to include the state’s immigrant tax filers. California lawmakers, after initially extending its EITC to ITIN filers who have at least one child under the age of six, passed legislation to expand eligibility to all taxpayers using ITINs. States can take steps to extend the reach and impact of their state EITCs by expanding eligibility to include ITIN filers.[5]

Enacting New EITCs

In 2017, Hawaii, Montana, and South Carolina enacted state EITCs. Montana added a refundable credit at 3 percent of the federal credit. Hawaii’s non-refundable credit, which is set to expire at the end of tax year 2022, is set at 20 percent of the federal credit. South Carolina’s non-refundable credit is set to reach 125 percent of the federal credit when fully phased in by 2023.

Increasing the Size of Existing Credits

Louisiana, Massachusetts, New Jersey and Vermont all increased the size of their EITCs in 2018. Louisiana upped its state EITC from 3.5 percent to 5 percent of the federal credit for tax years 2019 through 2025. Massachusetts increased its EITC from 23 percent to 30 percent of the federal credit, up from 15 percent in 2015. In New Jersey, lawmakers enacted an EITC increase from 35 percent to 40 percent of the federal credit to be phased in by 2020. And lawmakers in Vermont increased their EITC, currently at 32 percent of the federal credit, to 36 percent. California, Maine, Minnesota, New Mexico, Ohio, and Oregon all enacted expansions to their credits in 2019.

Expanding Age Eligibility and Increasing the Credit for Childless Workers

There have also been recent efforts to expand the EITC for workers without children in the home. While the federal EITC provides a great deal of help for families with children, its impact is limited for those without children; the maximum credit is much smaller and the income limits are more restrictive. For instance, under current law, a worker without dependent children in the home who is working fulltime at the federal minimum wage is ineligible for the EITC. Yet, if the same worker had children they would receive the maximum EITC. Under the current system, these low-wage workers continue to be taxed deeper into poverty.

Childless workers under 25 and over 64 years of age receive no benefit from the existing federal credit to which the majority of state credits are tied.[6] These “childless” workers are noncustodial parents, young workers who are just getting a foothold in the job market, and older workers who need to keep working well past the traditional retirement age and who often struggle to make ends meet.

At the state level, the District of Columbia has led the way in this regard. Since January 2015, more childless workers qualify for DC’s EITC (and receive a larger credit) thanks to higher income eligibility thresholds and a credit expanded to 100 percent of federal (up from 40 percent). California, Maryland and Minnesota joined the District of Columbia in their 2018 expansions to younger workers. California completely eliminated the age requirement for its EITC for workers without dependents in the home. This action expanded the EITC to young workers between 18 and 24, and workers over 65. California adjusted its state-level EITC income limits to reflect the state’s minimum wage increase to ensure that those working full-time for minimum wage are eligible to receive the credit. Maryland and Minnesota legislators also removed the state EITC’s minimum age requirement by using some of the revenue gained from the 2017 federal tax cut. Maryland’s EITC is now available beginning at 18 years of age, whereas Minnesota’s is available at 21 years of age. In 2019, Maine lawmakers lowered the minimum age to 18 and increased the share of the federal credit workers without dependents in the home receive to 25 percent of the federal. In 2020, as their credit fully phased up to 40 percent of the federal, lawmakers in New Jersey lowered the minimum age to include workers between 21-24 years of age. State lawmakers can work to correct this inequity and greatly benefit childless adults in their states by enacting reforms that would expand age eligibility and increase the credit for this population that has historically been left behind.

Local Level EITCs

Oregon and California have also enacted recent changes to the credit to give a boost to families with young children in the home. Oregon’s credit for families with young children is equal to 12 percent of the federal (as opposed to 9 percent for other EITC eligible homes) and California EITC eligible families with a child under 6 will receive an additional $1,000 credit. A few localities also have their own version of an EITC, most notably New York City and Montgomery County, Maryland, proving that a local level credit could also be powerful.

Adding Immediate Flexibility to Earned Income Tax Credits

As we continue to deal with the public health and economic fallout of the COVID-19 pandemic, lawmakers across the country are looking for ways to best support families who are struggling to meet their most basic needs. As the name suggests, eligibility for the Earned Income Tax Credit is dependent upon earning income to qualify. So during an economic slowdown and in the face of rising unemployment, lawmakers should consider temporarily modifying the structure of their EITCs to reflect the realities of our current economy.

There are a handful of steps that federal or state lawmakers can take to ensure that low-income families, some of whom have seen their earnings disappear as a result of this crisis, continue to receive this vital lifeline. Lawmakers could allow recipients to use their 2019 income—acknowledging that 2019 was a more normal year for earnings—therefore allowing families to claim the larger of what they calculated under ordinary 2020 rules, or what they would have received if they had the same level of earnings last year. As of this writing, the House has passed legislation that would implement a change along these lines but it is unclear if it will be taken up by the Senate.

Lawmakers could also temporarily modify the structure of the EITC to steepen the credit’s phase-in or eliminate it altogether. This ensures that low-income earners move more quickly toward the maximum credit even if they worked fewer hours and brought in a lower income in 2020. Lawmakers could also temporarily expand the definition of “earned income” for purposes of the credit to allow taxpayers the option to include unemployment insurance (UI).

Each of these options would protect EITC recipients faced with income and work disruptions from the coronavirus pandemic. Without such action, low- and moderate-income families could face a lower EITC during next year’s tax season, at a time when families are struggling to find work, put food on the table, and pay their bills.

Improving Tax Equity with State Earned Income Tax Credits

Whether enacting an EITC in states that do not yet have one or expanding an existing credit to more workers trying to get by on low wages, lawmakers would be wise to continue the positive trend of strengthening and enacting state EITCs and, as a result, improving the equity of state and local taxes, rewarding work and helping families meet their basic needs.

[1] Center on Budget and Policy Priorities (CBPP). “Tracking the COVID-19 Recession’s Effects on Food, Housing, and Employment Hardships,” Updated September 4, 2020. https://www.cbpp.org/research/poverty-and-inequality/tracking-the-covid-19-recessions-effects-on-food-housing-and

[2] Wiehe, Meg, Carl Davis, Aidan Davis, Matt Gardner, Lisa Christensen Gee, Dylan Grundman, and Misha Hill. “Who Pays? A Distributional Analysis of the Tax System in All Fifty States, 6th Edition,” Institute on Taxation and Economic Policy, October 2018. https://itep.org/whopays/

[3] Internal Revenue Service. “Statistics for Tax Returns with EITC,” December 2019. https://www.eitc.irs.gov/eitc-central/statistics-for-tax-returns-with-eitc/statistics-for-tax-returns-with-eitc

[4] Wamhoff, Steve, Jessica Schieder, and Meg Wiehe. ”Understanding Five Major Federal Tax Credit Proposals,” May 22, 2019. https://itep.org/understanding-five-major-federal-tax-credit-proposals/

[5] Community Change. “ITIN-EITC Fact Sheet,” April 14, 2020. https://communitychange.org/resource/itin-eitc-fact-sheet/

[6] Davis, Aidan. “Expanding State EITCs: Age Enhancements and a Credit Increase for Workers without Children in the Home,” February 18, 2020. https://itep.org/expanding-state-eitcs-age-enhancements/