The ITEP Guide to State & Local Taxes

Income & Profits

How Do Personal Income Taxes Work?

The personal income tax funds public education, health care, public safety, and other public services provided by state and local governments. If well-designed, it is the fairest major revenue source available to states.

How Do State Corporate Income Taxes Work?

A robust corporate income tax ensures that profitable corporations help fund the public services they benefit from, just as working people do. It’s one of the few progressive taxes available to state policymakers.

How Do State Itemized Deductions Work?

Most states that collect income taxes allow taxpayers to claim itemized deductions, which are tax breaks for items such as charitable donations, mortgage interest, medical expenses, and property taxes. These deductions reduce revenues that could otherwise be used for services like schools and health care, and they mostly benefit wealthy families. Because they are so skewed and ineffective, many states either limit itemized deductions or forgo them altogether.

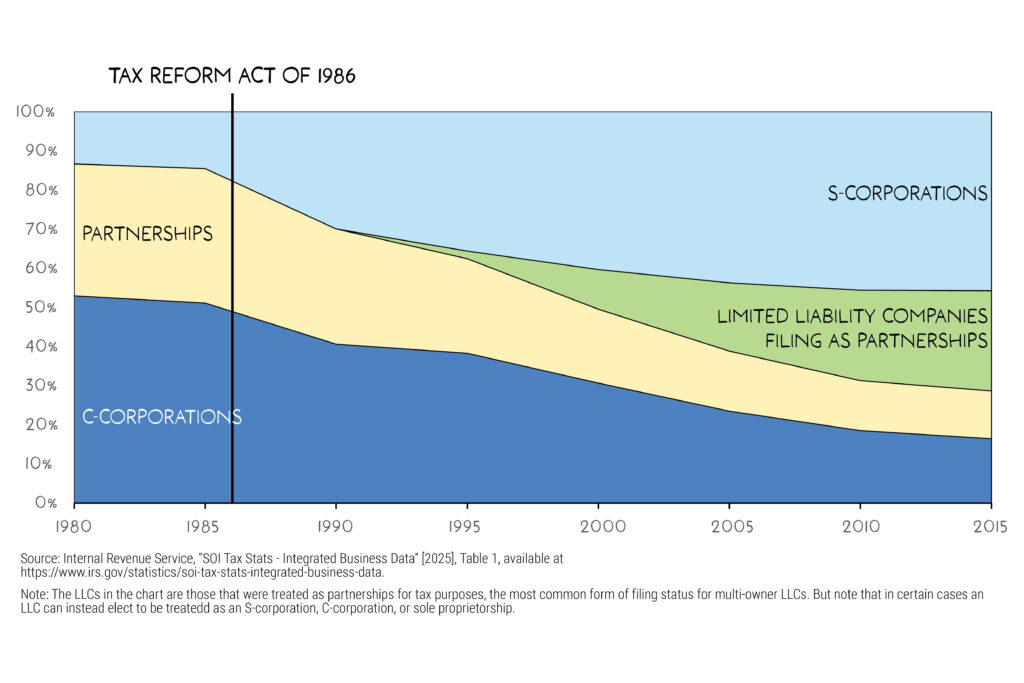

How Do States Tax the Profits of Pass-through Entities?

Most businesses are not liable for corporate income tax on their profits. Instead, federal and state tax laws allow them to choose a structure such as partnerships, sole proprietorships, and S-corporations under which their profits are passed through to their owners for taxation. These “pass-through entities” benefit from state-funded services like schools, infrastructure, and public safety, and their owners are generally wealthy, so taxing them fairly – at a minimum ensuring that pass-through income is taxed at the same rate as wages – is essential to a sound and equitable revenue system.

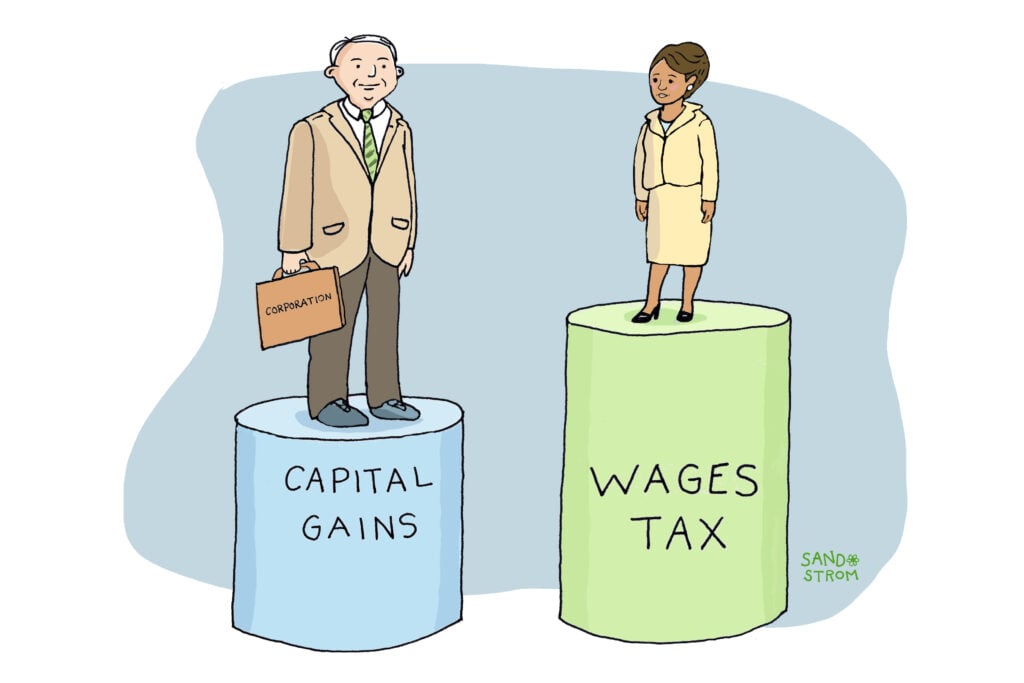

How Do States Tax Investment Income?

State personal income taxes apply not just to wages and salaries but also earnings on investments, like stocks and bonds. Most investments are held by wealthy people, so when states tax investment income at a lower rate than wages, high-income households pay tax at lower rates than middle-income households. By contrast, states that strengthen taxation of investment income can raise substantial revenue while improving economic and racial equity of their tax code.

How Do State Tax Credits for Workers and Families Work?

State-level Earned Income Tax Credits (EITCs) and Child Tax Credits (CTCs) help workers and families make ends meet by reducing their taxes and providing refunds. Research shows these credits are very effective at reducing poverty and creating more equitable tax systems.