Policy Briefs

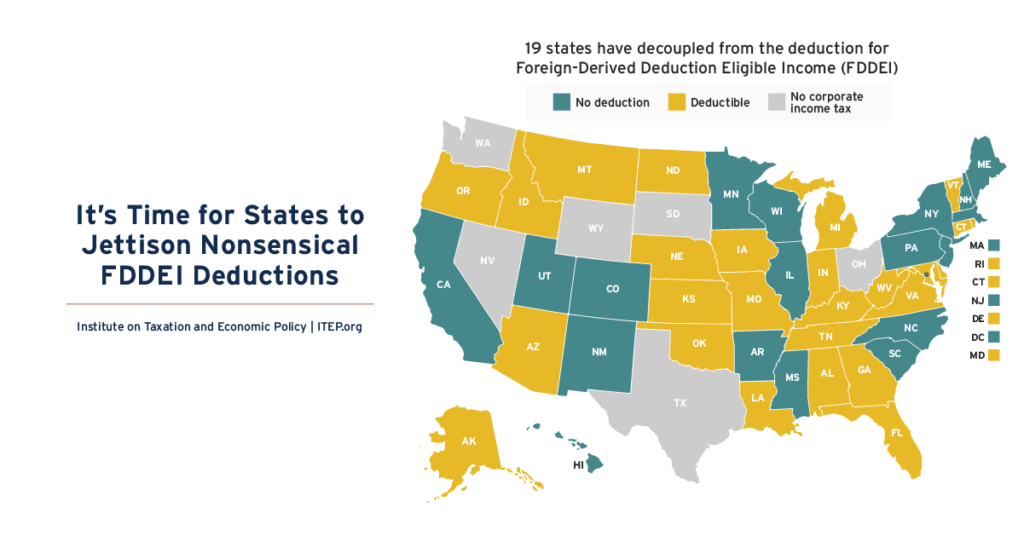

It’s Time for States to Jettison Nonsensical FDDEI Deductions

February 19, 2026 • By Carl Davis

States often link their tax laws to the federal code in significant ways. Many of these links are justified and can simplify tax administration for both taxpayers and state officials. But in other cases, something can get lost in translation, and states end up copying federal provisions that just don’t make sense at the state […]

Michigan Ballot Proposal Would Boost Public Education While Creating a Fairer Tax System

February 17, 2026 • By Miles Trinidad, Matthew Gardner

A new proposal in Michigan would create a 5-percentage point surcharge on top earners with taxable incomes over $1 million for joint filers and $500,000 for single filers. This would raise about $1.7 billion a year, which would be used for public education priorities.

An Analysis of a Potential Reduction in Massachusetts’ Long-Term Capital Gains Tax Rate

January 26, 2026 • By Eli Byerly-Duke, Matthew Gardner

A ballot initiative in Massachusetts has proposed cutting the base rate for nearly all income sources from 5 to 4 percent. In 2026, this would cost the state about $5 billion per year of which $347 million would come from the reduced rate on long-term capital gains.

10 Reasons Why the U.S. Should Reform Its Corporate Income Tax

December 17, 2025 • By Steve Wamhoff

The U.S. needs a tax code that is more progressive and that raises more revenue than the one we have now. An important way to achieve this is to reform the taxation of business profits. These four key policy reforms would greatly strengthen the corporate tax system: Eliminating or restricting special breaks and loopholes that […]

Tax Haven Data Demonstrate Need for Global Minimum Tax Despite Opposition from Trump Administration

December 10, 2025 • By Steve Wamhoff

American corporations use accounting gimmicks to make profits appear to be earned in tax havens. This widespread problem could be fixed by Congress enacting legislation to implement a minimum tax on corporations that meets the standards of the global minimum tax that other countries have begun to implement.

Linking to Tipped and Overtime Income Deductions Would Worsen State Shortfalls, Do Little to Help Workers

December 8, 2025 • By Neva Butkus, Galen Hendricks

State deductions for tips and overtime are not only ineffective at supporting working-class people, it will come at a substantial cost to state budgets.

Re-Examining 529 Plans: Stopping State Subsidies to Private Schools After New Trump Tax Law

November 20, 2025 • By Miles Trinidad, Nick Johnson

The 2025 federal tax law risks making 529 plans more costly for states by increasing tax avoidance and allowing wealthy families to use these funds for private and religious K-12 schools.

State Tax Dollars Shouldn’t Subsidize Federal Opportunity Zones

November 12, 2025 • By Eli Byerly-Duke

The Opportunity Zones program benefits wealthy investors more than it benefits disadvantaged communities.

The 5 Biggest State Tax Cuts for Millionaires this Year

October 16, 2025 • By Dylan Grundman O'Neill, Aidan Davis

Some states continue to hand out huge tax cuts to millionaires. The five largest tax cuts this year will cost states a total of $2.2 billion per year once fully implemented.

Quite Some BS: Expanded ‘QSBS’ Giveaway in Trump Tax Law Threatens State Revenues and Enriches the Wealthy

October 2, 2025 • By Sarah Austin, Nick Johnson

States should decouple from the federal Qualified Small Business Stock (QSBS) exemption.

IRS Enforcement Boost Was Supposed to Last 10 Years. Congress Killed It in Under Three.

September 16, 2025 • By Sarah C. G. Christopherson

The IRS was set to overhaul how it audits the ultra-rich. Now most of that funding is gone.

State Earned Income Tax Credits Support Families and Workers in 2025

September 11, 2025 • By Neva Butkus

Nearly two-thirds of states now have an Earned Income Tax Credit (EITC). Momentum continues to build on these credits that boost low-paid workers’ incomes and offset some of the taxes they pay, helping lower-income families achieve greater economic security.

State Child Tax Credits Boosted Financial Security for Families and Children in 2025

September 11, 2025 • By Neva Butkus

Child Tax Credits (CTCs) are effective tools to bolster the economic security of low- and middle-income families and position the next generation for success.

Sales Tax Holidays Miss the Mark When it Comes to Effective Sales Tax Reform

July 17, 2025 • By Miles Trinidad

Sales tax holidays are often marketed as relief for everyday families, but they do little to address the deeper inequities of regressive sales taxes. In 2025, 18 states offer these holidays at a collective cost of $1.3 billion.

States Should Move Quickly to Chart Their Own Course on SALT Deductions

July 17, 2025 • By Dylan Grundman O'Neill, Nick Johnson

While a federal SALT cap is hotly debated, capping deductibility at $10,000 was an unambiguously good idea at the state level. States would be smart to stick with the current cap or, better yet, go even farther and repeal SALT deductions outright. Going along with a higher federal SALT cap would double down on a regressive tax cut that will mostly benefit a small number of relatively wealthy state residents and cost states significant revenue.

Two in Three Americans Live in States with Variable-Rate Gas Taxes

July 16, 2025 • By Carl Davis

As inflation and fuel efficiency undercut traditional gas tax revenue, many states are rethinking how they fund transportation. Lawmakers across the country are beginning to modernize outdated gas tax systems to keep pace with rising infrastructure costs and changing driving habits.

Trump Megabill’s Deduction for Car Loan Interest Would Not Offset Tariff-Related Auto Price Increases for Most Buyers

June 12, 2025 • By Carl Davis, Sarah Austin

The auto loan interest deduction that recently passed the House is designed, at least in part, to mitigate the impact of tariff-induced price increases on vehicles assembled in America. But the deduction is incapable of offsetting even small-scale price increases, especially for working-class families and others with moderate incomes.

House Tax Bill Would Create a Parallel, Harsher Tax Code for Immigrant Filers and their Citizen Family Members

May 22, 2025 • By Carl Davis, Sarah Austin

Immigrant tax filers face a harsher tax code than citizens in some important respects. Sweeping tax legislation recently passed by the House of Representatives would apply new or stricter limits for immigrant tax filers to 10 additional areas of the tax code.

House Tax Bill Enlists the Wealthy to Spread Private School Vouchers

May 15, 2025 • By Carl Davis

The House tax plan cuts charitable giving tax incentives for donors to most nonprofit groups while roughly tripling the incentive available to donors to groups that fund private K-12 school vouchers. The bill would also allow private school voucher donors to avoid capital gains tax on their gifts of corporate stock, creating a profitable tax shelter for wealthy people who agree to help funnel public funds into private schools. The bill would reduce federal tax revenue by $23.2 billion over the next 10 years as currently drafted, or by $67 billion over the next 10 years if it is extended…

What Corporations Have to Gain from the Gutting of the IRS

May 7, 2025 • By Matthew Gardner, Spandan Marasini, Steve Wamhoff

Seven huge corporations recently announced that in 2024 they were allowed to collectively keep $1.4 billion in tax breaks from previous years that they had publicly admitted would likely be found illegal if investigated – all because the tax authorities were unable to identify and disallow them before the statute of limitations ran out.

The final budget adopted by the Maryland General Assembly shows progress in advancing tax equity in the state while boosting state revenues to address the state’s budget deficit. To help close a $3.3 billion budget deficit, Maryland legislators enacted much-needed tax reforms and progressive revenue raisers that help meet the state’s needs while making the […]

Want to know more about the tax and spending megabill that President Trump recently signed into law? We've got you covered.

Sharp Turn in Federal Policy Brings Significant Risks for State Tax Revenues

April 9, 2025 • By Carl Davis

Summary The new presidential administration and Congress have indicated that they intend to bring about a dramatic federal retreat in funding for health care, food assistance, education, and other services that will push more of the responsibility for providing these essential services to the states. Meeting these new obligations would be a challenging task for […]

A Windfall for the Wealthy: A Distributional Analysis of Mississippi HB 1

April 8, 2025 • By Aidan Davis, Dylan Grundman O'Neill, Neva Butkus

Mississippi lawmakers have approved the most radical and costly change to the state’s personal income tax system to date. House Bill 1 ultimately eliminates the state's personal income tax and cuts state revenues by nearly $2.7 billion a year when fully implemented. This deeply regressive legislation will create a windfall for the wealthiest residents of the poorest state in the nation while simultaneously jeopardizing the state’s ability to fund public services that support Mississippians and the state’s economy.

Advantaging Affluence: A Distributional Analysis of Missouri HB 798’s Uneven Tax Cuts for Wealth and Work

March 28, 2025 • By Aidan Davis, Carl Davis, Dylan Grundman O'Neill, Eli Byerly-Duke, Matthew Gardner

Missouri House Bill 798 would reduce personal and corporate income tax rates, fully eliminate taxes on capital gains income from sale of assets, and eliminates the state’s modest Earned Income Tax Credit that assists many working people in lower-paid jobs. HB 798 would radically transform Missouri’s income tax code into a system that privileges income from wealth over income from work, leaving many middle-income families to pay a higher income tax rate than wealthy people living off their investments.